IMF Cuts 2011 Global Growth

Posted By thestatedtruth.com on October 6, 2010

Posted By thestatedtruth.com on October 6, 2010

Posted By thestatedtruth.com on October 5, 2010

Posted By thestatedtruth.com on October 5, 2010

Hmm….This could get interesting with the Russians in control of the natural gas pipelines to Europe.  It’s also another reason why NATO has lost much of its power in Europe.  Â

Forecasters say this winter could be the coldest Europe has seen in at least 100 or more years.

In Russia, authorities are drawing up measures to help Muscovites survive the extreme cold. The change is reportedly connected with the speed of the Gulf Stream, which has shrunk in half in just the last couple of years. Polish scientists say that it means the stream will not be able to compensate for the cold from the Arctic winds. According to them, if or when the stream is completely stopped, a new Ice Age will begin in Europe.

Posted By thestatedtruth.com on October 5, 2010

From Art cashin on the floor of  The New York Stock Exchange……

Not Quite What They Seem – Our UBS pal in London, Andy Lees, put out an eye-opening piece on China this morning. Andy sees China becoming more vulnerable because of their growing energy dependence. The piece is too big to fully reproduce but here are some key parts:

Conventional wisdom is that the western world has entered a period of contraction, that the US is falling from its pedestal and that China is regaining the position it lost 500 odd years ago as the dominant power in the world. This kind of superficial picture is worse than that spouted in the 1950’s and 1960’s involving the extrapolation of former Soviet growth to the point where Khrushchev famously declared “We will bury youâ€. Like the Soviet Union, China’s economic strength has mainly been driven by factor mobilisation rather than efficiency and productivity gains, explaining why Green GDP (its total balance sheet) is said to be flat over the last 20 years – (the Chinese government actually published a form of Green GDP in 2006 re 2004 data which supported this finding, but the following year they blocked the publication and stopped its use). It uses more energy than the US economy which is about twice the size, and nearly five times as much as Japan’s economy which is of similar size. It clearly uses more labour and according to The World’s Water 2008 – 2009, it uses ten times the water per unit of industrial output than developed countries in general. As with the Soviet Union, state direction of capital means that imbalances can be sustained for a long period of time, only being limited by the exhaustion of resources or by social unrest, which is only likely if the economy is slowing down, hence why China will continue to drive at full speed into the eventual brick wall.

As resource countries benefit, they suffer from the so-called Dutch Disease. As oil exports become more valuable driving the currency higher, the competitiveness of other domestic industries deteriorates causing imports to rise and exports to fall. Within the country itself, the high returns available from the oil industry act as a magnet to capital, increasing the cost of funding for other industries. Some sort of capital control or internal subsidy is therefore necessary to maintain the value added within the country. This acts to hollow out the energy importers and cause large international imbalances to continue accumulating; it taxes efficiency and rewards inefficiency unlike a free market which would do exactly the opposite. The reason this is relevant to China and its capital controls is that, as the world’s largest energy producer by some margin, it also suffers from the Dutch Disease. Without capital controls its natural inefficiencies mean it is unlikely to be able to compete on the world markets or even domestically against foreign imports.

Andy goes on to point out that China has managed to use its vast coal reserves as a crutch. Those reserves will not sustain its energy needs in coming years. Andy also notes that China may be hearing footsteps in the trading area. Several smaller Asian nations are selling much more than China. Japan has pulled dead even on trade. Even Mexico is gaining market share at China’s expense.

Here’s how Andy concludes his thoughtful piece:

We are told that China has been the main driver of global growth in recent years as indeed it has. We shouldn’t forget however that by using its massive production of fossil fuels to impose capital controls on the rest of us, this growth has to a large extent simply been transferred from abroad, and in particular it has been taken from investment in productivity advancement. Though quite stunning, China’s growth has been at the expense of global economic advancement as it has used its fuel to support inefficient domestic industry rather than export the fuel to countries that could produce more with the energy. To be fair to China, not many countries wanted their coal as it didn’t necessarily suit our greener credentials; it was preferential to see China pollute its own environment and sell us the goods. It is here where the US could quite easily turn the table back on China by imposing an equalising tax on the embedded carbon within all manufactured goods. This would likely get wide public support and would go down extremely well in Japan and Europe. As very energy efficient manufacturers, it would effectively offset the impact of NAFTA and help tie them more closely to a US centric bloc, the scale of which would dwarf China and therefore gradually isolate it. Whilst I would generally not support taxes as an efficient method of allocating capital, in this circumstance it’s actually quite clever, taxing inefficiency. Whether such measures are imposed or not, the fact that capital is being allocated badly will eventually result in an economic bust for China in just the same way that it did for the USSR.

Posted By thestatedtruth.com on October 5, 2010

By George Friedman

The U.S. government issued a warning Oct. 3 advising Americans traveling to Europe to be “vigilant.†U.S. intelligence apparently has acquired information indicating that al Qaeda is planning to carry out attacks in European cities similar to those carried out in Mumbai, India, in November 2008. In Mumbai, attackers armed with firearms, grenades and small, timed explosive devices targeted hotels frequented by Western tourists and other buildings in an attack that took three days to put down.

European security forces are far better trained and prepared than their Indian counterparts, and such an attack would be unlikely to last for hours, much less days, in a European country. Still, armed assaults conducted by suicide operatives could be expected to cause many casualties and certainly create a dramatic disruption to economic and social life.

The first question to ask about the Oct. 3 warning, which lacked specific and actionable intelligence, is how someone can be vigilant against such an attack. There are some specific steps that people can and should take to practice good situational awareness as well as some common-sense travel-security precautions. But if you find yourself sleeping in a hotel room as gunmen attack the building, rush to your floor and start entering rooms, a government warning simply to be vigilant would have very little meaning.

The world is awash in intelligence about terrorism. Most of it is meaningless speculation, a conversation intercepted between two Arabs about how they’d love to blow up London Bridge. The problem, of course, is how to distinguish between idle chatter and actual attack planning. There is no science involved in this, but there are obvious guidelines. Are the people known to be associated with radical Islamists? Do they have the intent and capability to conduct such an attack? Were any specific details mentioned in the conversation that can be vetted? Is there other intelligence to support the plot discussed in the conversation?

The problem is that what appears quite obvious in the telling is much more ambiguous in reality. At any given point, the government could reasonably raise the alert level if it wished. That it doesn’t raise it more frequently is tied to three things. First, the intelligence is frequently too ambiguous to act on. Second, raising the alert level warns people without really giving them any sense of what to do about it. Third, it can compromise the sources of its intelligence.

The current warning is a perfect example of the problem. We do not know what intelligence the U.S. government received that prompted the warning, and I suspect that the public descriptions of the intelligence do not reveal everything that the government knows. We do know that a German citizen was arrested in Afghanistan in July and has allegedly provided information regarding this threat, but there are likely other sources contributing to the warning, since the U.S. government considered the intelligence sufficient to cause concern. The Obama administration leaked on Saturday that it might issue the warning, and indeed it did.

The government did not recommend that Americans not travel to Europe. That would have affected the economy and infuriated Europeans. Leaving tourism aside, since tourism season is largely over, a lot of business is transacted by Americans in Europe. The government simply suggested vigilance. Short of barring travel, there was nothing effective the government could do. So it shifted the burden to travelers. If no attack occurs, nothing is lost. If an attack occurs, the government can point to the warning and the advice. Those hurt or killed would not have been vigilant.

I do not mean to belittle the U.S. government on this. Having picked up the intelligence it can warn the public or not. The public has a right to know, and the government is bound by law and executive order to provide threat information. But the reason that its advice is so vague is that there is no better advice to give. The government is not so much washing its hands of the situation as acknowledging that there is not much that anyone can do aside from the security measures travelers should already be practicing.

