John Mauldin’s “Thoughts From The Front Line”

Posted By thestatedtruth.com on July 31, 2010

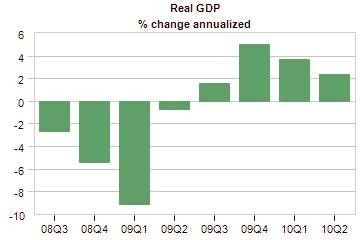

The economy of the U.S. grew at a weaker than expected 2.4% in the second quarter, but the first quarter was revised back up to 3.7% on the strength of stronger-than-projected inventory rebuilding. But the recession years were revised downward rather significantly for this late in the cycle. We find now that the recession was worse than we thought, taking the economy down a total of 4.1% during the recession. As of today, we are not quite back to where we started, still down 1%. That means it is quite possible that we could finish the year and still not be “there yet.” (To see a 1% rise in GDP we would need to see a 2% annualized rise for the rest of the year. We’ll look at that possibility in a few paragraphs.)

Let’s look at a few charts courtesy of the Dismal Scientist, at www.economy.com. First, recent GDP numbers:

If this were an average recovery, the economy would be growing at a 6% rate at this point, which pretty much says it all about our current 2.4% number. Further, 2.5 years after the beginning of a recession, we are typically already 8% higher than the prior high. This is a very tepid recovery, indeed.

There is a category called “Final Real Sales” you can create by subtracting the inventories number from the real GDP number. That reveals that final real sales grew by 1.3% last quarter. This is against what is normally a 4% number this far into a recovery. Is it any wonder that small businesses are asking “When will we get there?”

Next, look at the contribution from fixed residential investment. It has been negative or flat for six of the previous seven quarters. This time it added 0.6% to last quarter’s GDP. But the housing market is lousy. What gives?

It seems that the housing tax credits induced home builders to increase construction by an annualized 28% last quarter. That was in spite of there being 18.9 million homes vacant in the US (an all-time high), and the number of foreclosures rising by as much as 100% in some cities. (Hat tip: David Rosenberg)

“Lenders are accelerating foreclosures as borrowers fall behind in mortgage payments after the worst housing crash since the Great Depression. A record 269,962 US homes were seized in the second quarter, according to RealtyTrac Inc. Foreclosures probably will top 1 million this year, the Irvine, California-based data company said in a July 15 report.” (Daily Reckoning)

Ownership rates are falling and heading back to more traditional levels. Mortgage delinquencies are rising as the unemployment level stays persistently high. It is my guess that residential real estate will not contribute much if anything to GDP this quarter.

What about inventories? That has been a strength the last few years, adding a lot to our national growth. But inventory-to-sales ratios are at an 8-month high, which suggests that businesses may back off from increasing inventories at the recent pace.

Government spending? The bulk of the stimulus programs are going away in the latter half of the year, especially those that benefited state and local governments. Governments are slated to cut back spending or raise taxes by almost 1% of GDP. As many as 500,000 government employees may lose their jobs.

All that being said, if we take away housing and project slower inventory growth and less government spending, we could see the GDP number for this quarter fall to the 1% range and stay there for the rest of the year. Even the normally bullish Economy.com suggests that growth will be “sluggish” in the last half of the year. All in all, the very definition of a Muddle Through Economy.

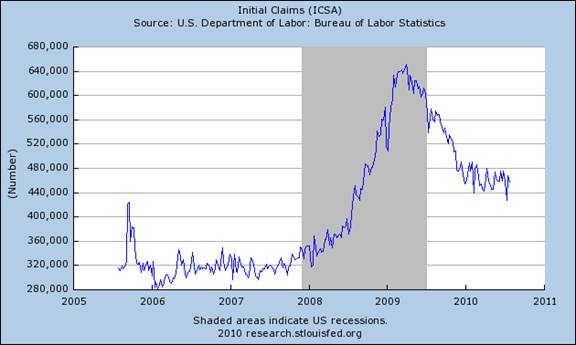

Until we start to see a real rise in employment, it is hard to get too enthusiastic. Everyone seems to be happy that initial claims have come down from their highs. But they have gone sideways for almost a year. Let’s look at two charts. First, the last five years of initial claims.

Then a chart (courtesy of Bill King) which shows that continuing claims are at levels typically associated with recessions. This is not the stuff that “V”-shaped recoveries are made of.

Driving with No Spare

I was on CNBC and Fox this last Thursday to talk about deflation. On CNBC I was side by side with my good friend Paul McCulley. It is no secret that Paul is a rather liberal Democrat. He is all for increasing taxes on the rich. This spring he told me at my conference that tax increases on the rich do not have the same multiplier as those for everyone else, and so therefore taking the Bush tax cuts away will not threaten the economy. I, of course, think it will.

I called Paul up to chat before we went on together. I was quite surprised to learn that he now thinks the Bush tax cuts should be extended for maybe another two years.

Why? We are both concerned about an unwelcome bout of deflation stemming from lack of final demand (as opposed to falling prices from increased productivity). Look at the graph below. Notice that prior to the beginning of the last recession inflation was running at a 4% clip and actually rose to above 5% before falling to a minus 2% and then rising to almost 3%. Since the beginning of the year, as the economy has softened, inflation has been steadily falling and is now at 1%. If the economy continues to falter, one would suspect that inflation could fall even lower.

If the economy were to tip into a recession with inflation so very low (or even near zero at the end of the year), the results could be very toxic. As Paul’s colleague and my friend Mohamed El-Erian writes, we are driving our economic car without a spare tire. If we were to go into a deflationary recession, there is not much that government could do. Our deficits are already at dangerous levels, and a recession would mean that tax collections would fall further. The Fed has some policy room, but it is of a variety that has not been tried for a very long time. Frankly, we cannot be sure of the unintended consequences.

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore

Comments