To ease or not to ease? That is the question we will take up this week. And if we do get another round of quantitative easing (QE2), will it make any difference? As I asked last week, what if they threw an inflation party and no one came? We will take as our launching pad today’s unemployment numbers, which serve to demonstrate just why the Fed may in fact be ready for some monetary shock and awe.

Teachers Don’t Count?

As the jobs report came out a number of headlines trumpeted the “strong” private-sector job growth of 64,000 jobs, trying to soften the overall loss of 95,000 jobs. If you exclude the loss of census workers, the job losses were “only” 18,000. However, for the first time since December of last year, we lost jobs in a month. That is not the right direction.

“Moreover, when you adjust for the slide in the participation rate this cycle, the byproduct of a record number of discouraged workers withdrawing from their job search, the unemployment rate is actually closer to 12% than the 9.6% official posted rate in September, which masks the massive degree of labour market slack in the system. This is underscored by the broad U6 jobless rate measure, which spiked to a five-month high of 17.1% from 16.7% in August.” (David Rosenberg)

Let’s go to Table A-1 in the BLS website. You find that the total number of “civilian noninstitutional population” has risen by exactly 2 million over the last year to 238,322,000. That is the number of people over 16 available to work. But the actual civilian labor force has only risen by 541,000. Over the last 12 months we have added only about 344,000 jobs, according to the data from the Establishment survey, or just about a month’s worth in the good old days.

Here’s an interesting note I picked up while looking at employment data by age and education (with seven kids, these things are important to me!). There is a cohort that has seen its employment level rise. That would be men and women over 65. The total number of people over 65 who are employed has risen by 318,000 over the last year, accounting for nearly all the job growth (although one bit of data is from the establishment survey and the other is from the household survey, but that should be close enough for government work).

Think about that. Almost all the job growth has come from those who have reached “retirement age” (whatever that is) continuing to work or going back to work. The unemployment rate for young people 16-19 is 26%. The unemployment rate for black youth is an appalling 49%. (This is not an abstract piece of data. I have two adopted black sons, so this figure means something in the Mauldin household.) Next time you go into malls, Barnes and Nobles, fast food places, notice again the work force. These are the jobs that traditionally went to those starting out.

As my friend Bill Dunkelberg, chief economist of the National Federation of Independent Business, wrote yesterday:

“Officially, the recession ended in June, 2009 according to the National Bureau of Economic Research, historical arbiters of recession and recovery dates. But in July, 2009, Congress raised the minimum wage by over 10% and 580,000 teen jobs were lost in the second half of the year even as GDP posted growth of 4% (annual rate). This was more than double the losses in the first half of the year when GDP declined at a 4% rate and fewer workers were needed. This was one of many policies implemented or proposed by Congress that made no sense as a measure to blunt the impact of the recession. The minimum wage determines the minimum value an unskilled worker must add to a business to justify employment. Congress has made this hurdle higher and more teens find they cannot get over it. This is just one of many barriers to hiring that are institutionalized in our economy, for example restrictions in the stimulus legislation that required union labor on projects.”

Let’s hear it for unintended consequences.

The Rise of the Temporary Worker

17,000 jobs in the latest survey were from new temporary jobs. I caught this graph from uber data slicer and dicer Greg Weldon ( www.weldononline.com). Notice that part-time workers “for economic reasons” is the highest on record at 9.4 million. My take on this is that part-time workers are no longer a leading indicator but simply a manifestation of the new reality that employers don’t want to take on the burden of a full-time employee who may not be needed or who comes with costly benefits under the new regulatory and health-care regimes.

State and local governments shed 39,000 jobs, the largest percentagewise loss since 1982. Those jobs mean something, and as state and local governments lose their stimulus money they will continue to shed jobs as they are forced to work with less revenue. Even after many places have raised taxes, revenues are down 3%. The consumption that government workers contribute to final consumer demand is just as important as that resulting from private jobs.

20% of personal income is now coming from the US government, and wages are flat. If you take into account the tax that is rising energy prices, that means many workers are falling behind the disposable-income curve.

