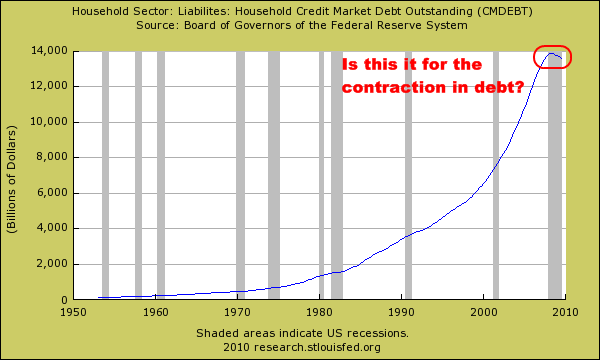

Household Debt…..A Long Way Down To Go!

Posted By thestatedtruth.com on February 7, 2010

So……if the Fed can create money out of thin air through their banking web why is the economy still faltering? In boom and bust cycles we see a love and revulsion towards debt. Banks can be willing to lend out money but you can’t force average Americans to borrow. This past decade we saw the absolute disregard for prudent debt lending and now, many Americans are averse to taking out loans. In fact, now that banks are actually checking and verifying incomes it turns out that many middle class Americans really don’t qualify for additional debt.

This brings us to our next chart looking at household debt:

Even after the stock market recovery, it is estimated that average Americans have seen their household net worth decline by $11 trillion since the peak of this bubble. Yet take a look at the chart above. Household debt still remains near the peak. And keep in mind that real estate was the biggest item of net worth for Americans and this has fallen by roughly $6 trillion. Yet the loans remain the same. And that is largely a reason for the flood of foreclosures and bankruptcies. While banks still have mortgages valued at peak levels the actual market value is much less. The U.S. Treasury and Federal Reserve made a troubling bet during the early days of the crisis that things would correct quickly. Actually, I tend to believe that the Fed knew all along that when push came to shove, the entire banking sector would be bailed out by the U.S. taxpayer since the Fed is simply the lender of first and last resort for member banks.

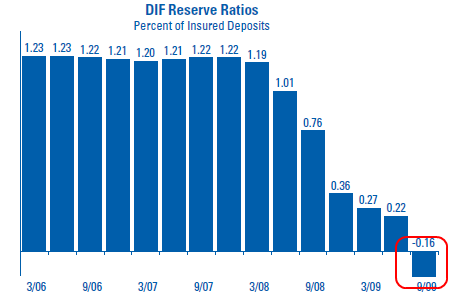

So this leaves Americans contenting with debt amounts that no longer reflect the value of their underlying asset. Yet the banking sector is now fully supported by the taxpayer. So with the current system in place, if banks do fail taxpayers are on the hook. The Fed has setup the perfect trap for middle class Americans. If average Americans decide to walk away from their underwater mortgages then the bill will be paid by taxpayers. After all, we are already told that the too big to fail by definition won’t fail. And the other option is to continue paying a mortgage on a home that is no longer worth its value. Many Americans simply cannot afford to do this. Do you notice how in no scenario the banks lose? This is another characteristic of the corporatocracy. And the FDIC which insures bank deposits is essentially insolvent:

And the FDIC backs $13 trillion in total assets with a fund that is insolvent! Now that is maximum leverage.

More at http://www.mybudget360.com/

Comments