Effects On GDP From Federal, State And Local Levels

Posted By thestatedtruth.com on July 30, 2010

Hint……this is not a pretty picture!

Posted from zerohedge.com

Exerts from a Goldman review are shown below.

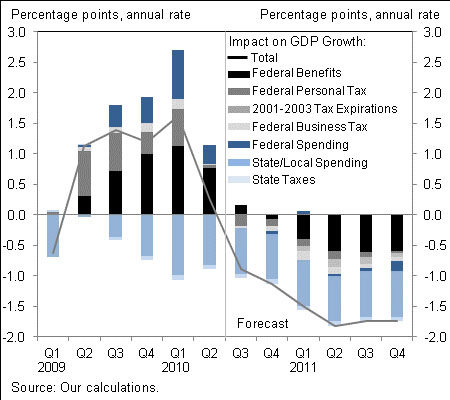

The chart below provides an integrated look at the GDP growth impact of fiscal policy at the federal, state, and local level.  These numbers are based on our current assumptions that (1) Congress will not extend emergency unemployment benefits beyond the current expiration date in November 2010, (2) state governments will need to make do without any additional federal fiscal aid beyond what was included in ARRA, and (3) Congress extends the lower- and middle-income tax cuts of 2001-2003 as well as the Making Work Pay tax cut of 2009 but not the higher-income cuts of 2001-2003.

Two additional comments are in order. First, we have lengthened and smoothed out the impact of tax changes on spending in order to reduce the volatility in quarterly GDP impulses from fluctuations in tax refunds and final settlements from one quarter to the next. Second, we recognize that part of the impact from income replacement measures, most prominently emergency unemployment benefits, is not a completely “exogenous†consequence of a shift to more generous benefit provision in ARRA but also partly an “endogenous†consequence of weakness in the economy.

Â

The upshot of the chart is that the overall fiscal impulse to GDP growth is likely to go from +1.3 percentage points between early 2009 and early 2010 to -1.7 percentage points in 2011. There are two main differences compared with our federal-only estimates—(1) a smaller positive impact in 2009 and (2) a somewhat earlier turn into negative territory in 2010. The reason for both is that state and local finances have been a drag on growth all along, and this drag has increased somewhat in early 2010. The earlier turn toward restraint may be one reason why growth has been weakening noticeably over the past few months, although the end of the positive inventory cycle has undoubtedly also been an important factor.

However, the basic implication is unchanged from our prior analysis—namely that fiscal policy will result in a substantial “swing†from stimulus to restraint. This is likely to contribute to slower GDP growth of around 1½% (annualized) in the second half of 2010, and it implies downside risks to our current forecast of 3% growth (on a Q4/Q4 basis) in 2011.

Comments