Posted By thestatedtruth.com on June 28, 2010

Gene Inger’s Daily Briefing . . . for Tuesday June 29, 2010

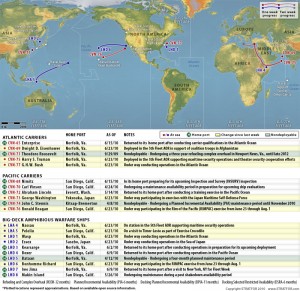

At presstime:     We just learned that the USS Nassau (I have personally been on that ship just as a curiosity to note, with an officer friend of mine who flew a helicopter off LHA-4 at the time) Amphibious Assault Ship carrying 4000 Marines has joined one of the battle groups in the area; supporting Fifth Fleet operations. It may be where waters of the Gulf of Aden flow into the Red Sea, but might not be there in the morning. One can only wonder if the location was/is to intercept any Iranian ship bound for Gaza if they still attempted that, since boarding would be authorized under UN sanctions.

Â

Good evening;

Policy splits . . .were the expectation in these parts ahead of the G20 meeting; so it is no surprise that Europe’s refuting the US diatribe against fiscal responsibility ‘now’, became the rallying cry of the majority of nations (some of whom have no choice and must constrain spending, while others will do so out of common sense realizing that it makes no sense to push for more stimulus when the earlier packages were so poorly implemented that the US was barely coming out of its fun before these globally testy gatherings). Perhaps Germany put it best by saying that if you want consumers ready to spend; you should keep a nation’s fiscal house ‘in order’ to inspire real confidence.

As inane as believing more spending (borrowed from nowhere as what China really is showing by its willingness to revalue, is not an effort to help ‘American retirees’, as an actual reporter argued ineptly; but a realization that the Greenback might deteriorate, so as usual China is looking out for herself, not for our wellbeing or anything else at all); one could also consider something else increasingly troubling. That’s with Iran.

Despite the message trying to be conveyed to Tehran by deploying multiple battle groups to the Arabian Sea and Indian Ocean (not just the Persian Gulf), there is a big hole in this strategy that Iran is all too aware of (and their prior attacks on a US Navy warship during their earlier effort to block the Straits of Hormuz years ago proved): there is concern about no carrier defense against missiles. That isn’t an entirely valid perspective, because one has to define between cruise missiles and ballistic missiles although it is true that 4 instances of Western warships caught by such sea-skimming weapons all ended poorly for the ships. Nevertheless, even if this Navy is excessively accustomed to using large ships as forward artillery or launching platforms; there is a scenario shaping-up in which old techniques for ‘battle surface’ best be dusted-off as well. That means view twin challenges: new missile technology and surface warfare.

It is incorrect for writers (as have some) to say that Navy brass is arrogantly unaware of this issue, like the British when they sent Prince of Wales to battle the Japanese in the initial assault on Singapore (and it was rapidly sunk by Japanese carrier aircraft), without air cover (even then that was unfathomable). Actually the Royal Navy and the US Navy are well aware of ‘force protection’ needs, and know that the miniaturization of sophisticated guidance systems makes all our fleets of carriers big targets that are inadequately defended. And the next generation of defenses (lasers) isn’t ready yet.

These risks are precisely the message it is clear, that is apparently understood by the barbarians running Iran; as implied by the ‘speedboats’ of the Iranian Navy harassing our ships in the Persian Gulf. (Such a strategy only works in littoral or calm waters as such small boats can operate, which they cannot in blue waters of the open oceans.)

But multiple missiles in a salvo cannot easily be defended against. That is (sadly) not the worst case: for over 30 years the US Navy has in its inventory one of the world’s earliest and reliable cruise missiles called ‘Harpoon’. It is sea-skimming and it pops-up before engaging a target, which confuses enemy target acquisition radars. It was demonstrated about 25 years ago in the sinking of a Libyan ‘corvette’ during that brief encounter. A similar assault by Iraq against the USS Stark using ‘Exocet missiles did essentially the same thing; as did the Hezbollah terrorists against the Israeli ship near Lebanon more recently. It is that latter case I’m more concerned about. The terrorists were using a Chinese designed variation of the Silkworm, and Iran has newer types.

