Posted By thestatedtruth.com on November 30, 2009

Is Britain On The Brink Of Financial

Â

Armageddon?

By James Palumbo

A year ago, the world reacted with astonishment as Iceland technically went bust. It seemed inconceivable that a modern democratic nation could have such parlous finances that only an emergency $6billion bail-out from the International Monetary Fund enabled its economy to keep functioning.

This week, we witnessed a similar crisis in the Middle East but on a far, far more dangerous scale, as Dubai effectively defaulted on £48billion of loans.

Unless its more prudent and oil-rich neighbour, Abu Dhabi, launches a rescue plan then Dubai – once a gilded monument to financial success – will effectively be insolvent.Â

Facing doomsday? London’s Canary Wharf. Britain has been hardest hit by the credit crunch

Which leads us to a haunting question: as the country in the world hardest hit by the credit crunch, with gross domestic product (GDP) projected to decline by almost five per cent in 2009, could Britain be next?

Let’s think the unthinkable for a moment. These are the facts.

Even before the financial crisis, the British Government spent roughly £30billion more per year than it earned in tax revenues. This money, of course, had to be borrowed from international investors.

Today, the Government needs up to £200billion a year for at least the next three years in order to meet its spending commitments. But the Government’s estimates invariably understate its true need, and they have to be continually revised upwards.

Before the crunch, total government debt stood at roughly 40 per cent of GDP. It is now around 60 per cent of GDP, but is projected to soar close to 100 per cent in the next few years. But again, that is not the full story.

Treasury estimates of the size of the national debt ignore so-called ‘off balance sheet commitments’, such as Private Finance Initiatives (effectively, hospitals and schools built with money loaned by the private sector) as well as the massive unfunded government pension liability.

There may be other, hidden, liabilities. After this week’s shocking revelation of secret loans of £62billion made by the Bank of England to the Royal Bank of Scotland and HBOS at the height of the credit crunch, who knows how many other skeletons remain in the Treasury’s closet?

It is wise to assume that the true size of Britain’s debts could be much bigger than we all think.

Yet politicians of both parties can’t acknowledge this. Why? Because any dispassionate analysis would spell only one thing – we need massive spending cuts and tax rises to avoid heading the way of Iceland and Dubai.Â

Crisis: A car abandoned by its foreign owner at a luxury development in Dubai

The news is potentially so bad that politicians simply don’t want the general public to know what’s going on.

Given the scale of the crisis, what then do they propose? New Labour is non-committal, suggesting that cuts will be prudent, thoughtful and spare people’s worst pain. The Conservatives have targeted around £7billion of spending cuts, but these won’t happen immediately and are nothing like enough to rebalance the nation’s books.

Besides, one minute the Tories are preaching ‘austerity’, warning that savage cuts are needed, the next David Cameron is telling the City that ‘our strategy has to be for growth, both now and in the long term’.

Such posturing, flip-flopping and vague promises are truly worrying. For, make no mistake, we could be teetering on the brink of a truly epic national crisis – one that makes the financial hardship of the past 18 months seem like a mere inconvenience.

For the past few years, Hollywood disaster movies have shown the world under attack by aliens or being destroyed by global warming. We have all thrilled to images of the White House being taken out by a giant laser beam or Big Ben frozen in an Ice Age snow drift.

Politicians don’t want the public

Â

to know what’s going on

A disaster movie involving countries going bust doesn’t quite have the same dramatic appeal, but it would be every bit as deadly as a tsunami hitting London – and we have precious little left to defend us.

We’ve already had one big shock to Britain’s financial system as many of our best-known banks teetered on the brink. The Treasury spent hundreds of billions of taxpayers’ pounds trying to steady the ship. The financial cupboard is now bare. So what could cause the second wave of the disaster?

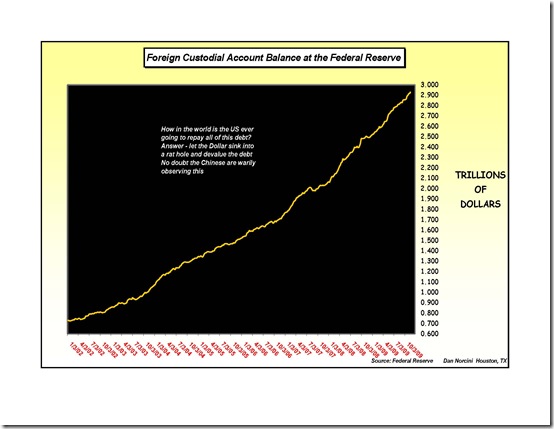

In three words – a sterling crisis. So far, containment of the crisis has focused on rescuing the banks and pumping more money into the system through the crazy Zimbabwe-esque expedient of ‘quantitative easing’Â -Â effectively flooding the banking system with more cash.

