Not all cars are eligible for the “cash for clunkers” program. Full information is available at www.cars.gov.

Trade-ins must:

* Be no older than 25 years, based on manufacture date.

* Have had a combined fuel economy of 18 mpg or less when new.

* Have been registered by the owner for at least one year.

* Have been continuously insured for at least one year.

* Have a clean title with no outstanding loans.

* Be drivable.

New cars must:

* Get at least 4 mpg more than the trade-in to qualify for a $3,500 rebate.

* Get at least 10 mpg more than the trade-in to qualify for a $4,500 rebate.

* Have a manufacturer’s suggested retail price of no more than $45,000.

New trucks and SUVs must:

* Get at least 2 mpg more than the trade-in to qualify for a $3,500 rebate.

* Get at least 5 mpg more than the trade-in to qualify for a $4,500 rebate.

* Have a manufacturer’s suggested retail price of no more than $45,000.

Source: U.S. Department of Transportation.     More……

Â

Â

Remember This Article If One Of These Birds Goes Down Early On……Boeing Stops Work on 787 Sections Due to ‘Wrinkles’……..

Posted By thestatedtruth.com on August 14, 2009

Boeing Halted Work on 787 Sections Due to ‘Wrinkles’Â

By Susanna Ray

Aug. 14 (Bloomberg) — Boeing Co. said it stopped work more than a month ago on two sections for the 787 Dreamliner after tiny wrinkles were discovered in the composite-material fuselages supplied by Italian vendor Alenia Aeronautica.

The flaws were found on 23 airplanes, starting with the seventh in production, Boeing spokeswoman Loretta Gunter said from Everett, Washington, where the 787 is being assembled. A solution has been designed and “it’s not expected to be a long time†before patches are applied to all the planes built so far, she said.

Boeing ordered work to stop on June 23, Gunter said. That’s the same day the Chicago-based company indefinitely delayed the 787’s maiden flight and entry into service so that engineers could reinforce some sections along the wing. The 787 was already almost two years behind its initial May 2008 first- delivery target before the latest delay.

“It didn’t have any material impact on the program in schedule or cost, so there was no reason to discuss it publicly,†Gunter said of the wrinkled material.

Alenia Aeronautica press officer Roberta Acocella said she wasn’t immediately able to comment today.

The new plane has a composite-plastic barrel that’s made in sections around the world and shipped to Everett for Boeing to assemble. The program has been hurt by parts shortages, defects, a redesign, a strike and problems managing a new supplier-based production process. Boeing, which has lost 54 percent of its market value since the first delay in October 2007, declined $1.32, or 2.8 percent, to $45.30 at 9:07 a.m., before the regular open of New York Stock Exchange trading.

Production Process

Alenia, a unit of Italy’s Finmeccanica SpA, has a plant dedicated to the 787 in Grottaglie, Italy. It began shipping completed fuselage sections in June 2008 to be joined with other pieces at a factory in Charleston, South Carolina, before being sent to Everett.

Boeing announced the plane’s fifth delay in June after ground tests showed some composite layers where the wing joins the body had separated. The 787 is being built with lightweight composites, rather than aluminum, to reduce fuel consumption.

The stoppage disclosed yesterday followed Boeing’s discovery of problems with the trimming on so-called stringers that run the length of the fuselage to provide structural strength, Gunter said. Patches will be applied outside the fuselage to “provide enough strength in that area to accommodate the microscopic wrinkles,†she said.

The two sections where the wrinkles were found make up the middle portion of the fuselage, she said.

‘Major Repair’

The wrinkles “represent a risk of a major repair,†Flightglobal.com’s FlightBlogger site said yesterday when it first reported the news after obtaining a copy of the June 23 stop-work order.

Boeing, which trails only Toulouse, France-based Airbus SAS in commercial plane-making, said last month it would give a new timeline for the plane by the end of September.

The Dreamliner 787 remains Boeing’s most successful new- plane sales campaign, with 850 on order even after 73 cancellations so far this year.

To contact the reporter on this story: Susanna Ray in Seattle at sray7

http://www.bloomberg.com/apps/news?pid=20670001&sid=acvzmwHXAEp8

Banks That You Can Stick A Fork Into……They’re Done

Posted By thestatedtruth.com on August 14, 2009

Toxic Loans Topping 5% May Push 150 Banks to Point of  No Return

By Ari Levy

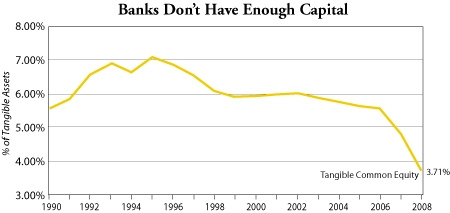

Aug. 14 (Bloomberg) — More than 150 publicly traded U.S. lenders own nonperforming loans that equal 5 percent or more of their holdings, a level that former regulators say can wipe out a bank’s equity and threaten its survival.

The number of banks exceeding the threshold more than doubled in the year through June, according to data compiled by Bloomberg, as real estate and credit-card defaults surged. Almost 300 reported 3 percent or more of their loans were nonperforming, a term for commercial and consumer debt that has stopped collecting interest or will no longer be paid in full.

The biggest banks with nonperforming loans of at least 5 percent include Wisconsin’s Marshall & Ilsley Corp. and Georgia’s Synovus Financial Corp., according to Bloomberg data. Among those exceeding 10 percent, the biggest in the 50 U.S. states was Michigan’s Flagstar Bancorp. All said in second- quarter filings they’re “well-capitalized†by regulatory standards, which means they’re considered financially sound.

“At a 3 percent level, I’d be concerned that there’s some underlying issue, and if they’re at 5 percent, chances are regulators have them classified as being in unsafe and unsound condition,†said Walter Mix, former commissioner of the California Department of Financial Institutions, and now a managing director of consulting firm LECG in Los Angeles. He wasn’t commenting on any specific banks.

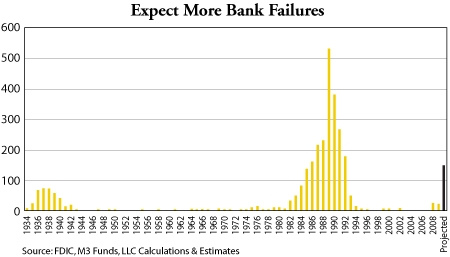

Missed payments by consumers, builders and small businesses pushed 72 lenders into failure this year, the most since 1992. More collapses may lie ahead as the recession causes increased defaults and swells the confidential U.S. list of “problem banks,†which stood at 305 in the first quarter.

Cash Drain

Nonperforming loans can eat into a company’s earnings and deplete cash, leaving banks below the minimum capital levels required by regulators. Three lenders with nonaccruing ratios of at least 6.2 percent as of March were closed last week. Chicago- based Corus Bankshares Inc., Austin-based Guaranty Financial Group Inc. and Colonial BancGroup Inc. in Montgomery, Alabama, each with ratios of at least 6.5 percent, said in the past month that they expect to be shut.

“This is a fairly widespread issue for the larger community banks and some regional banks across the country,†said Mix of LECG, where William Isaac, former head of the Federal Deposit Insurance Corp., is chairman of the global financial services unit.

Ratios above 5 percent don’t always lead to failures because banks keep capital cushions and set aside reserves to absorb bad loans. Banks with higher ratios of equity to total assets can better withstand such losses, said Jim Barth, a former chief economist at the Office of Thrift Supervision. Marshall & Ilsley and Synovus said they’ve been getting bad loans off their books by selling them.

Exclusions

Bloomberg’s list was compiled by screening U.S. banks for nonperforming loans of 5 percent or more, and then ranked by assets. The list excluded U.S. territories and lenders that have already failed. Also left out were the 19 lenders that underwent the Treasury’s stress tests in May; they were deemed “too big to fail†and told by regulators that government capital was available to keep them in business.

Excluding the stress-test list, banks with nonperformers above 5 percent had combined deposits of $193 billion, according to Bloomberg data. That’s almost 15 times the size of the FDIC’s deposit insurance fund at the end of the first quarter.

About 2.6 percent of the $7.74 trillion in bank loans outstanding in the U.S. at the end of March were nonaccruing, the highest in 17 years, according to the most recent data from the FDIC. Nonaccrual loans peaked at 3.27 percent in the second quarter of 1991, during the savings and loan crisis, and averaged 1.54 percent over the past 25 years.

‘Off the Charts’

“These numbers are off the charts,†said Blake Howells, an analyst at Becker Capital Management in Portland, Oregon, referring to the nonperforming loan levels at companies he follows. Banks are losing the “ability to try and earn their way through the cycle,†said Howells, who previously spent 13 years at Minneapolis-based U.S. Bancorp.

