Watch Out For Those Economic Hairpin Turns, They Are Everywhere…

Posted By thestatedtruth.com on March 19, 2012

Spend, spend spend……

The Federal Reserve Flow of Funds Report, issued two weeks ago, reveals the extent of the average mans plight : Forty percent of all credit card users do not pay-off their credit card every month and carry an average balance of $16,000 at an average interest rate of 15%.

- Total U.S. credit market debt has RISEN from $50.9 trillion in 2007 to $54.1 trillion as of 12/31/11, a $3.2 trillion increase.

- Household debt has declined from $13.8 trillion in 2007 to $13.2 trillion as of 12/31/11. The mainstream media would point to this $600 billion decline as proof that Americans have embraced austerity and have learned their lesson. But not so fast… The Wall Street banks have written off $200 billion of credit card debt and the 5 million completed foreclosures extinguished another $800 billion of mortgage debt. The truth is that consumers have continued on a debt binge.

- Much has been made of corporate America being flush with cash. So, why have they added $900 billion of debt since 2007, an increase of 13% to an all-time high of $7.8 trillion?

- The revealing data shows up in the financial company data. These Wall Street national treasures have reduced their debt from $17.1 trillion in 2008 to $13.6 trillion as of 12/31/11. How were they able to do this, while writing off $1 trillion of consumer debt?

The Federal government increased their debt from $5.1 trillion to $10.5 trillion. And our old friends called government sponsored enterprises (Fannie, Freddie, Student loans) increased their debt from $2.9 trillion to $6.2 trillion. Wall Street banks and millions of deadbeats who chose to game the system and live the good life have effectively foisted their $4.5 trillion of debt upon the backs of middle class taxpayers who lived within their means. Another $4.2 trillion has been pissed down the toilet by Obama with his $800 billion program, home buyer tax credits, cash for clunkers, green energy boondoggles, 47 million people on food stamps success story, 99 weeks of unemployment, doubling of SSDI membership, and his multiple wars of choice in the Middle East.

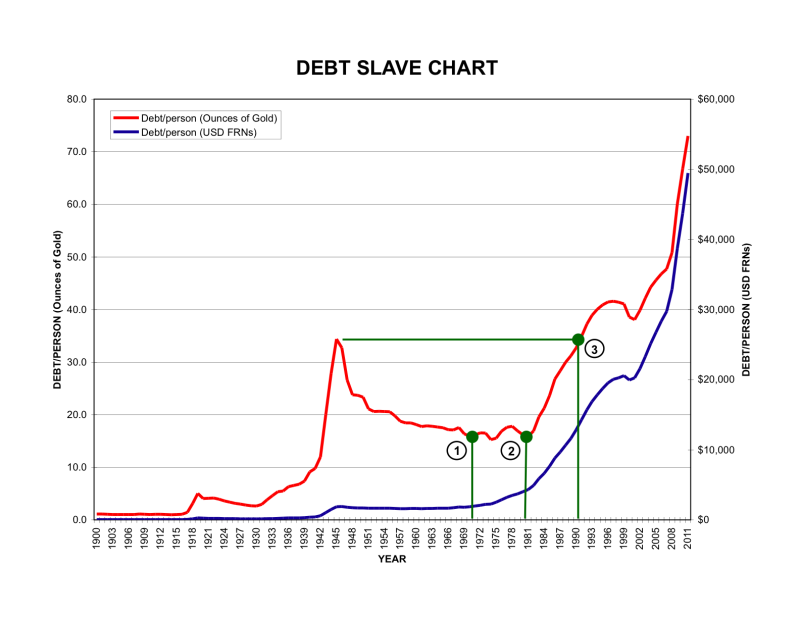

And, the little guy: he or she has little chance of getting out of debt! Here’s why….

Forty percent of all credit card users do not pay-off their credit card every month and carry an average balance of $16,000 at an average interest rate of 15%. Good to see the Wall Street banks passing along some of their 0% borrowing windfall to their “customers”. Not!

Capice!

Source: TF Metals Report

Comments

3 Responses to “Watch Out For Those Economic Hairpin Turns, They Are Everywhere…”

Leave a Reply

You must be logged in to post a comment.

free classified ads

No free advertisements,no kiss

The Stated Truth

[…] What host are you the use of? Can I am getting your associate link for your host? I desire my website loaded up as fast as yours lol[…]

free cryptocurrency mining

free mining