The New Normal: Social Security As We Know It Will Have To Change

Posted By thestatedtruth.com on September 18, 2010

The End of Social Security As We Know It

By Ian Mathias

Baltimore, Maryland

On September 30, America will quietly begin a generational shift. This will be the final day of the government’s fiscal year 2010, and consequentially, a very notable day for Social Security. September 30 will be the last day – maybe for a long time – that Social Security could possibly be operating at a surplus.

Back in March, the Congressional Budget Office (CBO) admitted that most Social Security funding projections were way off, and that sometime in 2010 the program would begin paying out more than it’s taking in. In August, the Social Security Board of Trustees said much of the same, that they too were drastically revising previous solvency projections. Just a year ago, both agencies forecast that the Social Security Trust Fund would stay out of the red until 2016. This year, they said 2010… As in, it’s probably already happened.

According to this year’s FICA/SECA tax receipts and benefit payouts, there’s reason to believe the SS fund dipped into deficit as early as February 2010. But since there’s no “official†government mandated date for when Social Security officially entered the red (we wonder if either agency actually knows) the end of the fiscal year will have to do, for now.

Though there will be some debate over when SS started losing money in 2010, there will be no such discussion in 2011, or the year after, or the year after that…or maybe ever again. Despite 2009 projections completely to the contrary, the CBO and Social Security Trustees now expect the fund to suffer deficits indefinitely. There may be two or three years of surplus if the US economy can avoid a double dip recession, but over the long term, in the words of the SS Board of Trustees, “program costs will permanently exceed revenues.â€

(Quick aside: That is one ugly revision. There’s nothing wrong with changing your mind, but someone at the CBO had quite an awakening in 2010.)

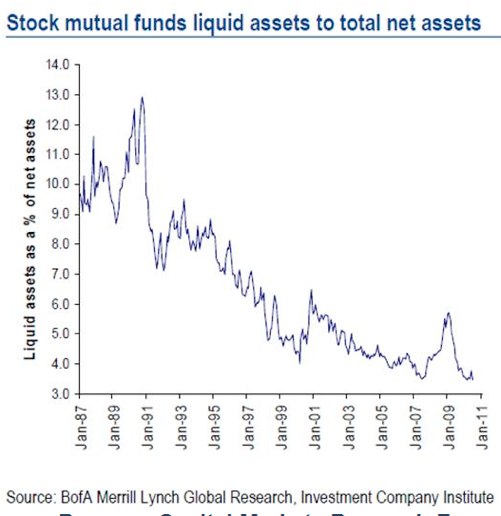

In summary of the CBO’s findings, the credit crunch and subsequent “Great Correction†moved a future Social Security crisis into the present tense. In fact, the whole issue is now worse. Stock market crashes and unemployment plights like those we’ve suffered lately have long term, arguably irreversible effects on wages, income inequalities, retirement plans and tax revenues…all of which will pile on top of Social Security at a time when it’s already bearing a heavy load.

But as you might remember, we’ve been here before. A not-so-dissimilar bout of high unemployment and lousy economic growth in the ’70s brought the Social Security fund to a sudden crisis in the early ’80s. By 1982, the powers that be weren’t just fretting over the program entering deficit…they had every reason to believe the Social Security would be out of money in as little as a year.

The Regan Administration’s solution was a bi-partisan study group called The National Commission on Social Security Reform (NCSSR). To lead the commission, Washington hired a man who has since proven to be one of the most unsuccessful monetary and fiscal planners in American history: Alan Greenspan.

Long story short, the Greenspan Commission marked “the end of Social Security as we know it  or at least as we knew it in 1983. That year the Commission released its findings and recommendations, most of which were gradually implemented over the next decade. Here are some of the basic elements of their reform:

- Social Security tax rates (including Medicare taxes) rose from 9.35% in 1983 to over 15% by 1990.

- The minimum age to file for full benefits was slowly raised from 65 to 67.

- The cost of living adjustment (COLA) was re-engineered to track growth in wages or inflation, whichever is lower. Previously, COLA just rose with inflation.

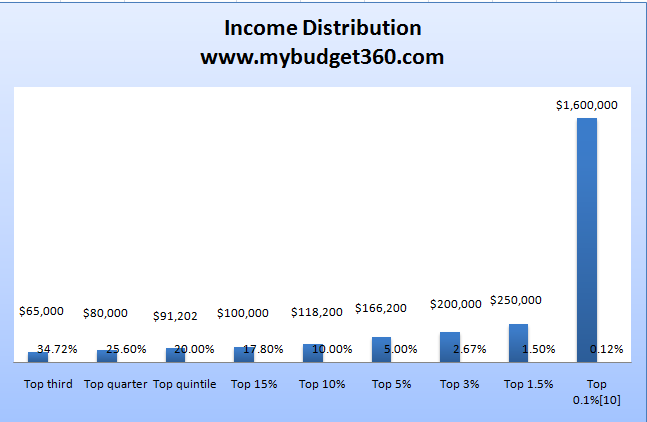

- The taxable wage base rose dramatically. In 1983, all individual income over $32,400 was not subject to Social Security taxation. Today that base level is $106,800.

