Bitcoin Hits 1 Year High Then Plummets After $1 Billion Liquidation In Seconds

Posted By thestatedtruth.com on August 2, 2020

Crypto currency heats up, Then blows a fuse.

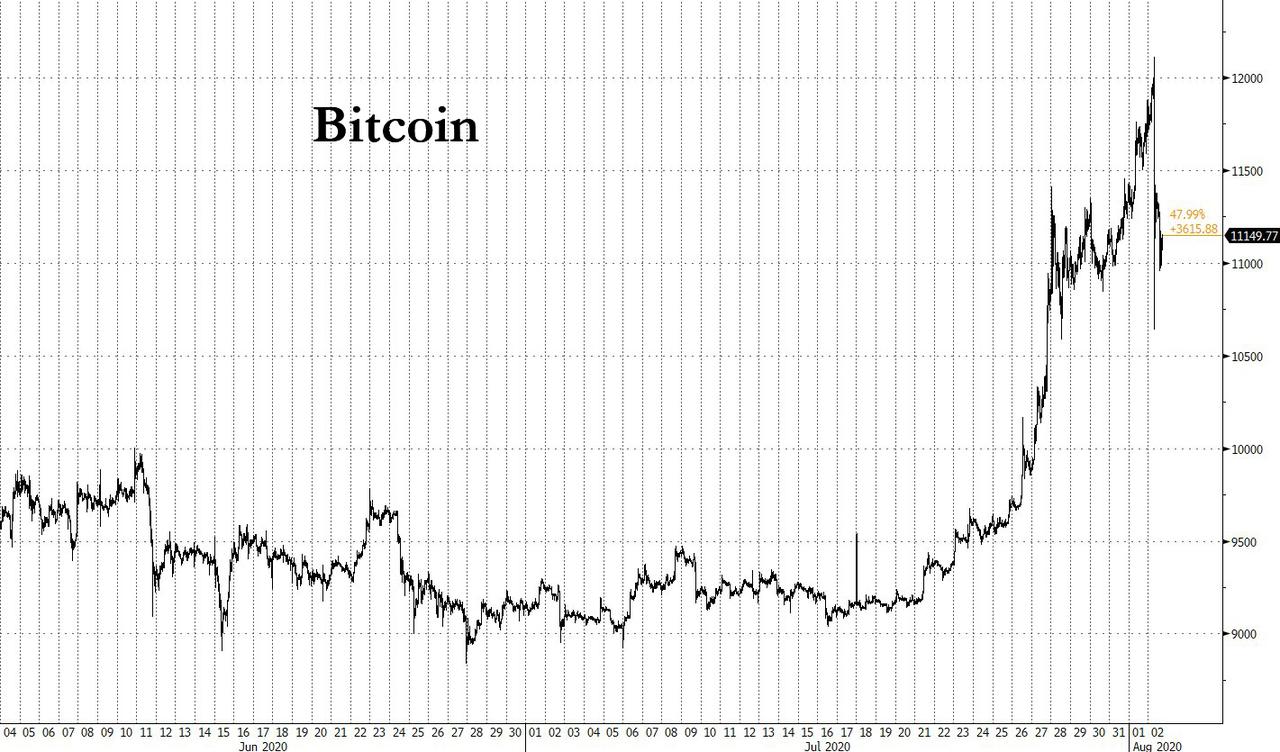

The infamous cryptocurrency pump-and-dump or dash-and-smash was on full display overnight, when shortly after midnight ET, bitcoin hit a one year high of $12,112 – rising 20% in just the past week when it hit $10,000 on July 27…

… before it was hit by a furious wave of selling that sent the price as low as $10,550. The catalyst: more than $1 billion worth of futures were sold in seconds.

As CoinTelegraph adds, in the last week as Bitcoin soared 20%, the cryptocurrency market was heavily swayed to the side of the buyers and the funding rates of Bitcoin and Ether were nearing levels that are not sustainable over a prolonged period.

Meanwhile, futures exchanges, like BitMEX and Binance Futures, utilize a mechanism called “funding” to implement balance in the market. When the overwhelming majority of market participants are holding long contracts, then short holders are incentivized with a fee and vice versa. Prior to the drop, the funding rate of Bitcoin was hovering at around 0.0721%. Since the average funding rate of BTC is at around 0.01%, the market was dominated by long contracts.

The market imbalance was even worse for Ether. The ETH funding rate was at 0.21%, which indicates significant bullish bias. After the liquidations, the predicted funding rate of ETH is at 0.19%, which means some more pain may be coming for longs.

Sources: ZeroHedge

Comments