A Great Review Of The American Middle Class Fight For Economic Survival In Todays World

Posted By thestatedtruth.com on February 3, 2010

The Devaluation and Fight for Survival of the American Middle Class – How Three Decades has Shifted the Concentration of Financial Wealth to the top 1 Percent.

Â

Posted: Wed, 03 Feb 2010

The American middle class ideal is lionized around the world. It is the core of what has made this country great. The land of opportunity and endless wealth so long as people worked hard enough. It was an implicit contract workers made with this country. Well that vision is now quickly coming under attack by the corporate structure with banks being the main culprits leading the American middle class to the edge of financial ruin. The average American is looking at their current economy and wondering what ever happened to the security that was once provided to the “greatest generation†era. The Wall Street crowd after devouring their bailouts is telling Americans that this is simply how the market corrects. Yet at the same time, they are offering record bonuses to their elite. The same banking crowd that led this country to the financial edge is now rewarding itself with massive bonuses (taxpayer funded) while jobs are being lost and no industry is emerging to provide work to the middle class. As tough as it may be for many to swallow we are in a class warfare struggle. That is why you are seeing populist rage growing in both of our entrenchment political parties.

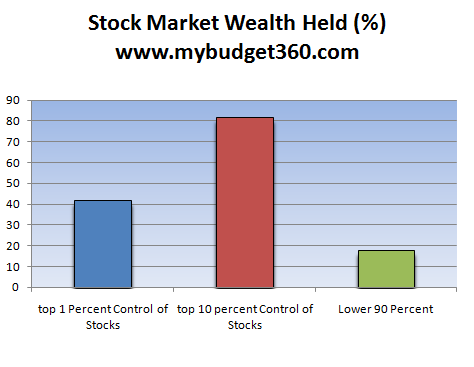

If you are wondering why those on Wall Street have a hop to their step, it is because the stock market wealth is concentrated in the hands of very few:

The top 1 percent control 42 percent of financial wealth in the United States.  Now think about that fact. Let us assume you have saved diligently for a few years into your 401k. Before the crisis hit, you had amassed $100,000 (much higher than the median amount for Americans but we’ll just use this to highlight our point). At the low, that $100,000 was probably down to $50,000 even being diversified. With the major run up, the amount might now be back to $75,000 to $80,000. Has the life of the average American really changed? This money is actually retirement funds and this amount is not going to make a big difference in the way people live on a day to day basis. Yet those in the top 1 percent with the current shift have seen billions go their way and this does make a big difference since many draw off capital gains on a yearly basis.

The 401k structure is problematic in many ways.  It is a method to lure in money from people to give them a taste of the Wall Street money machine. Most of these funds are designed for retirement. And with massive baby boomers retiring in the next few years, billions of dollars in funds will be sold into the market (which ironically will add pressure on prices because of demographic shifts). This will push prices down right when people will start drawing from their nest egg. The notion that you can garner 7 percent each year into infinity is a fallacy that has been exposed in this market crash.

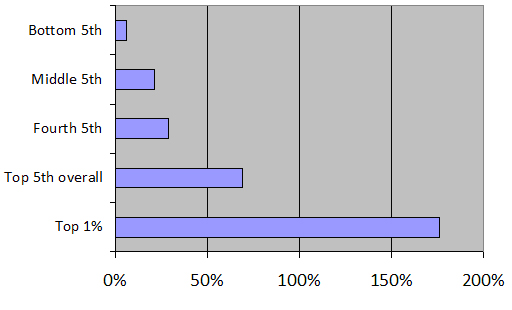

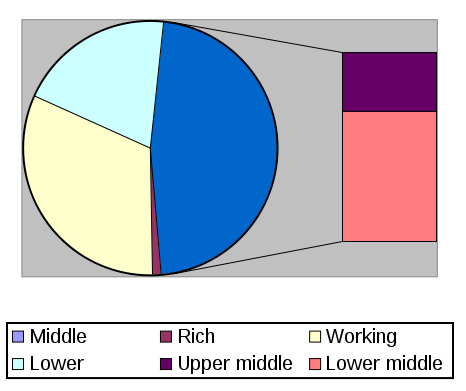

We have been getting richer as a nation overall. This is true. But why is it so hard for average Americans to now get by with two incomes when one income seemed adequate 40 years ago? The income gains have largely gone to the top 1 percent from 1979 to 2005:

Source:Â Wikipedia

The above gains are inflation adjusted over three decades. While income did increase across categories this distribution was not even. It was largely shifted to the top of the pile. Now it would be one thing if the top was being run by companies that actually provided jobs for a large part of America. But it isn’t. You have CEOs of Manhattan banks that are trading derivatives on toxic mortgages and betting up oil futures all so they can skim the system for money. How has that added value to our country? It hasn’t. All it has done is transformed part of our economy into one subsidized taxpayer casino at the expense of the working middle class.

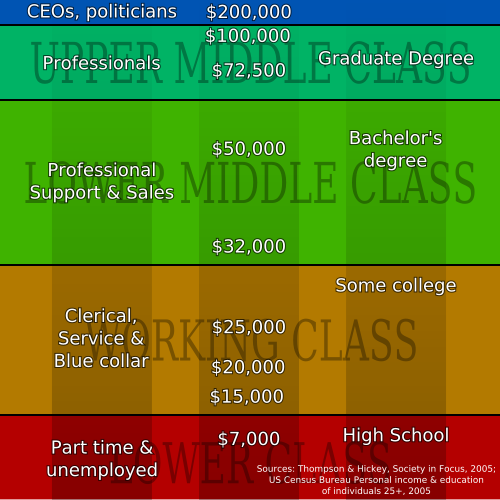

If you want to visualize this class division, it would roughly break down like this:

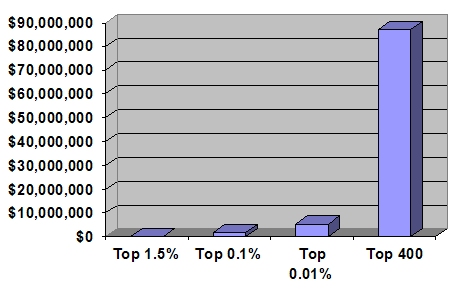

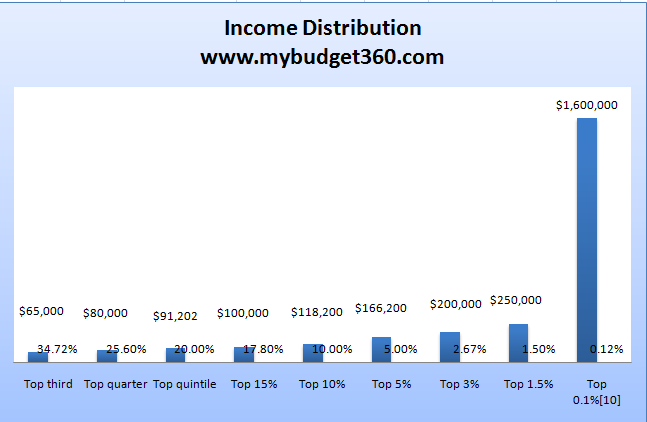

But even here, the top 1 percent isn’t even reflected. Even working families with say a nurse and an engineer can bring in $100,000 to $150,000 a year. But with things like the AMT even this tranche is feeling the burden. The big transfer of wealth is going to the top 1 percent:

“(Wikipedia) As of 2005 there are approximately 146,000 (0.1%) households with incomes exceeding $1,500,000, while the top 0.01% or 11,000 households had incomes exceeding $5,500,000. The 400 highest tax payers in the nation had gross annual household incomes exceeding $87,000,000. Household incomes for this group have risen more dramatically than for any other. As a result the gap between those who make less than one and half million dollars annually (99.9% of households) and those who make more (0.1%) has been steadily increasing, prompting The New York Times to proclaim that the “Richest Are Leaving Even the Rich Far Behind.†Indeed the income disparities within the top 1.5% are quite drastic. While households in the top 1.5% of households had incomes exceeding $250,000, 443% above the national median, their incomes were still 2200% lower than those of the top .01% of households. One can therefore conclude that almost any household, even those with incomes of $250,000 annually are poor when compared to the top .1%, who in turn are poor compared to the top 0.000267%, the top 400 taxpaying households.â€

