This Just Proves A Really Bad Year Can Happen To Anyone…….

Posted By thestatedtruth.com on September 10, 2009

Harvard Investments Lose 27.3%

By Gillian Wee

Sept. 10 (Bloomberg) — Harvard University, the wealthiest U.S. school, said its investments fell 27.3 percent in the past year, a $10.1 billion loss that was smaller than President Drew Faust’s forecast in December before markets started to recover.

The endowment declined to $26 billion from $36.9 billion in the year ended June 30, including the inflow of gifts from donors and $1.7 billion in distributions to the university, according to a report today by Harvard Management Co., which oversees the fund. Gains in non-U.S. fixed-income and emerging- markets securities helped trim a loss that Faust had said could reach about 30 percent.

Jane Mendillo, Harvard Management’s chief executive officer, is seeking to rebuild assets and protect the Cambridge, Massachusetts, university against future financial shocks. She raised cash holdings, cut $3 billion in commitments to private- equity and real estate funds, and began shifting assets from outside firms to Harvard Management, according to the report.

“We expect a prolonged period of instability and slower growth in some markets,†Mendillo said in the report. “We can do and are doing more to manage the risks we face, given the lessons of the past year.â€

Harvard fired workers, sold $2.5 billion in bonds and delayed construction projects after the bankruptcy of Lehman Brothers Holdings Inc. in September 2008 crippled financial markets and left the 373-year-old university short of cash. The Faculty of Arts and Sciences, which relied on the endowment for about 60 percent of its income, will cut about $220 million, or 19 percent, from its $1.15 billion budget in the next two years.

‘Oversized Commitments’

It was the first loss in seven years and the biggest in four decades for the endowment, whose earnings helped pay for new professors, expanded financial aid and campus construction. Harvard lost more money in one year than all but the six biggest U.S. universities had in their funds as of June 30, 2008.

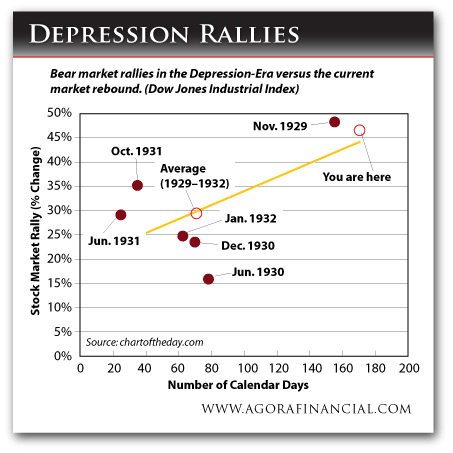

Harvard entered the worst financial crisis since the Great Depression with “recent oversized commitments to illiquid asset classes,†and didn’t have enough cash to meet “our obligations along with the needs of the university,†Mendillo, who took over as CEO in July 2008, said in the six-page report.

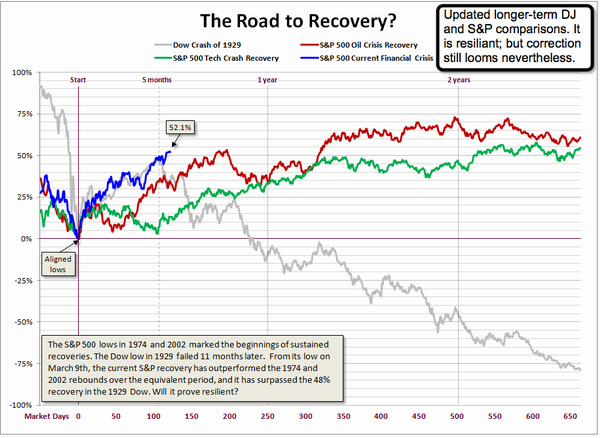

The Standard & Poor’s 500 Index plunged 54 percent from the start of 2008 to the nadir on March 9, affecting endowments nationwide. The S&P has since gained more than 50 percent.

Endowments probably recorded their biggest losses in 35 years in the 12 months ended June 30, according to research firm Commonfund Institute in Wilton, Connecticut.

Yale, Brown

Yale University in New Haven, Connecticut, the second- wealthiest U.S. school, said today its endowment dropped an estimated 30 percent to about $16 billion. Yale President Richard Levin said in a July interview that investment declines cut the fund by 25 percent and the school spent 5 percent.

Brown University in Providence, Rhode Island, said yesterday that its fund declined 27 percent, including a 23 percent drop in investments.

Mendillo, 50, inherited responsibility for the endowment from Mohamed El-Erian, who returned to Pacific Investment Management Co. after less than two years at Harvard Management. She has raised cash by offloading some private-equity stakes, redeeming from hedge funds and selling stocks.

The endowment is targeting cash levels this year equivalent to 2 percent of the portfolio, according to the report. In previous years the endowment was fully invested and borrowed to amplify gains. Allocations to other assets remain little changed.

Harvard’s public equities and real assets including natural resources beat benchmarks, declining 28 percent and 38 percent, respectively. The international fixed-income and internal emerging-markets teams outperformed indexes by 9 percentage points and 3.7 percent points. Other asset classes trailed benchmarks, including private equity, down 32 percent and absolute-return strategies, off 19 percent.

More Liquidity

The endowment lowered its commitments to private equity and real estate to $8 billion from $11 billion, as some firms reduced the size of their funds or made capital calls, and Harvard shed some of its pledges through secondary sales. Mendillo is reviewing private-equity and hedge-fund stakes.

“With perfect hindsight we and most other investors would have started this year in a more liquid position and with less exposure to some of the alternative asset categories that were hardest hit,†Mendillo said. She said it would be a mistake to “categorically avoid†hard-to-sell assets like natural resources and private equity.

“But the balance of liquid and illiquid investments within the portfolio needs to remain in the forefront of our portfolio strategy,†she wrote.

Return to Harvard

Mendillo was a fund manager at Harvard for 15 years before leaving in 2002 to build Wellesley College’s investment office. She returned as head of Harvard Management when El-Erian resigned in September 2007 to become CEO of Pimco, a bond manager based in Newport Beach, California. El-Erian in February 2006 had succeeded Jack Meyer, the endowment chief of 15 years, whose compensation was criticized by Harvard alumni.

Harvard’s internal management team, which is responsible for about one-third of the portfolio, is “extraordinarily cost effective — with total expenses equal to a fraction of the costs of employing outside managers for similar asset pools with similar results,†Mendillo said in the report.

Mendillo is considering more collaboration between teams and planning more hires. She added hedge-fund executives Emil Dabora from Caxton Associates LLC and Michele Toscani, a managing director for Fortress Investment Group LLC in Tokyo, to expand her internal investment team, while Mark McKenna, also from Caxton, will start this month in equity arbitrage.

“It is important to be realistic about near-term returns and about our expectations for several years to come,†Mendillo said in the report. “The impact of the events of 2008-2009 will not be reversed overnight. For Harvard, as for almost every major investor, regaining the market value lost as a result of the recent global economic crisis will take time.â€

http://www.bloomberg.com/apps/news?pid=20601087&sid=azaVNoupoSkA

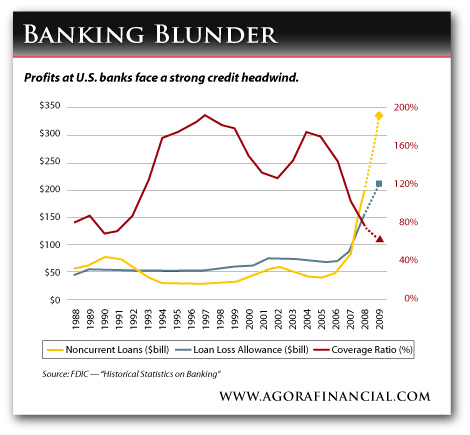

“Friday’s edition of The Wall Street Journal picks up on the theme of the long road of pain ahead for bank shareholders in the US,†colleague Dan Amoss tells us. “In ‘Banks on Sick List Top 400,’ the WSJ details several ugly highlights from the latest FDIC Quarterly Banking Profile, published last Thursday.

“Friday’s edition of The Wall Street Journal picks up on the theme of the long road of pain ahead for bank shareholders in the US,†colleague Dan Amoss tells us. “In ‘Banks on Sick List Top 400,’ the WSJ details several ugly highlights from the latest FDIC Quarterly Banking Profile, published last Thursday.