The alert serves another purpose beyond alerting the public. It communicates to the attackers that their attack has been detected if not penetrated, and that the risks of the attack have pyramided. Since these are most likely suicide attackers not expecting to live through the attack, the danger is not in death. It is that the Americans or the Europeans might have sufficient intelligence available to thwart the attack. From the terrorist point of view, losing attackers to death or capture while failing to inflict damage is the worst of all possible scenarios. Trained operatives are scarce, and like any strategic weapon they must be husbanded and, when used, cause maximum damage. When the attackers do not know what Western intelligence knows, their risk of failure is increased along with the incentive to cancel the attack. A government warning, therefore, can prevent an attack.

In addition, a public warning can set off a hunt for the leak within al Qaeda. Communications might be shut down while the weakness is examined. Members of the organization might be brought under suspicion. The warning can generate intense uncertainty within al Qaeda as to how much Western intelligence knows. The warning, if it correlates with an active plot, indicates a breach of security, and a breach of security can lead to a witch-hunt that can paralyze an organization.

Therefore, the warning might well have served a purpose, but the purpose was not necessarily to empower citizens to protect themselves from terrorists. Indeed, there might have been two purposes. One might have been to disrupt the attack and the attackers. The other might have been to cover the government if an attack came.

In either case, it has to be recognized that this sort of warning breeds cynicism among the public. If the warning is intended to empower citizens, it engenders a sense of helplessness, and if no attack occurs, it can also lead to alert fatigue. What the government is saying to its citizenry is that, in the end, it cannot guarantee that there won’t be an attack and therefore its citizens are on their own. The problem with that statement is not that the government isn’t doing its job but that the job cannot be done. The government can reduce the threat of terrorism. It cannot eliminate it.

This brings us to the strategic point. The defeat of jihadist terror cells cannot be accomplished defensively. Homeland security can mitigate the threat, but it can never eliminate it. The only way to eliminate it is to destroy all jihadist cells and prevent the formation of new cells by other movements or by individuals forming new movements, and this requires not just destroying existing organizations but also the radical ideology that underlies them. To achieve this, the United States and its allies would have to completely penetrate a population of about 1.3 billion people and detect every meeting of four or five people planning to create a terrorist cell. And this impossible task would not even address the problem of lone-wolf terrorists. It is simply impossible to completely dominate and police the entire world, and any effort to do so would undoubtedly induce even more people to turn to terrorism in opposition to the global police state.

Will Rogers was asked what he might do to deal with the German U-boat threat in World War I. He said he would boil away the Atlantic, revealing the location of the U-boats that could then be destroyed. Asked how he would do this, he answered that that was a technical question and he was a policymaker.

The idea of suppressing jihadist terrorism through direct military action in the Islamic world would be an idea Will Rogers would have appreciated. It is a superb plan from a policymaking perspective. It suffers only from the problem of technical implementation. Even native Muslim governments motivated to suppress Islamic terrorism, like those in Egypt, Saudi Arabia, Algeria or Yemen, can’t achieve this goal absolutely. The idea that American troops, outnumbered and not speaking the language or understanding the culture, can do this is simply not grounded in reality.

The United States and Europe are going to be attacked by jihadist terrorists from time to time, and innocent people are going to be killed, perhaps in the thousands again. The United States and its allies can minimize the threat through covert actions and strong defenses, but they cannot eliminate it. The hapless warning to be vigilant that was issued this past weekend is the implicit admission of this fact.

This is not a failure of will or governance. The United States can’t conceivably mount the force needed to occupy the Islamic world, let alone pacify it to the point where it can’t be a base for terrorists. Given that the United States can’t do this in Afghanistan, the idea that it might spread this war throughout the Islamic world is unsupportable.

The United States and Europe are therefore dealing with a threat that cannot be stopped by their actions. The only conceivably effective actions would be those taken by Muslim governments, and even those are unlikely to be effective. There is a deeply embedded element within a small segment of the Islamic world that is prepared to conduct terror attacks, and this element will occasionally be successful.

All people hate to feel helpless, and this trait is particularly strong among Americans. There is a belief that America can do anything and that something can and should be done to eliminate terrorism and not just mitigate it. Some Americans believe sufficiently ruthless military action can do it. Others believe that reaching out in friendship might do it. In the end, the terrorist element will not be moved by either approach, and no amount of vigilance (or new bureaucracies) will stop them.

It would follow then that the West will have to live with the terrorist threat for the foreseeable future. This does not mean that military, intelligence, diplomatic, law-enforcement or financial action should be stopped. Causing most terrorist attempts to end in failure is an obviously desirable end. It not only blocks the particular action but also discourages others. But the West will have to accept that there are no measures that will eliminate the threat entirely. The danger will persist.

Effort must be made to suppress it, but the level of effort has to be proportional not to the moral insult of the terrorist act but to considerations of other interests beyond counterterrorism. The United States has an interest in suppressing terrorism. Beyond a certain level of effort, it will reach a point of diminishing returns. Worse, by becoming narrowly focused on counterterrorism and over-committing resources to it, the United States will leave other situations unattended as it focuses excessively on a situation it cannot improve.

The request that Americans be vigilant in Europe represents the limits of power on the question of terrorism. There is nothing else that can be done and what can be done is being done. It also drives home the fact that the United States and the West in general cannot focus all of its power on solving a problem that is beyond its power to solve. The long war against terrorism will not be the only war fought in the coming years. The threat of jihadism must be put in perspective and the effort aligned with what is effective. The world is a dangerous place, as they say, and jihadism is only one of the dangers.

“Terrorism, Vigilance and the Limits of the War on Terror is republished with permission of STRATFOR.”

Â

Posted By thestatedtruth.com on October 4, 2010

The Mortgage Mess as it affectionately is called seems to be getting new names with each passing day – the latest one is, quite appropriately RoboSigning Scandal During today’s CNBC Kudlow segment Diana Ollick confirms various so far unfounded rumors that the government is planning to institute a 90 day foreclosure moratorium as it deals with the realization of just how big and pervasive the mortgage problem is, and even worse will soon be. Larry Kudlow noted that this is the “housing equivalent of the credit financial meltdown” and that “this is going to go on for ever.” The biggest issue that is now developing is the fact that title insurers (firms such as Fidelity National, First American, Stewart Info and Old Republic) are refusing to insure mortgages in foreclosure or otherwise, uncertain as to who actually owns the title. And for all those who believe this will merely keep prices artificially high,  there is very bad news – the problem with the title insurers walking away on fears of lawsuits is that no lender will be willing to write a mortgage without title insurance, meaning that suddenly the up-front component of home purchases will either have to surge, or home prices will have to fall by a like amount as there is simply not enough equity (money) to cover the resulting debt deficiency.

Kudlow: “We’re not talking just a few weeks, or a few months. This sounds like a long, drawn-out, bureaucratic, robotic process with lawyers, and oh my gosh.” Another implication: a veritable bonanza for both lawyers and defaulters, the former of whom will end up making billions in legal fees while the latter will be able to live mortgage free for years, while continuing to be the ultimate consumer.

Another important topic discussed is the fact that due to decades of faulty securitizations, suddenly no bank knows who owns what. Courtesy of several trillion in now title-undefined mortgages, which in turn form the basis for thousands of CDOs, which in turn are split up into millions of tranches, and includes the complicity of Fannie, Freddie and private label, it is the banks and their clients that have shot themselves in the foot: as other have noted, very soon, the entire MBS process can and very may grind to a halt.

As mentioned earlier, Ollick confirms that according to rumors, the government is going to impose “some kind of 90 day foreclosure moratorium on the banks which would melt down the housing market.” In fact Congressman Merkley already indicated he is for a foreclosure moratorium.

At the end of the day: the one true loser, is the law-abiding, conscientious, tax and mortgage paying middle class American, who is now preparing for TARP 2 as the banks will all almost definitely need to run to another bailout because of this catastrophe.

Must watch 10 minute discussion of this important story.