Corus, with more than two-thirds of its loans nonperforming, has the highest rate among publicly traded banks. The company said last month that it’s “critically undercapitalized†after five consecutive quarterly losses tied to defaults on condominium construction loans. Randy Curtis, Corus’s interim chief executive officer, didn’t respond to calls for comment.

Marshall & Ilsley, Wisconsin’s biggest bank, reduced its nonperforming loans last month to 5.01 percent from 5.18 percent after selling $297 million in soured loans, mostly residential mortgages in Arizona, the Milwaukee-based company said Aug. 10.

Deadline for Nonperformers

The bank has “been very aggressive in identifying and tackling credit challenges,†Chief Financial Officer Greg Smith said in an Aug. 12 interview. Smith said 26 percent of loans classified as nonperforming are overdue by less than the industry’s typical standard of 90 days. With those excluded, the ratio would be around 3.7 percent, he said.

Synovus, plagued by defaulting construction loans in the Atlanta area, said nonperforming loans rose to 5.4 percent in the second quarter from 5.2 percent the previous period. Disposals of nonperforming assets reached $404 million in the quarter ended in June, the Columbus, Georgia-based company said.

Synovus is selling troubled loans and will continue its “aggressive stance on disposing of nonperforming assets†as long as the level is elevated, spokesman Greg Hudgison said in an e-mailed statement.

Michigan Home

Flagstar is based in Troy, Michigan, the state with the nation’s highest unemployment rate. Flagstar has $16.4 billion in assets and reported last month that 11.2 percent of its loans were nonperforming; about two-thirds were home mortgages. Flagstar CFO Paul Borja didn’t return repeated calls for comment.

The bank’s allowance for loan losses was 5.4 percent of total loans at the end of the second quarter, compared with 3.3 percent at Synovus and 2.8 percent at Marshall & Ilsley, according to company filings. All three reported at least three straight quarterly deficits.

The FDIC doesn’t comment on lenders that are open and operating and doesn’t disclose which banks are on its problem list. The agency will probably impose an emergency fee on the more than 8,200 banks it insures in the fourth quarter to replenish the insurance fund, the second special assessment this year, Chairman Sheila Bair said last week. The FDIC attempts to sell deposits and assets of seized banks to healthier firms to avoid eroding the fund, said agency spokesman David Barr.

Capital Levels

To determine which banks are most troubled, regulators compare the ratio of nonperforming loans to the percentage of equity a firm has relative to its assets, said Barth, the former OTS economist. A company with 5 percent nonperforming loans and equity of 8 percent is better positioned than one with the same amount of troubled loans and equity of 4 percent, he said.

Flagstar’s equity-to-assets ratio in the second quarter was 5.4 percent, Synovus’s was 8.9 percent and Marshall & Ilsley, which raised $552 million through a stock sale in June, was at 11 percent, according to the banks.

The three lenders that failed last week — Florida’s First State Bank and Community National Bank and Oregon’s Community First Bank — all had nonperforming loans above 6 percent and equity ratios below 4.5 percent.

“The nonperforming ratio, in and of itself, should be a great concern,†said Barth, a professor of finance at Auburn University in Alabama and senior finance fellow at the Milken Institute in Santa Monica, California. “It becomes even more troublesome when it goes above 3 percent and the equity-to-asset ratio is quite low.â€

Toast Time

While 5 percent can be “fatal†for home lenders, commercial real estate lenders may be able to withstand higher rates, said William K. Black, former lawyer at the Federal Home Loan Bank of San Francisco and the OTS. Commercial loans carry higher interest rates because they’re riskier, he said.   More…….at Bloomberg.com

Looks Like Slashed Expectations Are Finally Being Reflected In To The Real Estate Market……

Posted By thestatedtruth.com on August 14, 2009

U.S. Homeowners Cut Asking Prices $27.8 Billion, Led by Nevada

By Dan Levy

Aug. 14, 2009Â

(Bloomberg) — U.S. homeowners cut their asking prices by $27.8 billion with some of the biggest reductions in Nevada and Florida, states hardest hit by the property slump, Trulia Inc. said.

Owners slashed prices by 15 percent in Nevada and by 13 percent in Florida and Arizona in the year through Aug. 1, the San Francisco-based real estate data provider said today. A quarter of home sellers lowered prices at least once, by an average of 10 percent.

“Sellers are resetting their expectations in line with falling prices,†Pete Flint, Trulia’s chief executive officer, said in an interview. “We’re still clearly in a downturn even though we’re coming out of it.â€

The median U.S. price of an existing single-family house dropped a record 15.6 percent to $174,100 in the second quarter, according to the National Association of Realtors, whose figures date to 1979. Sales increased 11 percent for new homes and 3.6 percent for existing homes, Commerce Department and Realtors data show, as buyers took advantage of discounts.

Idaho had the second-biggest average reduction at 14 percent, while prices were trimmed 13 percent in Hawaii.

The combined value of reductions was $27.1 billion in the year through July 1, Trulia said in its previous monthly report.

Sellers of higher-priced properties in states that haven’t been hard-hit during the housing recession may be “catching up with the rest of the country,†Flint said.

Discount Centers

Connecticut, Massachusetts, Rhode Island and Illinois had the highest share of homes with price reductions at 33 percent, followed by six states at 29 percent: Oregon, Washington, New Jersey, Minnesota, New Hampshire and Maryland.

Jacksonville, Florida, had the highest rate of reductions among cities tracked as 38 percent of listings there had been cut. Portland, Oregon, followed at 35 percent. Milwaukee, Minneapolis, Boston and Seattle each had 34 percent and Albuquerque, New Mexico, and Chicago had 33 percent.

Prices were cut 22 percent in Detroit; 16 percent in Las Vegas; 15 percent in Miami; 13 percent in New York City and Phoenix; 12 percent in San Francisco and Los Angeles; and 10 percent in Washington and Honolulu, Trulia said.

The company collects data from brokers and agents, third- party providers and multiple-listing services. The closely held company’s database includes 3.5 million properties.

Trulia excluded undeveloped land as well as foreclosed properties from the survey. It looked at all homes for sale that were listed on the company’s Web site since Aug. 1, 2008. Some prices were lowered more than once.    More……….

http://www.bloomberg.com/apps/news?pid=20670001&sid=av0pts0otNRc

Cash For Clunkers Rules………….

Posted By thestatedtruth.com on August 13, 2009

The Rules: Which Vehicles Qualify…..

Quote of the Day………..

Posted By thestatedtruth.com on August 10, 2009

You cannot help the poor by destroying the rich.

……Abraham Lincoln

Quote Of the Day…..

Posted By thestatedtruth.com on August 5, 2009

The problem with socialism is that you eventually run out of other people’s money.

–Margaret Thatcher

Just When You Thought You Were Safe In A Bunker…..

Posted By thestatedtruth.com on August 3, 2009

Report: Mega Bunker Buster bomb ahead. According to Stratfor.com: “The United States will speed the deployment of a new bunker-buster bomb, ten-times more powerful than the largest existing model, as soon as July 2010, the Air Force said Aug. 2, Reuters reported. The non-nuclear, 30,000-pound bomb is 20-feet-long and is designed to penetrate up to 200 feet underground before exploding. It will be able to be dropped from either the B-52 or the B-2 “stealth†bomber. A contract with the manufacturer, Boeing, could be made within 72 hours to build the first production models once Congress approves the necessary reapportionment of funds.”

Rick Ackerman Checks In……………….

