It’s Just A Matter Of Time Before We Can Say Goodbye to Historically Low Mortgage Interest Rates

Posted By thestatedtruth.com on February 22, 2010

Quantitative Easing and the Electronic Money Printing Machine – Saying Goodbye to Historically Low Mortgage Interest Rates. Federal Reserve 95 Percent Complete on Buying $1.25 Trillion in Mortgage Backed Securities.

Posted   02-22-2010

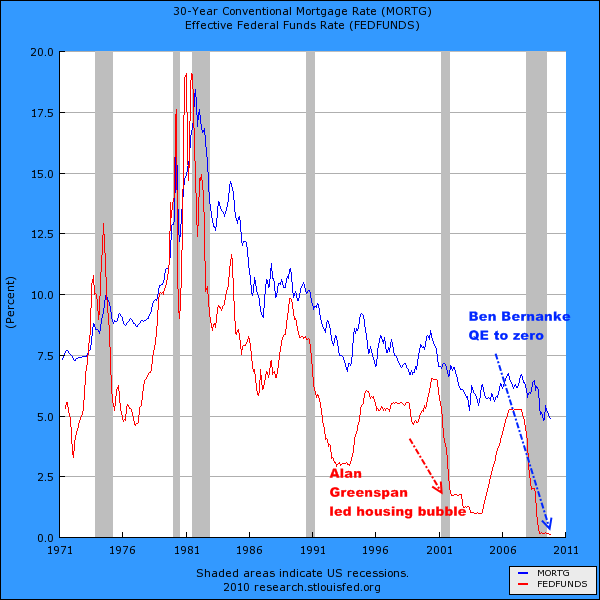

People forget that quantitative easing is a form of creating something out of nothing. This extreme form of monetary policy is called upon in certain situations when central banks reach the zero bound with their funds rate like the Federal Reserve in this current crisis. What is quantitative easing? The Federal Reserve trying to solve the economic recession via monetary policy dropped the Fed funds rate to zero to stimulate demand. Back when Alan Greenspan was chairman, he dropped rates to 1 percent to mitigate the damage of the technology bubble and set off and even bigger housing bubble. Current Fed chairman Ben Bernanke dropped rates to zero and the economy did not respond. In comes quantitative easing.

If you are wondering why mortgage rates are at historically low levels yet the economy is still in the doldrums look at the following chart:

Source:Â Federal Reserve, St. Louis

Over 40 years of data and the 30 year fixed rate mortgage averaged 9 percent. Today that rate is slightly below 5 percent, a level unseen in nearly a century. Now this isn’t where the quantitative easing stepped in to bolster the market. If you look at the chart above since Alan Greenspan dropped rates early in the 2000s the 30 year fixed mortgage has been historically low. The Federal Reserve added maximum fuel to the housing bubble. Banks borrowed at extremely low rates and speculated in mortgages and other forms of debt. Seeing how much demand was stimulated early in the decade with lowering the Fed funds rate, Ben Bernanke decided to pursue a similar policy this time as well. Yet it didn’t work and he reached the zero bound level. The market was saturated with debt and demand was nonexistent for mortgage backed securities. In steps the Fed:

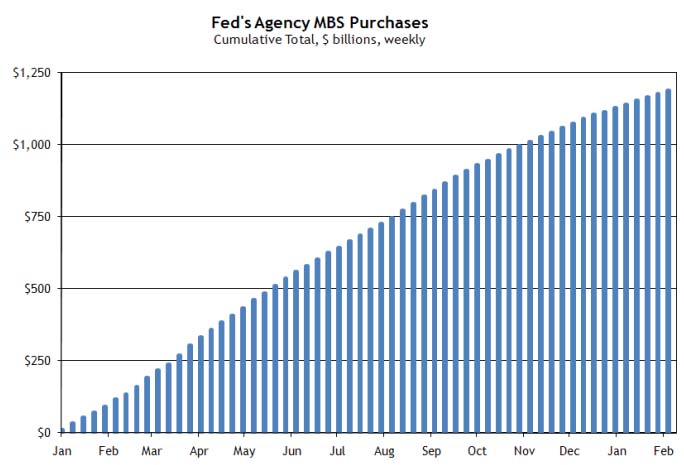

Source:Â Federal Reserve, Atlanta

It is interesting that the Federal Reserve Banks of smaller more fiscally prudent districts offers the best kind of data. The New York Fed with the most assets held offers very little transparency. Above, we see the major source of quantitative easing. With no market, the Fed starting early in this crisis has been buying up mortgage backed securities to keep the housing market going.

“The Fed purchased a net total of $11 billion of agency-backed MBS through the week of February 10. This purchase brings its total up to $1.188 trillion, and by the end of the first quarter of 2010, the Fed will have purchased $1.25 trillion (thus it is 95% complete).â€

So the Fed has roughly six weeks to go and $50 billion left in this component of the quantitative easing phase. If you think about this, this is electronically creating money out of thin air. The Fed in the past was only able to take on triple AAA rated securities on their balance sheet from banks. In this crisis, the Fed in order to free up the toxic waste on the balance sheet of banks decided to take over many forms of toxic assets including buying up mortgage backed securities. They nationalized the banking system without talking to Congress, the public, or anyone else for that matter. This is really the only reason the housing market did not correct further and the stock market is now up over 60 percent without any real change in the employment level. The Federal Reserve has monetized toxic waste since there is no other sensible buyer in the market that would buy this junk up. Banks have been lending government backed mortgage debt in barrels because this is off their hands once they finalize the loan. With the bailout funds costing banks near zero to borrow, they have gone back to making additional funds gambling in the stock market casino. In other words quantitative easing is financing the Wall Street circus with money we don’t have, literally.

Most Americans would probably be outraged to find out that their central bank is irresponsibly printing money out of thin air. Knowing this, the Federal Reserve obfuscates their real actions by calling it quantitative easing. But this is exactly what is happening. Banks have balance sheets full of junk and toxic waste. Without the bailouts many banks would be insolvent and fail. So the Fed steps in and removes this junk off their books to give them breathing room. But now after 26 months of financial crisis the average American is seeing no benefit from the actual bailouts. This is because the money was funneled into the banking sector elite, not the average public. They sold the public a bill of goods to keep their con game up.

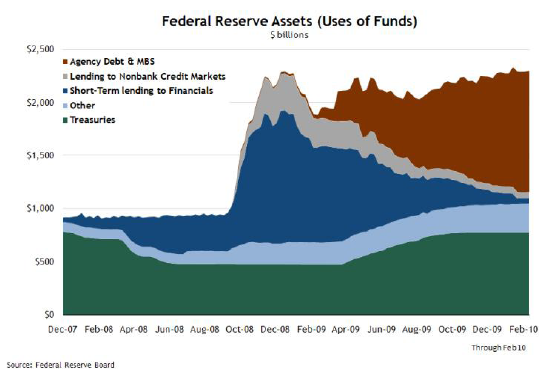

And if you look at the Fed’s balance sheet since the crisis started they have trillions of dollars in junk on it most of it picked up since the crisis started:

The Fed’s balance sheet has ballooned to nearly $2.5 trillion. Back in August of 2008 it was under $1 trillion. Most of that growth came in the form of quantitative easing as we have seen above from buying those mortgages that no one else in their right mind would buy. That is why mortgage rates remain artificially low. That is why over 95 percent of all mortgages made today have some form of government guarantee. But that gig is ending soon unless the Fed decides to go further with this charade. Expect mortgage rates to go up. Expect the housing market to enter a second adjustment because the artificial housing steroids will be removed. Quantitative easing failed in Japan and it didn’t do much in this market except allow the banking sector to drain the wealth from the middle class of this country.

Comments