Posted By thestatedtruth.com on August 2, 2010

SULTANS OF SWAP: Gold Swaps Signal the Roadmap Ahead

BIS – The Super SIV Solution

The news rocked the global gold market when an almost obscure line item in the back of a 216 page document released by an equally obscure organization was recently unearthed. Thrust into the unwanted glare of the spotlight, the little publicized Bank of International Settlements (BIS) is discovered to have accepted 349 metric tons of gold in a $14B swap. Why? With whom? For what duration? How long has this been going on? This raises many questions and as usual with all $617T of murky unregulated swaps, we are given zero answers. It is none of our business!

Considering the US taxpayer is bearing the burden of $13T in lending, spending and guarantees for the financial crisis, and an additional $600B of swaps from the US Federal Reserve to stem the European Sovereign Debt crisis, some feel that more transparency is merited. It is particularly disconcerting, since the crisis was a direct result of unsound banking practices and possibly even felonious behavior. The arrogance and lack of public accountability of the entire banking industry blatantly demonstrates why gold manipulation, which came to the fore in recent CFTC hearings, has been able to operate so effectively for so long. It operates above the law or more specifically above sovereign law in the un-policed off-shore, off-balance sheet zone of international waters.

Since President Richard Nixon took the US off the Gold standard in 1971, transparency regarding anything to do with gold sales, leasing, storage or swaps is as tightly guarded by governments as the unaudited gold holdings of Fort Knox. Before we delve into answering what this swap may be all about and what it possibly means to gold investors, we need to start with the most obvious question and one that few seem to ask. Who is this Bank of International Settlements and who controls it?

BANK OF INTERNATIONAL SETTLEMENTS (BIS)

The history of the BIS reads with all the intrigue of a spy novel and comes with a very checkered past. According to the BIS web site, as a privately held bank, it decided in recent years to become wholly owned and controlled by the Central Banks of the world – a highly unusual decision for a private enterprise. Lengthy court cases in Le Hague were involved by private members who objected. Something like this is usually called a buy out or takeover, but there are no public records of any of the central banks making such an acquisition – an extremely strange set of events with little media coverage.

I am sure it can all be explained very logically until we get to the size of the balance sheet. We are talking close to a half trillion dollar balance sheet, or more specifically 259 billion SDR’s, which is approximately $400B. Where did the capital or deposits come from? The BIS goes out of its way to specifically assert it only accepts deposits from member central banks, though it does also state confusingly in the financial notes that there are deposits from previous financial statements from recognized international banks. Therefore, are we to conclude that the US Federal Reserve has huge deposits at the BIS? Though I couldn’t find the assets on the Fed’s balance sheet, I’m sure they are there in the small print or on the New York Feds balance sheet somewhere. It would be a legal requirement. It is a forensic accounting nightmare to find these items based on public documents of the various private organizations. Apparently it is just none of our business. For such a major element of the world’s operating financial structure to have such poor visibility, it seems preposterous until you actually do the research. It should be laid out so a freshman Economics class could easily follow the ownership acquisition and money flows. It isn’t and it appears to this researcher that it is intentionally opaque.

Since the BIS goes out of its way to ensure readers in its annual financial report that no private funds are accepted, maybe all we really need to know is what the BIS officially tells us. The BIS is owned and controlled by their member Central Banks. Therefore if the BIS was to do a gold swap of the magnitude of 349 metric tonnes, then board member Ben Bernanke would have known of it in advance and approved it. He would know exactly who the transaction was with and why. If he didn’t then he is legally negligent in his fiduciary responsibility as a BIS board member, because of the size of the transaction and its material effect. Other board members include: Mervyn King, Governor of the Bank of England, Jean-Claude Trichet, President of the European Central Bank, Axel Weber, President of the Deutsche Bundesbank and William C Dudley, President of the Federal Reserve Bank of New York. You can’t have it both ways.

Though we can suspect many things, there is no other conclusion we can reach than the swap is part of an agreed upon plan or concurrence between these board members. So what is the possible understanding or plan?

WHO GAVE UP THE GOLD?

There are not a lot of institutions who possess 349 metric tonnes of gold. So who needs $14B worth of cash and has this amount of gold? That shouldn’t be too hard to find.

Sovereign governments have historically created their wealth by invading other countries to pillage their treasuries which held gold, silver and the crown jewels. The winning and seizure of more land allowed the sovereign to give it to the nobles who used it to tax and tithe the feudal tenets. Recurring wealth flowed upward to the sovereign treasury.

Considering today’s EU membership, where sovereign countries can no longer print their own currency (the politicians first weapon of choice), there are three channels (other than the very politically unpopular increase in taxes and fees) open in modern times to raising money for the treasury:

1-Â Â Â The public sale of debt offerings instruments such as Bills, Notes and Bonds

2-Â Â Â The more recent and stealthy approach of selling assets, including revenue streams from such things as taxes, fees, licensing etc.. These are sold into the securitization market through complex derivative structures such as Interest Rate and Currency Swaps contracts. This approach, as recently discovered, has been rampant throughout Europe even prior to the creation of the EU.