- Greenspan’s plan offered Social Security coverage (and colluded participation) for most tax-exempt and federal employees that were previously excluded.

Essentially, Greenspan’s fix for Social Security was to take in more money and pay less of it out at a later date. And with the help of a booming American economy through most of the ’80s and ’90s, it worked… until it didn’t. As noted above, we’re just about back to square one.

(The real irony here is that there’s reason to believe there was nothing long-term about Greenspan’s solution in the first place. The Greenspan commission was formed by President Regan’s chief of staff Jim Baker, and it’s an open secret Baker’s key objective was only to make Social Security a non-issue for the 1984 election. As with most administrations, the real crisis was left for the next guy to deal with.)

The current generation of leadership is now “that guy.†Worse yet, this Social Security crisis is larger than the one we faced in 1982, which was a combination of a cyclical economic downturn and SS rules and mechanisms in need of reform. Today we face a structural crisis…they’re called baby boomers.

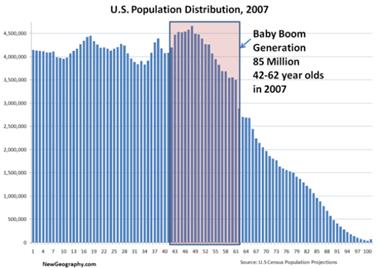

76 million Americans were born between 1946-1964, the so-called baby boomers. On January 1, 2011, the oldest member of this demographic – the largest America has ever known – will turn 65. At present they make up about a third of the entire US workforce. Taking their place will be Generation X, about 46 million people strong. Forgive us for the back-of-the-envelope math, but that sounds like 30 million fewer contributors to the Social Security fund and tens of millions of new beneficiaries. Hmmm…

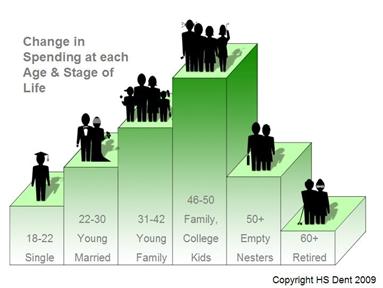

When the whole idea of Social Security was first brought to the table, way back in post-Depression FDR days, there were 16 Social Security contributors for every 1 Social Security beneficiary. Today, that ratio is closer to 4:1. By 2030, when America will be bearing the full brunt of retired baby boomers, that ratio will be 2:1. To accommodate that ratio, either recipients will have to get less, or workers will have to pay more. The current method of funding the program is simply no longer applicable.

And there’s a whole other “problem†with current or soon-to-be Social Security beneficiaries: They’ll likely live much longer (and expensive) lives than their parents. In 1935 the average life expectancy was 65, making the minimum age to collect SS almost a cruelly ironic death sentence. Today, the average American will live to around 77… yet the minimum age to collect full benefits has only risen by 2 years. And if you believe tech-savvy people like my colleague Patrick Cox, we are on the verge of generational medical breakthroughs that could expand our life expectancies into the triple digits.

So what happens when the largest demographic America has ever known taps into a fund already in deficit? And what will we do if they…well…won’t die on time?

You can whine about “paying into Social Security every month for the last 40 years and I deserve every penny†till the cows come home… But this is simple, cold math. If you’ve been in the working world that long, you must understand by now the difference between what’s fair and what’s reality. The reality of the moment is this: You must…

- Prepare to pay more Social Security taxes

- Prepare to receive less Social Security benefits

As it stands today, there’s just not enough money to fund the Social Security program as we know it. With $2.5 trillion left in the SS warchest, there is no immediate threat to the status quo. But as the SS Board of Trustees forecast in August, “Over [a] 75-year period, the Trust Funds would require additional revenue equivalent to $5.4 trillion in present value dollars to pay all scheduled benefits.†That gap will be filled by borrowing from abroad, taxing at home or slashing the benefits of those yet to retire. Either way, it’s hard to picture a happy ending for Social Security. It’s in your best interest to build a substantial retirement fund of your own and – probably more importantly – one for your children.

Ian Mathias

for The Daily Reckoning

![[pensionp1]](http://sg.wsj.net/public/resources/images/P1-AX277_pensio_NS_20100917202440.gif)

![[uspovertyrate10]](http://sg.wsj.net/public/resources/images/OB-KA517_uspove_G_20100916122202.gif) Â