More at: www.zerohedge.com

Posted By thestatedtruth.com on October 4, 2010

Possible targets in the suspected European terror plot are pre-security areas in at least five major European airports, a law enforcement official told ABC News. Authorities believe terror teams are preparing to mount a commando like attack featuring small units and small firearms modeled after the Mumbai attack two years ago.

The State Department issued a highly unusual “Travel Alert” Sunday for “potential terrorist attacks in Europe,” saying U.S. citizens are “reminded of the potential for terrorists to attack public transportation systems and other tourist infrastructure.”

Posted By thestatedtruth.com on October 4, 2010

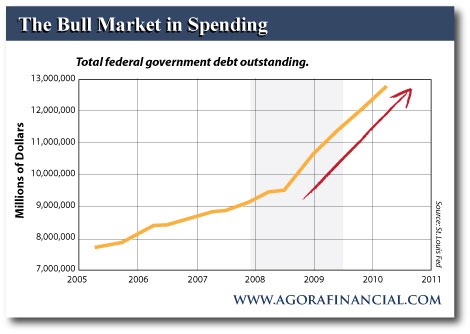

Recovery, what recovery!

Posted By thestatedtruth.com on October 3, 2010

The government already has unveiled guidelines for free enterprise activities in 178 fields, as part of the plan to absorb workers set to be laid off into a newly-expanded private sector. Cuba is the only communist country in the Americas, that business is all government-run.

New reforms will allow Cubans to become accountants, masseuses, park custodians, or even open small fruit and vegetable stores, according to the rules set out in the state-run daily Granma. But many have doubts about the experiment’s ability to absorb so many former state workers.

“It is true that some families could be hard hit during the implementation of this measure,” the official Cuban Communist Party newspaper Granma allowed. “But behind them will be the humanist Revolution, evaluating and offering solutions based on real possibilities.”

Posted By thestatedtruth.com on October 1, 2010

Data from the new Census report created the following income distribution chart:

So…..35% of U.S. households live on $35,000 or less.   Those making more than $100,000 fall under the top 20 percent category. But the real income disparity shows up clearly once you go over the $200,000 range. The top 20 percent of Americans made close to 50 percent of all income while those below the poverty line made up 3.4 percent. This ratio of 14.5 to 1 is the highest on record. In 2008 the ratio was at 13.6 and back in 1968 it was 7.69.

More at: http://www.mybudget360.com/

Posted By thestatedtruth.com on October 1, 2010

By ALAN ZIBEL

October 1, 2010

WASHINGTON -Â Bank of America is delaying foreclosures in 23 states as it examines whether it rushed the foreclosure process for thousands of homeowners without reading the documents.

The move adds the nation’s largest bank to a growing list of mortgage companies whose employees signed documents in foreclosure cases without verifying the information in them.

Bank of America isn’t able to estimate how many homeowners’ cases will be affected, Dan Frahm, a spokesman for the Charlotte, N.C.-based bank, said Friday. He said the bank plans to resubmit corrected documents within several weeks.

Two other companies, Ally Financial Inc.’s GMAC Mortgage unit and JPMorgan Chase, have halted tens of thousands of foreclosure cases after similar problems became public.

The document problems could cause thousands of homeowners to contest foreclosures that are in the works or have been completed. If the problems turn up at other lenders, a foreclosure crisis that’s already likely to drag on for several more years could persist even longer. Analysts caution that most homeowners facing foreclosure are still likely to lose their homes.

State attorneys general, who enforce foreclosure laws, are stepping up pressure on the industry.

On Friday, Connecticut Attorney General Richard Blumenthal asked a state court to freeze all home foreclosures for 60 days. Doing so “should stop a foreclosure steamroller based on defective documents,” he said.

And California Attorney General Jerry Brown called on JPMorgan to suspend foreclosures unless it could show it complied with a state consumer protection law. The law requires lenders to contact borrowers at risk of foreclosure to determine whether they qualify for mortgage assistance.

More at: http://www.washingtonpost.com/wp-dyn/content/article/2010/10/01/AR2010100105392_pf.html

Posted By thestatedtruth.com on September 30, 2010

The U.S. Postal Service was denied a proposed increase in rates after its regulator said the agency couldn’t justify the request. The decision left the price of first-class stamps unchanged at 44 cents.

The Postal Regulatory Commission in Washington today said the service couldn’t support a proposal for an average increase of 5.6 percent when the inflation rate is only 0.6 percent. The postal service said the recession has cut mail volume and revenue.

“There will be no rate increases as a result of our decision for any class of mail,†Ruth Goldway, chairman of the regulatory commission, said today at a Washington news conference.

Posted By thestatedtruth.com on September 30, 2010

September 30, 2010

The Eiffel Tower was evacuated Sept. 28 after an anonymous bomb threat against the symbolic Parisian tourist attraction was phoned in; no explosive device was found. The day before the Eiffel Tower threat, French authorities closed the Gare Saint-Lazare in central Paris after an abandoned package, later determined innocuous, was spotted in the train station.

These two incidents serve as the latest reminders of the current apprehension in France that a terrorist attack is imminent. This concern was expressed in a very public way Sept. 11, when Bernard Squarcini, the head of France’s Central Directorate of Interior Intelligence (known by its French acronym, DCRI), told French newspaper Le Journal du Dimanche that the risk of an attack in France has never been higher. Never is a long time, and France has long faced terrorist threats, making this statement quite remarkable.

Squarcini has noted in recent interviews that the combination of France’s history as a colonial power, its military involvement in Afghanistan and the impending French ban on veils that cover the full face and body (niqabs and burqas) combined to influence this threat environment.

After the French Senate approved the burqa ban Sept. 14 — which will go into effect next March — a bomb threat against the Eiffel Tower was called in that evening, causing French authorities to evacuate the site and sweep it for explosive devices.

On Sept. 16, five French citizens were abducted from the Nigerien uranium-mining town of Arlit in an operation later claimed by al Qaeda in the Islamic Maghreb (AQIM), a claim French Defense Minister Herve Morin later assessed as valid. In July, French Prime Minister Francois Fillon declared that France was at war with the North African al Qaeda franchise after the group killed a French hostage it had kidnapped in April. Fillon’s announcement came three days after the end of a four-day French-Mauritanian offensive against AQIM militants that resulted in the deaths of several militants. After the offensive, AQIM branded French President Nicolas Sarkozy an enemy of Allah and warned France that it would not rest until it had avenged the deaths of its fighters.

French officials have also received unsubstantiated reports from foreign liaison services of plans for suicide bombings in Paris. National Police Chief Frederic Pechenard told Europe 1 radio Sept. 22 that in addition to the threatening statements from AQIM, the French have received specific information that the group is working to target France.

On Sept. 6, Der Spiegel reported that authorities were investigating reports provided by the United States that a German-born Islamist extremist arrested in Afghanistan has warned of possible terrorist attacks in Germany and elsewhere in Europe — including France — planned by jihadists based in Pakistan. This story hit the English-language media Sept. 28, and included reports that the threat may have involved plans to launch Mumbai-like armed assaults in multiple targets in Europe.

In the words of Squarcini to the press, these combined incidents mean “all the blinkers are on red.†This statement is strikingly similar to one in the 9/11 Commission Report attributed to then-CIA Director George Tenet, who said that in July 2001 “the system was blinking red.â€

While an examination of the current threat situation in France is interesting, it is equally interesting to observe the way that the French are handling their threat warnings in the media.

While its neighbors such as Spain and the United Kingdom have suffered bloody attacks since 9/11, the French so far apparently have been spared — although there are some who suspect the yet-unsolved June 2009 crash of Air France Flight 447 may have resulted from foul play, along with the explosion at the AZF fertilizer plant in September 2001.

