Yesterday Goldman Lowered 2nd Half GDP Estimates Twice In The Same Day, Now Bank Of America Takes Down Its 2nd Half GDP Numbers…

Posted By thestatedtruth.com on March 2, 2012

Here we go….it feels like we could be at the peak of the good feeling time for this economic rebound. Things are getting hot everywhere we look. People are feeling better and the talk is that things are headed back to the good old times, which many consider to be normal. But gasoline prices are sky high, and prices are rising on virtually everything else one buys. We know of many people that have lost houses but recently bought new cars and other high ticket things because they feel good again, and can get financed. This won’t last, as savings have been falling, while most of this consumption has come from borrowing. It seems like people are creatures of habit, and often never learn from failures. Come to think of it, neither do the governments of the world.

From Bank of America

While we are quite concerned about second-half growth, we expect continued mixed news in the near term. Four fair winds are supporting growth: the fading shocks from the Arab Spring; the rebound in Japanese-related manufacturing after last year’s tsunami; reduced home foreclosures as banks wait for clarification on the rules; and mild winter weather. On the back of a very weak consumption report, we have lowered Q1 GDP growth from 2.2% to 1.8%. However, the early data for February has been healthy: although the national PMI weakened, jobless claims continue to drift lower, measures of consumer confidence continue to rebound and auto sales inched higher (Table 1). In the week ahead, we expect more of the same, with a solid 215,000 reading for February payrolls.

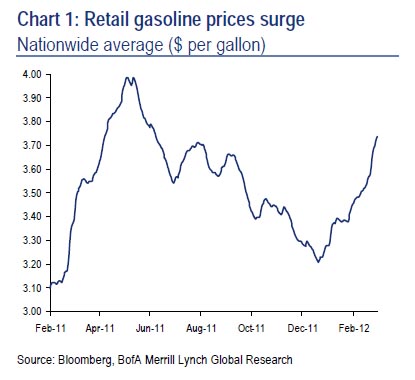

Unfortunately, the winds are starting to shift. In the spring the weather is much less important to economic activity than in the winter. Hence, the mild-weather induced bump up in the data should fade. Gasoline prices are up roughly 50 cents from their December lows and with the usual lags this could impact spending (Chart 1). The Attorney General Agreement in February paves the way for a ramp up in foreclosures over the next several months, dampening home prices and potentially construction. And the recovery in the auto sector now seems complete, suggesting a return to a slower pace of growth in sales and production. Based on these cross winds, we expect the data surprises to turn negative over the course of this spring.

When the facts change…

A popular indicator among clients is the Economic Cycle Research Institute (ECRI) leading index. Back in September ECRI argued that a recession was “inescapable,” pointing not just to their publicly released index, but to a series of other proprietary indexes. “Once the [negative] feedback loop starts,” they warned, “it’s more powerful than any policy response.” In the past week, they were back on the airwaves, saying “our call stands”: a recession is still likely in the first half of this year. Indeed, they argue, “when you look at the hard data that is used to officially date business cycle recessions, it has been getting worse, not better, despite…the consensus view of an improving economy

Risk of recession rises in the second half

The deterioration in leading indicators last summer was mainly because of waves of financial market stress coming from Europe and weak US data due to the oil and Japan shocks. Those shocks have now faded and the risk of a near-term recession has in our view fallen back to normal levels. Unfortunately, we believe the risk of a recession rises in the second half. The sudden stop in fiscal policy at the end of the year will likely cause a sharp slowing in growth. If it is handled badly, it could cause an outright recession. However, this has nothing to do with the now out-of-date signals from last fall.

Comments

4 Responses to “Yesterday Goldman Lowered 2nd Half GDP Estimates Twice In The Same Day, Now Bank Of America Takes Down Its 2nd Half GDP Numbers…”

Leave a Reply

You must be logged in to post a comment.

Sausalito Ferry Schedule

}

peruvian virgin hair

I prefer this product. It was subsequently excellent, it will make you are looking for a different. peruvian virgin hair are going to turn some of gear through not a specific thing.

Smart Balance Wheel

I truly stumbled across these types of Smart Balance Wheel online and admired these individuals! They happen to be household leather, Not really suede, having said that produce the wool with this report. Considerably more practical when it comes to win…

free cryptocurrency education

free cryptocurrency faucet