More On Problem Mortgages…….

Posted By thestatedtruth.com on October 15, 2009

“US foreclosures jumped to an all-time high of 937,840 in the third quarter,” writes Ian Mathias in today’s issue of The 5 Min. Forecast. “That’s a 23% rise from the same time last year, says a report from RealtyTrac today. One in every 136 households received a filing – also a record. Once again Nevada takes the cake… An incredible one in every 23 households was in some form of foreclosure last quarter.

“And they tell us the economy is recovering?

“But here’s the kicker – a theme that should be no surprise to 5 Min. loyalists: This isn’t about subprime anymore. The most recent data from the Mortgage Banker’s Association claims subprime mortgages currently account for hardly a third of foreclosure starts, down from 50% last year. Prime loans – the gold standard of the mortgage biz – now take up a 58% share.

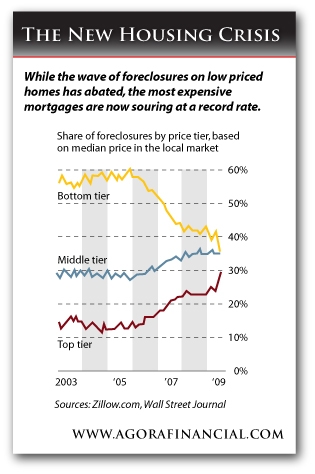

“Even the foreclosure scene in terms of home prices has been turned on its head. Check it out:

“About 35% of home foreclosures occur in the bottom third of the housing market, says zillow.com, down from 55% in 2006. In June, the most recent data available, 30% of foreclosures were in the top tier – nearly double the rate from the year before.

“And the icing on this rotten cake: Option ARMs. This pending rate reset crisis – which just about everyone ‘in the know’ saw coming in early 2008 – looks like its really going to happen. 46% of option ARMs are currently 30 days past due, despite the fact that just 12% have reset to higher payments. Resets for the rest of those ARMs are right around the corner.”

From The Daily Reckoning

Comments