Credit Card Companies Pulling Back……

Posted By thestatedtruth.com on January 19, 2010

Credit cards are ubiquitous like air in the American economy. Virtually every American that can qualify for a credit card has one (or many) in their wallet. Credit card companies have flooded the market with millions of plastic rectangles that have now come back to bite many American consumers. If we rewind back to the early days of this crisis, (so much has happened since that time) we will remember that the banking bailout involved some necessity of keeping credit alive. At least this is how it was presented to the American public. No bailout equaled no access to credit. Yet since that time we have seen consumer credit simply collapse on a record pace. Part of this is due to the extinguishing of debt via bankruptcy but also the fact that credit card companies (aka big banks) are not making loans accessible to the public.

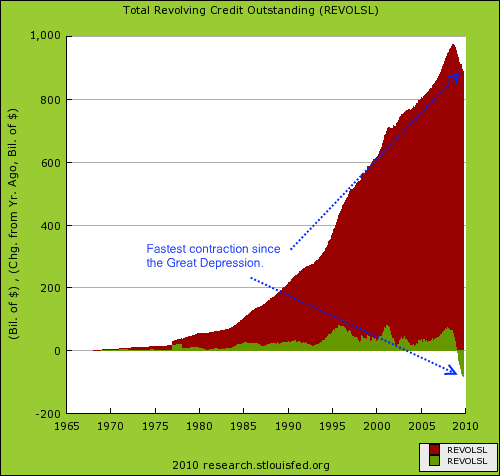

Credit card debt is contracting at its fastest pace since the Great Depression. In fact, over $17 billion in consumer credit was yanked from the market last month. And you don’t need to know the hard data coming out of the Federal Reserve to know this.

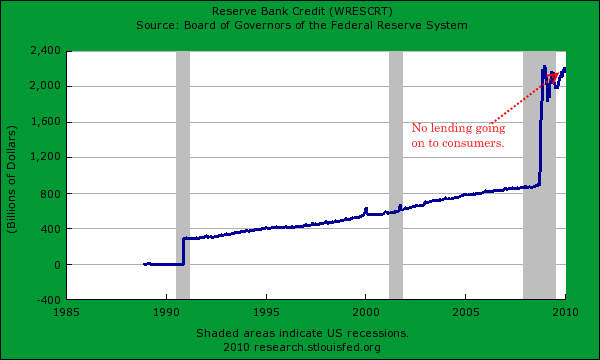

Banks are holding over $2 trillion in excess reserves. This is taxpayer money funded through the Federal Reserve and U.S. Treasury. What this actually tells us is that banks are gearing up for more internal problems like the $3.5 trillion implosion of the commercial real estate market or rising defaults. Currently banks have made massive profits by gambling with taxpayer money in the stock markets. The spigot to the consumer is nowhere to be found.

Comments