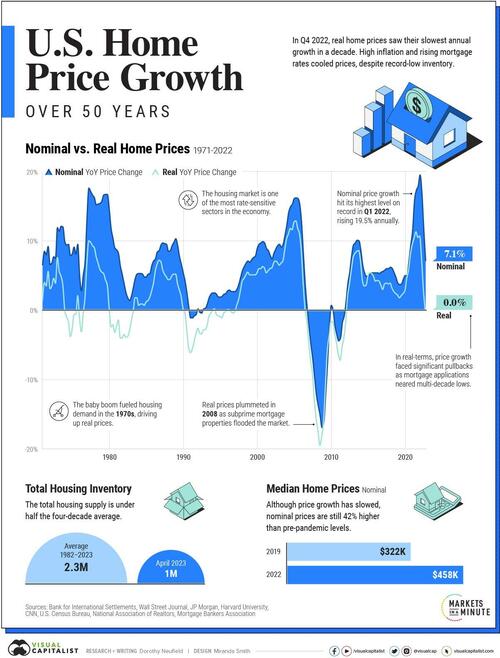

Visualizing ‘Real’ US Home Price Growth Over The Last 50 Years

Posted By thestatedtruth.com on July 2, 2023

Interesting explanation of inflation-adjusted terms in U.S. home prices, and it shows the slowest real growth in a decade.

U.S. home prices grew significantly in 2022, even as interest rates climbed higher.

Yet, as Visual Capitalist’s Dorotrhy Neufeld details below, in inflation-adjusted terms, this growth rate was far lower. By Q4 2022, it fell to being flat year-on-year, making it the slowest real growth seen in a decade.

The graphic below compares nominal and real residential property price growth over 50 years based on the latest data from the Bank for International Settlements (BIS).

Nominal vs. Real Home Price Growth

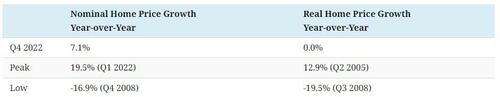

In 2022, opposing forces of rising mortgage rates and a narrow supply of housing produced a moderate nominal growth rate of just over 7% as of Q4 2022. That said, real price growth dropped to 0% over the period.

Here’s how that looks in context of the recent highs and lows of housing price growth:

Recent Highs: During the pandemic, growth hit almost a 20% year-over-year rate by Q1 2022, which was record home price growth at the time. It was driven by ultra-low interest rates and remote work leading people to seek out more space.

Recent Lows: In both real and nominal terms, home price growth sank to their lowest levels in 2008. The property market crashed after a wave of easing lending requirements. This flooded the market with an oversupply of houses as subprime homeowners couldn’t afford to make payments, leading prices to plummet.

Factors Influencing Home Price Growth

Today, a mix of factors are supporting nominal house prices.

First, the housing supply remains low.

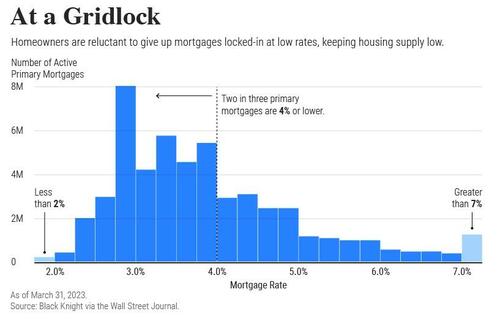

Total existing inventory stood at 1 million in April, under half the four-decade average. As interest rates have increased, homeowners have been hesitant to sell and the number of mortgage applications has fallen. In turn, this is pushing prices higher.

In fact, the majority of primary mortgages have interest rates locked in under 4%. As of July 1, the average 30-year fixed mortgage rate stood much higher, at 7.02%.

Along with this, new home sales are falling.

After hitting a 15-year peak in 2021, sales sank almost 27% year-over-year in April. New home sales are often considered a leading indicator for the residential market.

Wider Implications

The U.S. residential market is valued at about $45 trillion, and has historically been highly sensitive to interest rates.

While the rapid increase in interest rates haven’t yet had a major impact on housing prices, some cracks are beginning to show.

On the other hand, if prices remain stubborn, it may contribute to inflationary pressures, leading the Federal Reserve to continue with rate increases, given the market’s sheer size and influence on the overall U.S. economy.

Comments