Looks Like Quicksand…But It’s Really Quickcement

Posted By thestatedtruth.com on February 29, 2012

So, how do we do it…deleverage we mean? Uh, well, we need to spend less on cars and gas, and food, and housing and…healthcare, and buy less other things, and save more – oh, sorry about that last one, nothing left to save…..

From Today’s Bloomberg Brief:

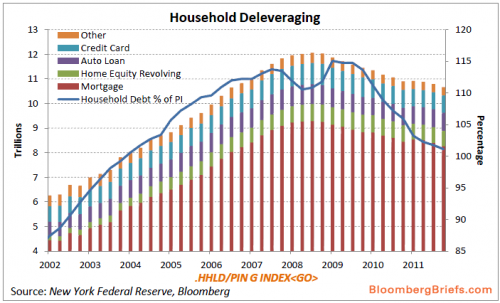

The slow pace of deleveraging will continue to weigh on growth over the next few years – even as they have drawn down debt as a percentage of personal income from its peak in June 2009 at 114.76% to 101.1% at the end of 2012. There is a long way to go to the apparent Maginot line of supposedly sustainable 90% and with wage growth stagnant, the bulk will come from debt reduction in true balance-sheet-recession style – putting still more pressure on a perniciously polarized government to do anything about it.

For the US Household to get to supposedly sustainable levels of debt to personal income…look at the chart below. the area of 2002 is a long ways off, and that was still on the high side.

Comments

One Response to “Looks Like Quicksand…But It’s Really Quickcement”

Leave a Reply

You must be logged in to post a comment.

Sausalito Ferry Schedule

Hey very interesting blog!|