By John Mauldin

August 13, 2010

First, let’s begin with the “good” news. The ecological destruction that was first feared is not going to be as bad as once thought, for a variety of reasons. It is not good, but it is not the unmitigated disaster it could have been.

Edward Overton, PhD, Professor Emeritus, Dept. of Environmental Sciences, LSU, is an expert on oil spills. He was at the Exxon Valdez. The Exxon Valdez (EV) was a big, black, thick tide of oil. The Deepwater Horizon is a much bigger spill: every ten days the amount of the EV spill spewed into the Gulf, from April 20 to July 15. Professor Overton spoke mostly for the record. He is very much a concerned environmentalist, and he is also a very serious scientist.

He reminded us that the Louisiana wetlands are a very important part of the ecological system of the Gulf of Mexico. Oversimplifying, they are the nutrient source for the small animal world which feeds the larger. Without the wetlands much of the Gulf ecosystem dies. If they were destroyed, they would not come back very easily, as without their very root system the land would erode away. Bluntly, oil kills wetlands if it gets into it.

There are only three ways to get rid of an oil spill. You can mechanically remove it, chemically remove it, or burn it. They used all three methods. But not fast enough. The Obama administration dithered while Rome burned. (This is not from Overton.)

As The Christian Science Monitor reported in ” The Top Five Bottlenecks“:

“Three days after the accident, the Dutch government offered advanced skimming equipment capable of sucking up oiled water, separating out most of the oil, and returning the cleaner water to the Gulf. But citing discharge regulations that demand that 99.9985 percent of the returned water be oil-free, the EPA initially turned down the offer. A month into the crisis, the EPA backed off those regulations, and the Dutch equipment was airlifted to the Gulf.”

Really? For 0.0015 percent clean water from badly contaminated, toxic water? It takes a month to get that decision? I can guarantee you that there were people arguing for such a decision early on, and some rookie environmentalist at the EPA who never had responsibility in the real world made things a lot worse. Moving on:

“A giant Taiwanese oil skimming ship, The A Whale, is only now working on the spill. It can process 500,000 barrels of oily seawater per day, but it also needed the same waiver from the EPA which, expressed in another way, limits discharged water to trace amounts of less than 15 parts-per-million of oil residue. It also needed a waiver from the Jones Act, which prevents the use of specialized foreign ships from the North Sea oil fields because they use non-American crews. Previously, the skimmers had to return to port to offload almost pure seawater each time they filled up with water.” ( http://reason.com/archives/2010/07/09/the-governments-catastrophic-r)

Ok, Let’s get this straight. The oil industry screwed up by not having enough disaster equipment and ships available. That’s bad beyond words. But for the government to compound that by not allowing needed ships to do the work, just because they did not have US union workers is just as bad. You expect better from government in a disaster, or we should.

(Overton said we never really did learn whether The A Whale would have been as useful as advertised, as it did not get into the Gulf soon enough.)

What should have been a no-brainer decision to use the Dutch ships was delayed for whatever reason. What should have been a no-brainer decision to waive the water purity rules was delayed beyond reason. My personal opinion. Whoever participated in that decision should be allowed to return to the private sector. They only made the problem of the spill worse. They should not be allowed near the decision-making process again.

Please note, this is no defense of British Petroleum. As noted below, they were extremely negligent, and deserve the costs and more. We just don’t need to compound stupid, incompetent, irresponsible (choose several more adjectives, some with color) corporate acts with dumb government ones.

The Corexit Decision

There is a chemical called Corexit that is a product line of solvents primarily used as dispersants for breaking up oil slicks. It is produced by Nalco Holding Company. Corexit was the most-used dispersant in the Deepwater Horizon oil spill in the Gulf of Mexico, with COREXIT 9527 having been replaced by COREXIT 9500 after the former was deemed too toxic. Oil that would normally rise to the surface of the water is broken up by the dispersant into small globules that can then remain suspended in the water.

In hindsight, Overton thinks the use of Corexit was the correct thing to do. It probably saved the wetlands. But it is not without its own bad effects.

When you put Corexit on an oil slick, the surface oil disperses but also drops into the ocean about 15 feet. While Corexit (basically a type of soap) itself is not toxic (an admittedly controversial claim), the resulting dispersed oil is quite toxic. Fish swimming through it can be and are harmed. Marine mammals like porpoises are seriously harmed when they rise to breathe through an oil slick.

But here is the good news. It turns out that there are about the equivalent of two Exxon Valdezes a year from natural oil seepage from the floor of the oceans. The Gulf has an ecosystem of bacteria that eat that oil, which are then eaten again by plankton. To those bacteria, dispersed oil is filet mignon. They thrive and grow rapidly, turning that toxic waste into nutrients, which are absorbed by the plankton. The bacteria keep on growing until they lose their source of nutrition (the toxic oil) and then die out over time. Note: once absorbed by the bacteria, the oil is no longer toxic. There are no toxic minerals like mercury introduced into the ecosystem.

