Thinking Of Buying A Home Today…..Does It Make Sense?

Posted By thestatedtruth.com on May 25, 2010

Why buying a home today makes little financial sense. 3 reasons why taking on a mortgage in today’s market is deep in speculation. Are homes still over valued? Tax benefit not as big as you would expect.

Â

Â

Tue, 25 May 2010

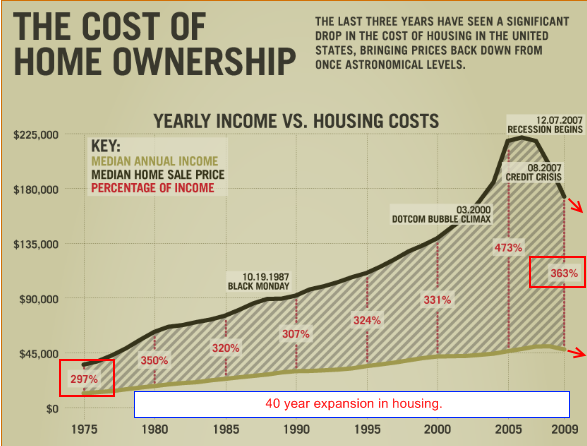

It is hard for many to believe that home prices in many of our largest cities are still overvalued. Part of this distortion has to come from living in a decade long housing bubble that has adjusted the perception of value and price. But in many areas home prices are still much too high relative to the income of local families. When disconnects occur here, bubbles are produced. The stock market is experiencing this since price to earnings ratios are still much too high for what businesses are drawing in through revenues. The housing market is off by 30 percent from its 2006 peak and weakness is now appearing once again now that the tax credit has expired and the Federal Reserve is finished with their mortgage backed security buying campaign. It only took a few weeks once artificial measures were taken off the table.

Home prices relative to income are still too high nationwide:

Source:Â Visual Economics

In fact, if we look at recent data the numbers are still too high:

Median Household income:Â Â Â Â Â Â $52,029

Median U.S. home price:Â Â Â Â Â Â Â Â Â Â Â Â $173,100

Yet on a nationwide basis, we are getting closer to the ratio of the 1970s. But on a more narrow level of cities and states, some areas are still very much in bubbles including California. It is a fascinating case of consumer behavior post-housing bubble. Since most of us have now been conditioned over the past decade that the only way to buy a home is to take out an enormous mortgage and leverage each penny of net income to a home payment, we have forgotten sounder times. In light of this, it might appear that home prices make more financial sense in today’s climate but they do not in many areas. Let us look at a few reasons why buying a home today is not a good idea.

Reason #1 – Smaller mortgage with higher interest rate better than big mortgage with small interest rate

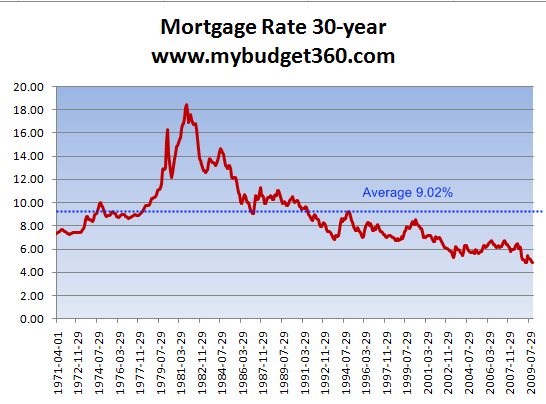

One argument you hear those in the housing industry continually make is “you should buy today because rates will rise.â€Â What they don’t tell you is that higher rates usually mean cheaper home prices and buying a less expensive home with a smaller mortgage and higher interest rate makes much more sense than buying an expensive home with a big mortgage and cheap interest rate. Before we walk through an example, let us look at historical mortgage rates:

Over 40 years of history shows an average 30 year mortgage rate of 9 percent. The current average that is lower than 5 percent is an anomaly. If we run a few scenarios, you will see that a cheap mortgage rate and an expensive home actually give buyers less power when it comes to paying down their mortgage.

We’ll run two scenarios with the current interest rate and the average to show why this occurs. We’ll assume a same monthly payment since this is usually what is used for debt-to-income qualifications so the home price will reflect this.

