Posted By thestatedtruth.com on June 20, 2010

Everyone should read this!

Â

Cumberland Advisors

Â

Oil Slickonomics

Â

Part 8 – Chemotherapy in the Gulf of Mexico

Â

June 20, 2010

“Plaquemines Parish President Billy Nungesser was out on Terrebone Bay at the break of dawn with his new industrial strength, compressed air-powered vac. Within 15 minutes, he said his crews had collected 55 gallons of oil and Nungesser — vocally frustrated by the response from BP and the federal government — was thinking about whipping out his credit card to pay for more pumps from an online site.â€Â

Â

Meanwhile, the BP president, “After being lambasted in Congress on Thursday … was spending the weekend with his family in Britain’s Isle of Wight. “On Saturday — Day 61 of the oil disaster – Tony Hayward was watching his yacht, a Farr 52 named Bob, compete at the J.P. Morgan Assessment Management Round the Island Race.â€Â Source: CNN, June 19, 2010

Â

Let’s be blunt. Only one of three presidents “gets it.â€Â That one is Billy.Â

Â

President Tony continues to demonstrate that he doesn’t get it. His congressional testimony proved it. We wonder how much prep help he got from his fellow BP board member and former US Senator Tom Daschle. Reminder: Daschle was a prospective President Obama appointee, whose name was withdrawn after financial revelations killed his nomination. Daschle is the former US Senate leader of his, and Obama’s, political party.

Â

The third president is now in deep trouble. Our national leader faces huge and growing disapproval and repudiation by his core constituency.  “Whose ass to kick†was supposed to be a demonstration of toughness. It backfired. Harvard lawyer and Chicago politician Obama is a skilled orator and chooses every word carefully. This phrase was selected by him to convey some type of forceful political nuance. It failed because it showed Obama out-of-character and therefore suggested that he is a politician first and leader second.

Â

The timeline of events starting with April 20 shows that the White House and the Obama administration had conflicting contingency plans and were disorganized. On April 22, the day the rig sank, President Obama, Homeland Security Secretary Napolitano, Interior Secretary Salazar and others did not know there was a leak. They were in an emergency meeting together in the Oval Office and were operating without good information. That is understandable. What is not comprehensible is why it took them so long to realize the seriousness of their ignorance.

Â

It took Coast Guard Admiral Allen to wake them up. On April 24, Obama’s staff was told there was a meaningful spill. On April 28, the White House finally accepted that it was big.

Â

The president made his first trip to the Gulf a week later and two weeks after the rig explosion. And he did not immediately activate sufficient federal resources to the level we now know was needed even when briefed by Admiral Allen and Governor Jindal. That is why Obama is being compared to George Bush and Katrina when the public evaluates the response to crisis.

Â

Sorry, Mr. President. You failed us at the beginning. You were ill prepared. You announced expansion of offshore drilling because of politics and, we now know that, you hadn’t considered increased research funding for NOAA and for the preventive measures we now know are necessary. You formed no commission of experts to study it. You failed to heed warnings. And we now know that your administration’s Mineral Management Service was a mess.

Â

And we also know that your present moratorium structure is improperly conceived, politically driven and lacks petroleum engineering professional skills. We also know that your present moratorium plan was discussed in Washington last week with Gulf folks who traveled to our nation’s capitol. They returned home convinced that Washington is likely to do huge damage to the US by the way you are shutting down existing and non-BP activity. Your moratorium doesn’t make us safer. It will make the US dependent on foreign sources for oil to the tune of another 2 million barrels a day as it shuts down the Gulf and if it causes the Alaska pipeline to cease operations for insufficient throughput.

Â

The list of bungling is extensive, Mr. President. When looking for asses to kick, you might want to start with the mirror. But first help me explain the use of this language to my four year old granddaughter after she sees her president demean himself and his office on national television.

Â

Let’s get to some very real economic reality.Â

Â

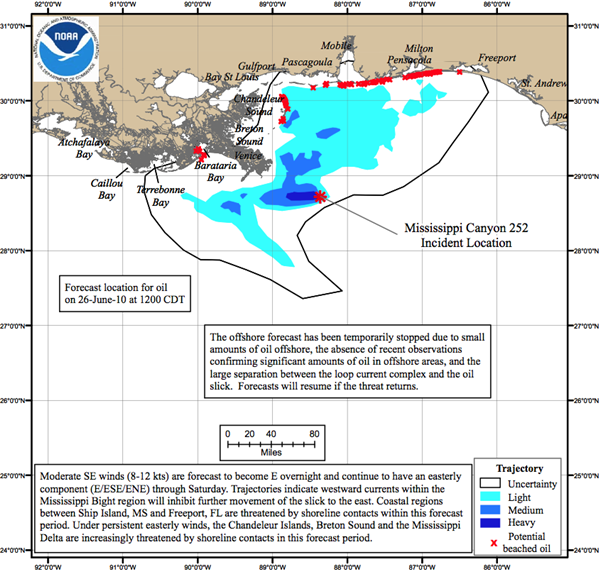

Five states are now suffering because of the BP spill. Florida, Alabama, Louisiana, and Mississippi are hit by oil slicks that are devastating their fisheries and tourism. Texas is a casualty along with the others because the drilling moratorium that was poorly designed by Obama’s team was created out of a political response.Â

