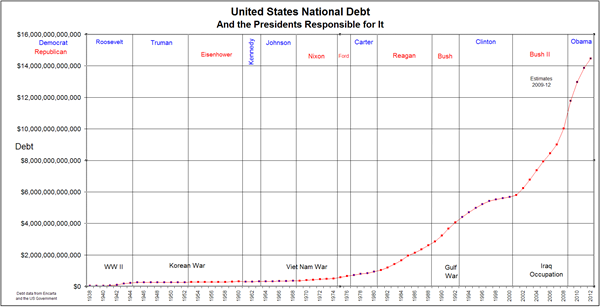

The U.S. Debt Taken On And The President Respnsible For It…..Repubicans Win Hands Down On Adding To The National Debt!

Posted By thestatedtruth.com on March 29, 2010

Borrowing costs borne by Government increase dynamically as the cost of forward debt service jumps. As servicing debt consumes the bulk of the Federal budget, it becomes a crisis almost immediately. The bloating of Governmental services, help to the states, and concurrent reluctance on the part of major creditors, just adds to what is an overall tempest now brewing in a toxic teapot.

If the Treasury can’t borrow enough to roll over the National debt without higher costs of significance, it will turn to a ‘lender of last resort’, the Federal Reserve. The Fed will then lend the Treasury money that it has printed, which would trigger inflation. As there is no evidence (since the days of Alexander Jackson at least) in history where a promise of serious debt reduction has taken place (not to be confused with the simple deficit reductions which are a ‘spin’ to confuse citizens to believe they’re being frugal) it is necessary to be suspicious of any program or agenda that has ‘money printing’ at the end of the line as a prospect. Normally any time you pay creditors ‘printed money’ you see the currency lose its value through inflation (that’s why we said eventually so but not yet, throughout this economic catharsis, because it was deflation not inflation on the front burner; with an eye toward probable inflation, later, on the back burner).

Given the stimulus borrowing (aside the misdirection of funds and so on we roiled bits of disapproval about), things promise to get worse! Treasury needs to borrow nearly a sum of 2 Trillion Dollars this year to roll-over the National debt. Not new debt either. On top of that, the Federal budget calls for over 1.5 Trillion Dollars in new debt just to cover new spending; that yields a total of over 3.5 Trillion Dollars in 2010, just alone.

These are unprecedented sums, and there is no assurance that Treasury will be able to borrow ‘that much’ without turning to the Fed (ah hah!). With foreign lender balking, and rates close to rising, along with brewing tensions between Sunni and Shiites in at least a half dozen Islamic nations (a story that doesn’t make the news, including loss of over a hundred troops to Iran-backed infiltrators into Saudi Arabia from Yemen), as risks sending oil prices notably higher if a full-blown conflict between the sects breaks out (even Bahrain had to clamp down on terrorists this weekend; hardly reported by a Western press that for some reason would rather not deal with the stark implications); you have the ingredients starting to take shape which could foment serious problems.

Take debt service costs up 15-25% and/or Oil prices back over $100/bbl, and for that kind of combination, I don’t see how you’d avoid a crisis. Now sure, Fed comes in so what you get is a ‘virtual default’ at worst. That means ‘money printing’; inflation that’s occurring while the domestic economy stagnates (a form of stagflation), and Treasury gets to pay its bills with inflated currency, letting creditors eat the loss. That solves an immediate problem that may develop, but further erodes confidence in the U.S. and a debasing of the currency would be underway. Imports become more expensive; our exports might remain relatively stable; but that’s insufficient to help broad joblessness and that takes you into the next Election series, with widespread justified discontent.

Is this a worst-case scenario? Perhaps; but it’s not hard to fathom, as we are still very hard-pressed to find a ‘plan B’ from our current Government (or anyone else really for strategies that would provide alternate outcomes quick enough to be truly effective). I definitely am not trying to throw politicians into the bonfire or placate all so-called ‘tea party’ advocates. We’re not looking for scapegoats; but solutions aside financial crisis anew. As we haven’t found one yet; we have to leave the door open to another crisis.

Comments