The Middle Class Financial Compact Being Washed Away – Income Dilution and the Saving Disparity- 57 Million Households Live On $52,000 Per Year Or Less.

Posted By thestatedtruth.com on March 3, 2010

The middle class is finding itself struggling to keep what was once seen as staples of a burgeoning working class in our country. Part of this battle has come from a system that has rewarded easy finance on the backs of the working class. Take for example residential real estate. For decades, this was probably one of the most boring and dull sectors of the economy. Residential real estate, if you were lucky, only tracked the overall inflation rate. That was the case until the banking system figured out a way to securitize bread and butter mortgages and turn them into securities for global consumption. Yet that game is now coming to a quick end. The middle class are literally being squeezed out of their homes. Healthcare costs are also cutting deeper into the wallets of most American families and many are finding that they have no coverage as unemployment is still at record levels. This decade will be a struggle for the middle class to save and prosper.

What constitutes “middle class†in the United States? If we go by the median household income the figure is roughly $52,000 per year. Some 57 million households live on $52,000 or less per year. This is based on 2008 Census data so it is very likely that figure is down to $50,000. In fact, 38 million households are receiving food assistance so some are below the poverty line.

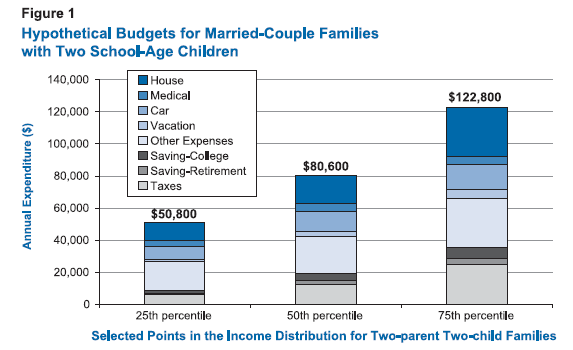

Let us look at how much income is used up by breaking down a few hypothetical budgets:

Source:Â U.S. Department of Commerce

The biggest line item for most American families is housing. When housing prices expanded into a massive bubble, more Americans to keep up with the middle class ideal took on more and more mortgage debt. But without growing incomes they were seeing more of their money being funneled into servicing the mortgage debt. With the advent of interest only and negative amortization loans, the process of building equity never took place and in some cases actually grew the initial mortgage balance. Instead of saving, many middle class families saw their net worth retreat backwards. This was one really new facet in this current economic crisis. Traditional mortgages were once seen as a forced savings account because every month a portion of the principal was paid off. Once you reached the later years of the mortgage, more and more went to paying off the mortgage. That was not the case with some of the debt we saw in the last decade.

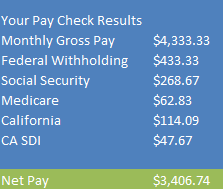

Part of the two income trap is hidden in more troubling ways. Take for example automobile costs. Most Americans with a two income household have two cars. Let us assume that both cars were bought for $20,000 each and carry a $300 monthly payment. So $600 a month right? Wrong. What about fuel? Add $100 to $200 per month depending on how much you drive. Car insurance? This will be roughly $100 per month. Car service? Try another $50 to $100 per month. So in total, many families are spending $600 to $900 per month on car costs. And people aren’t taking much home after taxes:

So the take home pay for the middle class family is $3,400 if they live in California. Subtract that $900 in auto costs and you are now down to $2,500. In places like California where the median home price went up to $500,000 any middle class family stood no chance at buying a home. Well, they were able to buy but holding on to the home was another story. Yet people bought at these peak levels and that is why we are seeing such large number of foreclosures in the state but also in other states. Even last month the number of foreclosure filings in California was near record levels. The middle class is finding it tougher and tougher to keep their head above water.

Let us run the numbers if someone were to buy a home:

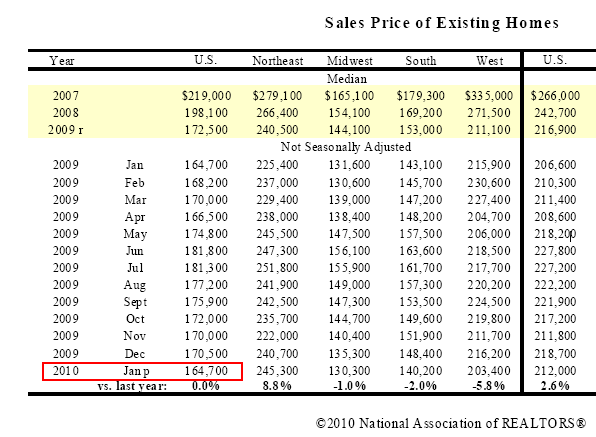

The latest home price for existing home sales in the U.S. is $164,700 for the median. It is interesting to note that we are now back to January of 2009 levels and for 2009, prices did go up but went full circle back. Let us assume this family uses a FHA backed loan and is only required to put 3.5% down:

