The Mortgage Interest Deduction…..Why Home Buying Is Heavily Subsidized In The United States

Posted By thestatedtruth.com on October 24, 2010

One of the sacred cows of our economy revolves around the mortgage interest tax deduction. Home buying is heavily subsidized in the United States. The Federal Reserve has injected trillions of dollars in purchasing mortgage backed securities and other questionable assets all for the purpose of keeping interest rates low. Yet this is one area of misunderstanding by the public because when the data is sorted out it becomes clear that the mortgage interest tax deduction heavily subsidizes the home buying of wealthier Americans and those who live in more expensive states. The golden goose is expensive to maintain. The median household income of $50,000 garners very little benefit from this deduction because the standard deduction is already high for half of U.S. households. Let us carefully examine the details of this expensive subsidy and visualize how costly this subsidy is but first let us look at the failed home buyer tax credit.

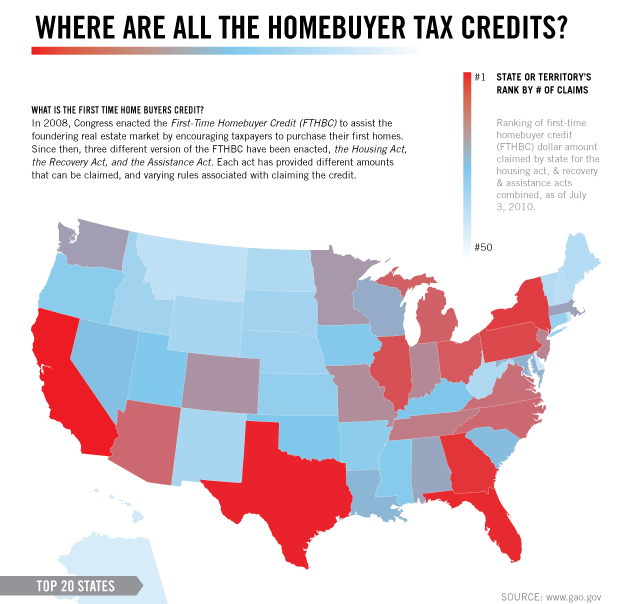

Homebuyer Tax Credit

Source:Â Intuit

The home buyer tax credit had a hand in boosting sales when it was enacted. Sales have fallen since that time and it has now been realized that this was merely an expensive subsidy to pull home sales forward. In California $814 million was claimed for this tax break. Texas claimed $682 million and Florida claimed $455 million. All in all the home buyer tax credit cost the U.S. taxpayer $7.2 billion for really only pushing sales forward. The market has now collapsed and the failure of the subsidy has been apparent. But this was a unique deal. The mortgage interest deduction has been a staple of our economic discourse for many years now but has failed in increasing homeownership or making homes affordable for working and middle class Americans. This is where the heart of the issue really exists.

Home Mortgage Interest Deduction

There are many reasons why the mortgage interest deduction is flawed. First, it subsidizes and industry that would do well regardless of the deduction. Next, it is costly at a time when the government is hurting for revenue. But here are the three common criticisms of the mortgage interest deduction:

-1. The actual deduction doesn’t really impact the rate of homeownership.

-2. We now allow deduction of interest on home equity loans which allowed consumers to go around laws and regulations that do not allow for the deductibility of personal loans. For example, someone who used their home equity loan to purchase 10 flat screen TVs can actually deduct the interest each year just because it was financed with a home equity loan. A renter that even buys one flat screen is unable to deduct this kind of consumption.

-3. The actual deduction favors the high-income taxpayer at incredibly disproportionate levels.

These issues strike at the core of the problem with subsidizing home buying to extreme measures. Many of the higher income states benefit extraordinarily from this and have also added fuel to the flame in regional housing bubble differences. For example, let us run an example with the standard deduction:

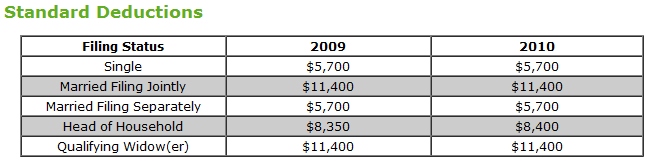

Source:Â H&R Block

A single filer already has a $5,700 deduction right off the bat. A married couple filing jointly will have a standard deduction of $11,400. So in lower priced housing states many people won’t really benefit from the deduction unless they itemize (and even then the standard deduction might be higher). In that case of itemization, it usually favors higher income families. This is revealed when we look at the data carefully:

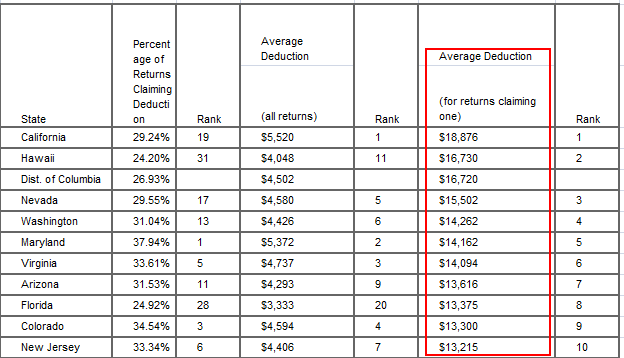

Now this is an interesting break down. If we look at the states that receive the highest average tax deduction based on returns claiming the mortgage interest deduction we will notice many states with inflated housing bubbles show up. California, Nevada, Arizona, and Florida all show up here in the top 10 states. It is incredible that California has an average of $18,876 for those who claim the deduction while the national average is $12,221 (35% lower than California). But even here, this average is skewed by higher income households across the country who write-off interest at the expense of everyone else.

