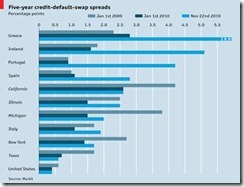

Credit Default Swap Spreads…..5 U.S. States Make The Top Ten List

Posted By thestatedtruth.com on December 9, 2010

Definition: A Credit Default Swap (CDS) is a swap contract and agreement in which the protection buyer of the CDS makes a series of payments (often referred to as the CDS “fee” or “spread”) to the protection seller and, in exchange, receives a payoff if a credit instrument (typically a bond or loan) experiences a credit event.

In its simplest form, a credit default swap is a bilateral contract between the buyer and seller of protection. The CDS will refer to a “reference entity” or “reference obligor”, usually a corporation or government. The reference entity is not a party to the contract. The protection buyer makes quarterly premium payments—the “spread”—to the protection seller. If the reference entity defaults, the protection seller pays the buyer the par value (100) of the bond in exchange for physical delivery of the bond.

Much has been written and reported about the European debt crisis, but if you look at the chart below, the capital markets are starting to anticipate defaults among some over-levered U.S. states.

Comments