The Naval Surface Warfare guys were trying to develop a laser weapon for several of the recent years, but (unless it succeeded in a classified manner and we don’t know) it has not yet been refined into an operational format to engage salvos of targets all in a simultaneous assault. One concern is that by the time short-range Phalanx systems were able to engage an inbound weapon there would not be time to intercept many in time to prevent some getting through (either under radar or fired in salvos or both). In a sense this is back to warfare generally unseen and untested by modern navies; it’s a threat to the ‘fast but under-armored’ aluminum hull construction of our frigates too. It’s not that these vessels were just intended to ‘show the flag’ and deter conflict, but it is the reality that they were not built to sustain ‘heavy hits’ in actual surface combat. (The older cruisers and battleships were; and they had trouble with mines and such.)

The US Navy has discussed this at war college levels recently. I know they broached this subject repeatedly if reluctantly in anything remotely public. In fact the hope (and eventual plan) is to equip the newest of the ‘littoral’ warships with laser weapons; but the weapons just aren’t ready yet. At the same time the nuclear weapons capability of Iran is about ready, and that means we may not have the luxury of convenience here.

For one thing, we can’t depend on Israel alone to knock-out all of those facilities, as if they can’t, there is still no option but for the US to finish that job, as there is not going to be a nuclear-capable Iran permitted as the President says, by waiting for very long.

One reason I’ll conjecture that Turkey became so chummy with Iran (wishful thinking it may be; but hard to tell) is as a ‘cover’ for Turkey to deal with the Moslem ‘street’ as it becomes clearer that conflict is developing. An irony is that in sophisticated Turkey, a large segment of the population is ticked-off with Ankara’s distancing from NATO and the West, again assuming that’s actually happened (we suspect it has not and as US Forces leave Iraq, you’ll see it if they fly through Turkey, and not only via Kuwait; especially if heavy weapons transit that direction for shipment back to the States).

At the same time there is a ‘bright side’. The battle groups may be arrayed to provide cover for the massive operation to find Bin Laden underway right now (CIA led we’re able to note), which would be very uplifting if they get the mass-murderer while he’s still alive, if he is. Also they might be arrayed to cover our withdrawal if that becomes necessary. It is even conceivable they are arrayed to support (the least probable but maybe most interesting option of) an overland ground assault from both Iraq and also Afghanistan on Iran, to topple the regime and replace it with reasonable Iranians of whom there are many who risked their lives for freedom, just a year ago. Plus having learned from the idiocy of how Iraq was handled, presumably we’d do better this time, by not firing the police or regular army and putting them on the payroll (aka: Germany or Japan at the end of World War II, when politicians opposed this but it worked well).

Nobody talks about it; but we have a ‘pincer’ set-up with the magic numbers needed for our own ‘force protection’ in-event this President (yes, this one) were to order the assault. Plus both the USAF and the IAF (Israeli AF) have units in Azerbaijan and in Georgia right now, which puts fighter-bombers within relatively easy striking-range of most of Iran’s nuclear facilities, and Teheran itself (near the Caspian Sea) if we are to at least target their government buildings. Such an assault may be more practicable in contrast to a ‘cruise missile’ assault (at least alone) due to proximity and distance.

Are we suggesting that we’re on the eve of warfare? Well that’s hard to say but more of the forces needed are in-place or rotating in that direction as we noted previously. It may be said that we cannot politically or financially afford this while engaged in two other conflicts. Two ways to look at that contrarily: one; that we can’t afford not to if it is evident that Iran is counting on those factors to dissuade our resolve while they go ahead and blunder into attacking anyone, and two; that we will likely never again be so well-equipped with forces on both sides of their border to support such campaigns.

The cost structure is comparatively low as it would be turning the force around, as it’s pointing towards Iran rather than towards Baghdad or Pakistan. If not a ground attack at least the US Army could deter an Iranian counter-offensive against their neighbors. This would be the exact opposite of worrying about our forces being targeted in their neighborhood; how about their forces being targeted if they don’t comply with the UN resolutions forthwith. The timing of the sanctions and implantation support this thesis.

As for our carriers, if you see them positioned well out beyond a 1500 mile perimeter of Iran, you’ll know the fear is a missile attack; but also that from that distance (the range of a Silkworm or Sunburst or new Dong) conventional defense is feasible. It’s also maximum range without refueling of our F-18’s but they can be refueled in air or by landing at bases in the Gulf region. Or they could overfly even into Georgia by the way; and then be refueled and rearmed for a return mission; eventually landing back on their home carriers. The Israeli Air Force has limited capabilities to do this with the same bases abroad; but lacks the capacity of multiple sorties once the conflict starts. If the world is serious about stopping Iran; it is unfair (almost legitimizes Iran’s insane rants, which of course instilled genuine fear in Israel and in neighboring Arab nations as well) to ask Israel to shoulder the burden for the comfort of others also threatened.

