The Wall Street Journal: Housing Recovery Stalls, Conference Board Said Consumer Confidence Fell Unexpectedly!

Posted By thestatedtruth.com on December 28, 2010

So, just wondering why this is such a surprise to the media types……Incomes are down (based on taxes paid) according to Trim Tabs, and home ownership maintenance expenses are rising across the board, including real estate taxes. The baby boomers are net sellers, not buyers. The middle class is being squeezed. The demographic economic model is to downsize and is going to get down right nasty in a few years!

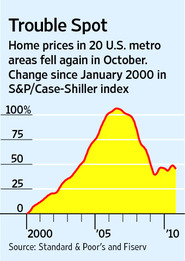

Home prices across 20 major metropolitan areas fell 1.3% in October from September, the third straight month-over-month drop, according to the S&P/Case-Shiller home-price index released Tuesday. The declines have erased most of the gains made since prices bottomed out in early 2009.

The housing market, which appeared poised for a recovery earlier in the year, now could be heading for a second downward drift.

“This looks like a double-dip [in housing] is pretty much on the way, if not already here,” said David Blitzer, chairman of the Standard & Poor’s index committee. “Somebody who thought last year that it’s going to be straight up from here was wrong.”

Job worries are hampering consumer confidence despite strength in holiday sales and a rising stock market. The Conference Board, a business research group, said Tuesday that its confidence index fell unexpectently to 52.5 from 54.3 in November, as consumers’ views about job availability worsened.

The index, after rising through May, now has retreated to its level of a year ago. The percentage of people planning to buy a home is also back to where it was a year ago, erasing all improvement seen in early 2010.

Comments