France has long been squarely in the crosshairs of jihadist groups such as AQIM. This is due not only to its former colonial involvement in North Africa but also to its continued support of governments in countries like Morocco, Algeria and Tunisia deemed un-Islamic by jihadists. It is also due to France’s military commitment in Afghanistan. Moreover, on the domestic side, France has a significant Muslim minority largely segregated in slums known in French as “banlieues†outside France’s major cities. A significant proportion of the young Muslim men who live in these areas are unemployed and disaffected. This disaffection has been displayed periodically in the form of large-scale riots such as those in October 2005 and November 2007, both of which resulted in massive property destruction and produced the worst civil unrest in France since the late 1960s. While not all those involved in the riots were Muslims, Muslims did play a significant and visible role in them.

Moves by the French government such as the burqa ban have stoked these tensions and feelings of anger and alienation. The ban, like the 2004 ban against headscarves in French schools, angered not only jihadists but also some mainstream Muslims in France and beyond.

Still, other than a minor bombing outside the the Indonesian Embassy in Paris in October 2004, France has seemingly been spared the type of attacks seen in Madrid in March 2004 and London in July 2005. And this is in spite of the fact that France has had to deal with Islamist militants for far longer than its neighbors. Algerian Islamist militants staged a series of attacks involving gas canisters filled with nails and bolts on the Paris subway system in 1995 and 1996, and during the 1980s France experienced a rash of terrorist attacks. In 1981 and 1982, a group known as the Lebanese Armed Revolutionary Faction attacked a series of diplomatic and military targets in several French cities. Algerian militants also hijacked an Air France flight in December 1994, a situation resolved when personnel from the French Groupe d’Intervention de la Gendarmerie Nationale (GIGN) stormed the aircraft in Marseilles and killed all four hijackers.

“Shoe Bomber†Richard Reid, who is serving a life sentence in the United States for trying to blow up a Paris-to-Miami flight with an explosives-stuffed shoe in December 2001, staged his attack out of France.

In 2001, French authorities broke up a French-Algerian terrorist cell planning to attack the U.S. Embassy in Paris. The six militants, some of whom French authorities had linked to terrorist training camps in Afghanistan, were convicted and sentenced to lengthy prison terms.

Also in 2001, Algerian extremists were convicted in connection with an aborted plot to attack a Christmas market at Strasbourg Cathedral on New Year’s Eve 2000.

In January 2005, French police arrested a cell of alleged Chechen and Algerian militants, charging members with plotting terrorist attacks in Western Europe. According to French authorities, the group planned attacks against government and Jewish targets in the United Kingdom as well as against Russian diplomatic and business targets in Western and Central Europe. Other targets included tourist attractions and crowds in the United Kingdom and France and French train stations.

More recently, in October 2009, French particle physicist Adlene Hicheur and his brother, Halim, who holds a Ph.D. in physiology and biomechanics, were arrested and charged with helping AQIM plan terrorist attacks in France.

In the final analysis, France is clearly overdue for a successful jihadist attack, and has been overdue for several years now. Perhaps the only thing that has spared the country has been a combination of proactive, skillful police and intelligence work — the kind that resulted in the thwarted attempts discussed above — and a little bit of luck.

France has a national security alert system called the Vigipirate, which has four levels:

The Vigipirate level has been set at red since the aftermath of the July 2005 London bombings. This level is probably justified given that France is overdue for an attack, and French authorities undoubtedly have been busy investigating a large number of potential threats since the decision was made to raise the level to red. Still, as we have long discussed, this type of warning system has a tendency to get some attention when the levels are initially raised, but after five years of living at level red, French citizens are undoubtedly experiencing some degree of alert fatigue — and this is why Squarcini’s recent statements are so interesting. Apparently, he does not have the type of hard intelligence required to raise the threat level to scarlet — or perhaps the French government does not want to run the political risk of the backlash to the restrictive security measures they would have to institute if they raised the level. Such measures could include dramatically increasing security personnel and checkpoints and closing certain metro stops, train stations and airports, all things that could be incredibly disruptive.

Generally speaking, a figure like Squarcini would not provide the type of warnings he has recently shared in the press if his service had a firm grasp on the suspects behind the plot(s) about which he is concerned. For example, the FBI felt it had good coverage of groups plotting attacks in some of the recent thwarted plots in the United States, including the group arrested in May 2009 and charged with plotting to bomb two Jewish targets in the Bronx and shoot down a military aircraft at an Air National Guard base. In such a case, the director of the FBI did not feel the need to alert the public to the threat; he believed his agents had everything under control. Therefore, that Squarcini is providing this warning indicates his service does not have a handle on the threat or threats.

Information about a pending threat is not released to the public lightly, because such information could well compromise the source of the intelligence and endanger the investigation into the people behind the plot. This would only be done in situations where one has little or no control over the potential threat. There are numerous factors that would influence the decision to release such information.

Perhaps one of the first is that in a democracy, where public officials and their parties can be held responsible for failure to prevent an attack — as the Aznar government in Spain was following the Madrid train bombings — information pertaining to pending threats may also be released to protect governments from future liability. Following every major attack in a democratic nation, there is always an investigation that seeks to determine who knew what about the threat and when. Making threat information public can spare politicians from falling victim to a witch hunt.

Alternatively, some suggest that French authorities are being pressured to make such warnings to distract the public from domestic problems and Sarkozy’s low popularity. Many also believe the French government has been using its campaign against the Roma as such a distraction. Sarkozy, widely perceived as law-and-order oriented and tough on crime and terrorism, is indeed struggling politically. While the current warnings may provide such a beneficial distraction for Sarkozy, it is our assessment that the terrorist threat to France is very real, and is not being fabricated for political purposes.

Warnings also can be issued in an effort to pre-empt an attack. In cases in which authorities have intelligence that a plot is in the works, but insufficient information to identify the plotters or make arrests, announcing that a plot has been uncovered and security has been increased is seen as a way to discourage a planned attack. With the devolution of the jihadist threat from one based upon a central al Qaeda group to one based upon regional franchises, small cells and lone wolves, it is more difficult to gather intelligence that indicates the existence of these diverse actors, much less information pertaining to their intent and capabilities. In such a murky environment, threat information is often incomplete at best.

Whatever Squarcini’s motive, his warning should serve to shake the French public out of the alert fatigue associated with spending five years at the red level. This should cause the public (and cops on the beat) to increase their situational awareness and report suspicious behavior. The suspicious package seen at the Gare Saint-Lazare on Monday may well have been reported as a result of this increased awareness.

As the jihadist threat becomes almost as diffuse as the criminal threat, ordinary citizens who practice good situational awareness are an increasingly important national security resource — a complex network of eyeballs and brains that Squarcini may have been attempting to activate with his warning. With the burqa ban scheduled to begin next spring, French troops in Afghanistan and the ongoing conflict with AQIM, the threats are likely to continue for the near term — meaning France will remain on alert.

Reprinting or republication of this report on websites is authorized by prominently displaying the following sentence, including the hyperlink to STRATFOR, at the beginning or end of the report.

“Terror Threats and Alerts in France is republished with permission of STRATFOR.”

Read more: Terror Threats and Alerts in France | STRATFORÂ

Posted By thestatedtruth.com on September 29, 2010

Â

ICI has just reported that in the week ended September 22, domestic equity mutual funds saw a 21st sequential outflow of $2.5 billion, bringing the total Year To Date to over $70 billion. and $16 billion worth in September  Also, according to ICI’s latest flow Trend tracker, total cash at mutual funds has just barely budged in August, creeping up to 3.5% from 3.4% in July, and 4% a year earlier.  The annual redemptions from stock funds, which as of August 2010 have hit a multi-year high of 25.8%, a number that has risen progressively from the 23.6% a year earlier.

Cumulative flows:

Posted By thestatedtruth.com on September 29, 2010

People with a credit score below 620 who want a loan were unlikely to receive even one quote, according to real-estate web site Zillow.com, even if they offered a down payment of 15%-25% for a home. Zillow notes that 29% of Americans have a credit score this low, according to data provided by myFICO.com.

“Today’s tighter credit is a predictable response by banks after the foreclosure crisis, but also keeps a cap on housing demand. This effects the greater housing market recovery,†said Zillow chief economist Stan Humphries.