Scientists are somewhat baffled. There are tens of millions of gallons of oil that seem to be missing. It seems that the Gulf is providing its own (albeit chemically assisted) defense mechanism. Overton thinks that within less than five years, and maybe only a few years, the ecosystem will largely be back. And fishing may even be better, since the fish and shrimp are not currently being harvested (he called it human predation). At least for a while.

We traded onshore damage for offshore damage. But the calculation is that much of the ocean is empty of fish. Every go deep sea fishing? Did they just jump into the boat? Did you fish all day and catch little or nothing? There are large parts of the ocean and Gulf with very few fish. It is not good to create those toxic pools of oil, even if they eventually go away. Some fish will be harmed. But better than on the marshes.

For that we should all be grateful. It was a very difficult choice to make to use the dispersants. But it was the right choice. Somewhat like the choices we have to make in our current economic environment, concerning deficits and stimulus. There are no good or easy choices in these crucial situations. It was tragic that the choice had to be made, but I am glad it was. Losing the Louisiana wetlands would have been an ecological disaster of biblical proportions.

Again, we should never have had to make that choice. Better that BP management had observed the warning signals.

Some More Takeaways

It was clear talking from experienced oil professionals that the blowout was human error, and probably compounded human error, ignoring multiple warning signs and safety procedures. We went to Shell’s Robert Training Center, where they train people to work on oil rigs. It is a very rigorous facility and the people running it are very professional. They take safety seriously. They train most of the oil rig workers in the Gulf, including British Petroleum’s. They showed us the simulated control rooms. There are lots of safety features and redundancy; and it is *my* take that complacency had set in at BP, as things had gone just fine for so many years, and then some corners were cut. Over time, this will all come out.

There are two types of Corexit. The newer version is considered less toxic. But for whatever reason (ahem), they used supplies of the older version first. As it turns out, they needed just about everything they had, using over 1 million gallons. But it would seem that someone made an economic decision to empty the shelves of a less desirable dispersant.

Before we start to drill again (and we must!), we need to build two very large containment devices (to provide for redundancy). The process of building them from scratch this time was too time consuming and was trial and error.

There is a coalition of large oil companies building a response system at a cost of over a billion dollars. A little late for this disaster, but good for the future. There need to be enough booms to gather oil, skimming vessels, and other equipment at the ready, just as we assume there will be fire trucks if we need them. And that should not be at taxpayer expense, of course.

Time to Lift the Moratorium

The Obama administration imposed a moratorium on drilling, which in effect has shut down even shallow-water drilling, even though Obama himself said it would not affect such shallow wells. A judge has overturned that ruling. The administration then issued another moratorium, with indications it will issue yet another when this one is overturned.

Enough already.

On Thursday night, we had dinner in the Louisiana Governor’s mansion, hosted by the Lt. Governor Scott Angelle. (I was privileged to sit at his table, and he is both gracious and quite sharp.) Before being appointed Lt. Governor, Angelle was Secretary for the Department of Natural Resources, overseeing the very large oil industry of Louisiana. He is very familiar with the issues.

Angelle, a Democrat, has agreed not to run for the Lieutenant Governor’s office in the next election, which the Governor said was a requirement for anyone he nominated for the post. Angelle plans to return to the agency once his tenure as Lieutenant Governor has finished.

Angelle was very passionate about the need to begin safely drilling again. Over 30,000 wells have been drilled without major incident until now. He is clear about the need to address safety, but there are 300,000 well-paid jobs at risk, and Louisiana (and the US) are losing ship rigs to Africa and Brazil, which won’t come back for a long time. And those 300,000 jobs have a large multiplier effect.

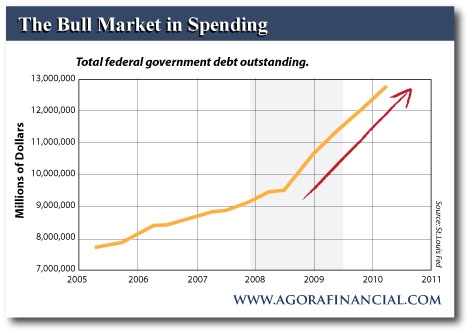

But it is more than that. If the US cannot become energy independent, we will not be able to balance our federal deficit without the private sector going into even greater debt.

Copyright 2010 John Mauldin. All Rights Reserved

John Mauldin, Best-Selling author and recognized financial expert, is also editor of the free Thoughts From the Frontline that goes to over 1 million readers each week. For more information on John or his FREE weekly economic letter go to: http://www.frontlinethoughts.com/learnmore