In any event; we are not being alarmist; just realists. You don’t send one of our top Flag officers to command the new battle group just for recreation; and you shouldn’t assume that the USN hasn’t learned the lesson of carrier vulnerability that some are claiming exists (how could they not know; we developed the cruise design; as I noted again… ‘Harpoon’… the original). We simply have to adjust operating tactics. By the way remember this: the anti-ship cruise missiles are not ballistic missiles. Those that are (to the extent they exist) are limited in numbers. Also; a CAP (combat air patrol) or especially an advanced Aegis cruiser or destroyer can shoot down ballistic missile attacks during the reentry phase, using the latest Standard III antiaircraft missiles. If anything you would presume continuous airborne CAP’s in such a ‘theater of war’.

As a final thought on tactics, one might presume that unlike Lebanon or Egypt (there was a sinking by Russian cruise missiles of an Israeli/British destroyer years ago), in the event Iran were to launch such a weapon against a US carrier group; we would in no uncertain terms go to ‘tactical nuke’ warfare almost immediately; and that’s Iran’s finish. Plus the USS Truman currently is cruising opposite Chah Bahar in the Arabian Sea, which is the primary Iranian Revolutionary Guards naval base. That alone says enough about the likely purpose (no press statement needed) of current deployment.

Â

….So it’s more likely the Iranians would harass but not directly attack our carriers. At the same time we cannot assume that; so proper advance defenses will need to be taken as it might be something like the Cole, where unmarked vessels assail our Fleet, and Iran tries to pretend they had nothing to do with it (might even try blaming al Qaeda).

As to whether a truly hotter war is coming. First of all we are not denigrating the effort of our valiant troops in Afghanistan; but it’s an inhospitable situation. Second, it’s not at all near the sea; thus Naval air and artillery support is essentially impossible. So it is highly unlikely that Naval air is being intended to support that and more than likely it is there related to Iran. Incidentally, the real target of the Iranians has never been in our thinking Israel; that’s a ploy to elicit support from Arab masses who normally are a good bit suspicious of the non-Arab-but-Islamic Iran. Until ‘imadingbat’ nobody ever really picked on Israel in Iran; then he did it to cover his nuclear program. In fact Iran was a primary supplier of oil to Israel (yes Iran) for years even with the mullahs there.

The likely real target is the oil-rich small sheikdoms of the Gulf, and probably Iraq; not to mention Iranian support for Islamist forces (read Revolutionary Guard’s equipped infiltrators) in Yemen, who really are after the Saudi Arabian oil fields, as already has been acknowledged by 2 penetrations that were eventually repulsed into Saudi itself.

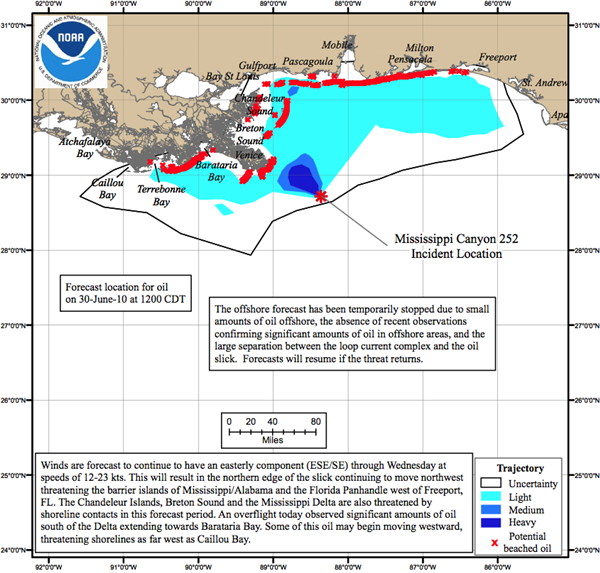

All this ties-into why Washington is so upset with the terrible mess BP made of what would have provided US energy independence during a war in which oil supplies will be constrained as and if Iran manages to close the Straits of Hormuz (and they well might be able to make transit hazardous to say the least). And perhaps we’ll be very lucky, and one ‘relief’ well will allow plugging the upper ‘gushing’ structure of the wild well, while the second ‘relief’ well bridges underneath and proceeds to produce it as we need the oil. There is then no more risk producing it then already exists by drilling the relief wells. Only fools would suggest that the project be plugged and abandoned.