And…..According to a new report from Pew Research, Americans find themselves in a tough situation. Pew separates its respondents into two groups, one that “held its own†— 45%, and another that “lost ground†— 55%.

Posted By thestatedtruth.com on September 29, 2010

Thoughts from Art Cashin on the floor of The New York Stock Exchange

“The months of May and October have always broken hearts on Wall Street. In fact when I studied under the Moose Head (at Eberlins) it was a frequent subject. Prior to 1929 it was almost logical. We were an agrarian society and huge chunks of money shifted from city banks to country banks (and vice versa) at planting time and harvest time. The resulting temporary dislocations in bank assets caused spasms of tight money and down drafts in the stock market. But after 1929 it kept happening even though we had more smokestacks than haystacks. Additionally, the creation of the Federal Reserve in 1913 should have smoothed out any imbalances in money shifts. Anyway it makes the debate interesting.”

This year we have to take seasonal patterns with a grain of salt that you would need a wheelbarrow to carry. The Rosh Hashanah seasonality didn’t work. The Autumnal Equinox seasonality didn’t work. And, we’re on the mark to close out the strongest September since 1939. Sometimes the groundhog strikes out.

Why the change this year you may ask…..It would apear that the government has much more control of the markets then it ever had before in the age of the new normal!

Posted By thestatedtruth.com on September 28, 2010

The City Council of Harrisburg, capital of Pennsylvania has voted to hire lawyers to explore bankruptcy protection.

The City Council voted 5-2 tonight to seek professional advice on bankruptcy or state oversight. Harrisburg needed state aid to avoid default on $3.3 million of bond payments this month.

The city, which has 47,000 residents, and has missed about $8 million in debt-service payments this year on bonds issued in connection with a trash-to-energy incinerator. The city owes another $40 million by the end of the year, and was sued by its home county, Dauphin, and bond insurer Assured Guaranty Municipal Corp. over its failure to honor the commitments.

Posted By thestatedtruth.com on September 28, 2010

September 28,2010

Stephen Ohlemacher

Associated Press    Â

WASHINGTON – A group of 47 House Democrats are telling party leaders they want to continue Bush-era tax cuts on investment income, breaking ranks with President Barack Obama and exposing divisions among Democrats over their party’s pre-election message about taxes.

The lawmakers, led by Rep. John Adler, D-N.J., have sent a letter to House Speaker Nancy Pelosi saying they strongly support extending the current tax rates on capital gains and dividends.

“Raising taxes on capital gains and dividends could discourage individuals and businesses from saving and investing,” said the letter, dated Friday and released Tuesday. “We urge you to maintain the current tax rate for both dividend and long-term capital gains taxes.”

Tax cuts enacted in 2003 set the top tax rate on capital gains and dividends at 15 percent. Those tax cuts expire at the end of the year, and Obama wants to let the top tax rate on capital gains and dividends increase to 20 percent for individuals making more than $200,000 and married couples making more than $250,000.

Democratic leaders in Congress had been pushing for a vote to extend middle-class tax cuts before lawmakers go home to campaign for the Nov. 2 congressional election. But action on the tax cuts was postponed until after the election when Democrats could not agree on how to proceed.

With no vote on the tax cuts scheduled before the election, Democrats are left writing letters to their leaders to publicize their positions.

Posted By thestatedtruth.com on September 28, 2010

The Conference Board’s sentiment index declined to 48.5 this month, lower than the median forecast of economists surveyed by Bloomberg News and the weakest level since February, according to figures from the New York-based private research group today. In another report home prices cooled, hurt by a slump in sales following the end of a government tax incentive.

Household purchases, which account for about 70 percent of the world’s largest economy, may be constrained by a jobless rate this is projected to average more than 9 percent through 2011.Â

The Conference Board’s measures of present conditions and expectations for the next six months both dropped, today’s report showed. Fewer respondents thought more jobs would become available and the share of those who expected incomes to rise fell to the lowest since February.

There is reason for consumers to worry about jobs. U.S. chief executive officers turned less optimistic in the third quarter as fewer projected sales and hiring will improve, a survey showed. The Business Roundtable’s economic outlook index fell for the first time since the beginning of 2009.

“The pace of recovery in output and employment has slowed in recent months,†Federal Reserve policy makers said in their statement last week after meeting on interest rates. “Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit.â€

Posted By thestatedtruth.com on September 28, 2010

For the first time in at least a century, the proportion of U.S. adults between 25 and 34 who have never been married exceeded those who are married, according to data released Tuesday by the Census Bureau.

In 2009, the proportion of adults 25 to 34 who had never been married was 46.3%, compared to 44.9% for those who were married, this is a modern day first.

Posted By thestatedtruth.com on September 27, 2010

WASHINGTON….. In an effort to preempt a suspected terrorist plot(s) against European targets, the Central Intelligence Agency has targeted missile strikes against militants in Pakistan’s tribal regions, according to current and former officials.

The strikes, launched from unmanned drone aircraft, represent a rare use of the CIA drones to preempt a possible attack on the West. The terror plot, which officials have been tracking for weeks, is believed to target multiple countries, including the U.K., France, and Germany, these officials said.

The exact nature of the plot or plots couldn’t be discussed, and counterterrorism officials in the U.S., Pakistan and Europe are continuing to access the situation. We have seen multiple terror warnings in recent days in France, Germany and the U.K.

“There are some pretty notable threat streams,” said one U.S. military official, who added that the significance of these threats are still being reviewed by counterterrorism officials,  but threats of this height are unusual. “The strikes are a product of precise intelligence and precise weapons,” the official said. “We’ve been hitting targets that pose a threat to our troops in Afghanistan and terrorists plotting attacks in South Asia and beyond.”

Posted By thestatedtruth.com on September 27, 2010

Los Angeles breaks heat record……Monday was the hottest day ever recorded in downtown L.A. as the weather station at USC hit the 113-degree mark, breaking the old all-time high of 112 set on June 26, 1990. It makes Monday the hottest day ever since records in downtown L.A. started being kept in 1877, said Stuart Seto of the National Weather Service, the record was impressive, “especially after such a cool summer.”

Posted By thestatedtruth.com on September 27, 2010

I think it’s fair to say that a majority of economists believe that excessive private debt played a key role in getting us into this economic mess, and is playing a key role in preventing us from getting out. So, how does it end?

A naive view says that what we need is a return to virtue: everyone needs to save more, pay down debt, and restore healthy balance sheets.

The problem with this view is the fallacy of composition: when everyone tries to pay down debt at the same time, the result is a depressed economy and falling inflation, which cause the ratio of debt to income to rise if anything. That is, we’re living in a world in which the twin paradoxes of thrift and deleveraging hold, and hence in which individual virtue ends up being collective vice.

So what will happen? In the end, I’d argue, what must happen is an effective default on a significant part of debt, one way or another. The default could be implicit, via a period of moderate inflation that reduces the real burden of debt; that’s how World War II cured the depression. Or, if not, we could see a gradual, painful process of individual defaults and bankruptcies, which ends up reducing overall debt.

And that’s what is happening now: as this story in today’s Times points out, the main force behind the gratifying decline in consumer debt appears to be default rather than thrift.

So basically, we can do this cleanly or we can do this ugly. And ugly is the way we’re going.

More at: www.nytimes.com

Posted By thestatedtruth.com on September 26, 2010

The computer code, dubbed Stuxnet, has spread to many industries in Iran, and has also affected equipment linked to the country’s nuclear program, which is at the core of the dispute between Tehran and Western powers.

Experts in Germany discovered the worm in July, and it has since shown up in a number of attacks—primarily in Iran, Indonesia, India and the U.S. The malware is capable of taking over systems that control the inner workings of industrial plants.