Posted By thestatedtruth.com on July 31, 2009

NYSE Embraces A Ruinous Idea

By: Rick Ackerman

| Â

Rick’s Picks Friday, July 31, 2009 “Phenomenally accurate forecastsâ€Â  Sadly, another venerable American institution has lost its way: the New York Stock Exchange. We read the other day that the Exchange is building a fast-trade hub in northern New Jersey that supposedly will help secure its future in an increasingly electronic world. But raising capital for companies that could presumably help Build a Better Tomorrow is nowhere on their agenda. In fact, “fast trading†will be about as helpful in achieving that goal as placing five hundred slot machines in the NYSE’s lobby. Instead of one-armed bandits, however, the Exchange will be installing in its new Mahwah facility some very sophisticated computing equipment that will allow hedge funds and other firms to engage in high-frequency trading. This type of trading is all the rage these days, and the firms who do it will be trying to get the jump on other traders who lack the hardware to execute scores or even hundreds of transactions in mere seconds. Firms on the cutting edge will be better able to exploit order flow in ways that traders could not have imagined even five years ago. Our guess is that fast trading was invented by the same geeks who gave us program trading. Who’d have imagined they could one-up themselves with yet a new game to further destabilize the markets? The NYSE will say that more efficient markets will better serve the public. Having worked on an exchange floor ourselves for a dozen years, we think fast trading will better serve white collar criminals whose tactics have yet to be imagined by the regulators. Stick to ‘Gambling and Prostitution’ It would be bad enough if the NYSE viewed fast trading as just another profit center. Unfortunately, the Exchange sees it as its bread and butter. “When people talk about the New York Stock Exchange, this is it,†NYSE Euronext co-CIO Stanley Young told a reporter. “This is our future.†We suspect that Young will be proven wrong, and in a big way. For one, we see fast trading as so far-removed from the Exchange’s core mission that it cannot possibly come to any good. Like Vito Corleone, the NYSE should stick to its brand of gambling and prostitution, passing up the hard-core “drug†of high-frequency executions. Moreover, we have our doubts that the trading is a growth industry. Until recently, trading in financial derivatives alone created a paper market aggregating into the hundreds of trillions of dollars. How can this be when all the goods and services produced on the planet are valued at only $60 trillion or so? Clearly, this game cannot continue. Nor will it. It is in fact the reason why deflation is wringing out the global financial system, bringing speculation back into line with real economic activity. The process has a long way to go, and we doubt it will long abide the feather merchants’ latest scheme, fast trading.  *** Rick’s Picks publishes a daily trading newsletter for gold, stock, commodity, and mini-index traders 240 times per year. Information and commentary contained herein comes from sources believed to be reliable, but this cannot be guaranteed. Past performance should not be construed as an indicator of future results, so let the buyer beware. Rick’s Picks does not provide investment advice to individuals, nor act as an investment advisor, nor individually advocate the purchase or sale of any security or investment. From time to time, its editor may hold positions in issues referred to in this service, and he may alter or augment them at any time. Investments recommended herein should be made only after consulting with your investment advisor, and only after reviewing the prospectus or financial statements of the company. Rick’s Picks reserves the right to use e-mail endorsements and/or profit claims from its subscribers for marketing purposes. All names will be kept anonymous and only subscribers’ initials will be used unless express written permission has been granted to the contrary. All Contents © 2009, Rick Ackerman. All Rights Reserved. www.rickackerman.com |

Stock Market Facing a 1929 Bounce…………

Posted By thestatedtruth.com on July 31, 2009

The US GDP shrunk at a slower-than-expected pace in the second quarter. What does it mean for the stock markets?

Art Cashin, director of floor operations at UBS Financial Sevices, offered CNBC his insights.

The market may temper optimism over the economy by analyzing “subsets” of the total GDP number, Cashin said: “How much of it had to do with fewer imports, for instance.”

He fears that, despite the rally, the market could still return to its previous doldrums:

“If you give up [Thursday’s] gains and get back into that trading rectangle…this could be an ‘intermediate top’.” Â

Cashin gave his outlook for next week:

“We’ve got a couple of cycles coming together. … I’m going to be looking at Wednesday and Thursday in particular.”

He noted that if the rally continues through to next Friday, “it will equal the length of the 1929, 1930 bounce — which also took back 48 percent. We’ll see if there are further parallels, or if this rally will go off on its own.”

Cashin suspects China pulled “Machiavellian” machinations in the US Treasury debt auction. Â

More…………http://www.cnbc.com/id/32237003/site/14081545?__source=yahoo%7Cheadline%7Cquote%7Ctext%7C&par=yahoo

Disclosures:

Disclosure information was not available for Cashin or his company.

Commercial Real Estate Crash Looming, Says Fed’s Yellen

Posted By thestatedtruth.com on July 29, 2009

Commercial Real Estate Crash

Â

Looming, Says Fed’s Yellen

Â

By AUSTIN KILGORE

July 29, 2009 9:55 AM CST

As the industry looks for signs the housing sector is beginning to stabilize, the threat of a crash in the commercial mortgage market grows, according to San Francisco Federal Reserve president Janet Yellen.

Speaking this week at a bankers convention in Idaho, Yellen said while there are signs that the economic growth is beginning to return — house price declines are abating, consumer spending is stabilizing and new unemployment is lessening — the recovery will be painfully slow and the Fed believes commercial real estate is the economy’s next vulnerable spot.

The problem, Yellen said, is maturing loans for commercial properties that lost significant value.

“Borrowers seeking to refinance will be expected to provide additional equity and to have underwriting and pricing adjusted to reflect current market conditions,†Yellen said. “In some cases, borrowers won’t have the resources to refinance loans.â€

Yellen urged the community bankers at the conference to be proactive in preparing for a potential downturn, which could include, she said, property value drops as high as 30% to 40%. Namely, she told the audience to address emerging credit problems and commission new appraisals, but also encouraged them to continue lending to creditworthy borrowers.

The remarks fall in line with a number of credit ratings reports that warn commercial real estate is set to take a tumble.

Update From Dave Kotok Of Cumberland Advisors

Posted By thestatedtruth.com on July 28, 2009

Cumberland Advisors Â

614 Landis Avenue Vineland NJ 08360-8007

1-800-257-7013Â http://www.cumber.com

Â

Being in the Sweet Spot (twice)

July 29, 2009

At the moment we are in the “sweet spot†in markets and soon, in Maine. We must enjoy it while it lasts. Some bullets follow.

1.   Fed policy is on hold at Quantitative Easing (QE), which means short-term interest rates near zero and plenty of liquidity in the financial system. The Fed has said it will continue this posture for a period of time. Markets do not expect any change until well in to 2010 at the earliest.

2.   The much-feared Obama healthcare initiative seems to be stalled. Markets are relieved, because this initiative, as it was presented, amounted to a huge transfer payment that would be funded by future tax increases. The tax hikes would come on top of those already discounted by markets. Lifting the double tax whammy has given stocks a boost.

3.   Foreigners are buying US Treasury securities again, and that has quieted the fearmongers who have been crying that the US will be abandoned and the dollar will face a crisis. That may still occur, but the day of reckoning for our fiscal profligacy seems to be postponed. Markets like dodging this bullet.

4.   Markets have not priced in any risk premium on the Bernanke-stays or Bernanke-goes debate. Markets are also not pricing any risk premium on how and when the Fed will exit the QE strategy. Right or wrong, markets are now powered higher by bullish momentum coupled with positive economic signs. The Fed and other central banks in the world are on hold. Markets like stasis and have it for the time being.

5.   Markets are not pricing any substantial inflation risk in the near term. TIPS yields are a market-driven indicator of this measure. Longer-term inflation risk is priced higher, but it is derived from forward rates and is subject to change as conditions unfold. That means it is not impacting short-term market movements.

In our view the biggest news this week will arrive on Friday. There will be an advance estimate of second-quarter GDP. But that is not what I mean. In fact, that estimate has little meaning to money managers, and markets are likely to ignore it as old news.

The really big news will be the revisions in the benchmark national income and product accounts. These are revisions done infrequently and substantively. They are the basis for much of the work done by analysts and economists. These numbers are critical to the development of national policy and to the longer-term valuation of financial markets.

We do not know what the release will say, of course, but we do have some expectations. We think the revised savings rate will be higher than the currently computed series. If so, that will give the markets some comfort. The newly revised numbers will also help in the projection of a longer-term growth rate for the United States, and they will give guidance on inflation and productivity. We believe that the forthcoming revisions will be positive on both counts.

If we are correct, the revisions will become an economic data platform that will support arguments for a higher movement of stock prices. The upward trend that has been powerfully active since March 9 will continue. In Cumberland’s ETF accounts, we are fully invested and have taken our target for the SP 500 index to over 1100 by the early part of 2010. Our global ETF accounts are similarly positioned.

Our managed bond accounts continue to favor spread positions over Treasuries. That is true for tax-free municipal bonds, which are very cheap for individual investors, and also taxable securities. We are placing a lot of emphasis on Build America Bonds. We caution investors to do the homework on each issue and to understand the cash flows that secure these bonds.

We continue to expand our use of certain ETFs that offer protection from interest-rate risk in accounts that are large enough to justify their use. These securities can lower the overall risk profile of an account when they are properly used. We note that many retail investors are trading these securities, and we caution that they may be doing something they do not really understand. Duration matching against a parallel yield-curve shift is a complex task. It takes a lot of effort on our part to do it. Folks who are doing so without fully understanding how these securities work travel at their own peril.

