The 12 American States With Highest Borrowing Risk

Posted By thestatedtruth.com on December 2, 2010

A holder of a bond may “buy protection†to hedge its risk of default. In its simplest form, a credit default swap is a bilateral contract between the buyer and seller of protection. The CDS will refer to a “reference entity” or “reference obligor”, usually a corporation or government. The reference entity is not a party to the contract. The protection buyer makes quarterly premium payments the “spread” to the protection seller. If the reference entity defaults, the protection seller pays the buyer the par value of the bond in exchange for physical delivery of the bond. Â

A default is referred to as a “credit event” and include such events as failure to pay, restructuring and bankruptcy.

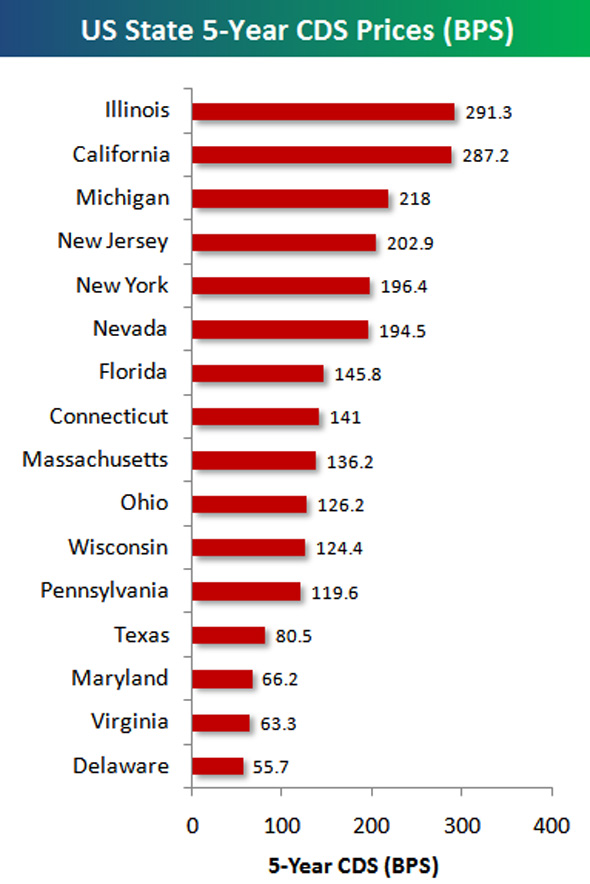

This chart from Bespoke Investment Group points out just where your state is in terms of the cost to insure its debt. The higher the cost, the more likely it defaults, or so the market would indicate.

Illinois has seen the largest surge in 2010, with its CDS price rising by 97%, according to Bespoke.

From Bespoke Investment Group:

Image: Bespoke Investment Group

Image: Bespoke Investment Group

Read more: http://www.businessinsider.com/state-cds-prices-2010-12#ixzz1703TQcrm

Comments