We have avoided Armageddon, at least for now. The cost to the US taxpayer has been a few trillion. Some in the media are loudly announcing the end of the recession. But we are not out of the woods yet. There are a few more bumps in the road. Actually, some of them are quite steep hills. As big as the subprime problem? Maybe.When asked a few weeks ago what was my biggest short-term concern, I quickly replied, “European banks have the potential to create significant risk for the entire worldwide system.” This week we will glance “over the pond” to see what gives me cause for concern. Then we briefly look at a few of the bumps I mentioned, which are likely to stretch out any recovery, and maybe even dip us back into recession.But first, a quick announcement. We are making dramatic changes to my free Accredited Investor E-Letter and service, and will have a new web site and much improved content in a month or so. But in the meantime, I have just finished a new letter; and if you sign up at the current site, you will of course get all the new services and benefits when we make the changes, as well as this new letter. Basically, this service is for accredited investors (net worth of $1.5 million or more) who are interested in learning more about and investing in alternative funds like hedge funds, commodity funds, and so on. You will get a call from one of my worldwide partners (Altegris Investments in the US, Absolute Return Partners in Europe, Nicola Asset Management in Canada, Plexus Asset Management in Africa, and Fynn Capital in Latin America) and gain access to a lot of information and an easy way to preview what I think is a great line-up of quality funds and managers. You can go to www.accreditedinvestor.ws and sign up today. Don’t procrastinate!And for those of you in the US who are on your way to becoming accredited investors (but not there yet), my friends at CMG have a platform of alternative managers that can be tailored to your specific needs. You really owe it to yourself to see the managers on their platform. The link to their form is http://www.cmgfunds.net/public/mauldin_questionnaire.asp. And now, let’s jump into the letter.

Europe on the Brink

Globalization is a two-edged sword. On balance, it has brought prosperity to those who have embraced it, with rising lifestyles, better health, longer lives, and more. The more we need each other, the less likely it is that we’ll shoot each other. Shooting your customers is not a good business strategy. And while the growth has not been even or smooth, only a Luddite would want to return to the early 1800s or 1900s, or even 1975.