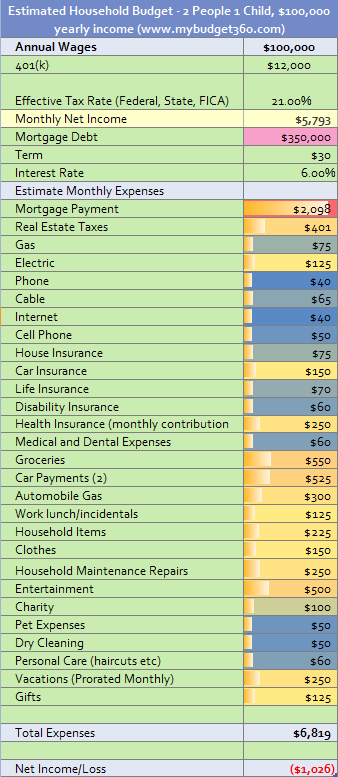

So we see where the money is really going. Even if we break down a family in California earning $100,000 you can see what was once considered rich is no longer the case:

And for those out in high cost states they will realize that a $350,000 home does not buy you much even after the tremendous crash in housing values. The cost of healthcare is rising and college costs are going up so with one child, they will want to set aside some money if they want to see their child have a decent college education when they are ready to go. And keep in mind that making $100,000 puts you in the top 17 percent of households in the U.S.:

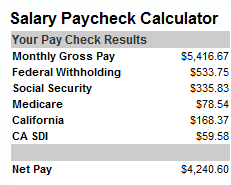

So in reality, we should look at household that brings in $65,000 per year to get a more accurate feel of what the middle class is going through:

So after taxes, this family is taking home $4,240 a month. With rising taxes, higher food costs, healthcare rising, and wages stagnant you can see how the middle class is falling behind on a daily basis. We can further breakdown the class distribution as follows:

We do have class in our system and the biggest misnomer that has been perpetrated is that somehow, our goals are aligned with those of the banking Wall Street elite. How much longer do people need to realize that both political parties seem to serve one master and it has an address on Wall Street? The debates and battles seem to amount to this charade because once it comes time for policy, nothing gets done. Even Elizabeth Warren who is fighting for basic consumer rights is finding it even hard to get through because of banking lobbyist:

“It is impossible to buy a toaster that has a one-in-five chance of bursting into flames and burning down your house. But it is possible to refinance an existing home with a mortgage that has the same one-in-five chance of putting the family out on the street — and the mortgage won’t even carry a disclosure of that fact to the homeowner.â€

The battle has gotten intense. Credit card companies have been doing criminal activities by jacking fees up and setting up traps for consumers before simple regulations come into effect. Banks have pulled back on lending to average Americans while profits from stock speculation have soared. They don’t call it speculation but label it as hedge funds, proprietary trading, or some other Orwellian language that hides the true nature of the system.

With the underemployment rate at over 17 percent and bankruptcies, foreclosures, and other financial distress rising for average Americans one small chunk of our population is benefitting on the backs of bailout funding. This has been characterized as it “taking a plunder†to rip off the village:

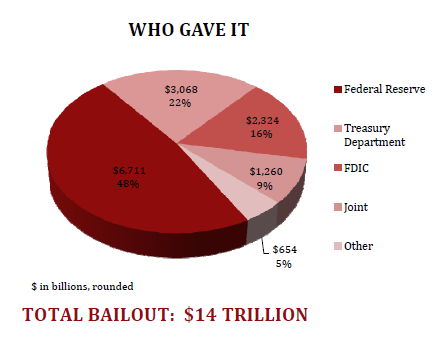

So what you do is take from the public:

Source:Â It Takes a Pillage

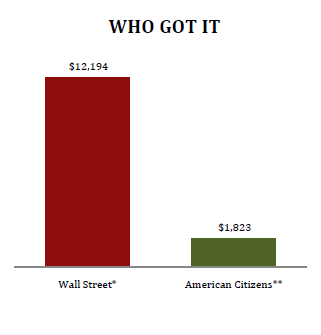

And give to the people that created this crisis:

Comments