In any case, with conflict, there goes the last chance of keeping Oil under 120 or so, in-event a conflict actually starts; although because there will be a fairly rapid victory (has to be, if we intend installing a friendly regime in Teheran, that has the support of educated and civilized Persians in that advanced society), the explosive run higher of Oil will be relatively temporary (no more than 6 months duration one would think; but that assumes all goes as planned); and the risk of homegrown or 5Â Â column terrorists because this Government has not properly secured our borders (near military bases).

Why so much discussion about this? It’s obvious. While higher Oil would somewhat it seems offset selling pressures elsewhere, it wouldn’t be sufficient and an already soft domestic economy would temporarily be even more suppressed. Likewise the market would dive; to levels that are hard to predict; but possibly 15-25% from current levels, and then become relatively attractive (again depending how things go; if poorly and/if at the same time we get ‘state defaults’, one could imagine a market cut in half or so).

Only today we hear major firm analysts talking about this as a ‘contained Depression’ (gee, where did I hear that one for the last two-three years); but one major analyst we all know, said it’s discounted (by what decline?). She is wrong in my opinion; and that view (a higher target) is exactly the same now as when they talked of solid growth for the year’s 2 half. Does that mean Wall Street is bullish if there is growth or if there’s no growth (or little)? Apparently. That means they are spinning fundamental reality to fit their earlier view; or that they are so loaded with positions (or their clients) that they have no alternative (the latter is the more likely answer). We’d say be very defensive.

Can you play this? Sure; but timing it is not meant to be easy. Such a war may not at all take place first of all (and our bearishness exists ‘sans’ any conflict, so add that as well and you have an ‘even more bearish’ prospect). Plus if so; the timing is intended to be a military secret. But as we look forward (and tend to think this would be much too soon) the next ‘new moon’ is July 12; just so you know (a favorite among military for launching strikes if need be). But again unless Iran provokes us (you’ll note they have backed-off wisely on their terrorist-laden ‘humanitarian’ ship; as has Turkey and even the Syrians have piped-down), that is probably too-early a date for real conflict.

Let’s just say that we need to ratchet-up the ‘military alert’ side a tad, and be aware of threats the Iranians have made about having co-conspirators already in the U.S. Oh it of interest that few have reported Interpol’s arrest of at last one Hezbollah terrorist in Paraguay just a few days ago. This is being severely underplayed. Let’s ponder why.

At presstime:     We just learned that the USS Nassau (I have personally been on that ship just as a curiosity to note, with an officer friend of mine who flew a helicopter off LHA-4 at the time) Amphibious Assault Ship carrying 4000 Marines has joined one of the battle groups in the area; supporting Fifth Fleet operations. It may be where waters of the Gulf of Aden flow into the Red Sea, but might not be there in the morning. One can only wonder if the location was/is to intercept any Iranian ship bound for Gaza if they still attempted that, since boarding would be authorized under UN sanctions.

Â

..FYI: between USS Nassau; USS Mesa Verde and USS Ashland (sailing together); it is apparently the entire Amphibious Ready Group 24 Marine Expeditionary Unit, that has arrived in the region. USS Nassau also carries six AV-HB Harrier attack planes in event close-in defense (or ground support of Marines) is called for as a contingency. I think this third group (USS Eisenhower being the first) affirms the growing tension. Let us see if the Eisenhower ‘rotates out’ as scheduled or stays there. May be revealing.

Â

Domestically; keep an eye on Arizona. The current Sec’y. of Homeland Security has attempted to tie border defense to immigration reform, and says the border is too big to defend (hello; then what are we doing in Iraq). Nothing against her; but I believe it is her duty to protect where infiltration occurs. At the moment that is Arizona primarily not the whole Southwest border. Furthermore, not to sound any alarm; but there is a traditionally poor mostly black farming town in Florida, west of Palm Beach, that has now become almost overrun with Moslems. What do they want and why are they in a town like Belle Glade (near Lake Okeechobee, which provides drinking water for the majority of South Florida). This is not prejudicial, because there is no history of Islam in Florida being in either citrus or sugar businesses (mostly black or Latino workers); hence a reasonable question as to ‘why’ are they gathering in such a sleepy town? I was alerted to this latter condition by a member here, and am curious what it’s about.