Next week is very busy, so Cumberland market missives may be in short supply. Bob Eisenbeis, Bill Witherell, and I will be presenting at the National Business Economic Issues Council (NBEIC) meeting in Samoset, Maine on Tuesday and Wednesday. This is a closed meeting that operates under Chatham House Rule, so no information will be published about it without specific permission of a presenter.Â

At the end of next week, Peter Demirali and John Mousseau will join us at another sweet spot, in the village of Grand Lake Stream, Maine at Leen’s Lodge for the annual Shadow Fed fishing retreat (nicknamed Camp Kotok by Becky Quick). CNBC will be broadcasting live on Friday, August 7, starting very early in the morning and running for much of the day. We are 34 attendees, plus Steve Liesman, Matt Greco (a Squawk Box producer), and the CNBC crew. The attendees are by invitation only and have traveled from as far east as Abu Dhabi to as far west as Vancouver and Newport Beach and from as far south as Dallas. We have booked the entire camp and will be testing its capacity.Â

Â

David R. Kotok, Chairman and Chief Investment Officer, email: david.kotok@cumber.com

*********

Copyright 2009, Cumberland Advisors. All rights reserved.

The preceding was provided by Cumberland Advisors, 614 Landis Ave, Vineland, NJ 08360 856-692-6690. This report has been derived from information considered reliable, but it cannot be guaranteed as to accuracy or completeness.

For a list of all equity sales/purchases for the past year, please contact Therese Pantalione at 856-692-6690, ext. 315. This report is currently about 600 pages in length. It is not our intention to state or imply in any manner that past results and profitability are an indication of future performance. This does not constitute an offer to sell or the solicitation or recommendation of an offer to buy or sell any securities directly or indirectly herein.

Cumberland Advisors supervises about $1.2 billion in separate account assets for individuals, institutions, retirement plans, government entities, and cash-management portfolios. Cumberland manages portfolios for clients in 43 states, the District of Columbia and in countries outside the U.S. Cumberland Advisors is an SEC registered investment adviser. For further information about Cumberland Advisors, please visit our website at www.cumber.com.

Please feel free to forward this Commentary (with proper attribution) to others who may be interested.

Archived Commentaries: http://www.cumber.com/comments/archiveindex.htm

David R. Kotok

Cumberland Advisors

PO Box 663

614 Landis Avenue

Vineland, NJ 08362-0663, USA

U.S. Assures China It Will Shrink Record Deficit

Posted By thestatedtruth.com on July 28, 2009

U.S. Assures a ‘Concerned’ China It Will Shrink Record Deficit

By Rob Delaney and Rebecca Christie

July 27 (Bloomberg) — The Obama administration’s economic leaders assured Chinese counterparts they will rein in a record budget deficit as China underscored its concern about preserving the value of its holdings of Treasuries.

“China has a huge amount of investment in the U.S.†and “we are concerned about the security of our financial assets,†Assistant Finance Minister Zhu Guangyao said in a press briefing at the end of the first of two days of talks in Washington. Treasury Secretary Timothy Geithner said in opening remarks that the U.S. will ensure a “sustainable†deficit by 2013.

In a shift from Bush administration meetings, officials indicated little sign of tension over the value of China’s yuan, which U.S. lawmakers have labeled as artificially cheap and an aid to Chinese exports. That may be because the “best idea is just to keep the yuan-dollar rate stable†given U.S. need for Chinese demand for Treasuries, said Ronald McKinnon, a professor of economics at Stanford University.

“The Chinese are trapped with supporting the value of the dollar,†McKinnon said in a telephone interview from Stanford, California. “If they withdrew from the market, there’s a big appreciation†of the yuan as a result that would send China’s exports down, he said.

The new focus on the deficit and Treasuries reflects the legacy of China’s record trade surpluses and its accumulation of dollars as a result of holding down the yuan. Chinese foreign- exchange reserves surpassed $2 trillion for the first time in the second quarter, and its holdings of Treasuries reached $801.5 billion in May, about 100 percent more than at the start of 2007.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aGKZviKKdfB0

Obama Popularity Plunging………

Posted By thestatedtruth.com on July 27, 2009

President Obama’s popularity continues to fade, as he had two bad days in the polls. According to the Rasmussen Reports.com daily poll, the number of those who disapprove of the president’s performance is now 51%. Here are some details: “The Rasmussen Reports daily Presidential Tracking Poll for Saturday shows that 30% of the nation’s voters now Strongly Approve of the way that Barack Obama is performing his role as President. Thirty-nine percent (39%) Strongly Disapprove giving Obama a Presidential Approval Index rating of -9.”

According to the Saturday report, the president’s press conference on Wednesday of last week seems to have done further damage to Mr. obama’s popularity as “The number who Strongly Disapprove of the President has increased slightly following the prime time press conference on Wednesday night. That figure—39%–is now at the highest level yet recorded. As a result, the overall Approval Index has fallen to the lowest level yet recorded for this President.”

Sunday’s poll was worse, with the Presidential Approval Rating falling to -11, the first time this measurement has fallen to double digits. According to Rasmussen: Sunday’s poll “is the first update based entirely upon interviews conducted after the President’s prime time televised press conference. The number who Strongly Approve of the President has remained unchanged since the press conference but the number who Strongly Disapprove has gone up by five percentage points (from 35% on Wednesday morning to 40%)” on Sunday.

Perhaps the most telling of all the polling details is the president’s loss of support among independent voters. While he has the approval 83% of Democrats and 53% of women, “37% (of independent voters) offer a positive assessment.

There is some mixed news for Obama also as “While the President’s ratings have slipped over the past month, 54% believe that President George W. Bush is still primarily to blame for the nation’s economic problems. Just 25% believe that the economic stimulus package has helped the economy.”

Jeff Nyquist….. The Deceptions From Russia

Posted By thestatedtruth.com on July 26, 2009

Acknowledging the Deception

Â

by J. R. Nyquist

Â

Weekly Column Published: 07.24.2009

Meet Victor Kalashnikov: former KGB officer, scholar, analyst, and writer. He is married to historian and journalist Marina Kalashnikova, the subject of last week’s column. Before the Soviet Union collapsed Victor worked for the KGB in Vienna. After Gorbachev’s bizarre abdication in December 1991, Victor found himself drawn into the Presidential administration of Boris Yeltsin on orders of KGB General Yevgeny Primakov. There he became a research director in the Russian Public Policy Center. “So I turned my attention 180 degrees from Europe to Russia,†Victor explained. “I was quite enthusiastic to explore what was going on in Russia. The people in the Kremlin came across a lot of surprises and discoveries as to what Russia really was.â€

And what is Russia?

With help from presidential advisor Sergei Stankevich, Victor managed to retire from the KGB. But the KGB wanted him back, just as they wanted Russia back. Whatever job Victor took, wherever he went, the KGB would appear. “They always arrived on the scene with offers and promises, wanting to exploit my contacts,†Victor explained. You see, the Cold War was still ongoing, and so was the work of Moscow’s spies. In 1997 the SVR (KGB) wanted Victor to bring spies into the German oil company he worked for. When he refused, the SVR promised he would “pay with his blood.†In 1999, after having coffee at the Russian Embassy in Brussels, Victor became very sick. Quite naturally, he suspected poison.

In 2000, one of Victor’s colleagues had been summoned by the secret police and told that the Kalashnikovs were on a “black list†due to their politically incorrect writings. People were being warned on all sides, including their dentist. Friends melted away. Co-workers avoided contact. Dental work could not be done. “What struck me, especially with the younger generation,†Victor noted, “is that they appear to be such conformists. No idealism, no values. They were just ready to cooperate with whomever they saw as their superiors. That’s why ultimately, nowadays, we unexpectedly found ourselves in the position of outsiders, dissidents, even enemies. That’s the way it developed.â€

In 2004 Victor and his wife continued their controversial writing activities and found themselves accosted on the street by FSB (KGB) officers who warned them against entering foreign embassies and disrupted their attempts to meet with diplomats. At about this time the Kalashnikovs were fired from their newspaper jobs. From that point forward, Victor and Marina could not find work in the Russian media, academia or business. Eventually, they sought an outlet for their talents in Ukraine. But here again, the Kremlin gave them no rest, as Ukrainian officials warned that the Russian Interior Minister had included the Kalashnikovs on a list of “extremists†and that, as a consequence, their personal safety in Ukraine could not be guaranteed.Â

“Conformism is absolutely overwhelming here,†Kalashnikov lamented. “You should not distinguish between the Russian authorities and the Russian people. From the unemployed in the provinces, to the top of the hierarchy, conformism is huge. Also within the media, they are all willing to cooperate. It is a reality and it will develop that way, despite today’s economic troubles. It is a typically Russian phenomenon.â€

If it sounds like Soviet times, you are not mistaken. The totalitarian system has now become more sophisticated and more streamlined. The West should not deceive itself. The Cold War never ended. The KGB remains in place. According to Kalashnikov, “It is not necessary to control the entire former Soviet area. We can project our influence. Even when we allow the Americans and NATO to have a presence there, we have the upper hand. I even suspect that what happened has produced a modernized strategic model.â€

Gone are the imperial burdens. Russia can use its secret agent networks to blackmail executives, politicians and intellectuals. Journalists can be bought inexpensively, as it turns out. The disinformation campaigns of the 60s, 70s and 80s have laid the groundwork for a great deception. The West thinks they are dealing with a new entity in Russia. Yet they are still dealing with the house that Stalin built.