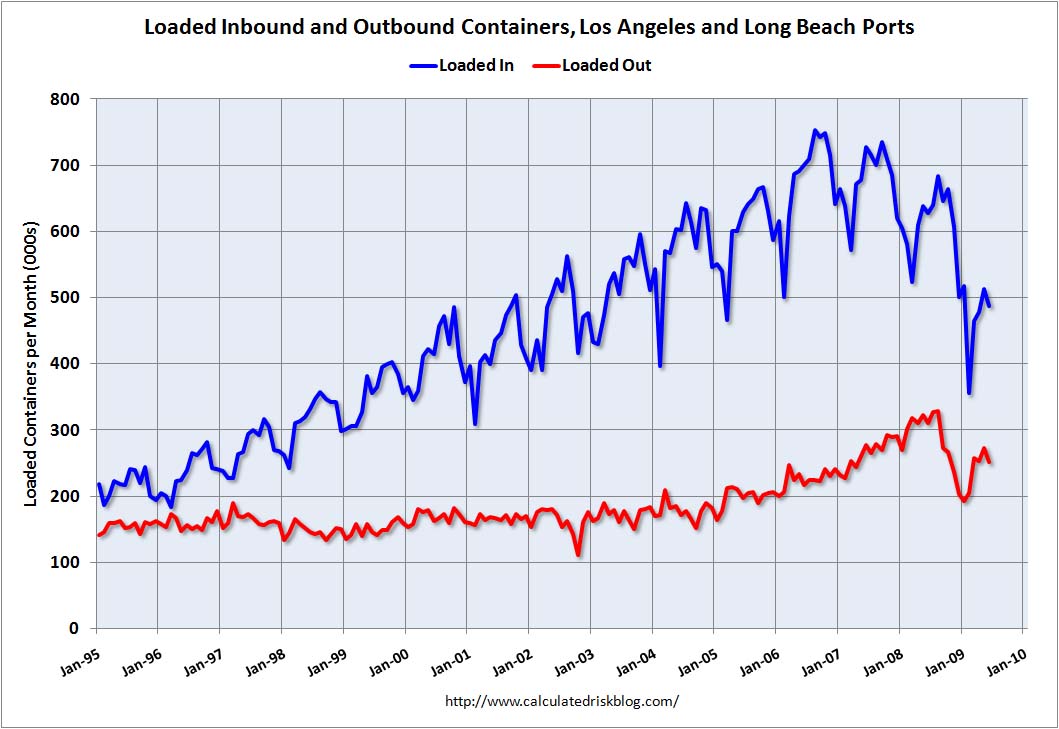

The other edge of that sword? We are connected in so very many ways, far more than most of the world suspected. Who thought that insane lending policies at US mortgage banks would bring the world financial system to its knees, increasing unemployment and leading to a global recession? World trade is down 20% or more. US railroad shipments are down more than 20% year-over-year. Chinese (and Asian) factories have seen their orders drop, as US consumers have gone on strike. The US trade deficit was just $25 billion last month; and while our exports are still dropping, our imports are dropping more. Oil is becoming a bigger and bigger share of imports, and that does not come from Asian exporters.

The US is far and away the country with the largest gross domestic product (GDP). California would be the 7 largest country, but few think of California in such terms. For this letter, at least, I would like to think of Europe as a whole rather than as 27 countries. From that perspective, Europe is as economically important to the world as the US. What happens in Europe makes a difference in the US.

Last week we looked at the precarious position of Japan, the second largest economy (or third if you think of Europe as a whole). It was a sobering letter. When you realize the extent to which Japan has funded Asian expansion, what is happening there cannot be good for the world.

But Europe’s banks have been much more aggressive in funding emerging-market expansion than US or Japanese banks. Western European banks have lent $4.5 trillion to various emerging-market countries, businesses, and consumers. Many Eastern European businesses borrowed in low-interest-rate euros. New homeowners in Hungary and the rest of Eastern Europe borrowed in Swiss francs and euros, and as their currencies have collapsed they now find they owe more on their homes than they’re worth.

And here’s the problem. Europe’s banking system is in far worse shape than the US system. The losses may be bigger, and their capital to meet those losses is certainly less. Let’s look at some charts. Remove sharp objects or pour another adult beverage.

As I noted last week, one of the real benefits of writing this letter is that I get to see a lot of really interesting information from readers and meet with very savvy investment professionals. I recently had the privilege of sitting with a team of analysts from Hayman Capital here in Dallas. Hayman runs a global macro hedge fund, so they spend a lot of time thinking about how all the different aspects of the global markets fit together. This week we again look at some of their analysis. There was a lot of work (as in months) done here; and Kyle Bass, the founder of the firm, graciously allowed me to share some of it with you (and kudos to Wes Swank, who pulled this together). The graphs are theirs, and my discussion about them is certainly informed by our meeting; but I am using the material as a launching point, so they are not responsible for my conclusions and interpretations.