Posted By thestatedtruth.com on September 26, 2010

| Thoughts from the Frontline Weekly Newsletter

Pushing on a String

Â

by John Mauldin

September 24, 2010 In this issue: |

|

| This week the Fed altered their end-of-meeting statement by just a few words, but those words have a lot of meaning. It seems they are paving the way to a new round of quantitative easing (QE2), if in their opinion the situation warrants it. A trillion dollars of new money could soon be injected into the system. Tonight we explore some of the implications of a new round of QE. Let’s put our speculation hats on, gentle reader, as we are moving into uncharted territory. There are no maps, just theories, and they don’t all agree. (Note: this letter may print a little long, as there are a lot of charts.)The Fed issued the usual statement at the end of their meeting this week, and Fed watchers poured over the words, looking carefully for any sign of change in Fed policy. The consensus seems to be that the most important change was the statement concerning inflation, the first such change in over a year.”Measures of inflation are currently at levels somewhat below those the Committee judges most consistent, over the longer run, with its mandate to promote maximum employment and price stability.”The next (and only other real) change was:”The Committee will continue to monitor the economic outlook and financial developments and is prepared to provide additional accommodation if needed to support the economic recovery and to return inflation, over time, to levels consistent with its mandate.” (my emphasis)Translation: inflation may be getting too low, but don’t worry, we are on the job.One of my laugh lines in my speeches (I don’t have that many) is: “When you are appointed to the Federal Reserve they take you into a back room and do a DNA change on you. After that, you are viscerally and genetically opposed to deflation.”

Bernanke made his famous helicopter speech about not allowing deflation to happen back in 2002. He happily assured us that the Fed has many tools to fight deflation and that it won’t happen here. Of course, he also told us the subprime problem would be contained, but I am sure that we have to give him a bit of slack – we all miss a few, including your humble analyst. (Well, I didn’t miss the subprime thingie. Nailed that one.) Anyway, the Fed seems to be setting us up for another round of quantitative easing. That is Fed speak for buying a few trillion or so dollars of government debt and injecting said cash into the economy. Before we get into the wisdom of such a move, let’s look at what might prompt them to do so. This is where we get into speculation. Recessions are by definition deflationary, but if we go into recession when inflation is already as low as it is, the Fed will be behind the curve. But telling us they are going to start easing because they are worried about a recession is not a good recipe for a positive market reaction. So? Why not just say that they are worried about the lack of inflation, “at levels somewhat below those the Committee judges most consistent, over the longer run, with its mandate to promote maximum employment and price stability.” That way they are not fighting a weak economy but rather something that everyone understands, i.e., deflation. I agree with David Greenlaw from Morgan Stanley. He writes: “Growth data still take precedence. The change in the inflation language, while important, does not, in our view, signal an elevated emphasis on the incoming inflation data itself as a possible trigger for asset purchases. To be sure, the inflation data do matter, but the growth indicators matter more because, from the Fed’s perspective, the pace of growth in economic activity is a leading indicator of inflation. Here is a key excerpt from Bernanke’s Jackson Hole speech that helps explain the perceived link between growth and inflation: ” ‘…the FOMC will do all that it can to ensure continuation of the economic recovery. Consistent with our mandate, the Federal Reserve is committed to promoting growth in employment and reducing resource slack more generally. Because a further significant weakening in the economic outlook would likely be associated with further disinflation, in the current environment there is little or no potential conflict between the goals of supporting growth and employment and of maintaining price stability.’ ” (emphasis added) The key driver for whether the Fed enters into another round of quantitative easing, likely to be in the trillions, is the growth in the US economy. If we are above 1.5-2%, I think they will hesitate, for reasons I go into below. If we drop below 1% and it looks like we are getting weaker, then they are likely to act. A slide into recession would bring about deflation. As noted, they are viscerally opposed to deflation. An Invitation to an Inflation PartyThe question in my mind is whether a few trillion dollars spent purchasing government debt would do the trick. What if they sent out invitations to an inflation party and nobody came? Let’s look at some data points. The Fed purchased $1.25 trillion in mortgage assets last year. The theory was that injecting money into the economy would cause banks to take that money and lend it, jump-starting the economy and bringing us back into a normal recovery. Let’s see how the lending part went. Here are a few graphs from the St. Louis Fed FRED database. The first is “Bank Credit of All Commercial Banks.” Please note that the straight upward line in the middle of 2010 is an accounting change. Without that the trend would still be down.

Then we have “Total Consumer Credit Outstanding.” That had been growing steadily for 65 years until this last recession.

Next we have “Commercial and Industrial Loans at All Commercial Banks.”

We could look at total residential mortgages (down); credit card debt (down); and commercial mortgages (down). The list goes on. Sidebar from Greg Weldon: “Also, the value of Commercial Property Loans classified as Special Servicing (restructured and-or- extended) rose to a NEW HIGH, pegged at 11.74% of all CMBS, as evidenced in the chart below.”

No wonder commercial mortgages are down. So, what happened to the trillion-plus dollars? It doesn’t look like it went into bank lending. As it turns out, it went back onto the balance sheet of the Federal Reserve. Banks put it back into the Fed. There are several ways you can measure this with the FRED database, but one way is to look at “Reserve Balances with Federal Reserve Banks, Not Adjusted for Changes in Reserve Requirements.”

