Credit Card Rate Report….How Does Your Card Stack Up

Posted By thestatedtruth.com on March 19, 2010

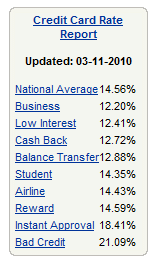

The current national average interest rate for credit cards is 14.56 percent yet they are offering clients who want to save 0.1% or even lower on their savings account. In business lingo this is what you call the margin and it is gigantic. This is why the banking system is fundamentally flawed. They borrow taxpayer money for cheap, take client money for cheap, and lend it out at usury rates. Not only does it encourage massive consumption but it creates a large part of our economy that is simply dedicated to paying rent above and beyond the face value of the product.  And many people only pay that minimum interest rate. As we have seen above, only paying the minimum with a 15% interest rate will double the cost of the item in 4.8 years. That flat screen TV no longer costs just $1,000 but $2,000 over many years and high amounts of interest.

And the problem with savings at least in our current banking model is that these same banks are also the biggest credit card pushers:

U.S. general purpose credit card market share in 2008 based on outstandings

(Note: 2007 ranking in parentheses)

1. JPMorgan Chase – 21.22% (17.74%)

2. Bank of America – 19.25% (19.36%)

3. Citi – 12.35% (13.03%)

4. American Express – 10.19% (11.40%)

5. Capital One – 6.95% (6.95%)

6. Discover – 5.75% (5.65%)

7. Wells Fargo – 4.21% (3.07%)

8. HSBC – 3.47% (3.65%)

9. U.S. Bank – 2.14% (1.84%)

10. USAA Savings – 2.02% (2.01%)Source: Creditcards.com

Comments