This has cost hundreds of billions of pounds, all of which needs to be repaid if we are to avoid rampant inflation. That means borrowing more money from the international money markets.

But there is a problem. Until recently it was unthinkable that a sovereign nation couldn’t service its debts. And yet this is exactly what’s just happened with Dubai.

Alistair Darling helped conceal £62bn of emergency loans to UK banks

If international lenders begin to doubt the creditworthiness of UK plc, they will downgrade our credit rating and dramatically increase the rates of interest they charge. UK banks will have to follow suit to match these rates, putting unsustainable pressure on our struggling economy.

Thousands of businesses already hit by the recession will go bust. Trapped by soaring unemployment and welfare benefits, the Government will have to borrow more. And so the vicious debt cycle will continue to spiral down towards national insolvency – and, potentially, social anarchy.

Why won’t our politicians get a grip?

The seeds of a possible future disaster were sown during the Blair years. Blair inherited a strong, stable economy which had been responsibly managed by his Conservative predecessors with acceptable levels of government debt.

He played his first term in office with textbook good sense; it was a continuation of Conservative policy to all extents and purposes, with debt kept at record lows. After that, perhaps because the Opposition was so weak, Blair and his Chancellor let rip.

The massive spending by New Labour on public services during its last two terms was a good idea in principle but a disaster in practice. This was because Blair was not a ‘details’ type of person.

As with the invasion of Iraq, he took wide-ranging decisions on economic planning based on little more than a broad vision, no doubt wishing to feel the hand of history upon his shoulder. Instead of the money being carefully managed, with every penny accounted for as with a household budget, it was sprayed about indiscriminately like a fire hose out of control.

As a result, the Conservatives accuse the Government of ‘not fixing the roof while the sun was shining’. But the problem is they didn’t suggest it at the time. Politics had became so centrist that for the Tories to suggest restraint at a time of economic prosperity would have been electoral suicide.

We are now reaping the harvest of that short-sighted conformism.

Yet even now, no one in power dares speak the truth.

Christmas is only four weeks away; people don’t want to hear bad news. Our politicians also don’t want to be the ones to deliver it (bad news equals lost votes). But unfortunately, as Dubai’s predicament now shows, we’ve got to stop thinking that it couldn’t happen to us and start having an urgent national debate if we are to have any hope of staving off disaster.

The Conservatives are odds-on to win the forthcoming General Election, to be held probably in May or June. There is a view they will not announce the full range of spending cuts they intend to make until it is safely won.

Once in office they can claim the situation is far worse than they envisaged and start swinging the axe. But do we want a party that surfs into office on a wave of optimism, only then to reveal its true character later? This is hardly the stuff of greatness.

The unfortunate reality is what we see with the Conservatives is probably what we will get; decent enough chaps but no Margaret Thatcher or Winston Churchill to save us in our time of need. An even worse result would be a hung Parliament and the ensuing political paralysis which would almost certainly cause a sterling collapse.

It is understandable that no one wants to talk the language of crisis. Spending cuts and tax rises are not popular concepts. Perhaps it is just a fact of human nature that it is only possible to begin the debate when the scale of the crisis is beyond question. But history teaches us that such obfuscation only worsens the pain in the long run.

Present times are alarmingly like 1939, when the nations didn’t want to accept the prospect of a war, or - if they did - liked to feel it would be over quickly.

Even our then Prime Minister, Neville Chamberlain, delayed, entering futile peace negotiations and refusing to accept reality. It took a great man, possibly the greatest Englishman of all time, to save the nation.

What if the great danger in our lifetime is not a military but an economic war? Who then has the moral courage to take the tough but necessary action?Â

James Palumbo is a former City banker and founder of Ministry of Sound, the largest independent record label in the world, which had a turnover of £80million last

Read more: http://www.dailymail.co.uk/news/article-1231563/Is-Britain-brink-financial-armageddon.html#ixzz0YOzNZPGA

Category: Commentary, Economy, Finance, Pictures, Wall Street |

No Comments »

Tags:

Facing doomsday? London’s Canary Wharf. Britain has been hardest hit by the credit crunch

Facing doomsday? London’s Canary Wharf. Britain has been hardest hit by the credit crunch Crisis: A car abandoned by its foreign owner at a luxury development in Dubai

Crisis: A car abandoned by its foreign owner at a luxury development in Dubai