This Review Of Personal Earnings And Savings Goes Hand In Hand With Rising Entitlements. It’s Called The New Normal And It’s A Rut.

Posted By thestatedtruth.com on September 25, 2012

Savings….The average American says, what savings?

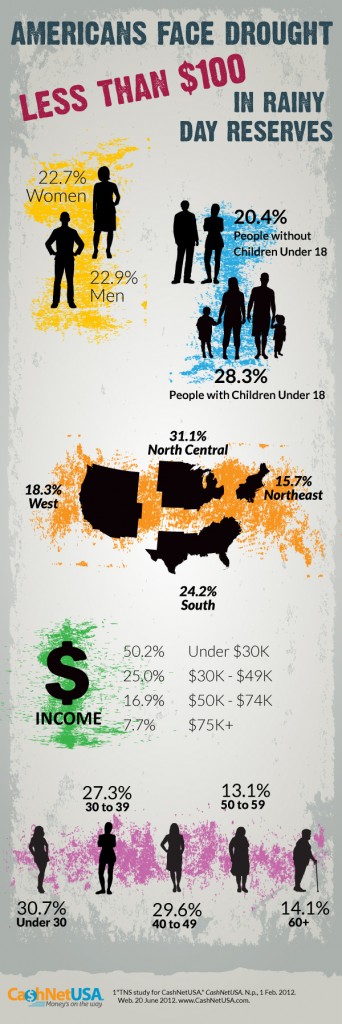

The main reason for the recent surge in consumer “confidence” in September was the near record surge in sentiment for those making $15,000-$25,000, which soared from 43.5 to 62.4 in the month, the most since April 2009. And whether this was due to their forecast of the future, and expectation that things will get much better, or not, we don’t know, what we do know is that half all of those people whose sentiment defined the market tone today, and who may be quite instrumental in the outcome of the upcoming election (per Mitt Romney), have less than $100 in cash savings. Other findings: both males and females reported similar savings patterns, however, 55 percent of Americans with children under the age of 18 reported having less than $800 in emergency savings compared to 42 percent of those without. Findings also reflect disparities across geographic regions, with 60 percent of individuals living in both the Northeast and the West having $800 or more in savings, yet 31 percent of those living in the North Central region reported that they had less than $100. Most importantly, 23% of all Americans have less than $100 in savings to cover any emergency expenses, and 46% have less than $800. One can see why when it comes to the discussion of whether or not financial assets should be taxes, soon 46% may be the new 47%.

Visually:

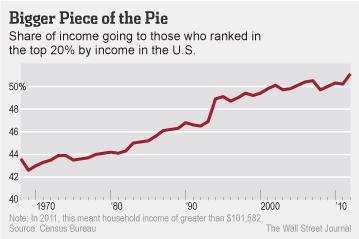

And…Top Earners Are Still Rolling!

But

The less affluent — the other 80%, some 250 million people — are little concerned by an eventual wealth effect but highly, directly and immediately impacted by the side effects of all these government QEs, namely rising commodity prices and near zero interest rates. Consider that:

- 15% of the U.S. population lives in poverty.

- 44% of those 46.2 million poor Americans are in “deep poverty,” which is half the poverty line defined as $22,811 for a family of four.

- More than 45 million Americans are in the food stamps program — 15% of the population compared with the 7.9% participation from 1970-2000. Food-stamp enrollment has been rising at a rate of 400,000 per month over the past four years. Only last August, more people went on the food-stamp program (173,000) than those who managed to find a new job (96,000).

- More than 11 million Americans are collecting federal disability checks.

- 11.2% of the labor force is out of work if we include the 7 million people no longer seeking employment. This number (over 17 million workers) is unchanged since 2009.

- Full-time employment remains 1.4 million below its 2009 level. Needless to say, part-timers earn and spend considerably less.

- Most of the 43.5 million American retirees must cope with nominal interest rates near zero through 2015 when inflation is around 2.0%.

Comments

Leave a Reply

You must be logged in to post a comment.