Low interest rate scenario – 5% 30 year fixed

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $250,000

30 year mortgage:Â Â Â Â Â Â Â Â Â Â $237,500 (using a 5% down payment)

Monthly principal and interest:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,274

Total interest over life of loan:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $221,482

High interest rate scenario – 9% 30 year fixed

Home price:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $165,000

30 year mortgage:Â Â Â Â Â Â Â Â Â Â $156,750 (using 5% down payment)

Monthly principal and interest:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $1,261

Total interest over life of loan:Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â Â $297,298

On the surface, this appears to be a good deal. By paying more with a lower rate you have more flexibility. But let us assume this family is able to contribute $300 more per month. What happens then?

Low interest rate scenario $300 additional monthly payment (239 payments – 19 years)

Total interest over life of loan:Â Â $137,388

High interest rate scenario $300 additional monthly payment (188 payments – 15 years)

Total interest over life of loan:Â Â $135,437

Here is the big difference. With $300 more per month, the person with the high interest rate can pay off their loan 4 years faster and save on their interest payments as well. This is the leverage of having a higher interest rate and a lower priced home. Also, the requirement for down payments is shifted lower since the price is moved lower. This is good if the person ever decides to sell their home in the future because more people can qualify for the home. The heavily exotic mortgage market simply caters to the idea that home price is the most important factor in housing. It is not. Affordability is the most important factor for long-term sustainability.

Tax benefits over sold?

One of the oddest pitches about buying a home is the tax deduction. The fact of the matter is, most homeowners live in cheap enough housing that the standard deduction is all that is needed without the mortgage interest deduction being taken. In fact, only a handful of states like California benefit from this tax deduction even though most think this helps them (probably from not understanding the complicated tax system). To be honest, the mortgage interest break actually helps out the wealthiest in our country.

“(Tax Foundation) For tax year 2008, a little over one quarter of the nation’s tax returns claimed the mortgage interest deduction, 26.8 percent of the nation’s 143 million tax returns. Rates of home ownership are much higher than this, but many home owners don’t claim the deduction. Often they live in low-cost homes for which the deduction isn’t large enough to make a tax difference, so they don’t itemize deductions on their tax returns. In addition, home owners who have paid off their mortgages make no interest payments to deduct.

The average tax return in the U.S. deducted $3,279 in mortgage interest; that includes all tax returns, even the non-homeowners and non-itemizers. Counting only the tax returns that deducted mortgage interest, the average amount was $12,221.â€

This is a stunning revelation. The homeownership rate is approximately 67% but only 26.8% claimed the mortgage interest deduction. So much for that sacred cow of housing right?

Reason #2 – Price to earning potential of home is still unsupported by long-term trend

Home prices in many cities are still in mini-bubbles relative to the income of families in those areas. California is a prime example:

According to the California Association of Realtors the median home price in California is $306,000. However the median household income is $60,000. This means the home price is 5 times the annual household income of a family in the state. Take for example the following:

Median household income:

1969:Â Â Â Â $9,302

2008:Â Â Â Â $57,000

California median home price:

1969:Â Â Â Â $24,640

2008:Â Â Â Â $500,000

So back in 1969, the ratio was 2.6 and at the peak it was close to 10. Today even at 5, it may appear to be lower relative to the peak but it is still too high. Expect this ratio to come back in line in the 3 to 4 range. This has historically been the case for most areas across the United States. Many states are actually back in line but many cities still think they are somehow immune to this trend.

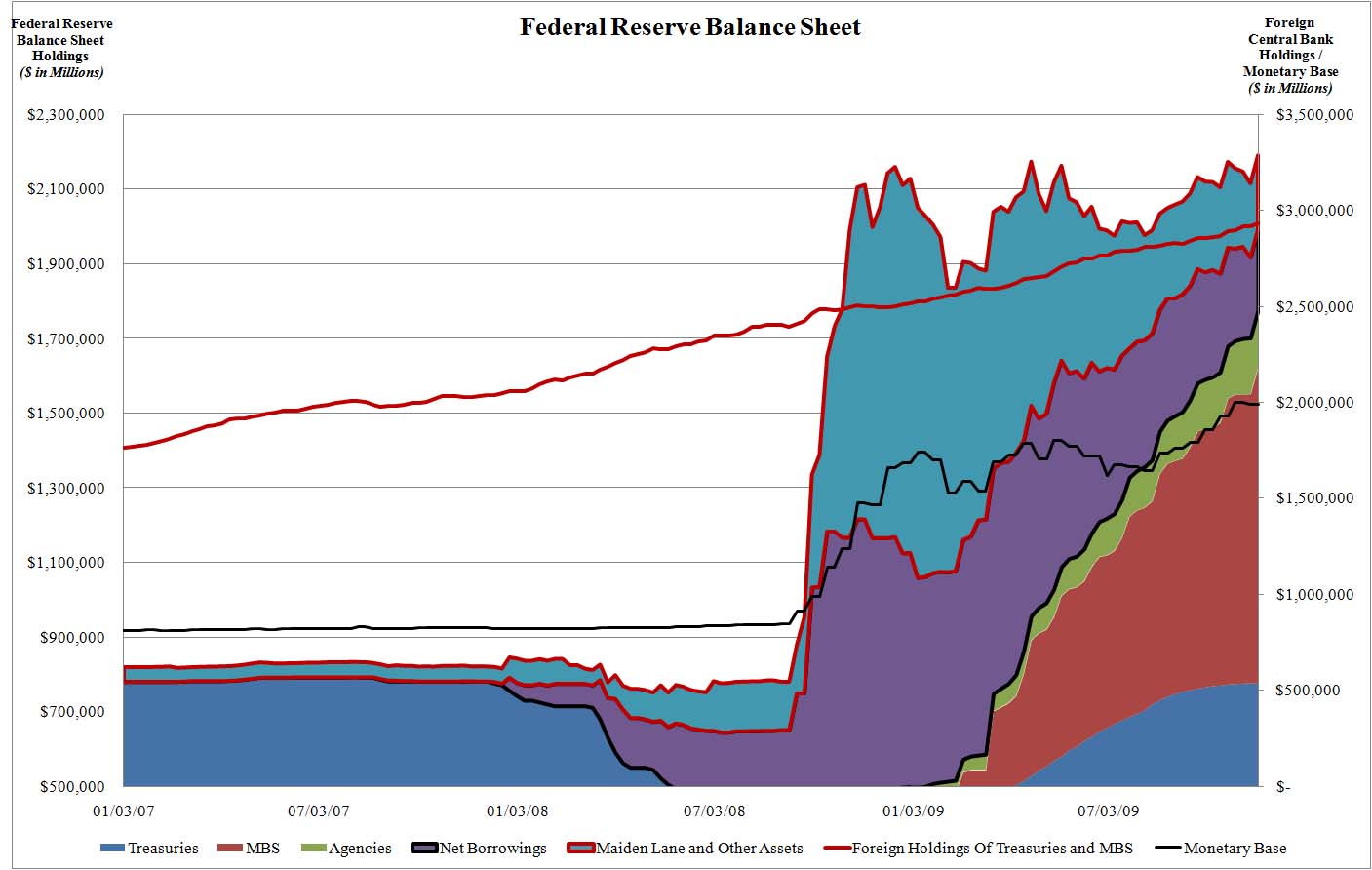

Reason #3 – Mortgage rates will go up

The U.S. Treasury and Federal Reserve have been systematically pushing mortgage rates lower. For example, the Federal Reserve just finished buying up $1.25 trillion in mortgage backed securities. The Fed balance sheet is already overfilling with mortgage backed securities, loans taken from banks, and other items which never were intended to fall under their prevue:

Source:Â Zero Hedge

This is not normal. Historically we have never been in a position like this. It is unwise to think that mortgage rates will stay low for an indefinite amount of time. Already the credit markets are starting to push rates higher because of the risk inherent in the current debt riddled system. Buying today assumes and is a bet that we can go into trillions of dollars of debt with no interest rate repercussions. This is a giant gamble and the markets are acting like a volatile casino.

To buy today is a big bet. There is too much that makes this market volatile. Aside from the above, there is also a large amount of shadow inventory which will keep a lid on price appreciation for years to come. Betting on housing today is probably the biggest gamble many will make.

Comments