Down payment:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $5,764

Mortgage payment (PITI):Â Â Â Â Â Â Â Â Â Â $1,098

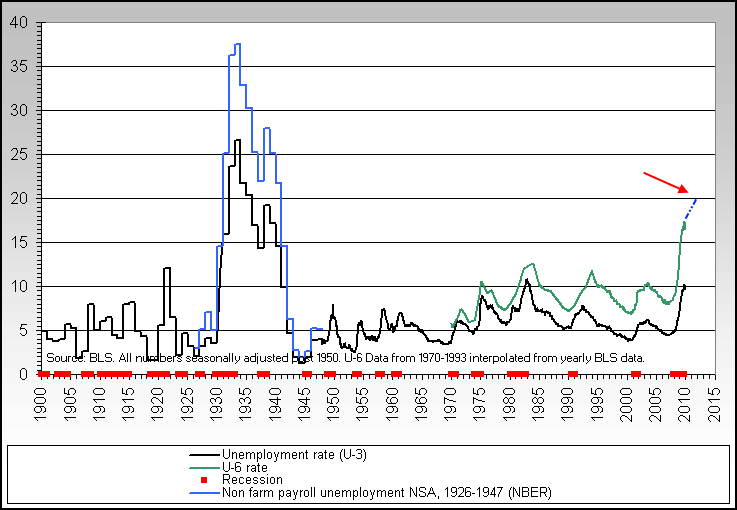

So take that $2,500 left over and now subtract this amount. $1,402 is what is left over. This is the amount of money left over for food, healthcare (one illness and that is it with no insurance), and other daily good costs. What about retirement savings? That has to come from here as well. The money can go quickly. What about cells phones? Utility bills? Quickly that number dwindles. And keep in mind this is household income. As we now know many families are seeing one of their incomes disappearing and people are having a hard time finding work:

Source:Â Itulip

When I look at the above chart it doesn’t take a rocket scientist to figure out that many people are still in the throngs of the recession. The talk of recovery is muted by the reality of the numbers and all the average American will see is a recovery on Wall Street but in terms of their pocket book, little is funneling to them. I’ve heard from people across the country looking for work and being unable to find anyone hiring. And if they do find something, the wages are much less than what they once earned. This isn’t reflected in the data. How many people that are now marked as fully employed are in jobs that now pay less than what they once had? That is why problems even in credit cards are filtering all the way to the bottom of the bank balance sheet. People are relying on credit cards as their last lifeline and many banks are now shutting these off.

What was once thought of as middle class security is now heavily at risk:

-Secure job   [no longer]

-Steady home values [no longer]

-Access to affordable education [costs are outpacing inflation]

-Healthcare costs are skyrocketing with an aging population [just look at your insurance premiums]

The middle class is really coming under an onslaught of issues. What we do in terms of financial reform and also, how we view our compact with our nation are going to be really important going forward. But if the only sure thing is protecting banks from failure, then we are seeing the fruits of that decision playing out.Â

Commercial Real Estate Problems in Financial Purgatory – $3.4 Trillion Debt Market and Expansion of Interest Only Loans to Finance CRE Deals. CRE Debt Found its way into Pension Funds.

Posted: Mon, 01 Mar 2010 22:44:20 +0000

The Congressional Oversight Panel put out a daunting report regarding the commercial real estate market. Commercial real estate is an enormous market with $3.4 trillion in debt secured by office space, malls, and apartment complexes to name a few examples. Commercial real estate does a fairly good job as being a barometer for the actual recovery on the ground that most average Americans will feel. If middle class Americans feel ready to spend again and are expanding their consumption, then more and more office space will be occupied. But looking at current vacancy rates we get a diverging picture of the recovery we keep hearing about but seem to escape the grasp of 95 percent of the population.

