It’s A Bear Market In Lending, And A Bull Market In Spending

Posted By thestatedtruth.com on August 12, 2010

We’re looking at what will likely be a multi year process of cleansing. Debts will have to be paid down, leverage decreased and ultimatly spending will have to be cut too! That will make things even worse. Asset values will continue to fall. At some point in the future the system will complete its debt recycling and a new growth period can start. But from the looks of things, we’re not close to that point yet!

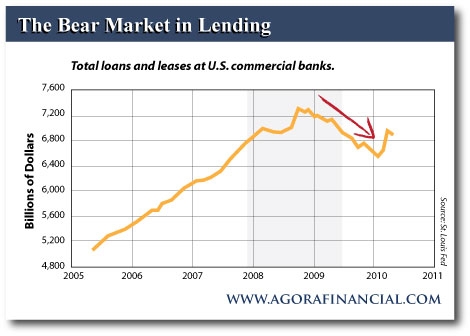

Contraction In Private-Sector Debt – When the credit crisis arrived in the summer of 2008 and asset prices collapsed later that year, over- leveraged consumers and businesses started paying off their debt. After all, this act of deleveraging was a logical reaction to the devastation caused by the most vicious bear-market since the 1930s. So, when private-sector debt began to shrink, the proponents of deflation (deflationists) announced the death of inflation. “How could the global economy inflate when the private-sector was tightening its belt?” was their battle cry.

|

Â

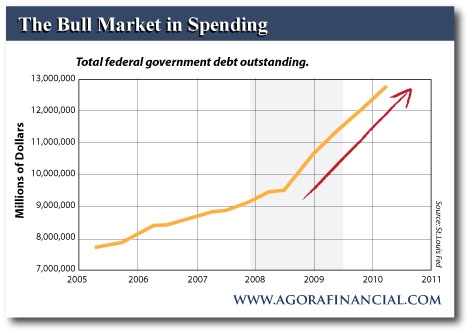

As the chart below shows, over the past two years US federal debt has surged by a whopping US$3 trillion, thereby more than offsetting the deflationary impact of private-sector deleveraging. If you have any doubts whatsoever, you will want to note that total debt in the US is now at a record high!

|

Â

Comments