Bond Vs. Stocks…..Pension Allocations

Posted By thestatedtruth.com on September 3, 2010

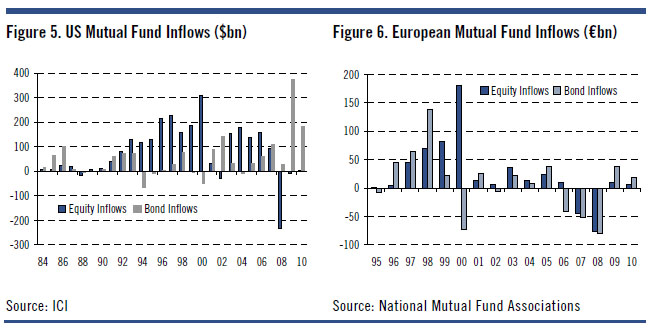

Reviewed below are mutual fund flows for the  year…..bonds over stocks by a huge margin. In fact, the monthly trends are so negative for stock mutual fund flows that we would be surprised if the small yearly stock inflows for 2010 don’t turn into outflows. The stock monthly flow data was posted here on September 2, which was yesterday.

17x forward P/Es and expecting a 20% rise in corprate earnings in 2011 with a flat GDP indicates a serious question mark.

17x forward P/Es and expecting a 20% rise in corprate earnings in 2011 with a flat GDP indicates a serious question mark.

Citi’s Robert Buckland is out with this must read report, parts of which are reviewed below.

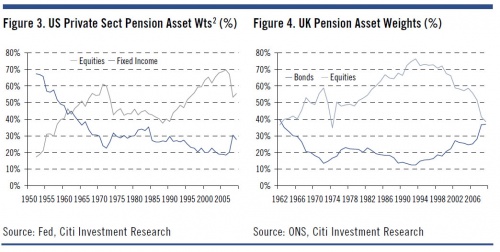

“A reduction in equity holdings back to pre-1959 levels (around 20% of total assets) would indicate considerable selling pressure to come. For US private sector pension funds alone, that would imply a further $1900bn reduction in equity weightings. The evidence suggests that there could still be considerable institutional selling to come.”

So let’s recap what the medium- and long-term trends for the market are:

- $2 trillion in equity sales from pension funds alone as capital flows normalize now that the “Equity Cult” is dead

- A seemingly endless push into fixed income by an aging demographic meaning billions more in ongoing monthly domestic stock mutual fund redemptions

- Hedge funds which are underperforming the market massively, and which will see an explosion in redemption letters as the end of Q3 approaches

- An inevitable change in the tax regime over the next 4-5 months, which as Guggenheim pointed out, will force investors to sell billions in stock to catch a sunsetting beneficial capital gains tax.

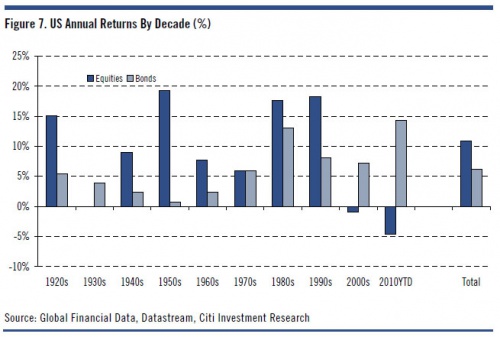

The annual returns data by decade sums things up!

More at: www.zerohedge.com

Comments