Gene Inger…..Credit Woes Piling Up

Posted By thestatedtruth.com on January 13, 2010

Credit woes piling up . . . threaten to dose the optimism generated by a false rally in terms of the extension by the stock market. This will be felt (didn’t say may be felt) by a slew of commercial sectors first, and by the consumer sector as the year advances I fear. After the close today, S&P downgraded ‘the State’ of California, cutting ratings on $64 billion of ‘general obligation bonds’ as Sacramento feels strains over what is a $20 billion budget deficit. Interesting how the financial press obscures that today as if everyone knew it was coming (sure); and it doesn’t therefore matter (not). Note S&P also issued a ‘negative outlook’ on California debt; a sign it may decline further than the A- (7th highest investment grade) rating of today. Now closer to Moody’s or Fitch (not that any of them were efficient or realistic in any of this) with a Baa1 or BBB rate, this emphasizes (or should) the coming ‘cash crunch’ in March, pre April tax revenue.

Just because many expected this; does not make it irrelevant; my goodness. When it occurs that California goes into a negative cash position in March, will they also say it doesn’t matter? Probably. Perhaps the jousting at the Washington ‘crisis’ hearings in this case may have inferred that if Wall Street banking houses were to fund California through this, Government would look the other way about possible ‘fraud’ accusation discussion, one would have a short-term loan solution to buy yet-more time for them.

I’m being slightly cynical because this bad news is good news stuff from the market is wearing thin. Then there is the crowd who believes hurricanes and earthquakes are a good thing for markets, if not for victims. Perhaps both if they are uprooted or moved to safer hygienic quarters. But this Government has squandered and misdirected lots of our tax (and borrowed) Dollars; so that there is a limit to what can be done for Haiti (which has not been a productive country previously). The point is whether what is an essentially ‘total devastation’ earthquake ‘event’ of historic proportions (never seen in the Caribbean since 1770) greater than nuclear bombs according to the AP regarding the potential death toll (they speak in horrific terms of up to half a million dead as well as all but 10 out of the 100 plus UN staff HQ personnel), means tens of thousands of impoverished Haitians legally or illegally leaving for Dominica, Cuba, or .. Florida??

It’s with all compassion that one has to also protect American citizens from again new overwhelming influxes, while doing what can be done to help the tragic victims of this; and it is not unfair to mention that TB is rampant in Haiti, whereas the original influx in the 1960’s of Cubans to Florida were the educated and middle class, who had a lot to lose in a communist regime. They were healthy, and not necessarily destitute. As for Florida; it’s as broke as California (on a slightly smaller scale); with no quick prospect for resolution; and services already cut to the bone (making Miami more dangerous).

There is no immediate answer; just challenges. A carrier battle group may provide at least a bit of aid, and it will be interesting to see if they even allow ‘sponsored’ victim emigration from Haiti to Florida (why now are warships being sent?); or in that case to other struggling countries, like Brazil, or the always critical Chavez of Venezuela. Is this a market event? Perhaps. Especially since there is no funding to adequately address the crisis; other than short-run remedial assistance which won’t do much in terms of long-term stability. Perhaps France would like to reoccupy the place? Not.

Why mention this at all? First, the humanity of tragedy requires it. Second, because it exemplifies what’s wrong when you squander what resources you have on helping a small number of citizens buy depreciating assets (cash for clunkers or houses, which are not at a low point; or if they are, will flirt with low levels for years to come), while a sensible tax-based strategy of cutting taxes and adding incentives to small business, has either not occurred or been too little too late, while the ‘crisis commission’ talks of reform two years after the panic, which was clearly evident well before the crumbling of 2008; per our ‘epic debacle’ call. Where this leaves the world is without a ‘cushion’ to adequate respond to Haiti; or much less to the forthcoming earthquake you know I am concerned about, along the West Coast of the U.S. Mainland. Exaggerating? No. Time Magazine has a piece on it today, agreeing that it’s overdue; and a real risk.

In Great Britain the economy continues to contract. Worst in 88 years now; a bigger single year fall than any single year of the Great Depression, and that won’t be heard (at least not yet that we know of) on financial media. Source: The Times of London. If you want to know the next worst year? 1921; when all the troops came back from the front lines after WW I, and the result was large unemployment and a recession then.

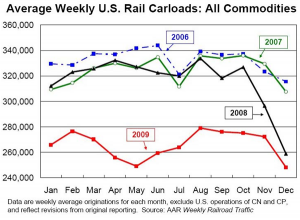

Now, if I wanted to throw more cold water on the ‘recovery optimism’ beyond reprieve I could reference ‘rail traffic’ in 2009; the lowest since at least 1988. And that’s with at least 12 of 19 major commodity categories of cartage being up due to foreign sales in the most part. It means that domestic demand isn’t zilch, but it’s definitely still slim. Of course I take no pleasure in reporting grim reality; but somebody has to do it if what a large segment of the public relies on for balance is actually imbalanced with regard to their perspectives. Perhaps Government has no choice (they are pained to spin most things favorably; and it shows); we understand. But the reality is actually fairly risky. I do not know for sure whether more would have improved had Government listened to a chorus of citizens of both parties and directed funds better, or cut taxes, or both vs. a ridiculous approach equivalent to the little Dutch boy sticking his finger in the dike. I do suspect it would have been better; especially had we not borrowed any funds with the realization that while they would argue that would keep us down; we are down in any event; so why be down and owe all that debt on top of it we ask, and asked lots earlier, because we expected Government to do just what they did; mediocre rescue of the economy, with we suspect close to a 40% risk of a double-dip recession scene.

For more go to…….www.ingerletter.com

… [Trackback]

[…] Read More on to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Read More Information here on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Here you will find 67152 more Info on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More here on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More on on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Read More on on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] There you will find 44884 additional Info on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Here you can find 93802 additional Information to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Read More Info here on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] There you will find 73758 additional Info on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] There you can find 59333 more Info to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Here you can find 64144 additional Information on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More on to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Read More to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] There you can find 48260 additional Information to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More Information here to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Here you can find 82211 additional Info on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Information on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Info on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More on on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Read More on on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Info on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Read More to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Here you can find 12629 more Information to that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Find More on on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Read More here on that Topic: thestatedtruth.com/?p=3890 […]

… [Trackback]

[…] Read More on that Topic: thestatedtruth.com/?p=3890 […]