Gene Inger Reviews The Bernanke Hike Of Feds Discount Rate

Posted By thestatedtruth.com on February 18, 2010

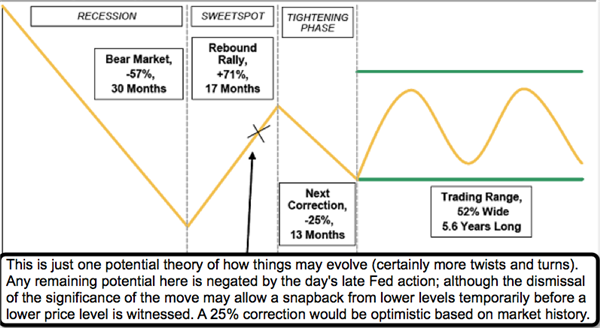

For sure, in that same discussion, I opined that the Fed was likely going to ‘gamble’ a bit; by stoking the illusion of recovery with a ‘discount rate hike’, reserve requirement increase or some similar move. The Fed’s timing is interesting, as they likely know at least a couple things: a) that the stock market is extended and ready to correct in any case; and b) that this is a good time to see if they can ‘psyche’ people into believing a recovery of more than minimal proportions is taking place. And by the way if it really is (meaning beyond the demand engendered by bottom fishers, tax-credit extension buyers, and the like); then all the more reason for the Fed to reign things in a bit. As for business, rates are and will remain so low that it’s tantamount to meaning nothing when credit

Now, do not assume this step closer to monetary policy shift is irrelevant. While most will say you have a minimum of 6-9 months before it effects ‘consumers’; that’s what is always said (to wit: regardless of policy shifts or implied changes, many marketers of assets, whether stocks or other assets, will always spin it as just something to get ‘out of the way’, and minimize the impact such shifts will have. That may actually let us ‘buy’ rather than sell, the first purge in the market (on a trading basis); but clearly not do so with any longer durations, given the prospect that we’re very much in what we have termed the ‘swan song’ of an old extended rebound (from last month’s break of the market) and that what you are looking at is not a sufficient anomaly justifying a change in strategy. The light volume and ‘grinding’ nature of the recent life was not at all unexpected in this nominal Expiration week; believing it would persist at the start of the abbreviated 4-days of trading; and diminish as the week persisted.

Today’s hit in the post-close futures market is indicative of how the market views the Fed action as theatre more than structural; as hours earlier some technicians tried to rationalize further upside based on the nominal corrections seen in recent months as somehow suggesting another (based on average gains) 15-20% market gain. Hardly say I; in-part because in an extended move, light volume rallies aren’t unprecedented but they tend to be below average performers once the overall move is extended. As to this particular picture; what you will likely see is that this was (weekly basis charts; not daily basis) just a ‘B’ wave that was doggedly-persistent because of Expiration; in a pattern that should now proceed to challenge and take out the preceding lows very much as we’ve outlined, while cautioning patience during the stubborn recent ‘grind’; simply because we knew (and said) that this could likely occur into if not through the Expiration. Friday could easily be a down-up-down session by the way, aside some late shifting that may be related to positioning ahead; not only in this Expiration. Did anyone I know use this week’s extended periods of rallies for ‘bets’ on the downside into March? Yup; which is no assurance; but makes sense given probabilities that of course favor the next meaningful move being to the downside, as noted yesterday.

More at www.ingerletter.com

Comments