“My feeling is that the old personnel management system has been reinstalled from Soviet times,†said Kalashnikov, explaining how the secret police can deprive uncooperative citizens of a livelihood. “In the Soviet Union your personnel file followed you whenever you changed from one job to another. Your employer sees any black marks set down by previous employers, and my former employer [the KGB] was eager to make life as difficult as possible. They wanted to press us to the degree that we would admit our defeat and failure, reconsidering our behavior.â€Â

In the West we were told that the Soviet system was finished. We were told that the Communist Party lost power, the KGB was reformed and democracy won the day.

Kalashnikov said: “There was not any moment, I can state with certainty, that the old system of KGB and nomenklatura admitted their failure or lost control. They just changed their form and appearance. It was a sort of generational change. Instead of generals in charge, we have lieutenant colonels. They behaved differently, but they are doing the same thing. There has never been any moment when they admitted historical defeat. There never was any serious step toward de-communization – never, never. The Yakovlev Commission was conceived to imitate de-communization procedures in Central Europe.â€

So it was a sham?

“Yes, it was a fake, an imitation,†Kalashnikov insisted. “From the very beginning the idea was, we’ll get back, we’ll modernize. And that’s how it happened. Of course, many Western observers were happy about the new faces and new styles and openness. But step by step, you yourself may remember that many American institutions here in Russia have been pushed out or brought under Russian control. So, formally, we have several Western bodies here allegedly doing democracy and consulting work, but in fact they have become an instrument of Kremlin policy to imitate and exploit for their own purposes.â€

Here are the words of a former KGB official, telling the truth from his home in Moscow, barred from employment for his honesty – blacklisted by his former colleagues because he did not want to participate in the greatest deception of our time. “There was no real accountability for the past,†Kalashnikov explained. “It was a big deception. People changed their appearance and behavior, but the real meaning of the system remained the same – in substance. It was quite visible to me. The West was just happy that we let go of the names of Communism and Soviet and so on. We changed our vocabulary. Instead of Politburo and Central Committee we have a president and a presidential administration. Instead of KGB, we have FSB. I insist that the interpretation of late Soviet history should be changed profoundly. The KGB maintained huge networks of domestic spies. Hundreds of thousands of people were deployed at the right time, influencing the democracy movement. That system has been extended by Putin. If you look at Russia from the outside you cannot discern who is manipulating the whole thing. Hundreds of thousands of assets are employed in politics and business. There is a hidden agenda and hidden structures. Even the Germans have not gotten rid of their hidden structures having to do with the Communist era. With all the German efforts and technology they still cannot solve the problem of hidden Communist structures. They are still being manipulated. Now take Russia, which was free to reconstruct its [totalitarian] structures under a different guise.â€

And what are the strategic implications?

“They would be huge,†said Kalashnikov. “You know, one thing people should understand. There is a definite line of continuity in Moscow’s military policies from Stalin’s time. Moscow has consistently followed the same line of policy. What is misleading for many people is that the material military presence is not there anymore. We don’t need so many tanks. The question is what sort of design, what sort of strategy you have in place. All of that Moscow has in terms of potentials. We see that the Russian presence is being reinstalled in some places – Latin America, Africa and the Middle East.†The important thing is manipulation and influence instead of direct control.

In terms of modern strategy Russia’s reduced size brings advantages. Now Russia is not responsible for feeding Azerbaijan or providing cheap energy to the Baltic States or Ukraine. The KGB’s weapons of influence and manipulation, including organized crime and drug trafficking, can be used to influence and manipulate without maintaining expensive armies. And so, the Russians have learned how to streamline their dominance. Make the Americans think that Washington has the upper hand. But look around today and see what is happening to the American economy, to the U.S. dollar, and to the U.S. nuclear deterrent. There is a visible weakening in all three areas.

Victor Kalashnikov is a brave man. He has refused to falsify reality for the sake of career opportunity or even personal safety. He is telling us the way things are the largest country in the world. You can ignore him if you like, but ignore him at your own peril.

Copyright © 2009 Jeffrey R. Nyquist

Global Analysis Archive

Storm Watch From Jim Puplava

Posted By thestatedtruth.com on July 26, 2009

Storm Watch Update

Â

THE END OF AN ERA

Â

(Excerpt from a 17 July 2009 President’s Message to Jim’s clients at PFS Group)

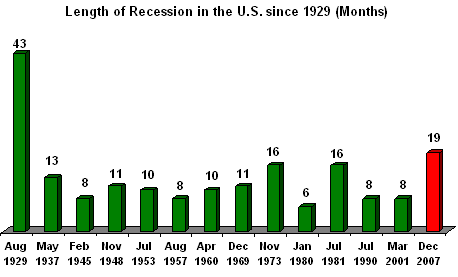

| When the facts change, I change my mind. What do you do, sir? — John Maynard Keynes, British economist (1883–1946), in reply to a criticism during the Great Depression of having changed his position on monetary policy, as quoted in Lost Prophets: An Insider’s History of the Modern Economists (1994) by Alfred L. Malabre, p 220″Green shoots” has become the new economic mantra used by the media to describe our current economic condition. The recession that began in December, 2007 is now in its twentieth month. You would have to go back as far as 1981–82 or 1973–74 to find a recession that has lasted this long with unemployment rates this high.The “green shoots” mantra is being used to reassure investors that “things will soon improve, therefore take hope things will soon be back to normal.” We disagree with that assumption. We believe things will never go back to the way they were but a year ago.