And Then There Was Leverage

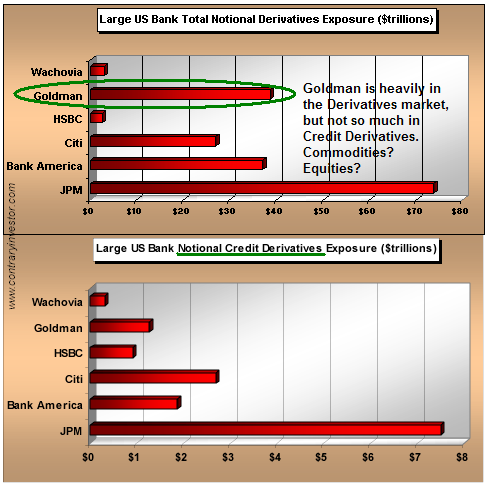

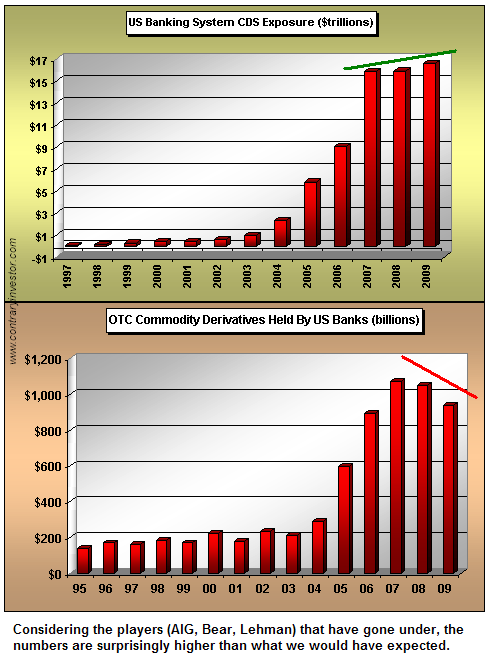

In the first few years of the G.W. Bush administration, the banking authorities decided it would be OK to allow five banks to increase their leverage from 12:1 up to 30:1. Which five banks, you ask? Bear Stearns, Lehman, Merrill Lynch, JPMorgan, and Goldman Sachs. How did that work out, just five years later? Three are gone and two survived with large dollops of taxpayer money.

(Sidebar: Is it really any surprise that Goldman and JPMorgan are making record profits on the underwriting and trading side of the business? Hell, if I could eliminate 50% of my competition, my profits would grow too! JPMorgan’s consumer credit, credit card, and other business groups are losing money big-time.)

Thirty times leverage means that if you lose 3.3%, you wipe out all your capital. And we watched as banks too big to fail were bailed out with taxpayer dollars. Slowly, banks are buying time, writing down assets. Remember, this month is the second anniversary of the onset of the credit crisis. I wrote back then that the strategy would be to stretch this out as long as possible. Time heals a lot of bad debts, especially at a 0% Fed Funds rate.

Banks that are reporting so far this quarter seem to be saying that the write-offs will start to level off in about two quarters, although banking expert Chris Whalen says that the level may stay higher than we think for longer than we think. There are a lot of assets to write off, and they are just now getting to the commercial real estate problems. This is going to take time. (For an interesting interview on CNBC with Maine fishing buddy Chris Whalen, click here: http://www.ritholtz.com/blog/2009/07/christopher-whalen-banking/.)

The point, before we get to Europe, is that here there was a central bank and a government that not only could step in but was willing to. I know former Treasury Secretary Paulson had his critics, but I am not one of them. Did he do some things that in hindsight he might like to take a “mulligan” on? Sure. But he dealt with the problems in the best manner he could. The time to have taken action was when we were making liar and no-doc loans and calling then AAA, or allowing banks to go to 30:1 leverage. Paulson had to deal with eggs that were already broken. That the system did not crater is to his credit. Securitizing what he and everyone else should have known would be garbage while he was head of Goldman Sachs is not to his credit. But I digress.

I am going to give you four charts showing the leverage of banks in the US, the United Kingdom, the Eurozone, and Switzerland. The bottom, blue portion is assets to common and preferred stock; the red is assets to common equity, which can include good will; and the purple is assets to tangible common equity.

Tangible common equity is all the rage, and that is what the recent “stress tests” measured, as opposed to tier 1 capital, which includes preferred stock (which would basically be the blue portion.) TCE only includes common shares. Now, let’s start with the US. These graphs show leverage. The average leverage of tier 1 capital of the five largest banks is in the range of 12:1, and is actually down from ten years ago. (By the way, a very good and simple explanation of all this can be found at http://baselinescenario.com/2009/02/24/tangible-common-equity-for-beginners/.)

While the TCE has obviously been rising and taking total leverage to rather lofty levels in the mid-40s, banks are raising capital, and over time leverage will come back down. It helps if you can borrow money at almost nothing and lend it out at much higher rates. Now, let’s turn to the United Kingdom. This is uglier.

Regulators in the UK allowed 20:1 leverage on a regular basis. It is now almost 40: and with TCE is around 55. The assets of UK banks are about five times as large as UK GDP. By comparison, for the US the ratio is barely 2:1.

Think about that for a second. The UK has banking assets which are five times as large as the annual domestic output of the country. They also had a housing bubble. They have their own bailouts to deal with, which are massive and will potentially get much larger. But at least they have a central bank and government that can try to fix the problems.

