Kicking The Can Down The Road….Then Stepping On It!

Posted By thestatedtruth.com on August 26, 2010

Hmm…..Two months in a row, right in the middle of the traditional best seasonal time of the year for real estate….not one new home was sold valued above $750,000 in the whole U.S. according to David Rosenberg (he worked for Merrill Lynch and now resides in Canada as chief economist and strategist at Gluskin Sheff). …..Attitudes towards discretionary spending, credit and housing have been altered, likely for a generation. To make matters worse, 25% of the household sector now have a sub-600 FICO score.

The most damning words on the recent horrendous housing data come from David Rosenberg: and since he has long been spot on in his macro observations, the 15% or so in additional price losses anticipated, will make this down turn a truly memorable one (we will investigate not only the surging supply side of the housing equation, but the plunging demand side in a later post), and will leave the Fed with absolutely no choice than the nuclear option: “If the truth be told, if we are talking about reversing all the bubble appreciation that began a decade ago, then we are talking about another 15% downside from here. The excess inventory data alone tell us that this has a realistic chance of occurring…The high-end market, in particular, is under tremendous pressure. In fact, it is becoming non-existent. Guess how many homes prices above $750k managed to sell in July. Answer zero, nada, rien; and for the second month in a row.”

This is what we have been saying for some time, in the aftermath of a credit bubble burst and a massive asset deflation, trauma has set in. The rupture to confidence and spending from our central bankers’ and policymakers’ willingness to allow the prior credit cycle to go parabolic has come at a heavy price in terms of future economic performance. Attitudes towards discretionary spending, credit and housing have been altered, likely for a generation.

The scars have apparently not healed from the horrific experience with defaults, delinquencies and deleveraging of the past two years — talk about a horror flick in 3D. The number of unsold homes on the market exceeds four million and that does include the shadow bank inventory, which jumped 12% alone in August, according to the venerable housing analyst Ivy Zelman.

Nearly 1 in 4 of the population with a mortgage are “upside down†and as a result are now prisoners in their own home. We have over five million homeowners now either in the foreclosure process or seriously delinquent. The government’s HAMP program was supposed to bail out between 3 and 4 million distressed homeowners and instead we have only had a success rate of fewer than half a million.

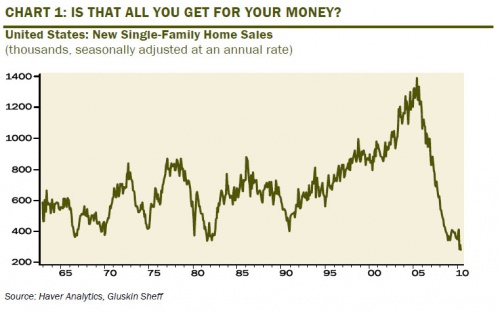

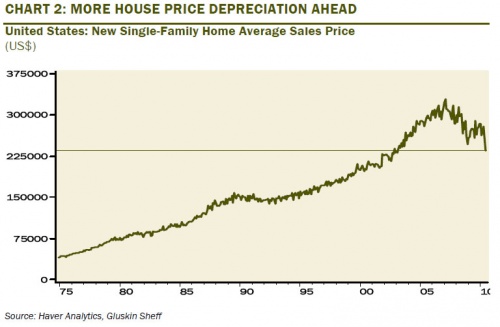

Now back to the new home sales data. Every region in the U.S. was down, and down sharply. The homebuilders did not cut their inventory levels and as a result, the backlog of new homes surged to 9.1 months’ supply from 8.0 months in June, which means more discounting and margin squeeze is coming in the homebuilder space. As it stands, median new home prices were sliced 6% in July and this followed on the heels of a 4.7% drop in June. And, at $235,300, average new home prices are down to levels last seen in March 2003, down nearly 30% from the 2007 peak. If the truth be told, if we are talking about reversing all the bubble appreciation that began a decade ago, then we are talking about another 15% downside from here. The excess inventory data alone tell us that this has a realistic chance of occurring.

The high-end market, in particular, is under tremendous pressure. In fact, it is becoming non-existent. Guess how many homes prices above $750k managed to sell in July. Answer — zero, nada, rien; and for the second month in a row. Only 1,000 units priced above 500,000 moved last month. That’s it! Over 80% of the homes that the builders managed to sell were priced for under $300,000. Just another sign of how this remains a full-fledged buyers’ market — at least for the ones that can either afford to put down a downpayment or are creditworthy enough to secure a mortgage loan (keeping in mind that 25% of the household sector does have a sub-600 FICO score).

Comments