The Consumer And Debt

Posted By thestatedtruth.com on September 11, 2010

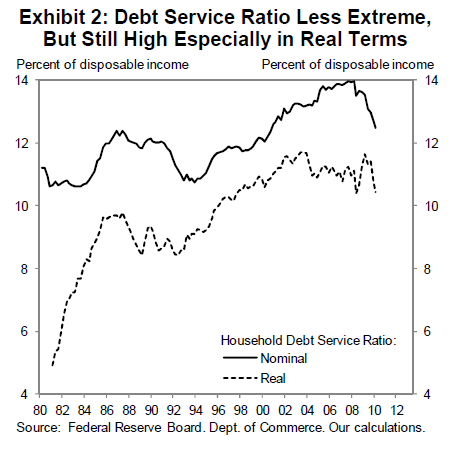

If not for record low interest rates, the Debt Service Ratio chart below would look a lot different!

The consumer, and why the expectation (and reality) of deflation will keep U.S. buyers subdued, and continue to make the US economy ever more reliant on the government’s transfer payment, aka welfare, program.

A very simple illustration of the challenge is provided in Exhibit 1, which shows that the ratio of household debt to disposable income remains far above levels prevailing prior to the asset price and credit boom that started in the late 1990s. This suggests that the deleveraging of household balance sheets still has much further to go.

But while the ratio of household debt remains exceptionally high, the ratio of household debt service interest and scheduled principal repayments to disposable income looks less out of line with longer-term norms. This is shown in Exhibit 2, which plots the household debt service ratio as calculated by the Federal Reserve Board.1 Although it is still above its long-term average, the gap was never as big as in the case of the debt ratio and has declined substantially since 2007. What should we make of this?

And here is the kicker, explaining why once again the Fed has misunderestimated American consumers:

While the debt/income ratio shown in Exhibit 1 is hardly the end of the story, we believe that Exhibit 2 leaves out an important factor, namely that debt service is defined in nominal rather than real terms. The calculation does not take into account the rate at which inflation erodes the real value of household debt over time. This erosion will confer a bigger benefit on indebted households in a high-inflation environment such as the early 1980s than in a low inflation environment such as now.

Comments