3-   When you exhaust all of the above, you then sell the family jewels – the sovereign treasury of gold holdings.

The BIS was very quick to respond to public speculation about the massive gold swap when they immediately clarified that the gold swap was with a commercial bank. Since by its own statements, as I mentioned above, it doesn’t accept deposits from non member banks, this seems confusing on the surface. Does it or doesn’t it accept private deposits?  It would be respectful to assume that the BIS is telling the truth and that they did in fact conduct the transaction with a private bank who was transacting the swap on behalf of a central bank or sovereign treasury. This would sort of make everything work. For the BIS to be telling the truth in all their statements, the transaction must be with a member central bank with the involvement of an intermediary commercial bank. But something still isn’t right here.

When you work through the details you quickly arrive at an astounding coincidence. Portugal shows it has 348 tonnes of sovereign gold. The swap was for 346. Portugal is a member bank, though does not sit on the Board, but attends the General Meeting as an observer only. Portugal, as a member of the PIIGS, only days after the unearthing of the swap, was again downgraded by Moody’s, thereby making its lending costs even higher than the already elevated levels being demanded by the financial markets. There is a very strong possibility that the swap is with Portugal. Though who the swap is with is important to those trading debt and credit derivatives it isn’t quite as important to those interested in the gold market.

Ben Davies the CEO of Hinde Capital in London and a player in the gold market suspects (12:40) we may have a modified form of swap emerging. There is the possibility that the commercial bank is in fact a major gold bullion bank. Some of the bullion banks have major short positions on gold that far outstrip the annual physical production of gold. The disconnect between physical and paper gold along with rising gold prices is likely causing serious strains on their balance sheet. As Davies points out the gold may be transacted from a central bank to the BIS through a bullion bank while the gold physically remains with the originating central bank; is classified as ‘unallocated’ at the BIS but in fact remains on the books of the bullion bank. It effectively is double accounted for. The increase in gold would allow gold prices to be pushed lower, which in fact is what has been happening. A careful reading of the BIS financial statements shows more clearly the accounting for such a transaction.

The March 31 2010 Financial Statement of the BIS shows 43.0B SDR’s of gold or 16.6% of total assets. According to note #4 to the BIS Financial Statements: “ Included in ’Gold bars held at central banks†is SDR 8,160.1 million (346 tonnes) (2009: nil) of gold, which the Bank held in connection with gold swap operations, under which the Bank exchanges currencies for physical gold. The Bank has an obligation to return the gold at the end of the contract.† It is very important to appreciate this note is pertaining specifically to BIS ‘assets’ which in the case of banks are what the reader would consider ‘loans’. Under Financial Policy notes #5 to the Financial Statement the BIS is clear that under banking portfolios “all gold financial assets in these portfolios are designated as loans and receivablesâ€. Separately, but very interestingly the BIS additionally states “ the remainder of the Banks equity is held in gold. The Bank’s own gold holdings are designated as available for saleâ€. Â

There can be little doubt that the Gold Swap is with a central bank where the physical gold remains. The transaction is considered a deposit at the BIS (liability) but has been lent to a commercial bank (likely a bullion bank) as a loan (asset). The question is only why a bullion bank needs to borrow this quantity of gold, remembering it never gets the physical gold because it remains at the originating central bank. The reader is encouraged to read the Financial Policy notes #4,5, 6, 13, 14, 15, 16, 17 and 19 within the BIS Financial Statement for a clearer understanding along with Notes to the Financial Statements #4 and #11.

The BIS is known as the central bank to the central bankers.

The BIS may equally be referred to as the Central Gold Bullion Bank to the Gold Bullion Banks.

Â Â Â Â Â Â

The BIS may equally be referred to as the Central Gold Bullion Bank to the Gold Bullion Banks.

SPECIAL DRAWING RIGHT (SDR)

If problems get worse for Portugal, as possibly the global economic climate worsens, then the gold may never legally belong to Portugal. The contracted swap terms at some point may simply reclassify it a net zero sale, if Portugal fails to return the cash portion of the swap. The BIS would have 346 tonnes of gold and Portugal the $14B of Euros it has long since spent to solve a 2010 problem. By then Portugal likely would need even more loans in whatever currency would replace a crumpling or possibly extinct Euro.

Up until 2004 the BIS denominated its financial statements in Gold Francs. It now has made a major shift to denominating itself into Special Drawing Rights (SDRs). The calculation is exactly the same as used for the IMF. The SDR is operating as a defacto currency.

It takes a little arithmetic (which is not done in the financial statements) to be able to get values in any currency that can give the reader a perspective of the scope of the activities at the BIS. The SDR reporting obscures the BIS’s significant size and scope.

FUNDING

For those who followed the European Sovereign Debt Crisis and the negotiations with Greece, you know that the IMF was an unwelcomed intruder into EU financial affairs. Greece on more than one occasion held the IMF as a negotiating ploy and as a funding alternative to the EU’s procrastination and lack of decisiveness.

