From The Eyes Of Gene Inger Of “The Inger Letter”

Posted By thestatedtruth.com on August 9, 2010

What this work by the San Francisco Fed team clearly intimates, is that those who’re viewing the Leading Indicator curve are not incorrect when they see the recessionary signals resurfacing (something we’ve warned of as a projection for 2010’s back half for months, because it made sense; but now there is factual economic evidence that backs up the projection); and besides that I visited for a good while Saturday with a personal friend who works at Fannie Mae, to hear a perspective about housing that’s not at all encouraging for those who are looking for an early low (much less last year as some proclaimed and we were pretty sure wasn’t feasible). This management guy tells me 2-3 years, not 1-2, is most likely to work-through what he sees forthcoming. Of course the caveat is that we’re talking about certain areas of the Nation; where the bubble was present; not a few areas where there were not bubblemania conditions.

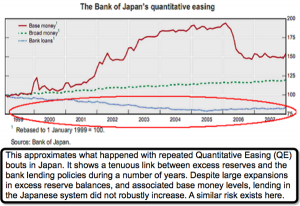

The bottom line of the FRBSF work was that the typical ‘presentation’ of an inverted yield curve preceding each of the last seven U.S. recessions might not occur this go-round. That’s in-part because monetary policy has been operating near the zero level for ‘Fed funds’ to provide maximum monetary stimulus (as they see it; while we see it as a counterproductive strategy to liquefy the banks with a free ride and thus curtail a lot of lending impetus by bankers; an ‘unintended consequence’ perhaps, but severe to say the least, with respect to impeding an American small business recovery start).

Also the Greek (and next the Spanish?) fiscal crisis generated a considerable flight to quality that pushed down yields on U.S. Treasury securities. If you thus omit the rate spreads because of the need to keep the official rate at nothing, you tent generating more pessimistic forecasts. The SF Fed concludes the odds of new recession slightly exceed that of expansion. Unfortunately agree, as there really has been no stimulus, outside of misdirected excessive funding of banks to the detriment of taxpayers and of course small business. In essence the way they structured it we thought (all along and in advance of the collapse because we thought they’d excessively focus on the banks) would be a negative in shaping the pace of recovery, and actually hinder it.

What they are talking about in ‘two years’ is a little ridiculous, as it’s the same sort of ‘controlled Depression’ I have contended we remain in, irrespective of the effort to try to push the equity markets to unreasonable heights (new bubble) creating perception of greater recovery than exists (outside of a few export-oriented big-cap corp. areas).

Do note that this kind of report ‘could’ be a ‘white paper’ of sorts to give a Depression term after-the-fact to what we’ve been through, as is also what occurred in the ‘30’s. I think (not whimsically) that if they ‘proclaim’ that we’re in a Depression come 2012; it is not out of the question that said ‘confirmation’ of weakness might denote the low of it all, ironically enough. Hence we’re back to the idea that after next year we’ll stop for the most part hearing more bad news, except to the extent government wants us to in the midst of belatedly trying to get a handle on Federal expenditures (and support for that, which will not be possible if they can’t actually convince people things are worse if you think about it). Are we thus optimistic? Not now; not at such extended market levels. But thinking about it for a period down-the-pike, and probably when nobody is believing we’ll get out of this. Frankly we think the market has a big sobering looming; and probably well before anticipating whatever they say in 2012. In fact, if 2012 now becomes a warning, that means all the forecasts for 2011 are excessive; but we sure knew that (or at least have contended that); well before Goldman figured it out too (or at least came forth to acknowledge it). Near-term suffice to say we don’t see QE2 as a salvation, as unless it was smaller and better-targeted (lots better) it’s useless and yet another ‘hail Mary’ pass from Government. If they target rebuilding electric grids, or something that has enduring worth to the people, we’ll gladly give it a fresh look.

Comments