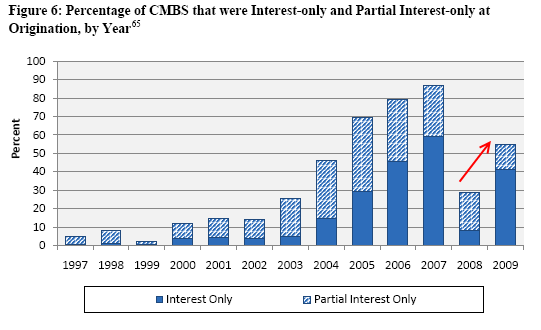

One of the troubling findings in the report is the lax lending found in residential real estate was mirrored in the commercial real estate market:

In fact, the amount of interest only or partial-interest only loans was even bigger in CRE than in the residential market which in itself is a rather stunning accomplishment. In 2007 at the height of the CRE bubble, nearly 90 percent of all loans were interest only or partial-interest only loans. This number is astounding. But what is even more disturbing is the recent ramping up of interest only loans. In other words, banks are rolling over loans with the absolute minimum payment possible to keep borrowers above water. Why does the bank want millions of square feet in empty office space? They don’t so the shift here probably has something to do with that. The commercial real estate market is in a giant form of financial purgatory.

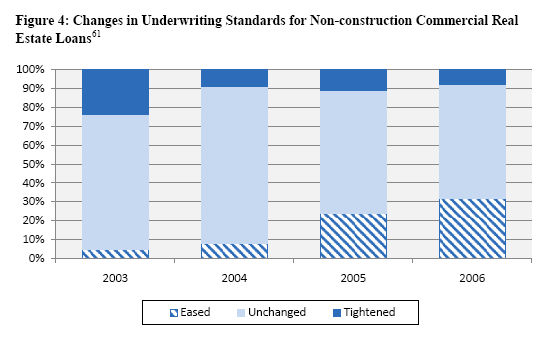

The lax lending standards that came into the CRE market also show that during the boom due diligence was an afterthought on most loans. Keep in mind many of these deals were multi-million dollar deals and in some cases, billions of dollars were at hand. This wasn’t a $90,000 subprime loan, which is bad in itself with weak underwriting, but here you had millions being thrown around as if somehow banks forgot the actual value of a dollar. The standards in CRE deteriorated rather quickly:

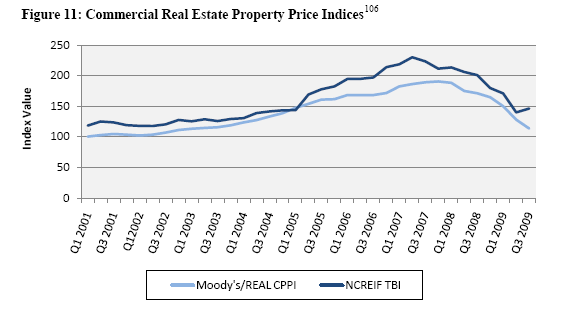

As more and more money bounced around the system lending standards became more and more generous. Of course this led to the massive expansion in CRE space even when demand did not warrant it but has now led us to this current precipice where the market is flooded with too much inventory. As is the case in most bubbles prices have corrected heavily in the CRE market:

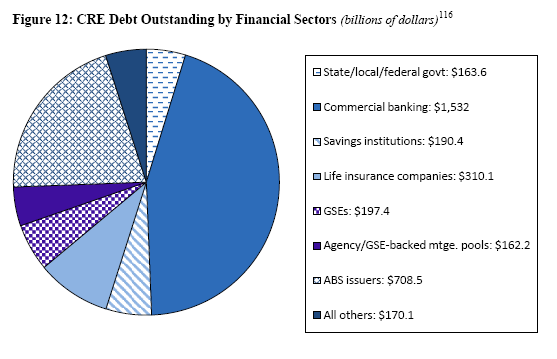

CRE values across the board are down by 40 percent from their peak values, a steeper decline than even the residential housing market. Yet banks holding onto these loans have been spared the stock market drubbing many banks took in 2008 and early 2009. The loans are equally as bad so why then is the market responding so favorably to what seems to be disastrous data? In March of 2009 it seemed the entire financial system was going to implode and finding a bid on any asset at one point seemed to be an act of futility. Now this might have been extreme given how quickly we were approaching zero. But today, the opposite is the case. Many are overvaluing the actual damage that is going to hit the system in the next few years courtesy of the CRE market. This is an enormous market where most of the loans are held by already weak banks:

The large amount of this debt is held in commercial banks. These are the same commercial banks that are backed by the insolvent FDIC fund. The FDIC now lists over 700 banks as “troubled†but it is very likely that when this crisis is over (which can be years away) we will have at least 1,000 bank failures. Most of these banks now have CRE loans that are not being serviced or are being serviced at lower levels that don’t even cover principal and interest. To paraphrase, if you owe the bank $1 on credit card debt that is your problem, but if you owe the bank $10 million in CRE debt it is the bank’s problem. Many banks are in a position where they are now realizing that the borrower is calling the bluff of the bank. You want your CRE back? Go ahead and take it! So banks would rather let the borrower hold onto the CRE even if it is bleeding on a monthly basis instead of forcing actual write-downs on their books.