If banks are not lending now, with what seems like lots of reserves, then what is to make us think that another $2 trillion in QE will make them feel like they have too much money in their vaults? If it is because they don’t have enough capital, then adding liquidity to the system will not help that. If it is because they don’t feel they have creditworthy customers, do we really want banks to lower their standards? Isn’t that what got us into trouble last time? If it is because businesses don’t want to borrow all that much because of the uncertain times, will easy money make that any better? As someone said, “I don’t need more credit, I just need more customers.” How much of an impact would $2 trillion in QE give us? Not much, according to former Fed governor Larry Meyer, who, according to Morgan Stanley, “…maintains a large-scale macro-econometric model of the US economy that is widely used in the private sector and in public policy-making circles. These types of models are good for running ‘what if?’ simulations. Meyer estimates that a $2 trillion asset purchase program would: 1) lower Treasury yields by 50bp; 2) increase GDP growth by 0.3pp in 2011 and 0.4pp in 2012; and 3) lower the unemployment rate by 0.3pp by the end of 2011 and 0.5pp by the end of 2012. However, Meyer admits that these may be ‘high-end estimates’. “Some probability of a resumption of asset purchases is already priced in, and thus a full 50bp response in Treasuries is unlikely. Moreover, a model such as Meyer’s is based on normal historical relationships and therefore assumes that the typical transmission mechanisms are working. For example, a drop in Treasury yields would lower borrowing costs for consumers and businesses, helping to stimulate consumption, business investment and housing. But there is good reason to believe that the transmission mechanism is at least partially broken at present, and thus the pass-through benefit to the economy associated with a small decline in Treasury yields (relative to current levels) would likely be infinitesimal.” (Morgan Stanley) That is not much bang for the buck, so to speak, but it would be pointing a gun with a very big bang at the valuation of the dollar. If QE were attempted on that scale, it would not be good for the dollar. My call for the pound and the euro to go to parity with the dollar would be out the window for some time, and maybe for good. Now, if the strategy is to lower the dollar, then QE might make some sense; but of course no one would admit to that, not when we are accusing other countries of manipulating their currencies (as in China). No, we would just be fighting deflation. The fact that the dollar dropped would just be a coincidence, a necessary but sad thing in the important fight against deflation. (Please note tongue firmly in cheek. Not you, of course, but some other readers sometimes miss my sarcasm.) Of course, not all agree that a lower dollar would necessarily be a bad thing. Ambrose Evans-Pritchard, writing in the London Telegraph, concludes a column in where he notes that there is a lot of opposition to QE2 from some fairly significant economic luminaries, and that: “Dr Bernanke said in November 2002 that Japan had the economic instruments to pull itself out of malaise but failed to do so. ‘Political deadlock’ and a cacophony of views over the right policy had prevented action. He insisted that a central bank had ‘most definitely’ not run out of ammo once rates were zero, and retained ‘considerable power to expand economic activity’. “Yet eight years later, the US is in such ‘deadlock’. Worse, Fed officials now say ‘the ball is in the fiscal court’, arguing that budget policy should do more to ‘complement’ the Fed’s existing stimulus. Oh no! “This is the worst possible prescription. What is needed is fiscal austerity (slowly) before debt spirals out of control, offset by easy money or real QE for as long as it takes. This formula rescued Britain from disaster in 1931-1933 and 1992-1994. “Damn the rest of the world if they object. They have been free-loading off US demand for too long. A weaker dollar will force the mercantilists to face some hard truths. So keep those helicopters well-oiled and on standby.” Hmmmm. If everyone else wants to devalue their currency, should we play along? Can you say buy some more gold? But back to the inflation party invitation. If the economy is recovering, QE is not needed. Note that the US economy in the current quarter may be doing better than last. And if you looked at the bank lending charts I presented above, an optimist could note that it looks like we might be seeing a bottom forming and even some increase in lending. Perhaps we have turned the corner. Again, the banks have plenty of reserves, so another $2 trillion is not needed. But what if they went ahead and threw $1-2 trillion against the wall? If it showed up back at the Federal Reserve, it would only serve to show that the Fed does not have the tools it needs, or would have to be really willing to monetize debt. It would be Keynes’ “liquidity trap” or what Fisher called debt deflation. Neither are good. That’s called pushing on a string. If the markets sensed that, it would not be pretty. The Fed has been buying government debt for several months, taking the money from the mortgages that are being amortized and buying the debt. Let’s maybe see how that works out before we bring out the big guns. Just a thought. I agree with Allan Meltzer, a historian of the US central bank: ” ‘We don’t have a monetary problem, we have 1 trillion or more in excess reserves, so it’s literally stupid to say we’re going to add another trillion to that,’ Meltzer, a professor at Carnegie Mellon University in Pittsburgh, said today in an interview on Bloomberg Television’s ‘InBusiness With Margaret Brennan.’ ” ‘One of the major mistakes that the Fed makes all the time is too much concentration on the short-term,’ said Meltzer, author of a history of the Fed. ‘Aiming at that is just a fool’s game.’ ” (Business Week) That being said, we live in a world where we need to act in terms of what will be rather than what should be. And if the economy continues to weaken, I think it is likely the Fed will act preemptively and start QE2. So the next few months of economic data are very important. And even more important is whether Congress will extend the Bush tax cuts at least until the economy is growing respectably, when they come back for the lame duck session in November. Not extending them would be a policy mistake bigger than QE2, and might force even more precipitous action. We do live in interesting times. Ten Years and CountingTen years ago I started this letter online with about 2,000 email addresses. Now the letter goes to over 1.5 million of my closest friends and is still growing. It is on dozens of web sites and is quoted everywhere. I have to admit to be somewhat overwhelmed by it all. I had literally no idea when I put that first letter on the Internet that it would become what it has. Of course, I made the lucky decision back then to make it free, when there were not that many free letters, so people sent it to their friends, who subscribed. Every letter since the beginning of 2001 is in our archives. Good, bad, or indifferent, they are all there, just as they were sent out. I sometimes wish I could edit a few sentences here or there (what was I thinking?!?!?), but we made the decision early on to just let the chips fall where they may. It wasn’t long after that that Tiffani came to work for me (temporarily, we thought). She literally started in a closet, filing and doing data entry. Now she runs the businesses and Dad just reads and writes and does a little traveling and speaking, and from time to time finds a few new opportunities for her to add to her growing list. And I have to mention my business partners around the world who have helped me create a dream job that gives me a comfortable lifestyle while having more fun than any one man should have. Jon Sundt and the team at Altegris, Steven Blumenthal at CMG, Niels Jensen and his team at Absolute Return Partners, Prieur du Plessis (and Paul Stewart) in South Africa, Enrique Fynn in South America, and John Nicola in Canada. Thanks so much. And of course this whole letter would not be possible without my great friend and publisher Mike Casson. The last ten years have been a great ride, but the next ten are going to be even better. We will be launching several new web sites in the next few weeks, and reworking our old ones with total makeovers. There will be a forum where you can respond to this letter and talk with each other. I will respond to questions. We will soon be introducing audio podcasts (“The Mauldin Minute”) and, when I get the concept down, go to video. Some new subscription services, too. And a much easier and better way to find alternative investments that have the potential to work for you in this crazy economic environment. We are excited. But the letter will stay the same. It is just you, me, and a few other of my closest friends sharing a few thoughts every weekend. At the end of the day, it is you, gentle reader, who is the reason for the growth of this letter. Your kind words and persistence in forwarding to your friends have been the reason for whatever success there has been. I am grateful and humbled. There is not a week that goes by that I do not acknowledge my great debt to you. My most sincere thanks. I will do my best to continue to deserve your valuable time that we share each week. And now it is time to hit the send button. Eight cities in seven countries in nine days (ten planes!) have left me a little tired. I think I will rest a great deal this weekend, although I will spend some time editing my book. We are getting close. I am ready to be finished, but it has to be right. Have a great week. |

|

Any views expressed herein are provided for information purposes only and should not be construed in any way as an offer, an endorsement, or inducement to invest with any CTA, fund, or program mentioned here or elsewhere. Before seeking any advisor’s services or making an investment in a fund, investors must read and examine thoroughly the respective disclosure document or offering memorandum. Since these firms and Mauldin receive fees from the funds they recommend/market, they only recommend/market products with which they have been able to negotiate fee arrangements.

You have permission to publish this article electronically or in print as long as the following is included:

Â

Posted By thestatedtruth.com on September 24, 2010

Two years after the financial crisis, the federal government has stepped in to stabilize a crucial part of the credit-union sector knocked down by losses on subprime mortgages. A summary of an article from the Wall Street Journal is reviewed below.

Regulators announced Friday a rescue of the nation’s wholesale credit unions, underpinned by a federal guarantee valued at $30 billion or more. Wholesale unions don’t deal with the general public but provide essential back-office services to thousands of other credit unions across the U.S.  The majority of retail credit unions are thought to be sound, but they are exposed to the losses through the industry’s insurance fund.

Friday’s moves include the seizure of three wholesale credit unions, plus an unusual plan by government officials to manage $50 billion of troubled assets inherited from failed institutions. To help fund the rescue, the National Credit Union Administration plans to issue $30 billion to $35 billion in government-guaranteed bonds, backed by the shaky mortgage-related assets.

Members United Corporate Federal Credit Union in Warrenville, Ill., Southwest Corporate Federal Credit Union of Plano, Texas, and Constitution Corporate Federal Credit Union, Wallingford, Conn., which had a total of $19.67 billion in assets as of July, were taken into conservatorship by federal regulators.

Losses on the mortgage-backed securities held by the five seized credit unions are expected by regulators to total about $15 billion. Wiping out the capital of the failed institutions will cover a chunk of those losses. But the remaining $7 billion to $9.2 billion eventually will be passed along to the nation’s 7,445 federally insured credit unions in the form of future assessments.

In an effort to minimize and spread out losses that must be absorbed by the credit-union industry, regulators said they will move all the risky securities into a good bank-bad bank structure. NCUA officials will manage the $50 billion portfolio, or “bad bank,” of the failed wholesale institutions.

Friday’s moves could deepen tensions between regulators and retail credit unions that withstood the financial crisis and resent having to bear financial costs caused by the mistakes of wholesale institutions.

Posted By thestatedtruth.com on September 23, 2010

The cutoff for the Forbes 400 wealthiest americans list is back up to $1 billion after falling to $950 million last year, and on average they are down about 13% from the high mark a few years ago.

Bill Gates, the co-founder of Microsoft Corp., remains the richest American with estimated assets of $54 billion, according to Forbes magazine’s annual ranking of the 400 wealthiest Americans.