Where Will the Jobs Come From?

Back to Dunk from the NFIB: “The percent of owners with unfilled (hard to fill) openings remained at 11% of all firms, historically a weak showing. Over the next three months, 13 percent plan to reduce employment (up 3 points), and 8 percent plan to create new jobs (unchanged), yielding a seasonally adjusted net -3 percent of owners planning to create new jobs, 4 points worse than August. The urge (based on economic factors) to create new jobs is clearly missing in the current economy and expectations for future business conditions are not supportive of job creation. Plans to create new jobs have lagged other recovery periods significantly.

“Overall, the job creation picture is still bleak. Weak sales and uncertainty about the future continue to hold back any commitments to growth, hiring or capital spending. Economic policies enacted or proposed continue to fail to address the most important players in the economy – the consumer. The President promised to continue to push his agenda for higher energy costs, few believe the health care bill will actually help them, and there is huge uncertainty about a VAT tax and the fate of the “Bush tax cuts”. Deficits are at “trauma” level, incomprehensible to the average citizen. No relief, just promises that the consumer sector will be asked to pay more of their income to support government spending. This has left consumer and business owner sentiment in the “dumpster”, unwilling to spend or hire.”

The employment surveys mentioned above are basically completed by the middle of the month. But yesterday a Gallup poll suggested that unemployment may be headed back to over 10%, and that the latter half of September was weaker than the first half. From the release:

“The rate of those ‘underemployed’ – mostly part-time workers – increased slightly to 18.8 percent, suggesting that the number of workers employed part-time but seeking full-time work is declining as the unemployment rate increases. Gallup explains ‘this may reflect a reduced company demand for new part-time employees.’

“This rate is likely to not be reflected by federal numbers to be released Friday, Gallup says, because the government numbers are based on conditions around the middle of September.

“Nevertheless, Gallup says the trend shows continuing high unemployment which does not help the economy, and could hurt retail sales during the holiday season.

“Gallup concludes by saying, ‘The jobs picture could be deteriorating more rapidly than the government’s job release suggests.'”

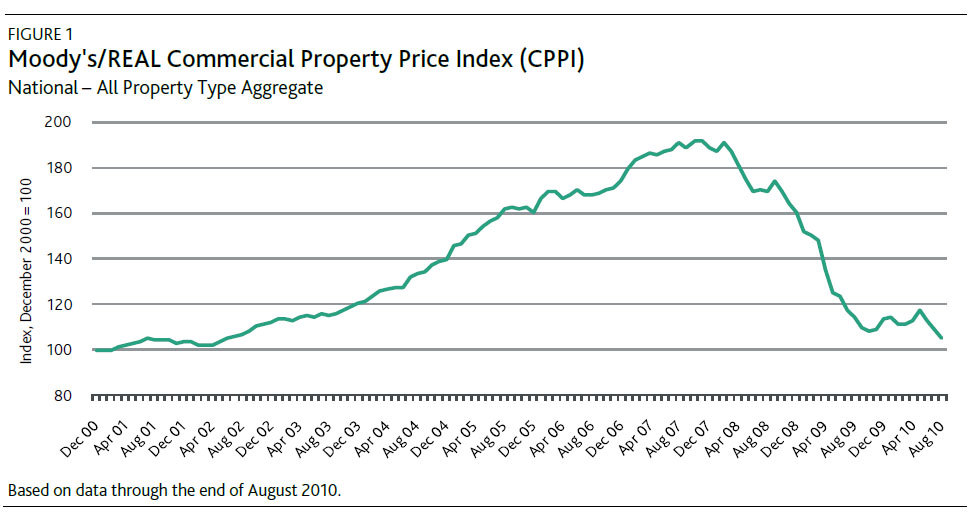

OK, the job picture is terrible. GDP is clearly slowing down. Consumer spending and retails sales are abysmal. Consumer credit creation is visibly falling, down for seven months in a row. Housing construction is not coming back any time soon. Commercial real estate is sick, with mall vacancy rates at almost 10%. Inflation (except in commodity and energy prices) is under 1%. The approximately 3% GDP growth we have seen the last four quarters was almost 2/3 inventory rebuilding, not a sustainable growth source.

It is pretty clear there will not be much more coming from the US government in the way of new stimulus. If you’re a Keynesian and in charge of the Fed or Treasury (which is the case), what are you to do?

The Ride of the Keynesian Cowboys

The Fed is basically down to one bullet in its policy gun. It cannot lower rates beyond zero, although it can pull down longer-term rates if it so chooses. But lower rates so far have not been the answer to creating jobs and inflation. All less-subtle instruments of monetary policy have been tried. The final option is massive quantitative easing, the monetization of US government debt. As the saying goes, if all you have is a hammer, all the world looks like a nail. And after the last FOMC meeting, the markets have openly embraced quantitative easing. And for good reason: that is the talk coming from the leadership of the Fed.

Since my friend Greg Weldon has so thoughtfully collected some of the more salient parts of some recent Fed speeches, let’s turn the next few paragraphs over to him.

“We note the following quotes, starting with the would-be-hero, maybe-headed-for-monetary-hell, Fed Chairman, Ben Boom-Boom Bernanke himself …

… “‘I do think that additional purchases, although we do not have precise numbers for how big the effects are, I do think they have the ability to ease financial conditions.’

“Next we note commentary that sparked Monday’s extension lower in US Treasury Note yields, from New York Fed President William Dudley:

“‘Fed action is likely to be warranted unless the economic outlook evolves in a way that makes me more confident that we will see better outcomes for both employment and inflation before too long.’

“Indeed, the Fed will keep pumping, until it sees the proverbial whites-of-their-eyes, as it relates to inflation, and job growth.

“More from Dudley …

… “‘The outlook for US job growth and inflation is unacceptable. We have tools that can provide additional stimulus at costs that do not appear to be prohibitive.’

“Indeed, when we first used the word ‘deflation’ in the Money Monitor, back in the nineties, and into the first part of the last decade, people scoffed, as this was a word equated to ‘monetary blasphemy’… and I might have been ‘charged’ as a ‘heretic’ for suggesting that, someday, the Fed would PURSUE INFLATION as a POLICY GOAL.

“Now, the New York Fed President openly states that subdued inflation is …

… ‘UNACCEPTABLE’!!!!

“Welcome to the new world order, where deflation is openly discussed, and inflation is, in fact, pursued by the Federal Reserve, as a policy goal.”

Greg goes on to quote Chicago Fed president Charles Evans as favoring easing, and you can bet vice-chair Janet Yellen is on board.

But there are voices that question the need for QE2. From the Bill King Report:

“Hoenig Opposes Further Fed Easing, Warns About Prices

“Kansas City Federal Reserve Bank President Thomas Hoenig said the central bank shouldn’t expand its balance sheet by purchasing more Treasury securities in an effort to spur economic growth… The Kansas City Fed official repeated his view that the Fed should raise its short-term target rate to 1 percent, then pause to assess the economy’s recovery. He also rejected the idea of raising the Fed’s informal inflation target above 2 percent because of concern over the possibility of falling prices.

“‘I have to tell you it horrifies me,’ Hoenig said, responding to an audience question. “It assumes you can fine-tune things like interest rates.” ‘I have never agreed to’ an informal inflation target, he said. ‘Two percent inflation over a generation is a big impact.'” http://www.moneynews.com/StreetTalk/HoenigOpposesFurtherFed/2010/10/07/id/372979

And then we have a speech from Dallas Fed president Richard Fisher that he gave yesterday at the Minneapolis Economics Club. I highly recommend you take a few minutes to read it in its entirety. It is well-written and thoughtful. We need more men like him on the Fed. ( http://www.dallasfed.org/news/speeches/fisher/2010/fs101007.cfm)

Let me give you a few paragraphs (all emphasis mine!):

“… In my darkest moments I have begun to wonder if the monetary accommodation we have already engineered might even be working in the wrong places. Far too many of the large corporations I survey that are committing to fixed investment report that the most effective way to deploy cheap money raised in the current bond markets or in the form of loans from banks, beyond buying in stock or expanding dividends, is to invest it abroad where taxes are lower and governments are more eager to please. This would not be of concern if foreign direct investment in the U.S. were offsetting this impulse. This year, however, net direct investment in the U.S. has been running at a pace that would exceed minus $200 billion, meaning outflows of foreign direct investment are exceeding inflows by a healthy margin. We will have to watch the data as it unfolds to see if this is momentary fillip or evidence of a broader trend. But I wonder: If others cotton to the view that the Fed is eager to “open the spigots,” might this not add to the uncertainty already created by the fiscal incontinence of Congress and the regulatory and rule-making ‘excesses’ about which businesses now complain?

“… In performing a cost/benefit analysis of a possible QE2, we will need to bear in mind that one cost that has already been incurred in the process of running an easy money policy has been to drive down the returns earned by savers, especially those who do not have the means or sophistication or the demographic profile to place their money at risk further out in the yield curve or who are wary of the inherent risk of stocks. A great many baby boomers or older cohorts who played by the rules, saved their money and have migrated over time, as prudent investment counselors advise, to short- to intermediate-dated, fixed-income instruments, are earning extremely low nominal and real returns on their savings. Further reductions in rates earned on savings will hardly endear the Fed to this portion of the population. Moreover, driving down bond yields might force increased pension contributions from corporations and state and local governments, decreasing the deployment of monies toward job maintenance in the public sector.

“My reaction to reading that article [what Fisher called that eye-popping headline in yesterday’s Wall Street Journal: “Central Banks Open Spigot”] was that it raises the specter of competitive quantitative easing. Such a race would be something of a one-off from competitive devaluation of currencies, a beggar-thy-neighbor phenomenon that always ends in tears. It implies that central banks should carry the load for stymied fiscal authorities – or worse, give in to them – rather than stick within their traditional monetary mandates and let legislative authorities deal with the fiscal mess they have created. It infers that lurking out in the future is a slippery slope of quantitative easing reaching beyond just buying government bonds (and in our case, mortgage-backed securities). It is one thing to stabilize the commercial paper market in a systematic way. Going beyond investment-grade paper, however, opens the door to pressure on a central bank to back financial instruments benefiting specific economic sectors. This inevitably leads to irritation or lobbying for similar treatment from economic sectors not blessed by similar monetary largess.

“In his recent book titled Fault Lines, Raghuram Rajan reminds us that, ‘More always seems better to the impatient politician [policymaker]. But any instrument of government policy has its limitations, and what works in small doses can become a nightmare when scaled up, especially when scaled up quickly…. Furthermore, the private sector’s objectives are not the government’s objectives, and all too often, policies are set without taking this disparity into account. Serious unintended consequences can result.'”

Hear. Oh, hear!

Can Fisher and Hoenig stand athwart the Keynesian tide at the Fed and get it to stop? Or for that matter, can the growing chorus of noted economists and analysts who openly question the need or wisdom of a QE2?

I doubt it. The Keynesian Cowboys are saddling their QE horses and they intend to ride. They have no idea what the end result will be. This is all a guess based on pure theory and models (like the broken money multiplier). And I really question whether the result they hope for is worth the risk of the unintended consequences (more later). As I wrote a few weeks ago:

“If it is because they don’t have enough capital, then adding liquidity to the system will not help that. If it is because they don’t feel they have creditworthy customers, do we really want banks to lower their standards? Isn’t that what got us into trouble last time? If it is because businesses don’t want to borrow all that much because of the uncertain times, will easy money make that any better? As someone said, ‘I don’t need more credit, I just need more customers.'”

How much of an impact would $2 trillion in QE give us? Not much, according to former Fed governor Larry Meyer, who, according to Morgan Stanley, “… maintains a large-scale macro-econometric model of the US economy that is widely used in the private sector and in public policy-making circles. These types of models are good for running ‘what if?’ simulations. Meyer estimates that a $2 trillion asset purchase program would: 1) lower Treasury yields by 50bp; 2) increase GDP growth by 0.3pp in 2011 and 0.4pp in 2012; and 3) lower the unemployment rate by 0.3pp by the end of 2011 and 0.5pp by the end of 2012. However, Meyer admits that these may be ‘high-end estimates’.

“Some probability of a resumption of asset purchases is already priced in, and thus a full 50bp response in Treasuries is unlikely. Moreover, a model such as Meyer’s is based on normal historical relationships and therefore assumes that the typical transmission mechanisms are working. For example, a drop in Treasury yields would lower borrowing costs for consumers and businesses, helping to stimulate consumption, business investment and housing. But there is good reason to believe that the transmission mechanism is at least partially broken at present, and thus the pass-through benefit to the economy associated with a small decline in Treasury yields (relative to current levels) would likely be infinitesimal.” (Morgan Stanley)

It is clear, at least from the speeches I read, that if the economy continues to sputter and looks like it may fall into recession, that the need to DO SOMETHING will overwhelm all caution. Not trying the last tool in the box if the economy is rolling over is just not something that will be considered by those of the Keynesian persuasion. Never mind that Congress is getting ready to raise taxes (and has already done so in the case of Obamacare, to the tune of almost 1% of GDP!); in the face of a slowing economy, the Fed is going to step in and try to do something.

Let me be clear. We do NOT have a monetary problem. And whatever solutions we need are not monetary. This is on Congress and the Administration. The Fed needs to step aside.

Let Us Count the Unintended Consequences

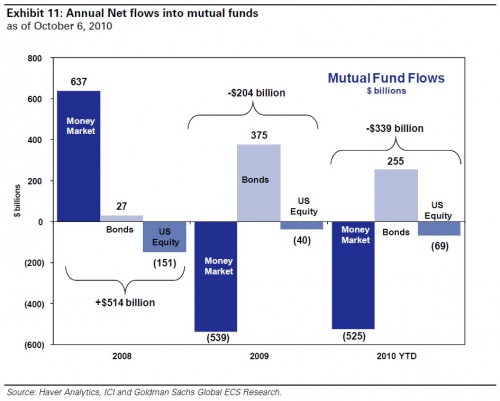

Is there a chance that it could work? The short answer is, “Yes, but I doubt it.” The whole purpose of QE2 is to try and get consumers and businesses spending. For a Keynesian, it is all about stimulating final consumer demand. That is tough in a world coming out of a credit crisis, where consumers are wanting to deleverage.

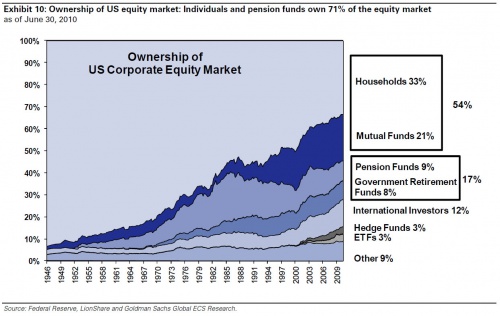

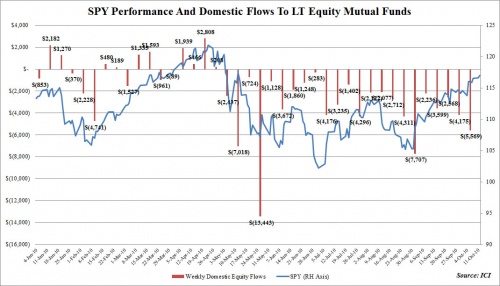

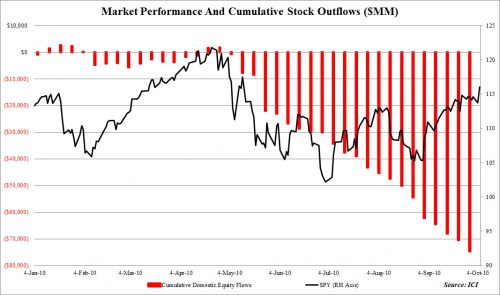

But what if they push a few trillion into the economy and it shows up in the stock market? Or the market just feels good that “Daddy” is doing something and runs up on its own? Can that change consumer sentiment? Will we feel like spending more? Could that be the catalyst? Maybe, but I doubt it. But you can bet your last trillion they are going to try.

It is doubtful that any QE2 that is enough to really do something in the way of reflating assets will be good for the dollar. Now, cynics might say that is the point, as a falling dollar is supposed to help our exports (and for my international readers, I get it that this is at the expense of other countries). Do we really want to open the first salvo in a race to the currency bottom? If the Fed does it, it gets legitimized everywhere.

(By the way, as I noted a few weeks ago, my call for parity for the euro and the pound is temporarily on hold. Stay tuned. We will get back to it.)

But QE2 also drives up commodity costs. Rising oil prices have the same effect on spending as a tax increase. As do rising food costs, etc.

How does one control inflation by printing money on the order of 10% or more of GDP? Is 3% ok? Do you really want to get to 4% and then have to start taking off the stimulus to get inflation under control, and push us back into recession?

You don’t get inflation without a rise in interest rates. What about the increased costs of financing an ever-rising government debt? And aren’t higher rates what the Fed is fighting? Talk about confusing the market.

Does the Fed really want us to get our animal spirits back up and go back in and borrow more money? Isn’t too much leverage what got us into this problem to begin with? Does the Fed really want to persuade us to go out and buy mispriced assets? Should we buy stocks now in hopes that QE2 somehow finds a transmission mechanism and keeps us from recession? If it doesn’t work, then all those buyers will get their heads handed to them, making matters even worse.

What if, as I think likely, the QE money simply makes a round trip back to the Fed balance sheet? Do we go for QE3? At the Barefoot Economic Summit I just attended (see more below), one very well-connected economist said he would start getting interested about QE when it approached $6 trillion. That is the number he thinks would be needed to actually have an effect. It raised a few eyebrows when he told that to David Faber on CNBC.

If the money makes a round trip back to the Fed, the markets will get spooked. All kinds of markets.

The only way I think they do not pursue QE is if the economic data in the next few months suggests the economy is beginning to heal itself. That will make the next few months worth of data more critical than usual. The stock market seems convinced that QE2 will be good for the economy and the markets, and thus bad news will be perversely considered good.

Sadly, if we go down that path I think this is going to end in tears. There are just too many unintended consequences that can reach up and bite us in our collective derrieres. I am not sanguine about 2011. I dearly, truly hope I am wrong. For your sake, gentle reader, and for my seven kids.

I want to thank Kyle Bass and his partners for inviting me to attend the Barefoot Economic Summit this week. It was one of the most interesting and thought-provoking meetings I have ever been to, with so many genuinely nice people. I took a lot of notes, and those ideas are going to filter into this letter over the next few weeks as I digest them.

A few quick impressions. First, many of these people were among the biggest hedge-fund managers, or really well-connected analysts. I truly felt that your humble analyst was there for comic relief. These guys can afford the very best consultants and advisors and staff.

That being said, the general level of perplexity and lack of clarity was striking. If you, gentle reader, are confused about the times, then you are in very good company. The future seems to be extraordinarily uncertain. I really didn’t get the sense of aggressiveness that you would normally think would be associated with these Masters of the Universe. The humility in the room was refreshing. There was an air of caution that was palpable.

There were two Congressmen at the conference, Jeb Hensarling and Randy Neugebauer. I was quite impressed with them. They are genuinely looking for solutions and recognize the limitations of government. Would that we had more like them. (Jeb had the best line about Obamacare, during last year’s debate: “There are three unintended consequences on each page of this bill.”)

Have a great week. Besides the Ranger game, we find out if the Cowboys are for real, a game I will watch with a few kids in tow. And then back to finishing my book. It is just all too much fun!

Your really wishing he had caught a 12-pounder analyst,

John Mauldin

John@FrontLineThoughts.com

Copyright 2010 John Mauldin. All Rights Reserved