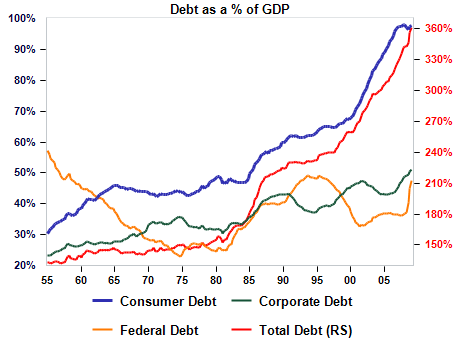

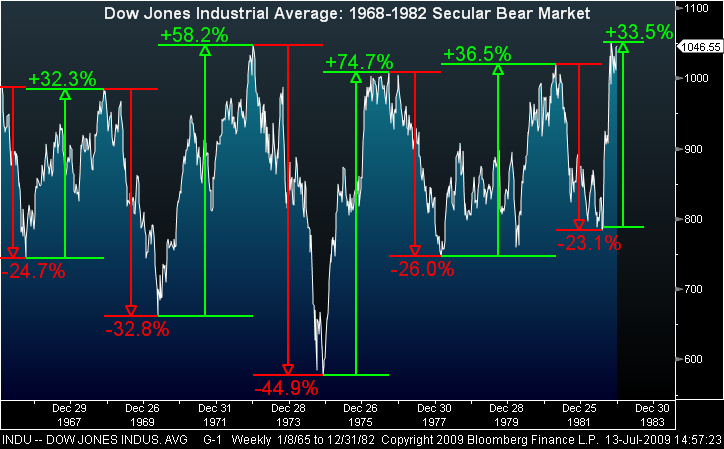

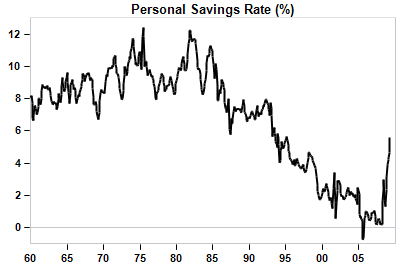

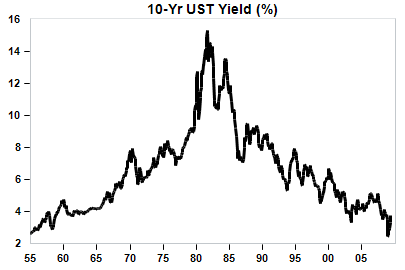

What we are witnessing in real time is the end of an era. For more than 40 years the government has used monetary and fiscal policy to soften the blow and cushion the impact of economic contractions. For decades now, modern economists have thought that government policy could be used to tame and overcome the business cycle. For a time, it seemed to be working. During the 1980s and 1990s we experienced only two recessions in the United States. The time between and severity of those recessions lengthened and lessened with the economy experiencing only 2–3 quarters of negative economic growth. In reality there was no miracle economic cure for the recessions during the 1980s and 1990s. Increasing amounts of debt were used to leverage the economy, spark consumption, rekindle economic growth and bring the country out of recession. The market/economic research publication Bank Credit Analyst coined the phrase “The Debt Supercycle” to describe the forces behind the rising trend in U.S. debt burdens during the last four decades. Escalating debt levels created inflationary bubbles—each one more overblown than the last—which increased the economy’s and financial system’s vulnerability to shocks. Each time the debt-driven bubble burst, authorities were forced to take ever-more-desperate reflationary actions in order to prevent the system from imploding as it tried to unwind all of the accumulated financial imbalances. The result is that each past reflationary episode set the stage for even greater financial excesses and imbalances down the road. Debt burdens have grown tremendously over the last four decades with a sharp acceleration beginning in the 1980s. Total debt to GDP has risen from under 150% in the 1950s to today’s level of 372%. That debt level will approach 450% over the next few years as a result of the accelerated spending of the Obama Administration (which piggybacked on some expensive stimulus measures implemented by the Bush Administration). The graph below puts our current predicament into perspective. It reflects all manner of debt from the consumer to corporations to the government. Source: Federal Reserve, Bureau of Economic Analysis (BEA). Source: John D McKinnon, “$1 Trillion Defecit Complicates Obama’s Agenda,” The Wall Street Journal, 15 July 2009 There is a finite limit to how much debt a country can absorb, but it is hard to identify what that point is. Analysts have worried for decades that the U.S. was reaching the outer limits of its ability to support more debt, but such fears have proved to be misplaced, as the ratio of debt-to-GDP has continued to climb. The U.S. long ago surpassed the domestic capacity to finance its spending from domestic savings, and has relied increasingly on borrowing from abroad. The result is that foreigners now own and control over 50% of U.S. public Treasury debt, over 25% of our corporate debt, and nearly 20% of U.S. equities. While the U.S. government continues to successfully tap the debt markets to finance trillion-dollar deficits, it is becoming more difficult for consumers and corporations to get financing. Banks have tightened lending everywhere—from home mortgages, to consumer lines of credit, to credit cards. Only sound companies with strong balance sheets have been able to tap the corporate debt markets. Those that do manage to tap the bond markets have been forced to pay the highest interest rate spreads in well over three decades. Economists refer to this as the “crowding out” effect. The enormous debt financing needs of the federal government are crowding out the financing needs of corporations and the consumer. The result is that the rate of change of debt expansion has been contracting at the consumer level. Moreover, the savings rate has now turned positive, rising from a negative rate two years ago to the current rate of 6.9%. This has enormous implications regarding future economic growth. As we see it the economy won’t begin to recover until the end of the year. Even then we may only get 2–3 quarters of positive economic growth before the economy turns down again. By 2011 we should head back into another recession since Bush’s tax cuts expire at the end of 2010; the Bank Credit Analyst research group is also predicting another recession by 2011 due to massive tax increases, higher rates of inflation, and higher oil prices. Furthermore, in order to finance Obama’s proposed healthcare plan, tax rates may rise as high as 52.4%. A 47% tax rate with an additional 5.4% surtax on married income of $1,000,000 (a surtax of 1% applies for married incomes over $350,000, and 1.5% over $500,000; these rates could rise to 2% or 3% respectively if certain targets are not met) has been proposed. This does not include nearly $2 trillion in new taxes that will be enacted under Cap and Trade. One of the lessons that the current administration has failed to learn from the Great Depression is that raising taxes during the middle of a recession lengthens and exacerbates the economic decline. That is why you are starting to hear more talk about a second economic stimulus. The Administration may deny it, but according to the economic sources we subscribe to, we have it on good authority that the administration is already working on a second stimulus plan that may be offered up during the first quarter of next year. The current stimulus plan begins to wind down by Q2 of next year. With mid-year elections coming up next fall you can bet another economic stimulus plan is in the works. Here is why. Rising stock prices during the 1980s and 1990s, and then rising housing prices during this decade allowed consumers to finance spending in excess of income gains. This resulted in pushing up consumer spending as a share of GDP from a 62% average to 71% this decade. Now, with stocks having declined for the second time this decade, and with housing prices still in search of a bottom, consumers are left with no new major sources of borrowing to fund their spending. In response to asset declines, consumers have embarked on a new wave of frugality, a theme we highlighted at last year’s Client Only Meeting. Over the past nine months, both BusinessWeek (9 October 2008) and Time (27 April 2009) have highlighted this new trend towards frugality. The problem for the government is that the majority of the economic stimulus packages is not being spent. After-tax income rose $140 billion at an annual rate in April and a further $178.1 billion in May. However, savings jumped $146.2 billion in April and jumped $150.3 billion in May. So consumers are saving rather than spending virtually the entire fiscal stimulus. What this means is two different sides of a bookkeeping entry—an increase in the federal deficit matched by an increase in household savings. This brings me to our conclusion regarding future economic growth. Yes, we may see some of these so-called green shoots morph into “green stalks” beginning next year. But I believe it won’t last. High consumer and corporate debt levels are likely to lead to higher savings rates in the years ahead. So whatever economic bounce we get from massive government deficits won’t last long. I want to point out that it is not unusual to see at least 1–2 quarters of positive economic growth within the timeframe of a recession. Since the end of World War II, 8 of the 11 recessions has had at least one quarter of rising GDP within them, but then suffered further weakness before the economy finally hit bottom. This idea that recessions start at the top and then decline steadily until they hit a bottom is an economic myth. Each recession takes a shape of its own. The economic whizzes have come up with an alphabet soup to describe them as V’s, U’s, W’s, or L’s. The economist A. Gary Schilling believes we’ll experience a saw-toothed pattern along declining trends, in other words a series of W’s. It took the United States four decades to go from the world’s largest creditor to become the world’s largest debtor. You cannot resolve four decades of debt accumulation in just a few years. It is going to take time for consumer debt loads to be unwound. The economic models of debt-based consumption spending will no longer work. If the country wants to see its economy revive it is going to have to go back to what drove our economy during the first half of the 20th century: saving and investment. You cannot borrow your way to prosperity. This means we will have to go back to what we do best which is: make things. That means reviving our manufacturing base, expanding our technology lead, and supporting our commanding agricultural base. It is unfortunate that very few in Washington, DC seem to understand these economic truths. The government is still trying to encourage debt accumulation and consumption. It won’t work. The “Debt Supercycle” era of American economic growth has come to an end. We expect consumer and corporate downsizing to last well into the next decade. If you want to know what this may look like you need go no further than the 1970s. The economy will experience a saw-toothed economic growth pattern. Economic growth periods will be brief and punctuated by periodic downturns. This economic pattern will have broad implications for investment markets. The key to survivability is going to be flexibility. Investment Cycles and Risk Management There is a time for everything, and a season for every activity under the heavens…a time to plant and a time to uproot…a time to tear down and a time to build…a time for war and a time for peace. — Ecclesiastes 3:1, 2, 3, 8 (Today’s New International Version) You have often heard me speak about investment cycles. If you examine investment markets you will find they have a pattern. Most investment cycles last between 16–18 years. They tend to alternate between bull markets in paper assets and bull markets in commodities. To paraphrase Ecclesiastes there is a time and a season for everything. After experiencing the worst depression in our nation’s history and after fighting one of history’s bloodiest wars, the U.S. stock market experienced a long bull market run from 1948–1966. The Dow Jones Industrial Average (DJIA) hit a peak of 1,000 in 1966 and did not surpass that level until 1982. As shown in the graph of the DJIA taken from the bear market of the mid-’60s to early ’80s, the bear market in stocks resembled a giant roller coaster with spectacular downdrafts as well as upswings in prices. During that entire period the stock market experienced five short bull and five short bear markets with bear market losses as high as 44.9% and bull market gains measuring 74.7%. Despite periods of market upswings, overall, the stock market went virtually nowhere for over a decade and a half. While the stock market vacillated between gains and losses during that time period, the commodity markets were experiencing a major bull market that took commodity prices up fourfold. Individual commodities such as oil rose from $1.25 a barrel to over $40 a barrel. The precious metals—gold and silver—experienced more spectacular gains with gold rising from $35 an ounce in 1971 to a high of $850 in 1980. Silver’s run was even more spectacular rising from a little over $0.50 to a high of $50. However, during this timeframe, commodity prices as a whole, like the concurrent bear market in stocks, also experienced spectacular gains as well as convulsive corrections (see chart below)—even though the gains in commodities were on a long-term up-trend. Gains & Corrections in Commodities 1971–1982Data Sources: Commodity Research Bureau, Kitco After rising in spectacular fashion from a low of $35 in August of 1971 gold prices rose nearly sixfold to $200 an ounce in 1974 before falling almost 50% in 1975. Clearly, bull markets in commodities and bear markets in stocks are more difficult to navigate than bull markets in equities. As these graphs illustrate, a buy-and-hold strategy doesn’t work very well during bear markets in equities. During these periods downturns can be quite severe, just as upturns can become explosive on the upside. One only has to view the events in the stock and commodity markets over the last year to confirm this point. Although the oil markets rose fifteenfold from 1998–2008, they fell by 74% in a matter of eight months, something never experienced before in the oil markets. The characteristics of bull markets in “paper” (equities) and in commodities are entirely different. Bull markets in paper generally occur during a time of political, economic and social stability and a time of peace. Think back to the Reagan and Clinton presidencies. The Cold War had ended, Paul Volker had tamed the evils of inflation, the Reagan tax cuts had spurred economic growth, and Alan Greenspan, Larry Summers and Robert Rubin had become the maestros of finance and the economy or what the 15 February 1999 issue of Time magazine called “The Committee to Save the World.” There were only two short wars during the ’90s: the first Gulf War and the Kosovo War. Both wars were brief. In contrast to this decade, which began with the attacks on 9-11, we are fighting two simultaneous wars in Iraq and in Afghanistan. This decade has seen two major bear markets and two recessions with the government now running $2 trillion deficits. The unemployment rate is at a level we have not seen since the 1981 recession and is still rising—it’s likely to hit a record 11% next year. Both bear markets included losses of 40% or more. We saw inflation levels rise last summer to the highest level in two decades. Social unrest is also starting to grow—witness the more than 700 “tea parties” held across the U.S. on April 15th. Unfortunately, commodity bull markets are more convulsive than bull markets in equities. They are characterized by wars, government intervention in the economy, expansive monetary and fiscal policies, large government deficits, high taxes and inflation, social unrest and stagnant economic growth. That is where we find ourselves today. I believe the bull market in commodities will last well into the next decade and that, in the long run, current government policies will only exacerbate the trend toward higher commodity prices. In summary, commodity bull markets and equity bear markets require a different strategy than equity bull markets in order to prosper. As John Maynard Keynes remarked, “When the facts change, I change my mind. What do you do, sir?” The stock market abhors uncertainty which is why we’ve seen an increase in volatility over the last year. Given this constantly changing and choppy environment, active rather than passive asset management is essential—as is the use of a greater number of investment tools. In this kind of market, managing risk is as essential as seeking opportunities for profit. One way to manage risk is to try to move out of the market near market tops, and move back into the market near market bottoms (i.e. make strategic use of “cash”). However, selling off entire positions in a portfolio can be a fool’s game; an all-or-nothing approach to markets like the current one isn’t likely to work. Round-the-clock vigilance and tight timing would be required, and frequent moves in and out of positions would create significant trade costs and could result in unfavorable tax consequences (i.e. short-term capital gains). A more flexible approach that includes defensive “hedges” on the underlying core positions in a portfolio may be more beneficial. Holding a larger portion of the portfolio in cash, a portion in highly liquid bond instruments, and hedging with puts (a specific kind of options strategy) and reverse ETFs (exchange traded funds) that benefit from the stock market’s decline (or the decline in a specific sector), could enable investors to continue to hold core positions while at the same time reducing portfolio volatility. Investors may also need to be more “awake” to short-term and intermediate-term movements in specific stocks and sectors. Since the return on cash ( money market) is next to zero, putting it to work by either investing it in the market or investing in “hedges” to reduce the impact of market corrections is worthy of consideration. (Some of the strategies mentioned are high risk, and may be suitable only for sophisticated and/or high net worth investors. Discus these strategies with your investment professional and/or educate yourself about the risks involved before attempting these strategies.) Yields Near Zero The world has changed over the last year as the process of deleveraging has been unfolding. We are seeing economic, financial, and social instability rise and we are currently in a state of war. Government intervention in the economy and in financial markets is also on the rise which carries with it its own uncertainties. What new government policy or intrusion will be proposed next week or next month? How long will we have to contend with trillion dollar deficits? How high will this Administration and Congress raise income tax rates? Will we see a national sales tax or VAT? What major financial or industrial corporation will become the next major bankruptcy or who will the government bail out next (maybe CIT Group, Inc [CIT])? How long will the war on terror last? What new major spending program will the Obama Administration propose and how will we be able to pay for it? Will foreigners, who now hold over 50% of our Treasury debt, continue to finance our twin deficits? How long will the dollar hold its value? As investors these are the questions we must contend with on a daily, weekly, and monthly basis. I’m sure we all wish that we could go back to the way things were before. It is a feeling that we all share. Unfortunately that world has gone with the wind and no longer exists. This is a new world and we operate in uncharted waters. It is going to take adaptability and flexibility to navigate it safely. The Reflation Cycle Inflation is like sin, every government denounces it and every government practices it. By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens. —John Maynard Keynes, The Economic Consequences of the Peace, Chapter VI (1919) Inflation is when you pay fifteen dollars for the ten-dollar haircut you used to get for five dollars when you had hair. In 1983, shortly after I began my career, I read a book that had a very profound influence on my investment philosophy: Is Inflation Ending? Are You Ready?, by investment strategists Kiril Sokoloff and A. Gary Shilling. When I first entered the investment industry in 1979, inflation rates were over 15%, oil was heading toward $40 a barrel, and gold and silver prices would soon attain $850 and $50 an ounce, respectively. Inflation was the dominant investment theme with oil and gas investments, gold, silver, commodities in general, and leveraged real estate being the principal investments of the day. Bond investments during this period were considered “certificates of confiscation” due to their eroding value as a result of inflation. The financial world failed to recognize the enormous changes that were in the wind with the Volker Fed and the Reagan presidency. Sokoloff & Shilling wrote their book to counter the numerous “hyperinflation survival guides” that dominated the investment bestseller lists. They contended that we were in for a long-term period of disinflation. The authors gave numerous speeches during the early and mid-1980s recommending the purchase of 30-year Treasuries, predicting the then-historically-high interest rates would fall to become the lowest. After reading Sokoloff & Shilling’s book I began to understand the subtle changes that were taking place in the economy and the financial markets. I gradually began to change my investment strategy from inflationary investments toward fixed income. It was a wonderful period for fixed-income investors. I still remember putting one of my first clients into a 14% Treasury bond. Throughout the 1980s I was able to get double-digit returns from fixed income investments. Ginnie Mae bonds paid 12–13% interest; municipal bonds carried 8–9% interest rates while corporate bonds offered interest rates of 12–14%. Who wanted to invest in equities when fixed income returns were in the double-digit range? High real interest rates were the norm until the recession of 1991. It wasn’t until 1995 that equity returns began to dominate investment markets. As shown in the above graph of Treasury interest rates, the secular bull market in bonds which began in September 1981—a 27-year run—has now come to an end. In the third edition of A History of Interest Rates by Sidney Homer and Richard Sylla, the authors discuss the long secular runs that develop in the bond market with average durations of 26–27 years. The bull market in bonds that began in 1920 had a 26-year run which ended in 1946 with the yield bottoming at 2.12%. The next bear market for bonds, which began in 1946, lasted some 35 years, by far the longest duration of any bear market in U.S. history. From 1946 interest rates would go on to rise until reaching a peak in 1982. From 1982 until the low of 2.05% reached in December of last year the bond market had a 27-year run. We believe that the next bear market in bonds is now in its infancy. Macroeconomic fundamentals of rising government deficits and the vast monetary expansion of the Fed’s balance sheet will ultimately drive interest rates higher as inflation risks increase. I have been astounded by the widespread complacency concerning inflation in the financial markets. Deflation seems to be the dominate theme in today’s investment markets and investment thinking much in the same way that hyperinflation survival books were all the rage back in the late 1970s and early 1980s. Several respected economists, ranging from Paul Kasriel, Director of Economic Research at Northern Trust; to Mervyn King, now head of the Bank of England; to the Global Economics Team at Morgan Stanley have recently written extensive papers as to why they expect higher rates of inflation. Investment strategist Kiril Sokoloff, who nailed the disinflation theme in early 1982, is now warning about inflation and the end of the bond bull market. We agree with their assertions. Deflationists are focusing on such things as the output gap, capacity utilization rates, low labor rates and a high unemployment rate to back their inflation thesis. However, they ignore the empirical evidence that clearly points to a different outcome. Paul Kasriel showed there is no correlation between the output gap and the CPI (Consumer Price Index). Likewise, some of our staff have illustrated there is virtually no correlation between low factory utilization rates and high unemployment rates. What some of our staff have shown is that there is a close correlation between the value of the dollar and inflation. That a falling dollar generally leads to higher inflation rates would seem to be obvious. The majority of goods in “big box” stores, department and electronic stores aren’t made here. We import them from overseas. As the dollar depreciates in value they become more expensive which elevates the level of inflation. However, our chief reason for believing inflation not deflation will be the biggest surprise for the markets rests in our belief that inflation is a “monetary disease.” Here we quote its symptoms from two Austrian economists: Murray N. Rothbard and Ludwig von Mises. What determines the price of money? The same forces that determine all prices on the market—that venerable but eternally true law: “supply and demand.” An increase in the supply of money will tend to lower its “price”; an increase in the demand for money will raise it. (Murray N. Rothbard, What Has Government Done to Our Money?, The Ludwig von Mises Institute, 1980, p 28) And from Ludwig von Mises: In theoretical investigation there is only one meaning that can rationally be attached to the expression Inflation: an increase in the quantity of money (in the broader sense of the term, so as to include fiduciary media as well), that is not offset by a corresponding increase in the need for money (again in the broader sense of the term), so that a fall in the objective exchange-value of money must occur. Again, Deflation (or Restriction, or Contraction) signifies: a diminution of the quantity of money (in the broader sense) which is not offset by a corresponding diminution of the demand for money (in the broader sense), so that an increase in the objective exchange-value of money must occur. (The Theory of Money and Credit, translated by H.E. Batson, Yale University Press, 1953, p 240) I believe that getting the inflation/deflation story right is the single-most important investment decision that needs to be made. It will determine the investment outcome of portfolios over the next decade. What I have tried to illustrate is that investment cycles have long durations. Bull markets in equities and in commodities tend to last 16–18 years while bond cycles of 26–27 years are longer in duration. We are now at a key inflection point in the investment markets and in the economy. Rising commodity prices since 1998 have been largely ignored by the investment community as an aberration. The common refrain is that the rise in commodity prices has been caused by speculators. The basic economic principle of supply and demand tends to be ignored. Oil prices, precious and base metals prices, and agriculture prices which remained tame throughout most of the 1980s and 1990s, before moving up significantly in fits and starts in this decade, are considered to be the norm. The fact that oil is no longer $20 a barrel, gold prices are over $900 an ounce, copper is over $2 a pound, and grain inventories are the lowest they have been in nearly three decades, tend to be ignored by most investment pundits. Also ignored is the fact that a fifteen-fold increase in oil prices from 1998–2008 failed to bring a significant supply of new oil to the market. In most economic theory, the thinking is that higher prices tend to lead to more production of the product in demand. However, commodities are unique in that they have finite limits. Thus, there are times when demand far outstrips supply. In the case of energy, the markets ignore the fact that the number of new oil discoveries has fallen now for four consecutive decades, as have the size of the new fields. It is our belief that the major selloff in commodities that occurred over the last year was brought about by deleveraging in the financial community. In addition to deleveraging, producers and manufacturers have been in the inventory liquidation mode. What we have witnessed over the last year is the single-largest inventory liquidation of the post-World War II period. In our opinion this is probably one of the largest collective misjudgments on the part of the business community. As Don Coxe of Coxe Advisors, LLC recently has written, what we are now seeing is a near-panic liquidation of inventories around the world.

