Just How Important Are Labor Costs…..Answer: Very!

Posted By thestatedtruth.com on August 26, 2010

More from JPMorgan:

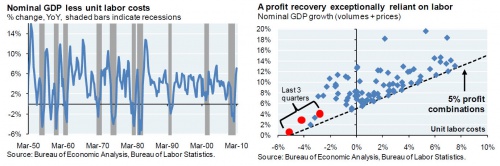

These deflationary trends surface some important questions about corporate profits, which have beaten expectations for the last 5 quarters. As shown below, a proxy for profits (nominal GDP growth less unit labor costs) is growing at a healthy clip, which usually indicates recovery rather than recession. But let’s decompose this profit proxy for a moment, looking specifically at periods when it’s rising faster than 5%. Most of the time, a profit proxy of 5% or more reflects healthy nominal GDP growth in excess of still-rising unit labor costs. But the latest profit recovery (the three red dots) is reliant on declining labor costs like none before it. A profit recovery whose foundation is so reliant on sustained high productivity and low real wage growth should not command a very high P/E multiple.

Comments