Â

Finally as to Paul Krugman’s ‘revelation’ about a potential third Depression (he means of course the 1930’s and the 1880’s before that); well, that’s what I said in 2007-2008 of course; calling it a likely ‘controlled Depression’. In my opinion we’ve been in it so I do not know what he’s forecasting. More likely he’s making a pitch for more stimulus; an assumption by politicians that what didn’t do much before would miraculously now work better (not). At least not unless channeled differently; and frankly times up for all this. The failure of policy accord at G20 should result in not divisive, but individual so thus a bit decentralized decisions in the EU and the Americas too. Anyone believing that there is even room for no belt-tightening and increased spending, doesn’t get it. I think we’re past that point politically and financially; and that’s why the Fed’s in panic. It’s also why you don’t hear much in the media about it; they’re fearful of confronting.

Â

By the way with all respect to Prof. Krugman, his comparison with the aborted upturn of 1933 (though the market’s low had occurred) misses a big point we’ve contended all along: the US had the borrowing capacity after the roaring ‘20’s; it didn’t begin the revival from a position of ‘guns and butter’ in two wars, or heavily indebted already. It is this reason that caused my emphasis on the whole thrust not really as Keynes said at the time; hence the overreliance on Keynesian policies, or interpretations of it. But as I’ve quipped; ‘Keynes is still dead’; and that was because he said you could not do it if you were a debtor nation to start with, and that was why my call for fiscal restraint three years ago, along with keeping the banks going (not more) and helping business (you’ll note that the vast majority of promises to homeowners and others were little more than deceiving, and often caused normal citizens to delay getting out of debts).

Â

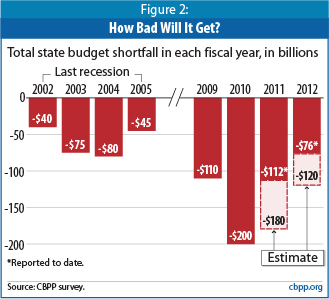

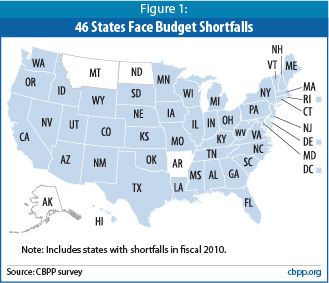

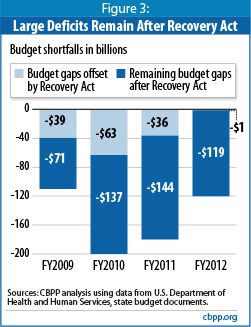

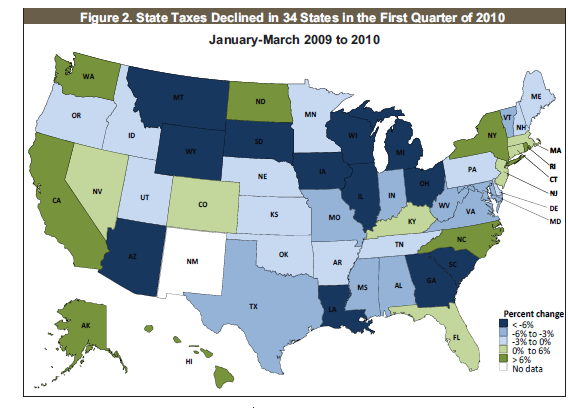

I also note that for three years I’ve argued ‘cash is not trash’ (it still is not) and that all the contrary arguments were intended to get you to take unjustified risks or to spend beyond your means; precisely what got this Nation into the problem in the first place. Government needs inflation and a debasing of the currency. They did not get that so now they’re in a quandary about what to do next. The President’s call for more newer spending is ‘old time religion’ and won’t work; just as the pleading for some states to defer cutting budgets because ‘we can’t handle too much at once’ is an old argument as it’s past that point, and there are about 40 states that can’t meet their obligations.

.

Many easier answers were addressable 2 years ago but they didn’t address them at the time. So now you do come down to fiscal restraint and doing it the old fashioned or proven way; earn it; don’t borrow it. This is very hard for politicians, or labor unions for their pensioners in particular, to accept. Because it means sharing the challenge. In most cases it’s not the salaries of poor teachers, or firemen being laid-off; it’s just the pensions for the three generations of those who came before, who the rest simply can’t carry on their backs in these circumstances. Double-dipping should be outlawed and it won’t be popular. Maybe these are the ‘tough decisions’ the President means..

Â

..Â

Category: Commentary, Economy, Finance, Interest Rates, Bonds, National News, Real Estate, Wall Street, World News |

No Comments »

Tags: