Crop Failures Are Now On The Horizon And This Will Be Inflationary

Posted By thestatedtruth.com on November 10, 2009

Much of the middle of the nation — from the Great Lakes to the Mississippi Delta — received at least twice the normal amount of rainfall in October. That, combined with unusually cool temperatures, slowed crop development and made fields too wet for farmers to navigate with harvesting equipment.

By Sunday, farmers in the major corn states had managed to harvest just 37% of that crop compared with 82% on average by that point over the past five years. This harvest is the slowest since at least the mid-1970s, when the federal government began tracking harvest progress.

In addition to lower-than-expected yields, the rainy fall is stinging recession-weary farmers who now are spending more on propane to dry their crops than they had planned. The rain delay also means some farmers won’t be able to clear their fields of corn and soybeans in time to plant wheat this fall.

Dave Koons, a 61-year-old farmer in Tower Hill, Ill., said Tuesday that he was able to plant only 100 acres of wheat this fall, half of what he had planned. “A lot of farmers around here have never seen anything like this,” said Mr. Koons, who also grows 800 acres of corn and soybeans.

From www.wsj.com

Gene Inger’s Daily Briefing . . .Left Field Surprises

Posted By thestatedtruth.com on November 10, 2009

Gene Inger’s Daily Briefing . . . For Wednesday November 11, 2009:

Good evening;

Left-field surprises . . . have ways of impacting over-extended markets occasionally we have observed; irrespective of whether the market ‘deserves’ to decline (as surely this one does). As if to remind the world of the power of cyber-terror; guess what just happened this evening? If you saw ’60 Minutes’ on CBS last Sunday you’ll get it right away. They mentioned how ‘foreign’ control had tested infrastructure disruption with a twin-pronged attack in the past on two cities in Brazil. Guess what? Happening right as I’m going to press with this report. A total blackout in Brazil’s largest cities. Yes the implication of the Department of Defense and CBS was of China being behind it, but at the same time they did not say that Islamic terrorists didn’t have some capabilities.

At this moment we have zero details; aside the basic realization of the blackout. The idea of a terrorist or cyber-attack (if ever mounted; such as the Northeastern blackout was thought by some to have actually been) would be a ripple ‘cascading failure’ that quickly brought down the power grids across a large segment of the East or the West of the United States. Given that everything (including water and whatever you think of nowadays) is dependent on the internet, more so in the U.S. than anywhere else, this is why the danger is so acute, and our systems so ill-prepared to confront as of yet.

(Media reports say problems at a huge hydroelectric dam are to blame for electrical outages affecting large parts of Rio de Janeiro, Sao Paulo and other cities in several states. The G1 Web site of Globo TV says Brazil lost 17,000 megawatts of power after an unspecified problem happened at the Itaipu dam that straddles the border of Brazil and Paraguay. Not to make a connection; but that’s the region where Islamic activity in Latin America is concentrated, and those who know, know that I’m correct; which again is not to say it’s not coincidental. What may be coincidental is that we’d just mentioned the ’60 Minutes’ show about power outages here the other night..)

I am not suggesting terror is what happened (though it’s a reminder), or that anything is needed of a left-field out-of-the-blue nature to break this heated stock market. But; I am suggesting that extended markets are vulnerable, just when many rationalize all sorts of reasons why it’s not. I think history is replete with examples proving the point; just when analysts dispense with normalcy, to become victims of the ‘spin’ that ‘this time is different’; the opposite of what occurred in late February / early March, when they were convinced we’d go lower, rather than have a rebound that would be the year’s best rally (even while we said that; this one has, granted, exceeded most logic, but the idea was generally on the mark then; and the market averages only recently finally became equidistant with respect to the A-B-C rally phases we have noted with respect to overall S&P actions.

More at www.ingerletter.com

Foreclosure Activity Is Up In The Top 50 Metro Areas

Posted By thestatedtruth.com on November 10, 2009

Many of the Top 50 metro areas in the US are reporting “sharp increases in foreclosure activity.

“Rising unemployment and a new variety of mortgage resets continued to gradually shift the nation’s foreclosure epicenters in the third quarter away from the hot spots of the last two years and toward some metro areas that had avoided the brunt of the first foreclosure wave,” said James J. Saccacio, chief executive officer of RealtyTrac. “While toxic subprime mortgages drove much of that first wave of foreclosures, high unemployment and exotic Alt-A and Option ARMs are spreading the foreclosure flood to more metro areas in 2009.”

“While the news itself is no surprise in the sense that we have expected and written about this situation repeatedly in recent months, the phrase ‘sharp increases in foreclosure activity’ is notable in the context of widespread views that credit difficulties are abating. Below is a reminder of where we stand in relation to the reset curve. This news of a shift in the character of foreclosure activity comes precisely in tandem with the beginning of the predictable second wave. The pleasant lull in the reset schedule is decidedly behind us.

“The mortgages certainly do not reset at Treasury bill yields or even at standard spreads over LIBOR. Instead, they reset to a ‘premium’ spread above those rates. That ‘yield spread premium’ is precisely what the homeowners agreed to in return for the undocumented loan, and is particularly obnoxious at the point of reset if the mortgage itself is underwater (loan amount in excess of home value). Given that these mortgages were written during the last stages of the housing boom, at the highest prices, it is reasonable to assume they now sport very high loan-to-value ratios.”

Gene Inger Checks In With His Daily Briefing……….

Posted By thestatedtruth.com on November 9, 2009

Gene Inger’s Daily Briefing . . . for Tuesday November 10, 2009:

Good evening;

Bears are caving-in . . . increasingly, as they become convinced that so long as the ‘untouchable’ Fed engages in cover-up’s of the problems, and stimulates massively it is impossible to break the stock market for more than 3-6% corrections (which we’ve had a few of). While we called for upside continuation early this week (and then what comes next), what you have is a light-volume thrust to the upside, while concurrently, the bond markets are once again ignoring the shallow equity melt-up as orchestrated.

Will this melt-up become a blow-off? Perhaps; but first it needed to deny a ‘head-and-shoulders’ topping possibility, that many technicians saw, but I didn’t really embrace, having seen such patterns decimated (and look like that until they simply aren’t). This is by far an unusual market movement (sure it’s periodically rewarding or frustrating, depending on the trading session); but what it is not is an immortal indestructible or perrinial advance, such as we rightly forecast from 2002-2006. It looks like that, but if it were to be, you’d need a lot more growth from the reflation than seems feasible. No doubt we’ve been too conservative about parts of our own forecast rebound; but let’s be candid; outside of a handful of big-caps (with the volume to get in as well as out if it becomes necessary for the big boys), there is less going on than meets the eye. In a sense that’s a narrowing rather than an expansion of participation, and a warning.

There’s no disputing the Dollar-destructive collusion between the Fed or major banks overseas. There’s no disputing the inability of this Nation to stand-up for what’s right in relations with large trading partners who are also potential adversaries (hope that if able you saw ’60 Minutes’ Sunday night; with respect to cyber terrorism with oblique references to Communist China in particular and the danger to our infrastructure); at the same time as there’s no disputing that Iran (now buying mini-submarines from it’s reported the North Koreans) is hell-bent on destabilizing the region and raising risks. I will touch on the economic aspects a bit more in the video; but this is a high-risk time.

The FX pitch about shorting the Dollar’s way out-of-line at this point even to debasing it as has obviously transpired. Be real careful about believing the idea that currency is about to be overtaken by physical gold; as there’s not enough to diversify thusly if the powers-that-be actually desired that, which they don’t. There is shadow currency in a sense; and an awareness that fiat currency (paper) has value because of confidence; which cannot be offset by a hard asset; hence the break of the Dollar either ‘crashes’ a lot of things fairly soon, or the stabilization we suspect (after this washout) actually materializes. Concurrently, those traders ‘cleaning up’ on this trade will experience, if that occurs, a fair amount of drama; while the Greenback rallies and stocks decline.

Absolutely I’m not defending what this Government has done to ordinary Americans; in fact we’ve railed against it through two Administrations, of both parties. We base a lot of it on benign neglect, a moratorium on sensible trade policies, and no oversight. The rest (which popped the bubble) was creative financial engineering both by banks and urged-on by Congress, which rarely owns-up to their role in setting the stage. As traders perceive that the Fed has given the ‘green light’ not to worry (ie: no rate hikes soon); all other aspects as could intervene are cast aside (though they ought not be).

True, as we wrote before the crash last year; the only way out of financial insolvency is to debase the currency and pay back creditors with depreciated Dollars. That’s the basis of the Dollar decline we forecast then; more recently we’ve allowed for it to end, or to be near an end (we’re often early; but then eventually the pattern proceeds later as it should). It’s so obvious that they are reflating the asset side of the ledger while a debt side deflating occurs, that it obviously drains massive liquidity, and carries with it a willingness to pummel the currency, which has occurred (and may in a climactic bit of a way yet). What we need is to repatriate capital to these United States, and then a bit of ‘farming it out’, which the banks have been reticent to do, as investments in us.

That would be naturally stimulative, but require higher rates; a stronger Dollar; sound fiscal policies (oh my); transparent accounting (the opposite of letting banks bury their toxic asset holdings); and an environment for public policy friendly to repatriating our capital. Up to now (and this better change); Government acts hostile to U.S. growth in this sense, and has actually contributed to worsening certain problems, which may be part of why the market’s persisted (because there’s no where else for money to go). It is simplified by saying that’s a chasm between Wall Street and Main Street; but it is.

More at www.ingerletter.com

Quote Of The Day……..

Posted By thestatedtruth.com on November 8, 2009

Few men have virtue to withstand the highest bidder.

George Washington

Â

U.S. News & World Report Publisher Mort Zuckerman: U.S. On Brink of Deflation Crisis

Posted By thestatedtruth.com on November 8, 2009

Paul Volcker: U.S. Must Consume Less

Posted By thestatedtruth.com on November 8, 2009

Volcker: U.S. Must Consume Less |

||

Â

|

||

| Former Federal Reserve Board Chairman Paul Volcker says the consumer accounts for too much of the economy, a point he says is understood by President Obama and one which implies political support for a weaker U.S. dollar.In a recent speech, Volcker said Obama realizes that “We cannot have so much consumption.”Consumer spending accounts for about 70 percent of GDP, a level has been reached only by “the magic of financial engineering,†Volcker said.”We cannot rebuild the economy to the tune of 70 percent consumption or housing booms. It will just break down again,” Volcker said.He told CNBC that in a recent meeting of economic advisors with Obama the president emphasized the need to increase exports.

“That means more manufacturing,†Volcker said. “There was discussion of the importance of infrastructure. And there was considerable discussion of how can we take advantage of, so to speak, the need for a green economy, where we do a lot of the innovation.†The key, of course, is turning innovation — a major strength for the United States — into actual production, Volcker pointed out. “There was considerable talk about retrofitting buildings, save a lot of energy, at the same time give some jobs.†It also means that there is little reason to stop a steadily weakening dollar from falling even more, an event that would help the politicians immensely — if the government allowed it to happen. A strong dollar makes U.S. exports too expensive for foreigners to buy. On the other hand, a falling dollar brings U.S. labor costs in line with the world, at the expense of savers and the long-term retirements of millions of Americans. Cheaper dollars also brings billions of entitlements costs down, something politicians would vastly prefer to having to raise taxes or cut benefits. © 2009 Newsmax. All rights reserved. |

||

At Least The United States Government Is Locking In A Low 30 Year Rate

Posted By thestatedtruth.com on November 5, 2009

U.S. to Sell $81 Billion in Long-Term Debt Next Week (Update2)

By Rebecca Christie

Nov. 4 (Bloomberg) — The U.S. Treasury Department said it plans to sell a record $81 billion in its quarterly auctions of long-term debt next week and will replace the inflation- protected 20-year bond with a reintroduced 30-year security.

The Treasury will auction $40 billion in three-year notes on Nov. 9, $25 billion in 10-year notes Nov. 10 and $16 billion in 30-year bonds Nov. 12. The amounts were in line with the median forecast of $80 billion in a Bloomberg News survey of nine analysts.

The U.S. is headed for a second straight year of budget deficits exceeding $1 trillion, and the country’s legal limit on debt may be reached next month. Treasury debt-management director Karthik Ramanathan told bond market participants this week to expect another year of government debt sales of $1.5 trillion to $2 trillion, minutes of the meeting showed today.

“Treasury debt managers will continue to remain aggressive in managing financing needs while minimizing potential market implications,†the Treasury said in a statement in Washington.

Not The Best Way To Deal With Your Major Banker

Posted By thestatedtruth.com on November 5, 2009

US slaps duties on Beijing steel pipe imports

By Sarah O’Connor in Washington

Published: November 6 2009

The US hit China with another big trade action on Thursday as it slapped Âpreliminary anti-dumping duties on $2.6bn worth of Chinese pipe imports.

The commerce department’s decision to impose duties of up to 99 per cent on imports of some steel pipes is the latest in a string of trade spats between over tyres, cars and chickens. It comes less than a fortnight before President Barack Obama’s first visit to China.

The ruling will affect more imports by value than Mr Obama’s recent move to impose duties on Chinese tyres, which sparked an international row in which Beijing accused the US of “rampant protectionismâ€.

The decision was a victory for steel companies, including US Steel Corporation, that petitioned for the duties in April. The United Steelworkers union said the decision was “an overdue message for thousands of American laid-off workers that trade laws are being enforcedâ€. It says nearly half the domestic industry’s workers have been laid off.

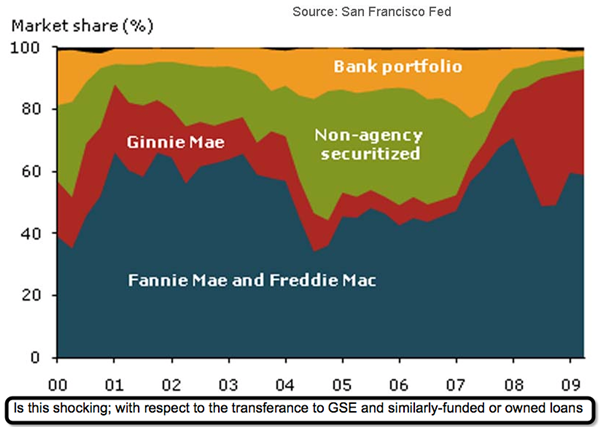

Here We Go Again……Fannie Seeks $15 Billion in U.S. Aid After Ninth Straight Loss

Posted By thestatedtruth.com on November 5, 2009

Fannie Seeks $15 Billion in U.S. Aid After Ninth Straight Loss

By Dawn Kopecki

Nov. 5 (Bloomberg) — Fannie Mae, operating under a federal conservatorship, said it will seek $15 billion in aid from the U.S. Treasury as its ninth straight quarterly loss once again drove the mortgage-finance company’s net worth below zero.

A third-quarter net loss of $18.9 billion, or $3.47 a share, pushed the company to request its fourth draw on a $200 billion lifeline from the government, Washington-based Fannie Mae said in a filing today with the Securities and Exchange Commission.

Fannie Mae, which posted $101.6 billion in losses over the previous eight quarters, has already taken $44.9 billion in federal aid since April. Its shares, which peaked at $87.81 in December 2000, closed at $1.12 today in New York Stock Exchange composite trading.

Berkshire Buys Burlington Northern In Buffett’s Biggest Deal

Posted By thestatedtruth.com on November 3, 2009

By Andrew Frye

Nov. 3 (Bloomberg) — Warren Buffett’sBerkshire Hathaway Inc. agreed to buy railroad Burlington Northern Santa Fe Corp. in what he described as an “all-in wager on the economic future of the United States.â€

The purchase, the largest ever for Berkshire, will cost the company $26 billion, or $100 a share in cash and stock, for the 77.4 percent of the railroad it doesn’t already own. Including his previous investment and debt assumption, the deal is valued at $44 billion, Omaha, Nebraska-based Berkshire said today in a statement. The railroad’s stock closed yesterday at $76.07.

Berkshire has been building a stake in the Fort Worth, Texas-based railroad since 2006 as Buffett looked for what he called an “elephantâ€-sized acquisition allowing him to deploy his company’s cash hoard, which was more than $24 billion at the end of June. Trains stand to become more competitive against trucks with fuel prices high, he has said.

“It is Warren being Warren, taking advantage of a market that is soft at a time when the possibility for competitive bids is relatively low,†said Tom Russo, a partner at Gardner Russo & Gardner, which holds Berkshire shares. “He looks at this as a business that has advantages against other forms of transportation.â€

At $100 a share, Buffett is paying 18.2 times Burlington Northern’s estimated 2010 earnings of $5.51, according to the average analyst projection in a Bloomberg survey. That compares with the 13.4 multiple for the Standard & Poor’s 500 Index as of yesterday’s close. Shares of Burlington Northern, the largest U.S. railroad, dropped 13 percent in the 12 months through yesterday.

Union Pacific, CSX

Competing railroad Union Pacific Corp.’s ratio was 13, while Jacksonville, Florida-based CSX Corp.’s was 13.1, Bloomberg data show.

Union Pacific rose $4.35, or 7.9 percent, to $59.41 at 4 p.m. in New York Stock Exchange composite trading. CSX climbed 7.3 percent. Burlington Northern surged to $97. Berkshire Class A shares rose $1,700, or 1.7 percent, to $100,450.

The deal culminates a search by Buffett, 79, that sent him to Europe looking for possible acquisitions and lamenting in letters to shareholders that he and Vice Chairman Charles Munger couldn’t find companies they considered large enough to meaningfully add to annual earnings.

Buffett needs “elephants in order for us to use Berkshire’s flood of incoming cash,†he said in his annual letter to shareholders in 2007. “Charlie and I must therefore ignore the pursuit of mice and focus our acquisition efforts on much bigger game.â€

Trains, Trucks

Burlington Northern, with pretax income of $3.37 billion on revenue of $18 billion last year, would be Berkshire’s second- largest operating unit by sales. The McLane unit, which delivers food to grocery stores and restaurants by truck, earned $276 million on revenue of $29.9 billion in 2008.

Berkshire’s largest business is insurance, with units including auto specialist Geico Corp. Buffett, who is the company’s chairman and chief executive officer, has said he likes insurance because he gets to invest the premiums paid by customers until the cash is needed to pay claims. The insurance businesses last year collectively earned $7.51 billion on revenue of $30.3 billion.

Buffett will use $16 billion in cash for the deal, half of which is being borrowed from banks and will be paid back in three annual installments, he told the CNBC. Berkshire will have more than $20 billion in consolidated cash after the purchase, he said.

Cash Hoard

“It doesn’t mean we’re out of business, but it does mean that we won’t be making any huge deals for a while,†Buffett told the network today. He said earlier this year the company needs at least $10 billion in cash to be ready for unforeseen events such as catastrophe claims at its insurance units.

Berkshire would get $264 million from Burlington Northern if the railroad’s board accepts a higher bid, according to a regulatory filing today.

Buffett built Berkshire into a $150 billion company buying firms that he deems to have durable competitive advantages. His largest purchases include the 1998 deal for General Reinsurance Corp. for more than $17 billion. Buffett expanded into power production with the purchase of MidAmerican Energy Holdings Co., and last year bought Marmon Holdings Inc., the collection of more than 100 businesses, from the Pritzker family. Marmon’s Union Tank Car unit manufactures and leases railroad cars.

He expects the economy to recover, he said in an interview in September with his company’s Business Wire unit.

“We are still tossing out 14 trillion worth of product a year,†he said. “It will return. It’s already returned with most people in most ways, but it’s not back 100 percent. It’ll get there.â€

‘Simple Bet’

The U.S. economy returned to growth in the third quarter after a yearlong contraction as government incentives spurred consumers to spend more on homes and cars. The world’s largest economy expanded at a 3.5 percent pace from July through September, Commerce Department figures showed last week.

“It’s a pretty simple bet,†said Mario Gabelli, CEO of Gamco Investors Inc., which has holdings in Berkshire and Burlington Northern. “Warren knows the assets. He’s been involved in basic businesses like this for years.â€

Buffett is increasing his stake in an industry that doesn’t have any competitors for certain types of freight. Federal law requires some chemicals to be moved only by rail.

Railroads burn less diesel fuel than trucks for each ton of cargo carried, giving companies such as Burlington Northern and Omaha-based Union Pacific a grip on bulk commodities such as coal. That fuel-efficiency advantage also gives railroads a share of the profits from moving goods such as Asian imports of cars and other consumer goods sent to U.S. West Coast ports.

Fuel Prices

From ships, containers are loaded onto railcars to be hauled to so-called intermodal terminals, where they’re transferred to trucks for the final leg of their journey.

Buffett said in 2007 that railroads may prosper at the expense of trucks. “As oil prices go up, higher diesel fuel raises costs for rails, but it raises costs for its competitors, truckers, roughly by a factor of four,†Buffett told shareholders in 2007 at his company’s annual meeting. “There could be a lot more business there than there was in the past.â€

Berkshire’s board approved a 50-to-1 split of its Class B shares as part of the acquisition plan, the company said in a second statement. Berkshire will schedule a shareholder meeting to vote on an amendment to the company’s certificate of incorporation that’s needed to split the stock. B share typically trade for about a thirtieth of the price of A shares.

Stock Split

Most of the shares exchanged for Burlington Northern stock will be Class A shares, Berkshire said. Splitting the B shares is designed to accommodate the smallest holders who elect for a tax-free swap of the railroad’s stock, it said.

Goldman Sachs Group Inc., Evercore Partners Inc., and Cravath Swaine & Moore LLP are advising Burlington. Berkshire didn’t disclose a financial adviser and said Munger Tolles & Olson LLP furnished legal advice.

Matthew Rose, the chief executive officer of Burlington Northern, said he struck the deal with Buffett after the two met in Texas. Buffett, named by Forbes as the second-richest American, was visiting because he has other business interests in the state, Rose said.

“We spent a couple hours talking about the economy and the business,†Rose told Bloomberg Television. “The next day I got a call. He asked me to meet on a Friday night down in downtown Fort Worth. It was a relatively short conversation; he told me what he wanted to do. The next day we fired up the process.â€

Antitrust Review

Burlington Northern operates 32,000 miles of track, with 6,700 locomotives, according to its Web site. Most of the carrier’s network is west of the Mississippi, where it competes with Union Pacific.

The U.S. Department of Justice will conduct an antitrust review, which Burlington expects to be completed by the first quarter of next year, the company said today in a conference call with analysts and investors.

Burlington Northern said two-thirds of the shares that aren’t held by Berkshire must vote in favor of the transaction for it to proceed under Delaware law. The railroad said it anticipates a shareholder meeting in the first quarter of 2010 and the completion of the transaction “very shortly thereafter.â€

More at…..http://www.bloomberg.com/apps/news?pid=20601087&sid=aonNZzzcmEOY&pos=2

Gene Inger Gives Us His Opinions On Where Things Stand

Posted By thestatedtruth.com on November 2, 2009

******************************************************************************

Requisite disclaimer: Trading in securities of any type may not be suitable for all individuals. Futures or options entail risk and volatility, versus investments. In our view, futures or options aren’t investments, but speculations. Decisions are the sole responsibility, discretion and at risk of any trader. Our discussions, or guidelines, in stocks & futures, are structural for purpose of giving shape and flow to our analysis. Patterns should be considered as guidelines only; to compliment your own good judgment, or that of your financial advisor. Market and/or economic forecasts are intended to be of a general nature, and should not be taken directly as a recommendation to buy or sell referenced securities, debt instruments, or futures contracts. To consider doing so; consult your own broker or professional to determine suitability. No commentary is to be considered an offer to buy or sell securities. While we may own securities discussed, it’s our policy not to cloud our judgment (right or wrong) in-event we hold a position. We normally disclose holding a position.

More at www.ingerletter.com

Isn’t The Horse Already Out Of The Barn……Fed Summons CEOs of 28 Top U.S. Banks to Meet With Supervisors On Compensation Issues

Posted By thestatedtruth.com on November 1, 2009

By Craig Torres and Ian Katz

Oct. 31 (Bloomberg) — The chief executive officers of 28 of the largest U.S. banks have been summoned to meet with supervisors at Federal Reserve banks to discuss new rules on compensation, said a person familiar with the matter.

The Fed this month said it will review the largest banks to ensure compensation doesn’t create incentives for the kinds of risky investments that brought the global financial system to the edge of collapse, prompting bailouts of firms including Bank of America Corp. and Citigroup Inc.

By summoning bank chiefs, the Fed is sending a message that it wants the pay reviews taken seriously, said Kevin Petrasic, an attorney at Washington law firm Paul Hastings and a former special counsel at the Office of Thrift Supervision.

“It starts with the CEO,†Petrasic said. “It is not subtle at all to tell the most highly compensated people in the organization, ‘Okay we are starting with you.’â€

Chief executives at the Nov. 2 meetings will be briefed on so-called horizontal reviews used by regulators to compare banks and identify those where pay practices differ significantly from the norm, the person said. Among the topics to be covered will be how banks will share information with supervisors.

In May, the Fed conducted so-called stress tests of the 19 largest financial firms, including Wells Fargo & Co., Morgan Stanley, Capital One Financial Corp. and MetLife Inc. to ensure their capital was adequate to withstand a more severe economic downturn. This time, the Fed isn’t naming the banks and the compensation review will be kept confidential.

Sharing Information

Fed Governor Daniel Tarullo is leading an overhaul of the central bank’s supervision and is making greater use of firm-by- firm comparisons and the Fed Board’s research economists to help supervisors identify risks. Tarullo, who is President Barack Obama’s first appointment to the Fed, will give a speech on compensation in Washington Nov. 2.

The central bank’s action parallels efforts by U.S. lawmakers, the Obama administration and world leaders to overhaul incentives usually set by corporate boards and reduce threats to the financial system. Banks worldwide have taken more than $1.6 trillion in credit losses and writedowns since the financial crisis began around August 2007, according to data compiled by Bloomberg.

Risky Behavior

“The government wants to fan out the basic principles of reducing risky behavior and compensation design that supports that, such as stock payments over cash, clawbacks, pay tied to long-term performance,†said David Schmidt, a senior consultant for New York-based compensation firm James F. Reda & Associates.

While the Fed’s proposed guidelines will apply to banks it supervises across the nation, the largest firms will have to describe plans to bring their practices into alignment. The central bank may take enforcement action against banks where compensation or risk-management practices threaten “safety and soundness†and no prompt measures are taken to address them, according to Fed’s proposed guidance.

“It’s possible that the Fed will be putting pressure on pay levels in this review,†said David Wise, senior consultant at the Hay Group in New York, a management consulting firm.

In their proposed guidance and in talks Fed officials have insisted that large pay packages will be viewed in light of the risks they generate.

Delayed Bonuses

Banks could make compensation more sensitive to risk, the Fed said in its proposed guidelines, by delaying the payout of a bonus. They could also extend from one year to two the period covered by performance measures and adjust bonus payments for any actual losses that become clear during the deferral period, also called a “clawback.â€

Employees who expose a firm to large amounts of risk might receive smaller bonuses than those whose activities are less risky, even if both types generate the same revenue or profit, the Fed said.

Compensation practices at the thousands of smaller banks will be reviewed in the normal course of their risk management examinations. In 2008, the Fed supervised 5,757 bank holding companies as well as 862 state-chartered banks.

The Fed’s reviews come as a revival in stock and commodity markets have boosted trading profits at the biggest banks. The Standard and Poor’s 500 Index has jumped 53 percent since March 9.

Goldman Sachs Group Inc. set aside $16.7 billion for compensation and benefits in the first nine months of 2009, up 46 percent from a year earlier and enough to pay each worker $527,192 for the period.

Almost three in five traders, analysts and fund managers believe their 2009 bonuses will either increase or won’t change, according to a quarterly poll of Bloomberg customers in six continents conducted Oct. 23-27.

More…..http://www.bloomberg.com/apps/news?pid=20601109&sid=a4F2nP9DxqKk&pos=11

Ok….. Now We’ll See if The Stimulus Works Longer Term, If It Does, Things Should Start Rolling Soon In The United States!

Posted By thestatedtruth.com on November 1, 2009

By Bloomberg News

Nov. 2 (Bloomberg) — Chinese manufacturing data for October showed the nation’s economic recovery is strengthening, giving policy makers more room to pare stimulus measures in coming months.

The Purchasing Managers’ Index rose to a seasonally adjusted 55.2, the highest level in 18 months, the Federation of Logistics and Purchasing said yesterday in an e-mailed statement.

Premier Wen Jiabao’s stimulus package and an unprecedented $1.27 trillion in new loans in the first nine months of this year are sustaining China’s rebound after overseas shipments slumped because of the global financial crisis. In the latest data, an index of export orders climbed to 54.5, the highest since April last year, suggesting global demand is recovering.

“External demand will provide an additional source of support for growth in the months ahead,†said Brian Jackson, Hong Kong-based strategist for emerging markets at Royal Bank of Canada. “This should provide scope for Beijing to start tightening policy from early 2010 while still keeping growth at relatively high levels.â€

Jackson said the key one-year lending rate may climb to 6.39 percent from 5.31 percent by the end of next year. The yuan may rise to 6.5 per dollar after staying close to 6.83 for the past 15 months.

UBS AG says the government may tighten by imposing a lending target of about 7 trillion yuan ($1 trillion) for 2010.

Faster Economic Growth

The world’s third-biggest economy may grow 9.5 percent from a year earlier this quarter, Zhang Liqun, of the State Council Development and Research Center, said in the statement. That would be the third straight acceleration and the biggest gain since the second quarter of 2008.

China’s cabinet pledged Oct. 21 to continue monetary and fiscal stimulus even after growth exceeded officials’ expectations for the first nine months of the year. Commerce Minister Chen Deming warned Oct. 31 that the global economy may “plunge†if nations withdraw support measures too quickly.

The latest PMI number was higher than the median estimate of 54.7 in a Bloomberg News survey of 10 economists. A reading above 50 indicates an expansion. Yesterday’s figure compares with a record-low 38.8 in November last year, when recessions in the U.S., Europe and Japan sent export orders plunging.

A jump in the import index to 52.8 from 50.7 “shows an acceleration of domestic demand,†Zhang said.

An output index rose to 59.3 in October from 58 in September and a measure of new orders climbed to 58.5 from 56.8. An index of employment dropped to 52.4 from 53.2.

Auto Sales

Surging auto sales, driven by tax cuts and subsidies, are boosting manufacturing. Passenger-car purchases exceeded 1 million for the first time in September as General Motors Co., the largest overseas automaker in China, reported that sales doubled.

China will sustain its economic rebound this quarter and growth is likely to top the government’s 8 percent target for 2009, the central bank said Oct. 30.

Policy makers need to “manage inflation expectations,†curb excess capacity and encourage sustainable lending growth, the central bank said in its report on the third-quarter economy.

Billionaire investor George Soros said Oct. 30 in Budapest that China will be the “greatest winner†from the global financial crisis, with the U.S. losing the most. Nobel Prize- winning economist Joseph Stiglitz said Oct. 31 that emerging economies including China need to guard against “bubbles†caused by surging liquidity as governments around the world stimulate growth.

The manufacturing index, released by the logistics federation and the Beijing-based National Bureau of Statistics, is based on replies to questionnaires sent to purchasing executives at more than 730 companies in 20 industries. It was instituted in January 2005.

More at  http://www.bloomberg.com/apps/news?pid=20601087&sid=a_ThP1U.43VI&pos=3

Sounds Good, But Do Any Of Us Need More Debt At This Time? Geithner Urges Banks to Resume Lending

Posted By thestatedtruth.com on November 1, 2009

By Alison Fitzgerald

Nov. 1 (Bloomberg) — U.S. Treasury Secretary Timothy Geithner said the country’s economic recovery and job creation hinge on banks taking more risk and restoring the flow of credit to businesses.

“The big risk we face now is that banks are going to overcorrect and not take enough risk,†Geithner said in an interview today on NBC’s “Meet the Press†program. “We need them to take a chance again on the American economy. That’s going to be important to recovery.â€

Geithner judged the banking system to be “dramatically more stable†than it’s been in more than a year. U.S. banks have been reluctant to lend as the economy emerges from a recession and unemployment approaches 10 percent.

Loans by the biggest banks receiving the most government assistance from the $700 billion Troubled Asset Relief Program fell by 17 percent in August to $234.7 billion, the third time in six months that lending declined.

Bank of America Corp.’s total loan originations fell 22 percent to $57.1 billion in August from a month earlier, according to an Oct. 15 report from the Treasury. Lending by Wells Fargo & Co. fell 18 percent to $55 billion for the month, and JPMorgan Chase & Co.’s loan originations dropped 5 percent to $43.8 billion, the report showed.

Household and business borrowing have plummeted in the last year. Consumer credit fell in the second quarter by 6.5 percent, according to the Federal Reserve’s flow of funds report. Non- financial business debt fell at a 1.75 percent annual rate.

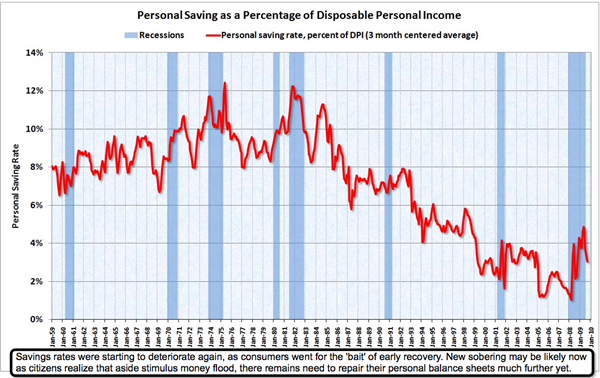

U.S. Savings Rate

U.S. households are saving more, which Geithner said is a logical response to the economic crisis.

Geithner said he expects the recovery to be “a little choppy.â€

The U.S. economy expanded in the third quarter for the first time in a year, the Commerce Department said last week. Gross domestic product grew at a 3.5 percent pace from July through September. Geithner declined to say whether he thinks the recession is over.

“A lot of damage was caused by this crisis. It’s going to take some time for us to grow out of this,†he said. “It could be a little choppy. It could be uneven. And it’s going to take awhile.â€

While the GDP report was a “good number,†he said a better measure of economic recovery will be job growth. The unemployment rate rose to 9.8 percent in September. Geithner said the rate is likely still rising, and he noted that most economists expect it to eclipse 10 percent.

October Jobs

A Labor Department report Nov. 6 will probably show joblessness nationwide reached 9.9 percent in October, according to a Bloomberg News survey of 61 economists. That would be the highest level since June 1983.

“This is a tough economy still for huge numbers of American businesses,†he said. “The real test will be when we have unemployment come down.â€

The Treasury secretary said it’s not yet time to announce steps to cut the U.S. deficit, which has shot up to a record $1.4 trillion in the last year, triple the previous year, after the U.S. Congress committed billions to bailing out banks and President Barack Obama and lawmakers committed $787 billion to an economic stimulus package.

Geithner said it’s “not yet†time to discuss whether another economic stimulus package should be considered, because only about half of the first one has been spent.

More at    http://www.bloomberg.com/apps/news?pid=20601087&sid=aBG6IqPjtD1k&pos=5

Commercial Lender CIT Group Seeks Bankruptcy Protection After Bailout

Posted By thestatedtruth.com on November 1, 2009

By Tiffany Kary, Dawn McCarty and Lester Pimentel

Nov. 1 (Bloomberg) — CIT Group Inc., a 101-year-old commercial lender, filed for bankruptcy with financing from investor Carl Icahn after the credit crunch dried up its funding and a U.S. bailout failed.

New York-based CIT listed $71 billion in assets and $65 billion in debt, according to the filing. The company filed in the U.S. Bankruptcy Court for the Southern District of New York.

CIT has $1 billion from Icahn to fund operations while it reorganizes. The credit line, to be drawn on until Dec. 31, would be a so-called debtor-in-possession loan if the company enters bankruptcy, CIT said in a statement Oct. 30.

The company had asked bondholders to exchange $30 billion in debt for new securities and equity. Icahn made a competing offer. After CIT’s offer expired at midnight on Oct. 29, the company said it was tallying 150,000 ballots.

CIT said it would try to emerge from bankruptcy two months from the date of its filing.

Under the plan, the lender said it expects to cut total debt by about $10 billion, reduce its liquidity needs over the next three years and boost its capital ratios.

More at    http://www.bloomberg.com/apps/news?pid=20601087&sid=aGR8yTH2eLwY&pos=1

White House Using Unrealistic Assumptions For Annual Budget Deficits……..

Posted By thestatedtruth.com on October 31, 2009

“Inflation is a monetary phenomenon, as Milton Friedman said. But hyperinflation is always and everywhere a political phenomenon, in the sense that it cannot occur without a fundamental malfunction of a country’s political economy.”

Look at the chart below. Using realistic assumptions, It suggests that the annual US government fiscal deficit will approach $2 trillion in 2019. How can we come up with what looks to be about $15 trillion over the next ten years? The Argentinian answer was to print the money.

In the US, the short answer is that unless the US consumers become a massive saving machine, to the tune of 8% or more of GDP and rising each year, and willingly put their savings into US government debt, it’s not going to happen. So sometime in the coming years, interest rates are likely to start to rise in order to compensate bond investors for what they perceive as risk. That will bring us to some very difficult and painful choices.

More at John Mauldin’s    www.frontlinethoughts.com

Flying Pigs…..Banks Get New Rules on Property

Posted By thestatedtruth.com on October 31, 2009

Banks Get New Rules on Property

Â

Federal bank regulators issued guidelines allowing banks to keep loans on their books as “performing” even if the value of the underlying properties have fallen below the loan amount.

The volume of troubled commercial real-estate loans is skyrocketing. Regulators said that the rules were designed to encourage banks to restructure problem commercial mortgages with borrowers rather than foreclose on them. But the move has prompted criticism that regulators are simply prolonging the financial crisis by not forcing borrowers and lenders to confront, rather than delay, inevitable problems.

The guidelines, released on Friday by agencies including the Federal Deposit Insurance Corp., the Federal Reserve and the Office of the Comptroller of the Currency, provide guidance for bank examiners and financial institutions working with commercial property owners who are “experiencing diminished operating cash flows, depreciated collateral values, or prolonged delays in selling or renting commercial properties.” Restructurings are often in the best interest of both lenders and borrowers, the guidelines point out.

The new rules don’t reverse existing rules. Rather they are more explicit than regulators have been in the past about how banks should deal with restructuring issues. Banks in recent months have been peppering agencies with questions about this as the number of problem loans has soared.

Regulators have been expressing increasing concern that problems in commercial real estate could unglue the nascent economic recovery by slamming financial institutions with billions of dollars in new losses. FDIC Chairman Sheila Bair told a Senate subcommittee earlier this month that reworking the terms of these loans could help banks avoid larger losses. She likened it to the push regulators made last year for banks to rework troubled residential mortgages.

About $770 billion of the $1.4 trillion commercial mortgages that will mature in the next five years are currently underwater, according to Foresight Analytics. As of last week, 106 banks had failed this year, the most since 1992?the peak of the savings-and-loan crisis. Regional and community banks especially have been paying dearly for their aggressive push into commercial real-estate lending during the boom years.

The new guidelines are targeted primarily at the hundreds of billions of dollars worth of loans that are coming due that can’t be refinanced largely because the value of the properties have fallen below the loan amount. In many of these situations, the properties are still generating enough income to pay debt service.

Banks have generally been keeping a lid on commercial real-estate losses by extending these mortgages upon maturity. However, that practice, billed by many industry observers as “extending and pretending,” has come under criticism by some analysts and investors as it promises to put off the pains into the future.

Now federal regulators are essentially sanctioning the practice as long as banks restructure loans prudently. The federal guidelines note that banks that conduct “prudent” loan workouts after looking at the borrower’s financial condition “will not be subject to criticism (by regulators) for engaging in these efforts.” In addition, loans to creditworthy borrowers that have been restructured and are current won’t be reclassified as “high risk” by regulators solely because the collateral backing them has declined to an amount less than the loan balance, the new guidelines state.

Critics say the new rules are yet another example of a head-in-the-sand approach by regulators, pointing to the relaxed accounting standards last year that enabled banks to avoid marking the value of the loans down. This is doing long-term damage to the economy, they say, because it ties up bank capital, preventing them from resuming lending.

Critics say a wiser approach would be for regulators and banks to deal with problems quickly like the Resolution Trust Corp. did in the early 1990s during the last commercial real-estate crash. Back then, the RTC helped purge the financial system of toxic mortgages.

The new guidance “gives people a long time to figure out they’re not going to pay it back,” said Douglas Durst, a leading New York City developer. “We are in a period where nothing is happening,” he said, adding that banks are “not making any new loans because they have this bad debt on their books and not writing it down and getting rid of it.”

Peter Grant and Damian Paletta contributed to this article

GMAC (The Car Financing Arm) Needs Another Government Injection (Its 3rd) Of $2.8 To $5.6 Billion

Posted By thestatedtruth.com on October 27, 2009

The U.S. government is likely to inject $2.8 billion to $5.6 billion of capital into the Detroit company, on top of the $12.5 billion that GMAC has received since December 2008, these people said. The latest infusion would come in the form of preferred stock. The government’s 34% stake in the company could increase if existing shares eventually are converted into common equity.

The willingness by Treasury officials to deepen taxpayer exposure to GMAC reflects the troubled company’s importance to the revival of the auto industry. Founded in 1919, GMAC has $181 billion in assets and is a major financing provider on car purchases from General Motors Co. and Chrysler LLC. The new capital would help firm up GMAC’s balance sheet and solidify its auto-loan business.

![[Helping Hand]](http://s.wsj.net/public/resources/images/P1-AS238_GMAC_f_NS_20091027184903.gif)

Federal officials also are moving to shore up GMAC’s ability to fund its daily operations, with the Federal Deposit Insurance Corp. telling the company Tuesday the agency will guarantee an additional $2.9 billion in debt, according to people familiar with the discussions. The FDIC guarantee will make it easier for the company to sell debt to investors. The FDIC backed $4.5 billion in GMAC-issued debt earlier this year.

The FDIC approval came just four days before the expiration of the regulator’s program that guarantees debt issued by certain banks. It ended months of tense negotiations between GMAC and regulators. Without a deal, the company would have been forced to further reduce its lending volume. New-car loans by the company tumbled 55% to $5.6 billion in the second quarter from a year earlier.

As part of the agreement, GMAC agreed to keep interest rates on deposit accounts offered through its banking unit at certain levels, according to people familiar with the situation.

While GMAC is the only U.S. company to get three capital injections from the government since the financial crisis erupted two years ago, thousands of banks and other financial firms remain weakened by their exposure to fallen real-estate values and clobbered financial markets.

Among U.S. banks that got a total of $204.64 billion in aid through the Troubled Asset Relief Program, just one-third of the capital has been repaid so far. Government officials are skeptical that some banks now wanting to escape the government’s grip are strong enough to do so, with Bank of America Corp.’s attempt to repay federal bailout funds snagged by a disagreement over how much additional capital the bank must raise to satisfy regulators, people familiar with the situation said.

At GMAC, the likelihood of a third infusion increased when the government’s stress-test results were released in May. The test concluded GMAC needed $11.5 billion in common equity to continue lending in a stressed economy.

Here Comes The Second Wave Of Mortgage Problems

Posted By thestatedtruth.com on October 26, 2009

Â

|

Subprime resets crushed the housing market in ’07 and ’08. Now a new wave of adjustable-rate mortgages is just around the corner.

“These helped frame where we are in the mortgage crisis,â€Â “which has been the main shark in the water over the past couple of years. You should know where that shark is and whether or not it is hungry…

“Clearly, it is not yet safe to get back in the water: Years 2010 and 2011 face big resets in so-called Alt-A and Option ARM loans. What this means is more write-downs and more losses for banks and others who hold these mortgages.

The Value Of Debt Relief

Posted By thestatedtruth.com on October 25, 2009

Debts have value only to the extent that they are being paid, and a rapidly rising number of U.S. households aren’t doing so. Those defaults are leading to losses at banks, a wave of foreclosures, trouble for neighborhoods and strife for families. But they are also providing an immediate, albeit radical, form of debt relief.

“It’s not ideal, because it carries other costs,” said Karen Dynan, a consumer-finance specialist at the liberal Brookings Institution think tank who recently served as a senior adviser to the Federal Reserve. But it is “going to help get household balance sheets back to the right place.”

![[Debt Relief chart]](http://s.wsj.net/public/resources/images/NA-BB455_OUTLOO_NS_20091025191244.gif)

If one accounts for defaults, U.S. households’ debt burden is shrinking a lot faster than the official data suggest. First American CoreLogic, which tracks the performance of mortgage loans, estimates that some 9.3% of the nation’s 52.4 million mortgage holders were 60 or more days behind on their payments as of July. That represents relief on about $1.2 trillion in loans. The official data miss most of that, because the Fed doesn’t erase debts until banks have foreclosed, sold the homes and taken the loans off their books, a process that can drag out for more than a year.

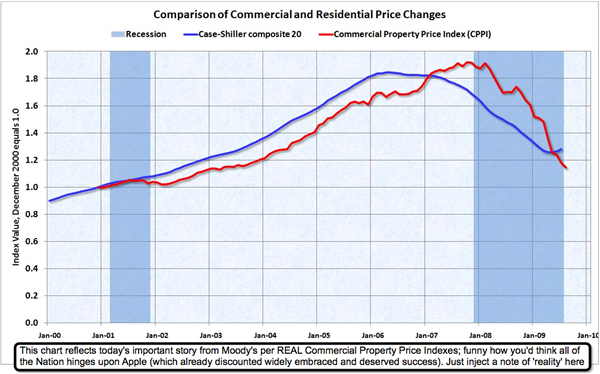

Commercial Real Estate Bust Looms Dead Ahead

Posted By thestatedtruth.com on October 23, 2009

Commercial Real Estate Bust Looms

That big whoosh you’re hearing is the air rushing out of a commercial real estate bubble.

More than two years into the worst housing crisis in decades, commercial real estate is shaping up as the second half of what some are calling a “double bubble. Owners of shopping malls, hotels, office space and apartment buildings and the bankers who financed them face a major crunch over the next two years as the mortgages on those properties start coming due.

Much like homeowners who now owe more on their mortgage than their house is worth, many commercial property owners have seen the value of their properties plummet, increasing the risk of default on hundreds of billions in commercial real estate loans.

That is expected to put more stress on thousands of banks that have already been deemed not too big to fail.

“I have never seen anything this bad, said Dan Tishman, CEO of Tishman Construction, one of the nation’s leading construction and management firms, comparing the current slide to major commercial real estate busts in the 1980s and ’90s.

Even as economists and federal officials point to recent signs that the recession may be ending, there’s widespread concern that commercial real estate could pose a threat to the recovery. Federal Reserve Chairman Ben Bernanke told members of the House Financial Services Committee this month that “commercial real estate remains a very serious problem.”

Though the market is only about a third the size of the $22 trillion residential market, in some ways the problem for commercial real estate is more severe. Unlike home mortgages that run for 15 or 30 years, much of the roughly $1.6 trillion in commercial real estate loans outstanding involves much shorter terms of three to seven years. Many of the loans were written at the height of the boom.

“There was this unbelievable bout of lending that occurred all on a very short term, said Tishman. “With short maturities you’ve squeezed the accordion as close as you can get and caused a lot more refinancing in a short period of time.

Commercial real estate became hugely popular with bankers during the boom. In 2006, commercial real estate made up 56 percent of U.S. banks’ loan portfolios up from 40 percent a decade earlier, according to FDIC data. For smaller banks with assets under $1 billion the concentration is even higher. Some 74 percent of all loans held by smaller banks are secured by commercial real estate. These roughly 6,500 banks represent some 90 percent of all U.S. banks.

The risk for consumers is that heavy losses on commercial real estate could force banks to tighten lending for home mortgages, car loans and credit cards even further. It also could force bankers to try to offset commercial loan losses by accelerating sales of foreclosed homes, which could put further pressure on home prices.

For commercial real estate owners, the problem starts with the impact of the recession on their properties. Massive layoffs have left office buildings with unrented space. The slowdown in consumer spending is hitting owners of malls and retail space where foot traffic has dried up. Hotel owners have been hurt by the slowdown in travel and tourism.

On top of lost rent, commercial real estate owners who bought properties at the height of the boom have suffered the same fate as homeowners and suffered plunging values. From the peak in mid-2007, commercial property values are down by some 35 percent, according to Moody’s.

As commercial real estate loans come due, property owners face the same dilemma as many homeowners. If they sell the property, they’ll take a big loss. But to refinance, they’ll have to come up with a lot of cash to make up for the value lost since they took out the loan.

Most lenders are not especially interested in foreclosing because they’ll lose money selling into a distressed commercial real estate market. That’s prompted lenders to undertake a strategy of what industry insiders are calling pretend and extend.”

As long as the commercial property owner is making payments, bankers are willing to delay refinancing for a few years in hopes that the economy and real estate market improve. But it remains to be seen whether that strategy will work.

‘I don’t think the banks can hold out that long, said Lesley Deutch, who follows the commercial real estate market for John Burns Real Estate Consulting. There was a lot underwritten during (the boom); there’s just too much to refinance, and the values have gone down too significantly.”

A lot depends on how well the economy recovers in the next several years. If companies begin hiring again, empty space in office buildings will begin to fill up, shuttered stores in malls will reopen and hotel owners will see occupancy rates rise. But even if that happens, it’s not clear how long it will be before these properties regain their lost value.

“So many of those assets were acquired at top dollar, said Susan Smith, director of the real estate group at Pricewaterhouse Coopers. When you add on top of that the significant amount of debt that was used to acquire many of these real estate properties, I think you are looking at a much more troublesome problem down the road with commercial defaults than residential if something doesn’t happen to facilitate refinancing.

Some commercial property owners won’t have a patient banker to talk to when it comes time to try to postpone their refinancing. That’s because about a third of commercial loans are held by investors who bought commercial mortgage-backed securities, or bonds backed by the interest payments on those loans.

Because each loan is held by dozens of investors, there is no mechanism for negotiating an extension, even if there were new investors to buy fresh mortgage bonds. Tishman estimates that some $200 billion of these bonds will need to be refinanced in the next year, or about four times the annual volume during the lending boom.

“The reason that everyone is projecting the pain yet to come in commercial real estate is because the bulk of this debt that was done at high valuation, and high leverage has yet to mature, said Michael Pollock, general counsel of The Ashforth Co., which owns, develops and invests in commercial real estate. We’re really just seeing the tip of the iceberg.”

Though there’s widespread agreement that a financial crunch is looming, some think the commercial real estate market may escape the kind of collapse in residential housing that brought down the U.S. economy. For one thing, the market is smaller.

Bankers also have time to prepare for the crunch over the next few years. Tishman says he hopes federal regulators and legislators will be more proactive this time in heading off the problem.

“Washington is no longer in the position to just float every industry there is, he said. But when they see an industry that’s in need, they are going to do something about it before they will let it take the general economy down like the housing market and Lehman did.

URL: http://www.msnbc.msn.com/id/33404369/ns/business-personal_finance/

It’s Not Question Of If, But Only A Question Of When!

Posted By thestatedtruth.com on October 20, 2009

Oct. 20, 2009, 12:25 p.m. EDT

Hedge Manager Sprott Sees Trouble

Â

US government is new “dead man walking”

By Alistair Barr, MarketWatch

NEW YORK (MarketWatch) – When so-called quantitative easing by central banks ends, the world economy may slip back into trouble, Canadian hedge fund manager Eric Sprott warned on Tuesday.

Toronto-based Sprott called Citigroup, Fannie Mae, Freddie Mac, and General Motors “dead men walking” in late 2007. On Tuesday, he said the U.S. government is the new dead man walking, partly because it may struggle to keep borrowing enough money if the Federal Reserve stops buying Treasury bonds.

Sprott’s Canadian hedge fund, Sprott Hedge Fund LP, is up more than 400% since inception in 2000 as it rode a surge in gold prices and shares of gold miners and other raw materials companies.

Bank bailouts and other dramatic efforts by central banks have stopped the world “going into the abyss,” Sprott said during a presentation at the Value Investing Congress in New York.

The “granddaddy” of all those bailout efforts is quantitative easing, in which central banks in the U.S. and the U.K. especially buy government bonds to keep interest rates low, Sprott said.

The U.S. government has raised roughly 200% more by selling bonds this year, versus last year, Sprott noted. Through the end of the second quarter of 2009, he said the only major buyers of these government bonds were central banks.

“When quantitative easing ends, what’s going to happen?” he added, noting that there are already two clues to answer that question.

When the U.S. government’s cash-for-clunkers program ended, car sales slumped. Meanwhile, as the end of the government’s first-time homebuyer incentive approaches, recent data suggest weakness building again in the housing market, Sprott said.

Roughly 35% of all homes bought in the U.S. recently were purchased through the incentive program. If it is not extended, December home sales could slump 25%, Sprott estimated.

Sprott remains concerned about banks and other financial institutions in the U.S., because he thinks they remain too leveraged.

Banks leveraged roughly 20 to 1, have about 5% of equity supporting mostly paper assets. If those assets fall by more than 5%, the institutions are effectively bankrupt, Sprott said.

“The fundamental problem today is that the appropriate leverage ratio is certainly not 20 to 1,” Sprott said, citing some of the bank failures this year in the U.S.

To be seized by the Federal Deposit Insurance Corp., these banks have already lost their 5% equity cushion. But some of the largest bank failures this year, including Colonial Bank, Guaranty Financial, and Corus, involved write-downs of between 11% and 25%, Sprott noted. Â

More….http://www.marketwatch.com/story/hedge-manager-sprott-sees-trouble-when-easing-ends-2009-10-20

Einhorn Bets On Major Currency ‘Death Spiral”

Posted By thestatedtruth.com on October 19, 2009

Oct. 19, 2009, 2:39 p.m. EDT

NEW YORK (MarketWatch) — Greenlight Capital is betting on the possibility of a major currency collapse and a surge in interest rates, the hedge-fund firm’s manager David Einhorn said Monday, citing ballooning government deficits in some of the world’s most developed countries.

Einhorn, who warned about Lehman Brothers’ frailty before it collapsed last year, also said financial institutions that are deemed as “too big to fail,” such as Citigroup Inc. , should be broken up.

Greenlight has been buying physical gold this year because Einhorn is concerned that efforts to save the financial system and fuel economic recovery are undermining the value of such currencies as the U.S. dollar.

On Monday, he said Greenlight has added new trades to this investment theme, buying long-dated options on much higher interest rates in Japan and other developed regions — effectively giving the firm the chance to make big profits from a jump in rates. The options, bought from major banks, are tied to interest rates four to five years out, Einhorn noted.

“Japan may already be past the point of no return,” he said during a presentation at the Value Investing Congress in New York.

Japan’s debt is equal to 190% of the country’s gross domestic product and its government deficit will be 10% of GDP this year, according to Einhorn.

Japan has been able to borrow money at roughly 2% a year to finance these deficits, partly because the country has many savers willing to buy low-yielding government bonds. However, some of these savers may begin spending instead as they enter retirement, Einhorn argued.

“When the market refuses to refinance at cheap rates, problems emerge,” he said, adding that this could trigger a “currency death spiral.”

Interest rates have been very stable in Japan for years, so the options on higher rates that Greenlight bought were relatively cheap. Einhorn said the “asymmetry” of that trade was interesting: If rates were to jump suddenly in Japan, Greenlight stands to make “multiples” on its positions.

“There remains a possibility that I’m wrong, and I hope I am,” he commented. But earlier in the speech he remarked: “Just because something hasn’t happened before, that doesn’t mean it won’t.”

Remedy to shore up system

Einhorn also compared potential problems in sovereign-debt markets to the financial crisis that engulfed markets last year.

When Lehman collapsed, investors reacted by dramatically increasing the cost of borrowing for rival Wall Street firms to the point where their business models were threatened, he Einhorn. The collapse of any major currency could have same impact of rerating the cost of financing governments in deficit.

Unlike Japan, the United States isn’t past the point of no return, the fund manager stressed. However, he criticized financial-reform proposals pushed by Treasury Secretary Timothy Geithner, arguing they provide a government backstop for the largest institutions, entrenching them further.

No institution should be too big to fail, Einhorn contended. “The real solution is to break up anything that fails that test. Lehman shouldn’t have existed in any size to threaten the financial system.”

The same applies to Citigroup and Bear Stearns, which J.P. Mortgage Chase & Co. acquired, as well as American International Group Inc. and “dozens” of other firms, he said.

More….http://www.marketwatch.com/story/story/print?guid=23465BA4-9D9F-4AA0-AD7E-88E2D5FBC7E6

Is He Kidding? Ted Turner Only Worth About 1.8 Billion Now, Has To Live With Less…..Say’s “You Know, If You Economize And Don’t Buy Any New Airplanes Or Long Range Jets, You Can Get Buy On A Billion Or Two”

Posted By thestatedtruth.com on October 18, 2009

Turner Lost CNN, Fonda, Fortune, Feels ‘Like a Dummy’

By Brett Pulley and Anita Sharpe

Oct. 16 (Bloomberg) — Ted Turner, the cable television pioneer who became one of the richest Americans, recalls the pain of losing his job at Time Warner Inc., his wife, the actress Jane Fonda, and $7 billion of his fortune.

“It was like having my heart ripped out,†Turner said yesterday in an interview in New York. The founder of Turner Broadcasting System and the 24-hour cable news channel CNN, Turner said that he has “a couple billion†dollars left, including $700 million in Treasury bills.

While contemporaries such as News Corp. Chief Executive Officer and Chairman Rupert Murdoch, Liberty Media Corp.’s John Malone and Viacom Inc.’s Sumner Redstone keep competing in the media industry, Turner says that he doesn’t have enough money to get back in the business. He now focuses on nuclear disarmament, global climate change, women’s rights, and the environment.

“I’m working on the issues that are life or death for us,†said Turner, 70, who co-chairs the Nuclear Threat Initiative along with Sam Nunn, a former Democratic Senator from Georgia. “What I’m trying to do is stay relevant.â€

The CNN founder, known for provocative comments in his 40- year career, has lost none of his passion for news. He says 24- hour coverage of fighting worldwide has made war tougher for people to stomach.

“War is obsolete,†Turner said. “The last time someone surrendered was Japan and that was 60 years ago. The Afghans will never surrender. We will just get tired and come home. We’ve already given up on Iraq and there’s oil in Iraq, there’s no oil in Afghanistan.â€

Turner quit the media business three years ago when he left the board of Time Warner, based in New York. The company bought Turner’s cable channels, also including TBS, TNT and Cartoon Network, in 1996, making him its largest individual shareholder. Turner lost $7 billion when Time Warner’s stock collapsed in the wake of the 2001 merger with AOL, the Internet business it is now shedding.

Discussing the growing value of cable networks in the U.S., Turner said, “I feel like a dummy.†Mocking himself, he sings, “You let the big one get away.â€

Turner, who founded CNN in 1980, said that if he got his wish to run the network again, he would increase coverage of countries including China.

“If I had the money, I’d think seriously about getting control of Time Warner and getting CNN to focus on serious journalism,†Turner said in a separate interview from his eighth-floor office at Turner Enterprises Inc. in downtown Atlanta. “They’re doing a good job but they could do better.â€

Time Warner’s stock dropped 60 percent in three years following the AOL merger’s completion in January 2001. Turner, once ranked among the richest Americans in the Forbes 400 list, was listed at number 196 in this year’s list, with an estimated net worth of $1.8 billion.

Before Time Warner lost so much value, Turner says he had given away much of his money. His largest gift was a $1 billion pledge in 1997 to establish the United Nations Foundation. So far, $750 million of the pledge has gone to the organization, Turner said. He said he has the rest set aside.

“If you were around at the time, I gave everybody a hundred thousand dollars if they came up with anything,†Turner said. “I just couldn’t hold onto it. I wanted to keep it moving. I get a dollar, I give it to you, you spend it, somebody else gets it. You know, pass it around. You know, it’s kind of like a joint — you just pass it around, light it up, you know, share with your friends.â€

Turner’s Atlanta offices are filled with memorabilia from his years in media and sailing, including his 1977 America’s Cup victory aboard Courageous. Three swords sit on his coffee table; a photo with Warren Buffett hangs on a nearby wall.

Turner Enterprises owns about 2 million acres in 12 U.S. states and Argentina. More than 50,000 bison roam on parts of his land, according to the company. Some of those bison wind up in burgers and other dishes at Ted’s Montana Grill, a restaurant chain he co-founded in 2002.

Ted’s has more than 50 outlets, according to its Web site. One of the restaurants is on the ground floor of the Atlanta offices, where a sign out front reads, “Eat here and we both can live.â€

Turner said he bought much of his land from energy companies. They retained the rights to oil, coal or natural gas found on the property, while he is entitled to royalties.

“My land value has gone down,†Turner said. “I’m not in a position to buy anything substantial. I will still look at anything adjacent to me.â€

Turner said he has learned to live with less, yet he still bemoans the decline in his net worth.

“To drop out of that league, that was hard to do,†Turner said. “I’ve had the experience of being on top and riding the roller coaster down again, nearly to the bottom. You know, if you economize and don’t buy new airplanes or long-range jets, or that sort of thing, you can get by on a billion or two.â€

Last Updated: October 16, 2009 15:18 EDT

More……http://www.bloomberg.com/apps/news?pid=20601109&sid=afyLWnoS2WlA

U.S. Has record Budget Deficit……..

Posted By thestatedtruth.com on October 16, 2009

Geithner Says U.S. Must Instill Confidence in Fiscal Management

By Robert Schmidt

Oct. 16 (Bloomberg) — Treasury Secretary Timothy Geithner said the U.S. must reduce its record budget deficit as soon as the economy returns to a sustainable growth rate without relying on government assistance.

“Americans understand that we have to go back to living within our means as a country,†he said in an interview broadcast today on CNBC. “When we have an economy that’s growing again and we get unemployment down, we’re going to have to bring those deficits down.â€

The U.S.’s 2009 budget gap widened to $1.42 trillion as the deepest recession since the 1930s crippled tax revenue and the administration increased spending to rescue the economy. The shortfall for the 12 months ended Sept. 30 was more than triple the $455 billion record set a year earlier, the Treasury Department said today in Washington.

Geithner cautioned that a lack of confidence that the U.S. will return to fiscal sustainability may lead to a weaker economic recovery, higher interest rates and constrained investment.

More……http://www.bloomberg.com/apps/news?pid=20601087&sid=aOWY.L8unNU8

Dirty Swines…..Minnesota Pigs Tested Positive for H1N1

Posted By thestatedtruth.com on October 16, 2009

Minnesota Pigs Tested for H1N1, May Be First in U.S.

Â

By Whitney McFerron

Oct. 16 (Bloomberg) — Three pigs from the Minnesota state fair have been “tentatively identified†as having swine flu in what may be the first U.S. cases of the H1N1 virus among domestic livestock.

The pigs were tested at the fair from Aug. 26 to Sept. 1 and “have probably gone to slaughter,†Gene Hugoson, the commissioner of the Minnesota Department of Agriculture, said today on a conference call with reporters. The pigs, which did not exhibit flu symptoms at the fair, were tested as part of a university project.

“There is absolutely no food-safety risk from eating any kind of pork that has been contaminated at one time or another with H1N1,†Hugoson said. “Any pig that exhibits any type of an indication of sickness would not be accepted at slaughter.â€

The state has not traced the animals back to their owners. Final results of the tests likely will be confirmed next week, Hugoson said.

The U.S. Department of Agriculture and the World Health Organization have said the H1N1 virus is not transmitted through properly handled pork. Concern over the illness has eroded pork demand and U.S. exports of the meat, sending hog futures down 25 percent since April 23, when the outbreak started. China, once the second-largest importer of U.S. pork, has blocked shipments.

“I want to remind people that people cannot get this flu from eating pork or pork products,†USDA Secretary Tom Vilsack said in a statement. “Like people, swine routinely get sick or contract influenza viruses. We currently are testing the Minnesota samples to determine if this is 2009 pandemic H1N1 influenza.â€

An outbreak of the H1N1 virus also occurred among “multiple†children who were staying in a dormitory at the fair as part of a 4-H Club program, Joni Scheftel, the public health veterinarian at the Minnesota Department of Health, said on the call. It is “very, very unlikely†that the children were infected by the pigs, he said.

“It’s likely that the pigs were infected by a person, either a 4-H kid or one of the 1 million visitors to the fair,†Scheftel said.

Bill Hartmann, the executive director of the Minnesota Board of Animal Health, said all the producers who brought hogs to the fair are being notified that the virus was discovered.

The National Pork Producers Council, a Washington-based trade organization, said “strict safeguards†are in place to prevent contamination in U.S. meat supplies.

“All pork found in retail stores and restaurants is inspected to the rigors of USDA standards for wholesomeness, and every pig is inspected to ensure that only healthy pigs enter the food supply,†the agency said today in a statement.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aIqH2gH2o0MQ

More On Problem Mortgages…….

Posted By thestatedtruth.com on October 15, 2009

“US foreclosures jumped to an all-time high of 937,840 in the third quarter,” writes Ian Mathias in today’s issue of The 5 Min. Forecast. “That’s a 23% rise from the same time last year, says a report from RealtyTrac today. One in every 136 households received a filing – also a record. Once again Nevada takes the cake… An incredible one in every 23 households was in some form of foreclosure last quarter.

“And they tell us the economy is recovering?

“But here’s the kicker – a theme that should be no surprise to 5 Min. loyalists: This isn’t about subprime anymore. The most recent data from the Mortgage Banker’s Association claims subprime mortgages currently account for hardly a third of foreclosure starts, down from 50% last year. Prime loans – the gold standard of the mortgage biz – now take up a 58% share.

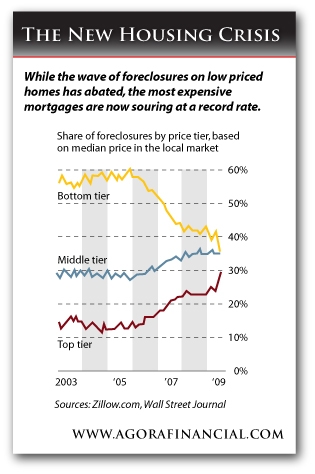

“Even the foreclosure scene in terms of home prices has been turned on its head. Check it out:

“About 35% of home foreclosures occur in the bottom third of the housing market, says zillow.com, down from 55% in 2006. In June, the most recent data available, 30% of foreclosures were in the top tier – nearly double the rate from the year before.

“And the icing on this rotten cake: Option ARMs. This pending rate reset crisis – which just about everyone ‘in the know’ saw coming in early 2008 – looks like its really going to happen. 46% of option ARMs are currently 30 days past due, despite the fact that just 12% have reset to higher payments. Resets for the rest of those ARMs are right around the corner.”

From The Daily Reckoning

Dow 10,000….That Was Then, This Is Now

Posted By thestatedtruth.com on October 15, 2009

That Was Then, This Is Now – In his terrific “Big Picture†blog, Barry Ritholtz cited a neat 1999 comparison by Peter Boockvar. Here’s the citation……

With the DJIA approaching 10,000 again, let’s reminisce about 1999, the year it first passed that magic level on March 29th. Millennium by the Backstreet Boys was the best selling album, American Beauty won the Academy Award, the Euro was established, SpongeBob SquarePants aired for the first time, Hugo Chavez was elected President of Venezuela, Karl Malone, Pudge, Chipper Jones, Jagr and Kurt Warner won MVP awards and the average price of a gallon of gasoline at the pump was about $1.20. US nominal GDP ended at $9.6b vs $14.1 as of Q2 ‘09. Also, on March 29th 1999, the DXY was at 100.36 (now 75.60), the CRB was at 192.40 (now 269.15), gold was at $280 (now $1,060), oil was $16.44 (now $74.80), corn was $2.32 (now $3.85), copper was $.62 (now $2.83), the 10 yr yield was 5.19% (now 3.38%), and the fed funds rate was at 4.75% (now 0-.25%). Oh, how time flies.