Gene Inger….The China Power Posture

Posted By thestatedtruth.com on February 2, 2010

It may be several-fold that we approach these issues. China probably expected much smarter and less partisan cooperation within American politics to enable a recovery; at least one worthy of the term. Even though they intentionally outfoxed us at almost every turn in terms of trade negotiations (as we’ve often denoted that in recent years, along with comparisons with what the United States is doing now versus Japan in the so-called ‘lost decade’), I doubt that China would commit what they have just to ‘buy’ their position in the world; especially since that also meant erosion of best customer status for their myriad of produced goods. However, it may be reasonable to say that China wins something by default, based on the history of countries that lost the edge in the mercantilist history of marketing; as none were able to maintain their leadership in projecting economic or military power abroad thereafter. Years ago Great Britain of course; and more recently look at what happened to Japan after the projected ‘crash’ there so many years ago (from which markets somewhat recovered; but image and prestige in the world never really did).

Just as Japan worries today about an aging as well as really financially-unsustainable economic situations (aside a mere lateral behavior for the most part); so too must the U.S. be concerned not only about debt service for the future generations to bear, but even the inability to launch new initiatives that galvanize a Nation with enthusiasm as new innovations spin-off from such projects (to wit: the ‘moon’ cancellation hits much the same nerve here, as did the Supersonic Transport cancellation years ago; when a Nation like the United States stops striving to go higher and faster and better too; it is disconcerting, and is a sign of erosion in vision; not to mention that no Nation really advances smartly, but falling-back on an attempt to underwrite service industries; and provide incentives for depreciating or dubious assets, rather than funneling funds for the future of mankind, and thus industry and eventually technologies and advances it is impossible to even contemplate as of yet).

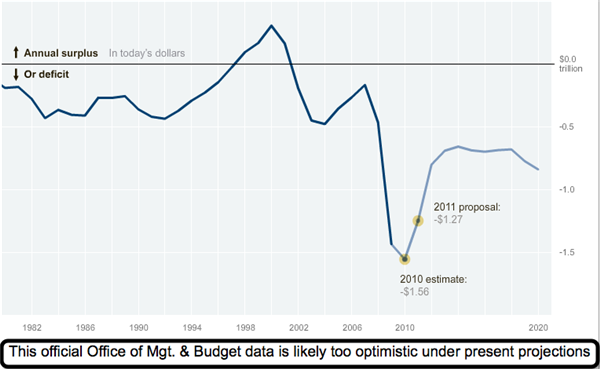

Yes we’ve addressed these issues in the past; and yes it’s impossible to entirely call for prosperity in the 2020-2030 timeframe as we have suggested feasible. However it is also known from history that while you can’t project that far ahead with accuracy (it may be that every past President would concur), it can be said as we have, that this era of focus on an aging society (which politically demands entitlements untrimmed, as well as pulls essentially subsidizing funds from a hard-pressed younger segment of society), along with ‘Federal Paternalism’ (as we’ve dubbed it) that suppresses as it superficially seems to stimulate initiative, now has ownership of a deficit that’s very difficult to envision being grappled with. While we’re not yet willing to contemplate an approach to ‘bankruptcy’ for the United States (though Gold bugs called for that for a couple decades perennially, and even we have said the debt will eventually be repaid in a sense with depreciated Greenbacks); it’s reasonable to say that this President as well as this Congress are now ‘boxed-in’ with relatively little maneuvering room. That means initiative and innovation shift almost solely to the private sector, which leads in all cases best, but usually with grants or underlying projects that allowed innovation, or in many cases provided the impetus through research and development for those (whether in space, in computing, with the internet, or even in drug development and medical research). To wind-down all these areas is to put the U.S.A. into reverse. It’s why this comment tonight; as aside ‘security’, the focus ought to be not only deficit as well as debt containment (in a serious way), but not simply trying to ‘muddle through’.

Solutions . . .are limited; however let’s consider a couple. After all to do otherwise is a bit reminiscent of that cartoon that shows a well-dressed man and woman going up on an escalator that suddenly comes to a halt. Instead of simply walking forward they cry-out for help. After all, they’re not stuck in an elevator, but on an escalator. Trying to buy-down debt without enhancing the citizenry’s earnings ability overall, and quite substantially at that, is like crying out for help on an escalator versus just climbing on up to the next landing. Politicians are acting as-if they were in an elevator so needed to get assistance; and behaving as if they can ‘money-print’ their way to salvation. It’s not feasible, even with the stock market moving higher (which actually gets riskier as it proceeds). Historically the market almost always runs into trouble when the rescue actually results in recovery by the way, which means higher interest rates prevail. As that occurs investors stop chasing yield in equities and an equity unwinding occurs.

But as for solutions (to the case at hand); whether it be a flat-tax; whether it be fees or a true level-playing-field trading policy as we’ve advocated for a generation now; or a realization that (for all but the senior or near-senior citizens) entitlement reforms are not a choice but a requirement if we’re to channel funds to wind-down an overall debt structure that is unsustainable even if we recover smartly; something must occur. To us it seems that merely raising taxes and fees on everything in life won’t muster real mainstream support; and as the financial media generally focuses on progress (great where that actually exists, limited as it may be); they have forgotten the derivatives or other holdover and even ongoing (foreclosures and commercial property declines) as are likely to ruffle the edges at minimum of this environment acting as if problems are behind. They are hardly even being worked-through; so far we’ve avoided the abyss in a sense; but not much more (not even reform) has really been generated so far.

More at www.ingerletter.com

Comments