But as the commercial says, “But wait, there’s more!” Let’s look at the Eurozone.

Leverage is now 35:1 and with TCE is almost 55. How did 35:1 work out for the US? Given the massive credit problems that Eurozone banks have with emerging markets (plus Spain’s housing bubble, which is every bit as bad as that of the US), will this not end up in wailing and weeping?

Too Big To Save

And here’s the real issue. They have no Paulson and Bernanke. Now some of my Austrian-economist friends will say, “Good, they should all be allowed to die;” but that is a very cavalier attitude when you start talking about actually increasing the unemployment rate to something like 20%. I agree that management should be changed (as well as the regulators: 35:1 to 1 – really? What were they thinking?) and shareholders wiped out, but I do not want the system to collapse. And this is a global risk, not just localized to Ireland or Spain or Austria. Sure, the pain might be worse in the local region, but we will all feel it.

The European Central Bank, at least as of now, cannot step in and start saving individual banks. How do you save a Spanish bank and not an Austrian bank? Austria’s banks have made large loans to Eastern Europe, in euros and Swiss francs, and are going to have large losses, far more than 3%, which would wipe out their capital. But bank assets in Austria are 4 times GDP. What we have are banks that are too big to save for relatively small Austria. And for Italy, Spain, Greece, et al. More on this below. For now, let’s turn our eyes to Switzerland.

Those Wild and Crazy Swiss

We think of Switzerland as a stodgy, by-the-numbers, clockwork type of banking country. I have done business with Swiss private bankers, and they are conservative. But somewhere, somehow, UBS and Credit Suisse ran up a little leverage. Before the crisis, they were over 40:1. And now they’re nearly at a nosebleed-high 70!

As an aside, I was in Switzerland about two years ago, meeting with some very well-known Swiss, let’s call them dignitaries. In a very off-the-record conversation, they told me UBS was technically bankrupt. As it turns out, there were a lot of banks around the world that were technically bankrupt.

Now, the next graph underscores the problem of “too big to save.” Let’s say the US will eventually pump $1 trillion into the banking system (in taxpayer losses). That is about 7% of US GDP. We may not like it, but it doesn’t stop the game. US bank assets are only twice US GDP. Switzerland and Ireland are over 7 times, the UK is over 5, and the Eurozone is at 4 times. And so it goes.

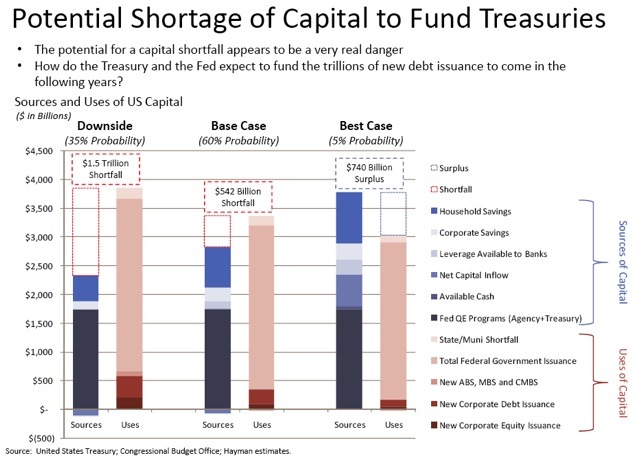

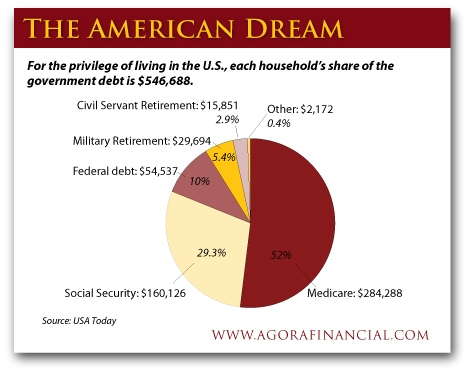

Eurozone banks are already reeling from losses from US subprime-related problems. They are now getting ready to deal with even deeper losses from their own lending portfolios. If the losses were just 5% of the portfolio (an optimistic assumption), it would be 20% of Eurozone GDP. But each country is responsible for its own banks. While it is thought Germany will be able to handle its problems, the prognostication for Austria and Italy is not so sanguine. Italy is already running a massive deficit, and has no central bank to monetize its debt. The same goes for Portugal, Spain, Greece, and Ireland. 5% loan losses in Ireland would be 40% of GDP, the equivalent for my fellow US citizens of about $5 trillion. Where does Europe find a few trillion dollars?

