Meet The Real Estate Housing Market “Vampire REOs” Where Many Americans Live Mortgage-Free

Posted By thestatedtruth.com on October 3, 2013

Zero Hedge is just out with this interesting article concerning the housing markets and what they call artifical price gains. Yeh, we agree, the whole free market system has been rigged in one way or another since 2009.

ZeroHedge:

Concerning Foreclosure stuffing. We explained this scheme by banks to limit the amount of available for sale inventory as follows: “since the properties not entering the foreclosure pipeline are effectively kept out of inventory, even shadow inventory, and thus the distressed end market, the monthly drop in foreclosures has acted as a form of subsidy to the housing market, as month after month less inventory than otherwise should, enters the market…. What this has resulted in is a logical increase in prices of the properties that are on the market.” Today, the mainstream has finally caught on, and courtesy of RealtyTrac has come up with its own name for this subsidy: Vampire REOs.

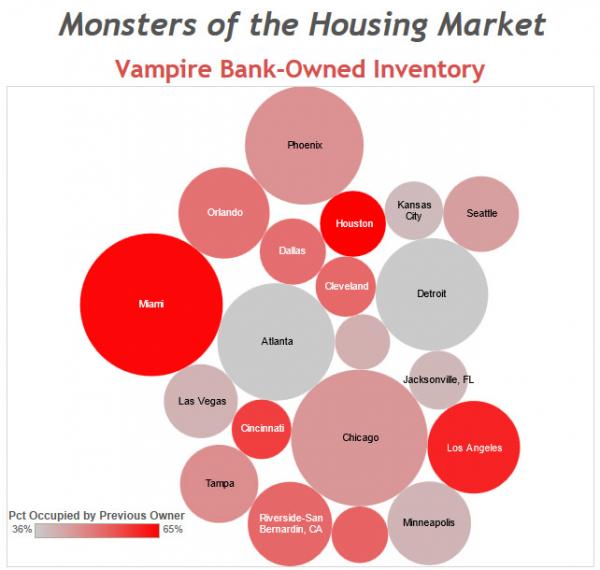

In a press release overnight, the foreclosure tracking service RealtyTrac, observed that a stunning 47% of bank-owned homes are still occupied by their previous owners who were foreclosed on, creating “vampire REOs.“

Vampire REOs are bank-owned homes that are still occupied by the previous homeowner who was foreclosed on. On the surface these properties often will look like normal, non-distressed homes, but beneath the surface they represent a shadow inventory that is becoming more imminent as rising home prices motivate banks to sell off these homes to try to recoup their losses on soured loans.

The vampires are particularly acute in Miami (64%), Houston (65%), Los Angeles (61%) which have nearly two thirds of bank-owned properties falling into the “vampire REO” category. This means that in order to generate a housing scarcity, millions of deadbeat Americans have been given a carte blanche to live mortgage-free, in some cases for years, and in a state of default in their existing homes, as the banks have no incentive to actually clear out the properties to which they have title, making home purchases for everyone else – those who have the funds and are willing to purchase a home – impossible due to artificially los supply and artificially high prices.

Putting the problem in perspective, Emmett Laffey, CEO of Laffey Fine Homes International said that “The New York metro area is experiencing a spike in mortgage defaults, however, there are very few vacant foreclosures or bank-owned properties that are languishing on the market.” “Typically these types of properties are sold well within 30 days of hitting the market,” he added. Except when they never make the market.

Of course, now that home prices have been artificially boosted courtesy of just this foreclosure process “stuffing”, “banks likely wish to sell these homes sooner rather than later as home prices have been rising” predicts RealtyTrac.

However, therein lies the dilemma: since the primary driver of home price appreciation has been fake scarcity, either due to Vampire REOs or Zombie foreclosures (the far more traditional homes that are still languishing in the foreclosure process but have been vacated by the homeowner being foreclosed), the second that banks unclog the foreclosure pipeline exit and begin selling this uber-shadow inventory, the entire facade of the fake housing non-recovery will begin to crumble as one after another bank scramble to hit the highest bid possible, before some other bank does so.

Expect the broader mainstream media to begin reporting on this phenomenon in another 6-8 weeks, about the time when the Y/Y increase in home prices is solidly rolling over, and the usual 18 months delay behind Zero Hedge.

Finally, those curious to see how many foreclosed homes are being occupied mortgage free in their metro area, the following interactive chart from RealtyTrac has the answer.

Wise Dog

Comments

Leave a Reply

You must be logged in to post a comment.