Â

The moratorium payback will be the loss of thousands of jobs.Â

Â

We now add the Alaska pipeline as a possible casualty, because of insufficient throughput due to the shutdown of existing drilling thousands of miles from the Gulf. The pipeline is built for 2 million barrels a day capacity. It currently carries about 700,000 which is near the minimum necessary to operate. It is supplied by oil drilled offshore. If it doesn’t maintain sufficient volume of warm oil the oil will cool and congeal. Five existing offshore wells that would keep the volume sufficient are now affected by the Obama moratorium.Â

Â

We estimate that an extended moratorium, which we now expect to continue because of Obama political calculus, will cost up to 200,000 higher-paying jobs in the oil drilling and oil service business and that the employment multiplier of 4.7 will put the total job loss at nearly 1 million permanent employment shrinkage occurring over the next few years. Five states have a regional recession/depression development underway. Alaska could become the sixth state on the damaged list.Â

Â

Readers may note that for the Gulf region, they can watch the Beige Books of the Atlanta and Dallas Federal Reserve Banks for economic details over the next several months.Â

Â

And we must not be deceived by the $20 billion fund. It is not nearly enough to cover the liabilities that may develop for BP and its partners, who are already in dispute with each other over who is going to pay for what and when and how much. Remember at $4300 fine for each leaked barrel of oil, the $20 billion is likely to just cover the fine. We expect that the total cleanup and payment of the liabilities to all injured parties in all five states may approach 5 times that amount. Â

Â

Let’s get to dispersants.Â

Â

The United States has approved and is supervising the administration of chemotherapy to the Gulf of Mexico. I have personally watched chemo too many times. It attempts to restrain the fast-growing cells by doing more damage to them than it does to the healthy cells, in a desperate attempt to keep the patient alive. There are many warnings in chemotherapy about longer-term damage and about unknowns. They are accepted because chemo for a cancer victim is viewed as a life or death option.

Â

Dispersants in the GOM are similarly problematic. Think of them as chemotherapy to a 2000 mile coastline and to hundreds of square miles of sea.Â

Â

Use them sparingly and on the surface and we have a pretty good idea what will happen – they seem to accelerate evaporation and natural processes that get rid of the oil. Â

Â

Use them below the surface, however, and we have little experience and simply do not know what the longer-term effects will be. Oil on the sea floor is a naturally occurring phenomenon. There are natural processes that Mother Earth has to deal with it. Microbes eat it. And when it rises to the surface it is then broken down and evaporates. Yes, it’s toxic, and, yes, it does do damage.Â

Â

Dispersants are manmade; no Mother Nature involved in this one. They are toxic chemicals that can do damage themselves.Â

Â

When they are used in very cold water and a mile below the surface, we simply do not know what the outcome will be. And we do not know if the small droplets they create become an emulsion that travels for hundreds or thousands of miles. There is initial, but inconclusive, evidence that this is happening in the GOM. We will soon find out. I fear it will be the hard way.Â

Â

The rest of this commentary consists of quotes from the Obama Administration’s Environmental Protection Agency and other sources. They were extracted from public documents.Â

Â

During the GIC meetings in Europe last week there were several discussions on the impacts of the GOM events. We owe great thanks to Jim Lucier for sharing his insight. His database on this subject is enormous.Â

Â

The quotes follow. They are sequenced and lead to the issue of the use of Corexit. Remember, about 5 million liters of dispersants, mostly Corexit, have been used in the GOM in the last two months. About one-third of that has been at the wellhead, 5000 feet below the surface, in very cold, very high-pressure water. There are numerous reports of deeper-water oil plumes that are sufficiently subsurface to avoid easy measurement and detection. We will leave the rest of this to each reader to consider for her/himself.

Â

As you read these extracts, please note that the UK has now banned Corexit. British oil comes from the cold and deep water off its coast.

Â

Â

Copyright 2010, Cumberland Advisors. All rights reserved.

Â

Category: Commentary, Commodities, Economy, Finance, National News, Oil and Nat Gas, Wall Street, World News |

48 Comments »

Tags:

People in the large Western Quebec seismic zone have felt small earthquakes and suffered damage from larger ones for three centuries. The two largest damaging earthquakes occurred in 1935 (magnitude 6.1) at the northwestern end of the seismic zone, and in 1732 (magnitude 6.2) 450 km (280 mi) away at the southeastern end of the zone where it caused significant damage in Montreal. Earthquakes cause damage in the zone about once a decade. Smaller earthquakes are felt three or four times a year.

People in the large Western Quebec seismic zone have felt small earthquakes and suffered damage from larger ones for three centuries. The two largest damaging earthquakes occurred in 1935 (magnitude 6.1) at the northwestern end of the seismic zone, and in 1732 (magnitude 6.2) 450 km (280 mi) away at the southeastern end of the zone where it caused significant damage in Montreal. Earthquakes cause damage in the zone about once a decade. Smaller earthquakes are felt three or four times a year.