Warren Buffett, the chief executive officer of Berkshire Hathaway Inc., ranks second in the U.S. with $45 billion, according to the list published yesterday. Gates, 54, and Buffett, 80, were Nos. 1 and 2 last year.

The number of list members whose wealth declined this year is 85 compared with 314 in 2009, while wealth increased for 217 members. The total worth of the 400 rose by 8 percent to $1.37 trillion, still below the 2008 total of $1.57 trillion.

“They’ve recovered, but we’re still so far off from 2008,†Luisa Kroll, global wealth editor for Forbes, said in a telephone interview.

Facebook Inc. CEO Mark Zuckerberg, 26, who is tied for No. 35 on the list, saw his wealth jump 245 percent to $6.9 billion, the largest percentage increase of anyone on the list. “Very few are at an all-time high, with the exception of how phenomenally well Facebook is doing,†said Kroll, who is based in New York.

California has the most people on the list, with 83, followed by New York, with 64. Texas has 45 members and Florida has 26.

Sixteen new people joined the list this year, including Dustin Moskovitz, a co-founder of Facebook who left the social networking site in 2008. He has a net worth of $1.4 billion, tying him for No. 290. Moskovitz, 26, is the youngest person on the list.

The oldest is philanthropist David Rockefeller Sr., 95, who is tied for No. 153 with $2.4 billion.

Raj Rajaratnam, 53, founder of Galleon Group LLC, who is under indictment for insider trading and is due to go to trial next year, dropped off the list along with 33 others. Rajaratnam has denied the charges.

There are 42 women on the list, led by Christy Walton, 55, and 60-year-old Alice Walton, of the family that controls Wal- Mart Stores Inc. They rank Nos. 4 and 8. Jim Walton ranks seventh with $20.1 billion and S. Robson Walton is No. 9 with $19.7 billion.

New York City Mayor Michael Bloomberg is ranked 10th with $18 billion. Bloomberg, 68, is the founder and majority owner of Bloomberg LP, the parent company of Bloomberg News.

The other members in the top 10 are Oracle Corp. CEO Larry Ellison, 66, at No. 3 with $27 billion. Charles Koch, the 74- year-old chairman and CEO of Koch Industries Inc., tied for fifth with his brother David Koch, 70, with $21.5 billion.

Talk-show host and television executive Oprah Winfrey, 56, is tied at No. 130 with $2.7 billion. Mark Cuban, the 52-year- old Dallas Mavericks owner is tied for No. 144 with $2.5 billion. Bill Gross, 66, who manages the world’s biggest bond fund at Pacific Investment Management Co., is tied at No. 170 with $2.1 billion. Meg Whitman, 54, the former EBay Inc. CEO who is running for California governor, has $1.2 billion, tying her for No. 332.

Posted By thestatedtruth.com on September 23, 2010

Three out of every five Americans are overweight. One in five are obese. Indeed, there are only two areas (one state, Colorado, and Washington DC) where obesity rates are under 20%.

Nearly three in four of us don’t get enough sleep. Almost one third of us report having trouble falling asleep EVERY night. And almost half of us report that day-time sleepiness interferes with normal activities including work.

Posted By thestatedtruth.com on September 23, 2010

According to David Rosenberg of Gluskin Sheff:

Posted By thestatedtruth.com on September 23, 2010

Is there a message to Congress in this!

House Republicans announced a governing agenda today that would cut federal spending, extend expiring tax cuts and repeal the Democrats’ health-care law.

The program was released by party leaders at a hardware store in Sterling, Virginia, as Republicans make their case to voters to retake the House majority in the Nov. 2 elections.

The first priority, according to Representative Mike Pence of Indiana, is the extension of Bush-era tax cuts.

“It’s the top of the list to get the economy moving again right now,†Pence said today on Bloomberg Television. “There would be almost nothing more important that Congress could do right now.†He called on House Speaker Nancy Pelosi and Senate Majority Leader Harry Reid to take all of the proposals for extensions of 2001 and 2003 tax cuts to a vote.

Titled “A Pledge to America,†the plan is patterned after House Republicans’ “Contract with America†from 1994. Republicans unveiled the earlier plan six weeks before elections in which they gained the majority for the first time in 40 years. House Republican leader John Boehner of Ohio was an architect of the 1994 plan and the new version. Democrats regained the House majority in 2006.

“It’s a governing agenda that could be enacted tomorrow,†Boehner said at the event in Virginia. “These are the things the American people are demanding,†he said. “Republicans stand ready to get it done.â€

Posted By thestatedtruth.com on September 23, 2010

Even a temporary lapse in the tax provisions “would essentially wipe out most of the modest growth we expect in the first half of 2011,â€Â Goldman Sachs

Letting all of the roughly $270 billion in tax cuts lapse would subtract almost 10 percentage points from annualized disposable income growth in the first quarter of 2011. That could reduce final demand by about 2 percentage points in the first half of 2011 and cut gross domestic product by almost the same amount, Goldman’s Phillips said in his note.

Gross domestic product would be cut by almost 2 percentage points if Congress fails to extend the tax cuts, due to expire Dec. 31, along with temporary tax credits under the 2009 stimulus bill as well as relief from the alternative minimum tax, Phillips calculates.

Even a temporary lapse in the tax provisions “would essentially wipe out most of the modest growth we expect in the first half of 2011,†Phillips wrote in a research note released yesterday. He said in a phone interview that a higher tax rate in the first two months of the year would have that effect.

Bank of America’s global strategy group also issued an update yesterday that advised that “Congress will be gridlocked through year end.â€

“Having consulted BofAML legislative advisors, it is now the view of U.S. Equity Strategy that Congress is unlikely to pass any tax package before the Bush tax cuts expire at 2011 start,†David Bianco, the firm’s chief U.S. equity strategist, said in the update.

“The fear of across the board tax hikes in 2011 is likely to constrain growth†in both household spending and business hiring and capital expenditures in the fourth quarter of 2010, Bianco said. “The setback to confidence is likely to prevent the S&P 500†from reaching a forecast target of 1300.

President Barack Obama and most Democrats want tax cuts enacted under former President George W. Bush extended for individuals who earn less than $200,000 a year and couples earning less than $250,000. Republican leaders in Congress want the tax cuts extended for all income groups.

Goldman Sachs’s Phillips predicts Congress will allow the tax cuts for the wealthiest Americans to expire while extending middle-class tax cuts, the “Making Work Pay†payroll-tax credit and relief from the alternative minimum tax.

“However, with essentially no congressional action to date, the prospects for such an extension are uncertain,†Phillips wrote

Goldman Sachs this month forecast economic growth at a 1.5 percent annual rate in the first quarter of 2011 and 2 percent in the second quarter, according to a Bloomberg News survey.

Letting all of the roughly $270 billion in tax cuts lapse would subtract almost 10 percentage points from annualized disposable income growth in the first quarter of 2011. That could reduce final demand by about 2 percentage points in the first half of 2011 and cut gross domestic product by almost the same amount, Phillips said in his note.

Income tax rates now are at 10 percent, 15 percent, 25 percent, 28 percent, 33 percent and 35 percent. If Congress doesn’t act, they’ll revert to 15 percent, 28 percent, 31 percent, 36 percent and 39.6 percent.

Posted By thestatedtruth.com on September 23, 2010

Sorry, But The Answer Of Too Much Debt Is Not More Debt

In Price Is Knowledge

If you told Rip van Bondtrader that gold had risen to a record during his decade-long slumber, he’d want to know what the inflation outlook was, and how badly he’d gotten killed on his bond investments. He’d be astonished to discover that he’s made a total return of about 8 percent since January on Treasuries maturing in more than a year.

“What makes the gold story so interesting is that bullion has so many different correlations — with inflation, with the dollar, with interest rates, with political uncertainty,†according to David Rosenberg, chief economist at Gluskin Sheff & Associates in Toronto. “This year, for example, gold has shifted from being a commodity toward being a currency — the classic role as a monetary metal that is no government’s liability.â€