Unprecedented 19th Sequential Equity Outflow, $10 Billion In September Redemptions

Posted By thestatedtruth.com on September 15, 2010

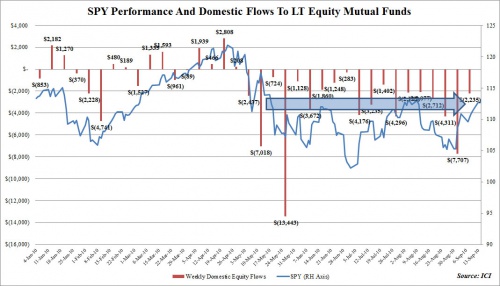

ICI’s latest data discloses that in the week ended September 8, domestic funds saw outflows of $2.2 billion, following last week’s massive $7.7 billion. And ETFs experienced outflows as well. So far September has experienced nearly $10 billion in outflows, even as the market has ramped by over 6%. This is the 19th sequential outflow from US stocks, and amounts to $65 billion in redemptions for the year. With the market pretty much unchanged YTD, it means that mutual funds can not resort to capital appreciation as a substitute to outflows. Interesting fact: the S&P is at the level it was when the outflows began back during the flash crash.

Weekly YTD Outflows:

Cumulative YTD Outflows:

Comments