(What I Learned This Week, 9 July 2009) It is obvious from the few facts listed above that the financial media is missing the bigger picture by remaining focused on weekly U.S. consumption and inventory levels for oil and gasoline. Weekly inventory levels are the product of statistical computer models with seasonal adjustments added to smooth out the level of inventories. I’m not sure these models accurately reflect what is occurring in the real economy here or in emerging markets. Once the global economy begins a temporary recovery (perhaps in the next 6–9 months), we expect that the bull market in commodities is likely to resume. We also expect that the Fed, despite its statements to the contrary, will be faced with additional rounds of money printing as the U.S. government deficit balloons to $2 trillion dollars and remains above a trillion dollars for the balance of the next decade. We also anticipate a pickup in inflation by year-end and a rise in interest rates later on this year. Contrary to the consensus view that deflation is what lies ahead we believe otherwise, especially in the long term. I can’t guarantee that inflation will be the outcome, but what I’m relying on is over 5,000 years of recorded history to back up my inflation thesis. I would be surprised to see a nation that imports most of its goods, runs up trillion dollar budget deficits, and whose central bank is monetizing $1.75 trillion of government bonds, would see the value of its currency appreciate. The U.S. has been fortunate so far to have its currency accepted as the world’s reserve currency. This privilege, afforded to no other nation, allows the U.S. to “export its inflation” to the rest of the world, a privilege that is being increasingly challenged by the major nations of the world. The days of the Dollar’s hegemony are drawing to a close. We are now in the beginning stages of its demise. Jim Puplava NOTICE: You are welcome to print this article for your personal use. However this article may NOT be reproduced for public distribution without the expressed, written permission of the author.Email Author Selective quotations are permissible as long as the author, Jim Puplava, and this web site are acknowledged through hyperlink to: www.financialsense.com The material on this website has no regard to the specific investment objectives, financial situation, or particular needs of any visitor. It is published solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. References made to third parties are based on information obtained from sources believed to be reliable but are not guaranteed as being accurate. Visitors should not regard it as a substitute for the exercise of their own judgment. Any opinions expressed in this site are subject to change without notice and Financial Sense is not under any obligation to update or keep current the information contained herein. PFS Group and its respective officers and associates or clients may have an interest in the securities or derivatives of any entities referred to in this material. In addition, PFS Group may make purchases and/or sales as principal or agent. PFS Group accepts no liability whatsoever for any loss or damage of any kind arising out of the use of all or any part of this material. Our comments are an expression of opinion. While we believe our statements to be true, they always depend on the reliability of our own credible sources. We recommend that you consult with a licensed, qualified investment advisor before making any investment decisions. Disclaimer |

by Jim Puplava, www.financialsense.com, July 24, 2009

Inside The Health Care Bill, aka HR3200……

Posted By thestatedtruth.com on July 26, 2009

Here is the entire 1017 page Health Care Bill. There is a man by the name of Peter Fleckstein (aka Fleckman) who is reading it and has been posting on Twitter his findings. This is from his postings (Note: All comments are Fleckman’s)

Pg 16: SEC. 102. PROTECTING THE CHOICE TO KEEP CURRENT COVERAGE. lines 3-26 of the HC Bill – OUTLAWS PRIVATE INSURANCE by forbidding enrollment after HR 3022 is passed into law.

Pg 21-22: SEC. 113. INSURANCE RATING RULES of the HC Bill MANDATES the Government will audit books of ALL EMPLOYERS that self insure!!

Pg 29: SEC. 122. ESSENTIAL BENEFITS PACKAGE DEFINED: lines 4-16 in the HC bill – YOUR HEALTHCARE IS RATIONED!!!

Pg 30: SEC. 123. HEALTH BENEFITS ADVISORY COMMITTEE of HC bill – THERE WILL BE A GOVERNMENT COMMITTEE that decides what treatments/benefits you get.

Pg 42: SEC. 142. DUTIES AND AUTHORITY OF COMMISSIONER of HC Bill – The Health Choices Commissioner will choose your HC Benefits for you. You have no choice!

PG 50-51: SEC. 152. PROHIBITING DISCRIMINATION IN HEALTH CARE in HC bill – HC will be provided to ALL non US citizens, ILLEGAL or otherwise.

Pg 58: SEC. 163. ADMINISTRATIVE SIMPLIFICATION HC Bill – Government will have real-time access to individual’s finances and a National ID Healthcard will be issued!

Pg 59: SEC. 163. ADMINISTRATIVE SIMPLIFICATIONHC Bill lines 21-24 Government will have DIRECT access to your BANK ACCOUNTS for electronic funds transfer. This means the government can go in and take your money right out of your bank account.

PG 65: SEC. 164. REINSURANCE PROGRAM FOR RETIREES is a payoff subsidized plan for retirees and their families in Unions and community orgs (ACORN).