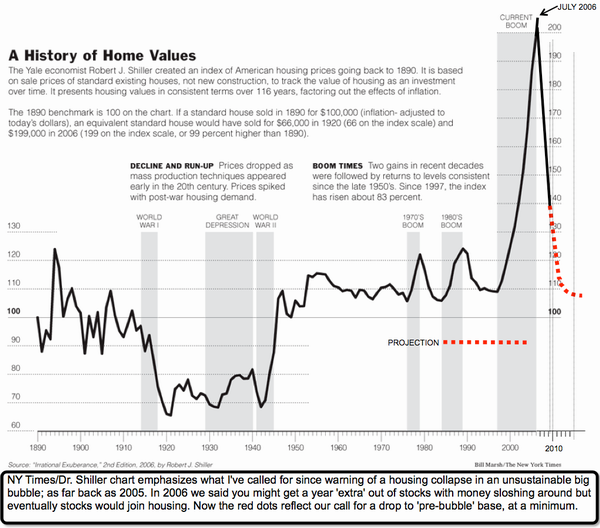

I was writing in late 2006 that the subprime lending market would end in tears. And I think the European banking crisis that is on the horizon has the potential to be every bit as big a problem as subprime loans. The world depended on Europeans banks for much of the lending that allowed for growth and development. Like their counterparts in the US, they are going to have to reduce their loan portfolios. Deleveraging is not fun.

It takes time to build up a banking infrastructure that can raise the capital necessary to make and process loans. A lot of time. Europe is a big customer of the US and Asia. Their businesses are going to be hit hard by the lack of capital, which is of course no good for employment, etc. We are all connected. What happens in Rome no longer stays in Rome.

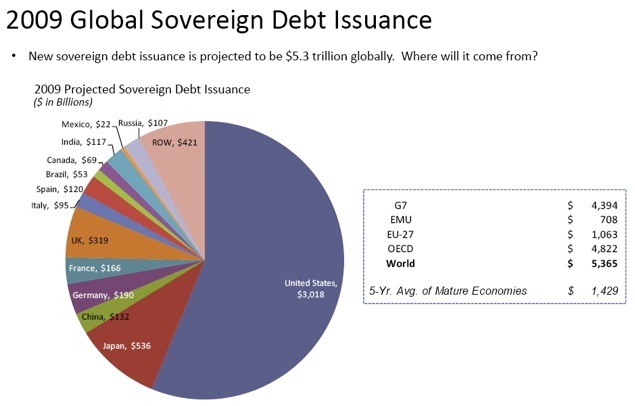

Let me reprint a graph from last week. Burn it into your mind. The world is going to need to find $5 trillion to finance government debt issuance. And we need to fund private business and consumer debt. Where is all this money going to come from? “If you lend me $5 trillion today, I will gladly repay you Tuesday.”

A Positive Third Quarter?

Those who are calling for the end of the recession are shouting that the third quarter may be positive in terms of GDP. And that is possible. But only for statistical and not for fundamental reasons. For instance, lower imports are a net positive for GDP. But lower imports mean a weaker economy. Government spending adds to GDP. Normally, if the government spends too much, then we get inflation, which is subtracted from nominal GDP to give us real (after-inflation) GDP. But inflation is low and getting lower, so there is not going to be much to subtract from nominal GDP. Are government spending and massive deficits a sign of fundamental strength?