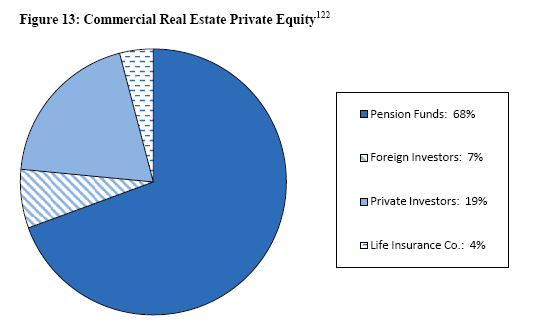

And what is troubling is that many so-called conservative investment funds ate up this toxic waste:

So you might be thinking, “I don’t own any CRE so why should I care?â€Â You might not own any of this CRE debt but your pension might. Now when things get this systemic, it is bound to roil the system just like subprime was the fuse that lit off the economic crisis. Today, no one thinks that subprime was the cause of this entire crisis but was merely the most obvious first domino to fall. CRE is equally as toxic but it seems that the market has chosen to ignore the problems inherent in the system. Eventually the system will have to realize what is going on either through a market correction or by funneling more bailout funds to inefficient components of the economy.

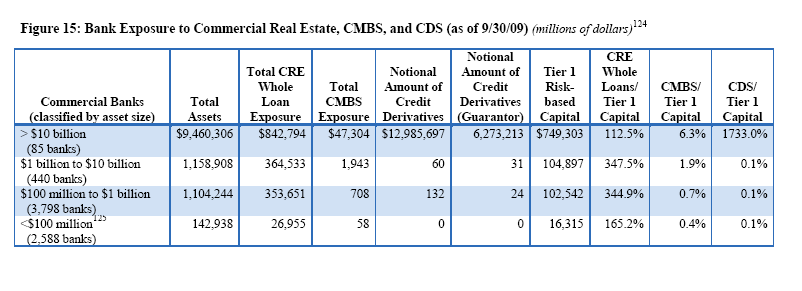

The market is probably mispricing the actual problems in the system because it assumes that the bailouts of the banking industry will protect the problems with this mess. Yet someone will be paying for this. Wall Street is simply assuming it will be the middle class yet again. Take a look at the concentration of CRE debt with the too big to fail:

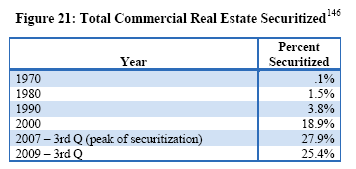

At the core of this problem was the shifting of debt to the global markets by securitization. To repeat an often misused quote, real estate is local. So how can an investor in Norway really have a good sense of CRE in Houston Texas? They don’t and clearly this is the same inefficient spreading of risk (and gambling) that led us into this crisis:

For 40 years securitizing debt was only a Wall Street trader pipe dream. Suddenly in 2000, this was the way to make mounds of money on what used to be boring real estate debt. CRE was only another asset class that was once relatively stable and suddenly became another slot machine in the Wall Street casino. It is no mistake that over the past decade the middle class in America have lost ground seeing wages stagnant while a smaller portion of our economy goes to those in the government sanctioned casino knows as Wall Street.

Expect bigger problems to hit in the CRE market. From the report:

“(COP) Between 2010 and 2014, about $1.4 trillion in commercial real estate loans will reach the end of their terms. Nearly half are at present “underwater†– that is, the borrower owes more than the underlying property is currently worth. Commercial property values have fallen more than 40 percent since the beginning of 2007. Increased vacancy rates, which now range from eight percent for multifamily housing to 18 percent for office buildings, and falling rents, which have declined 40 percent for office space and 33 percent for retail space, have exerted a powerful downward pressure on the value of commercial properties.â€

In other words, get ready for more bailouts or dollar devaluation.

Comments