Moody’s Commercial Property Price Index Drops To Lowest Level Since 2002

Posted By thestatedtruth.com on October 19, 2010

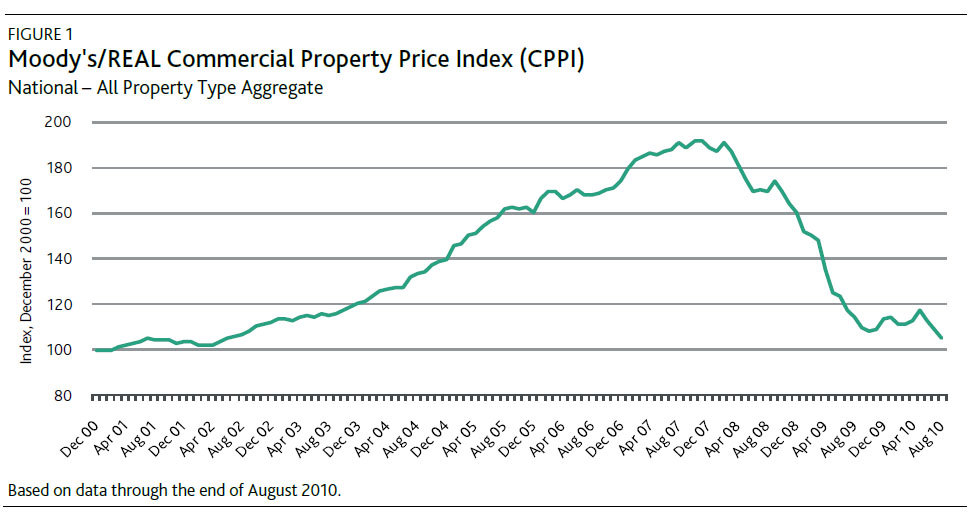

The banks have a $3 trillion footnote on their balance sheets known as CRE. They are lucky they’re not insolvent: the Moody’s REAL/Commercial Property Price Index index dropped by 3.3% in August, and is now 45.1% lower compared to the October 2007 peak.

Moody’s Summary Points:

The National — All Property Type Aggregate Index recorded a 3.3% price decline in August. The index is currently at a new recession low, 45.1% below the peak measured in October 2007.

The data suggest that the commercial real estate market has become trifurcated, with prices for larger trophy assets rising, prices for distressed assets declining sharply, and prices for smaller but healthy properties remaining essentially flat. One way to view index returns is by looking at the interplay of these three components of the overall market. The index again turned negative this month in part because large negative returns on distressed properties created a drag that outweighed the positive and flat results of the performing properties.

Comments