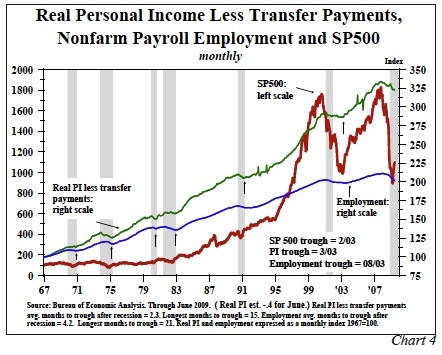

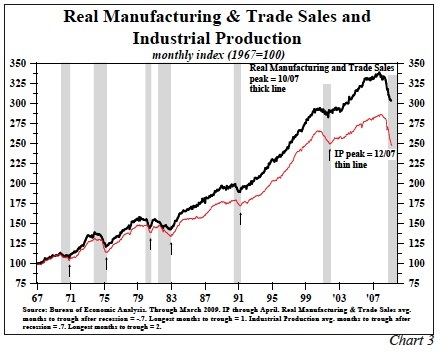

It is quite usual for there to be a positive quarter in the middle of a recession. Watch the fundamentals: industrial production, unemployment, capacity utilization, tax receipts, etc. When those turn up, or at least level off, the recession is over. Then we get to the long recovery.

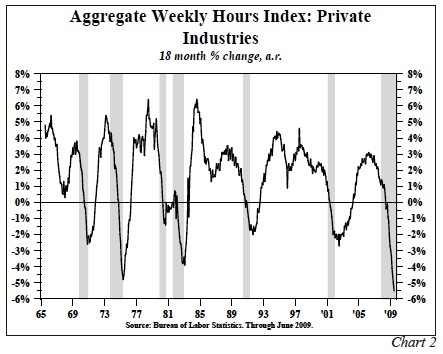

Quick point. As I have noted, unemployment is at 9.5% and going to 11% and hopefully no higher. Average hours worked per week is at an all-time low. The number of people working part-time but wanting full-time work is another 7%! And that part-time number is rising very rapidly.

When the recovery actually does begin to manifest itself, and it eventually will as we find the New Normal, what do you think employers are going to do? Hire new workers? Or give their current employees more hours? The latter, of course. This is going to be a long, slow, painful, jobless recovery. Unemployment is going to remain stubbornly high.

And this Congress wants to raise taxes on small business. 75% of the “rich” are small businesses. How do you expand your business in California or New York, where taxes will be over 60% by the time you add in local taxes? We will talk about this next week; but as a preview, from an economic viewpoint, massively raising taxes in the middle of a recession is about as dumb as you can get. But it looks like we are headed there. Green shoots, my foot.

Have a great week, and remember that the world will not come to an end. It is important to find the good in life and enjoy it, even in the midst of the fight. Somehow, we will all figure out how to Muddle Through together.

Your ready to find some wine analyst,

Â

Copyright 2009 John Mauldin. All Rights Reserved

Note: The generic Accredited Investor E-letters are not an offering for any investment. It represents only the opinions of John Mauldin and Millennium Wave Investments. It is intended solely for accredited investors who have registered with Millennium Wave Investments and Altegris Investments at www.accreditedinvestor.ws or directly related websites and have been so registered for no less than 30 days. The Accredited Investor E-Letter is provided on a confidential basis, and subscribers to the Accredited Investor E-Letter are not to send this letter to anyone other than their professional investment counselors. Investors should discuss any investment with their personal investment counsel. John Mauldin is the President of Millennium Wave Advisors, LLC (MWA), which is an investment advisory firm registered with multiple states. John Mauldin is a registered representative of Millennium Wave Securities, LLC, (MWS), an FINRA

Â

Â

Â

Â

Â

Â

registered broker-dealer. MWS is also a Commodity Pool Operator (CPO) and a Commodity Trading Advisor (CTA) registered with the CFTC, as well as an Introducing Broker (IB). Millennium Wave Investments is a dba of MWA LLC and MWS LLC. Millennium Wave Investments cooperates in the consulting on and marketing of private investment offerings with other independent firms such as Altegris Investments; Absolute Return Partners, LLP; and Plexus Asset Management. Funds recommended by Mauldin may pay a portion of their fees to these independent firms, who will share 1/3 of those fees with MWS and thus with Mauldin. Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor’s services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

Â

Â