Household Debt Accelerating Once Again, But At A Much Slower Pace Then Before!

Posted By thestatedtruth.com on March 19, 2011

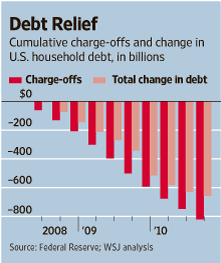

Defaults have lopped $822 billion off U.S. household debt since mid-2008! These loans were not payed off, but it looks that way with many of the statistics…..

One of the puzzles of the recovery has been how U.S. households have managed to shed some $658 billion in mortgage, credit-card and other consumer debt over the past two and a half years: Are they really paying it down, or are they just giving up and defaulting?

The latest data from the Federal Reserve suggest defaults have played a big role in debt declines and that “paying down†would be a misnomer. Based on the Fed data, banks’ and investors’ charge-offs, the result of defaults, have lopped $822 billion off households’ debt load from mid-2008 to the end of 2010. In other words, net of defaults consumers actually only borrowed an added net $163 billion.

That calculation alone, though, doesn’t provide a full picture of consumers’ change in behavior. They may be adding debt, but they’re doing so at a much slower pace than during the housing and credit boom. Net of defaults, household debt grew at an average annualized rate of only about 0.5% from mid-2008 to the end of 2010. That compares to about 10.5% in the preceding decade, a difference of 10 percentage points.

Comments

One Response to “Household Debt Accelerating Once Again, But At A Much Slower Pace Then Before!”

Leave a Reply

You must be logged in to post a comment.

Sausalito Ferry Schedule

When I originally commented I clicked the “Notify me when new comments are added” checkbox and now each time a comment is added I get several e-mails with the same comment. Is there any way you can remove people from that service? Thank you!|