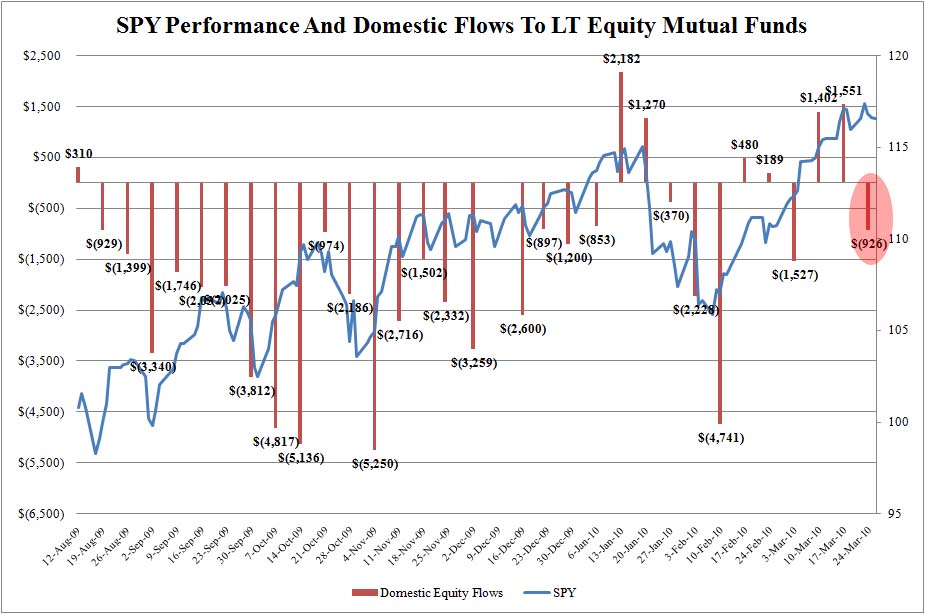

Domestic Equity Fund Flows….. $3.5 Billion In Outflows Year To Date

Posted By thestatedtruth.com on April 1, 2010

$3.5 Billion In Outflows Year To Date

The broader public, where the first baby boomers begin retiring this year, continues rotating out of equities and into the safety of bonds. The ICI just disclosed that fund flows for domestic equity mutual funds turned negative for the week of March 24 to the tune of almost $1 billion, after a substantial spike the week before. This occurred even as the market has barely had a single down day in the past two months. Year To Date the outflows have now hit a massive $3.5 billion, surprising when considering the performance of the actual stock market, which continues being bid up into the stratosphere by Primary Dealers, or as Rosenberg affectionately calls them, Pig Farmers, using free Fed money, as they merely trade with nobody but each other in a disappearing volume game of musical chairs in which each and everyone is just focused on the exit strategy and getting the market to a sufficiently high level where a 30% “bidless” drop doesn’t destroy too many.

Comments