The mortgage interest tax deduction seems to be sacrosanct for many. Yet there should be a cap on how much can be written off. The difference can be seen on a $100,000 mortgage versus a $1 million mortgage. Why not cap the maximum interest deduction to the actual median home price nationwide? Currently that stands at $178,000 so this should cover the bulk of the country without favoring one state over another. Why should there be a bigger benefit in more expensive states?

Why don’t people touch this issue even though the bulk of middle class Americans garner very little benefit from it? Because of this:

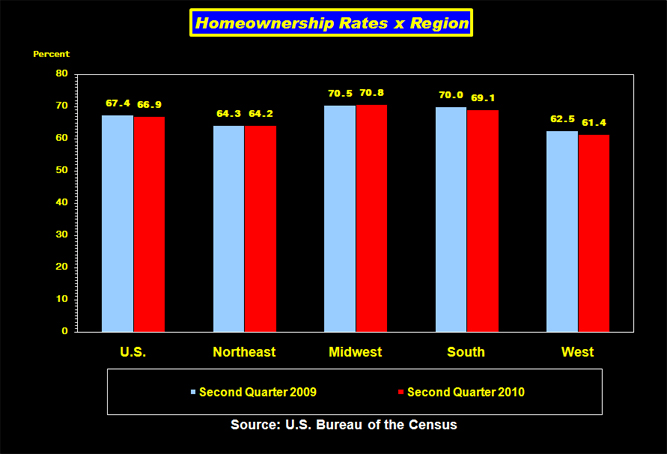

Source:Â Census

Over 66 percent of U.S. households own their home so politicians are reluctant to issue nuanced arguments that demonstrate to the vast majority of Americans that the mortgage interest deduction should be modified to have a cap since it is subsidizing the lifestyle of higher income Americans. It is unfortunate that many Americans already through the standard deductions have benefitted but misunderstand the actual bigger picture with the mortgage interest deduction. A high income family will benefit incredibly by the deduction while a middle class family will not. Let us run a scenario here. Let us look at a family making $50,000 a year with a $80,000 mortgage (on a $100,000 home) versus a family making $250,000 with a $500,000 mortgage (on a $600,000 home):

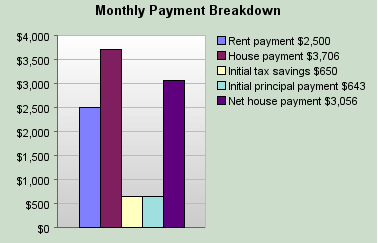

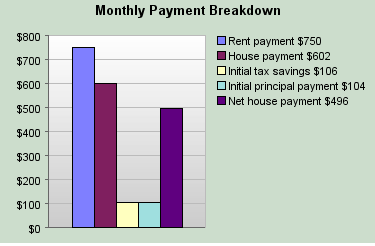

Here is a rundown for the home with an $80,000 mortgage. The tax savings aren’t that significant. We’ve assumed that this family would have a rental substitute at $750 a month. The tax savings are minimal in the bigger scheme of things. But let us look at that $500,000 mortgage:

The tax savings here are significant. Some might say that a $500,000 mortgage is rare. Actually, at the height of the housing bubble California had a median home price that reached close to $600,000. This occurred in the most populated state. So this scenario wasn’t merely hypothetical, it actually happened.

It is important to examine the mortgage interest deduction because it is simply another policy that has lost its way. The middle class are largely financing the debt spending of the wealthy.   Why not cap the deduction to the median home price nationwide? So far we have seen very little movement in terms of helping the working and middle class in the U.S. and this is simply another example.

Start making money right Now

made over 83 millionaires in the last 9 months

… [Trackback]

[…] Read More on|Read More|Read More Infos here|There you will find 19372 more Infos|Infos to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More on|Find More|Find More Informations here|There you will find 3578 additional Informations|Infos to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More here|Find More|Read More Infos here|Here you will find 13665 additional Infos|Infos to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More here|Find More|Find More Informations here|Here you can find 1886 additional Informations|Informations to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More on|Read More|Read More Infos here|There you will find 52914 additional Infos|Informations on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More on|Read More|Find More Infos here|Here you can find 36311 more Infos|Informations to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More here|Read More|Find More Informations here|Here you will find 64063 more Informations|Infos on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More here|Read More|Read More Infos here|There you can find 53936 additional Infos|Informations on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More here|Read More|Find More Infos here|There you will find 78112 more Infos|Infos on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More on|Read More|Find More Informations here|Here you will find 81671 additional Informations|Infos on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More here|Find More|Find More Informations here|Here you can find 74165 more Informations|Informations on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More here|Find More|Find More Infos here|There you will find 44595 more Infos|Informations to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More here on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Info on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Info on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Here you will find 88308 additional Info on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Info to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More on to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Here you can find 88186 additional Information on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More Info here to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Here you can find 35938 more Info on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Information on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More on on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More here to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Here you will find 60388 more Information on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More here to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] There you will find 43786 additional Information to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Here you can find 69868 additional Info on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Here you will find 61282 additional Info on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Here you will find 362 more Information to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Here you will find 50080 more Information to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Info on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Find More to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More on to that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Read More on that Topic: thestatedtruth.com/?p=11206 […]

… [Trackback]

[…] Information on that Topic: thestatedtruth.com/?p=11206 […]