The IMF’s willingness to interfere created a lot of bad feelings within the EMU and Germany specifically. As Ambrose Evans-Prichard reported:  “The ECB is barely on speaking terms with the IMF – the “Inflation Maximizing Fund” as it was dubbed in a Bundesbank memo – – The IMF has not caught up to the reality in Europe said ECB über-hawk Jürgen Stark on July 9,2010  the final EU bailout in fact heavily involved the IMF participation. The very busy IMF is the dominant crisis lender of last resort throughout all Central & Eastern European current financial problems.

What we are seeing is the emergence of another funding structure based on the SDR – SDR’s that have a degree of gold backing. The BIS now has a total of 12.4% of its deposits (32B SDR) in the form gold deposits. Note #11 to the BIS financial statements states: “Gold deposits placed with the Bank originate entirely from Central Banks. They are all designated as financial liabilities measured as amortized costâ€.

ARE WE SETTING THE PINS UP FOR AN ALTERNATIVE RESERVE CURRENCY?

Are we moving towards the BIS and IMF being fractional reserve banks that will create money & credit – a reserve currency that will satisfy Russia and China with an element of Gold backing? A bank such as the BIS could easily assume this role (if it hasn’t already) as could the IMF with possible banking charter adjustments.

The chances are high that this is the roadmap we will find ourselves taking. Like all banking that started as Gold backed you could expect that in this case the little gold backing that starts the process is quickly diminished so a limitless money machine could begin functioning. The gold backing would likely be an initial requirement by Russia and China. The partial gold backing would lend credibility to the acceptance and a possible reserve currency alternative and eventual establishment as the global reserve currency.

SHADOW BANKING REPLACEMENT

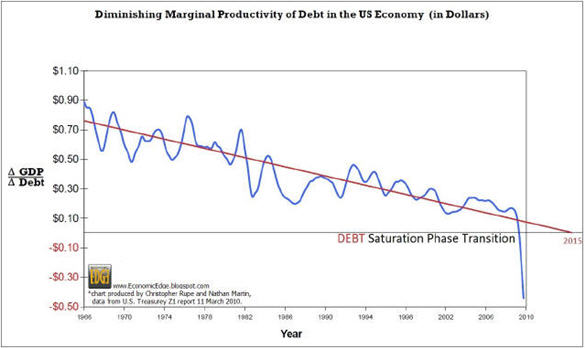

The collapse of the Shadow Banking system and its attendant SIV / CDO structures were at the root of the financial crisis.  That structure which is representative of a huge amount of the credit growth since the dotcom bubble burst isn’t coming back soon, if ever. The world needs more liquidity than the central banks or sovereign treasuries can currently deliver politically. The central bankers, huddled in their bimonthly board meeting at the BIS in Basel, Switzerland, know this better than anyone. Their discussions in the very halls of the BIS must resonate with them to use all the tools available at their disposal – quickly.

Paul McCulley and Richard Clarida at Pacific Investment Management Co. (PIMCO) have written extensively about the Shadow Banking System and its growth. An extensive slide presentation on the Shadow Banking System can be found on my web site at TIPPING POINTS. I won’t go into the detail here, but suffice it to say that the shadow banking system collapse has created a massive hole in credit creation that central bankers can’t fill in the manner in which they presently appear to be approaching the problem. Of course appearances can be deceiving.

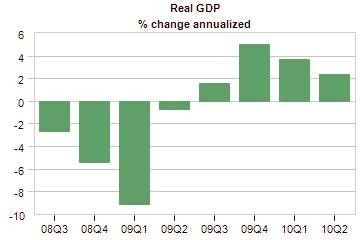

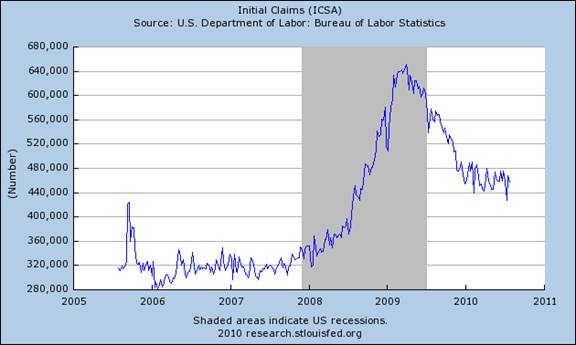

The problem has now reachd crisis proportions and the central bankers know they must urgently act in a coordinated manner. Deflation now has a firm hand on the global economy and this must be reversed. I have been calling for a US Quantitative Easing QE II of $5T in my writings for some time. This amount is required for the US alone. The entire global requirement is three to four times this amount.

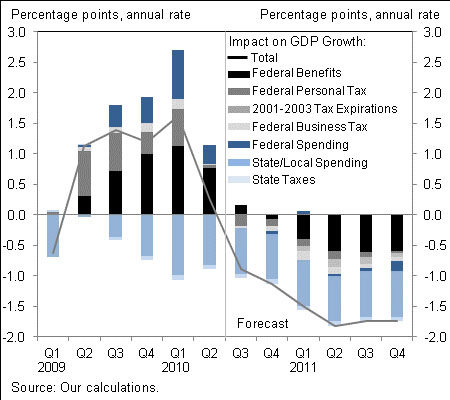

The above chart serves as an illustration to simplify the essence of the Shadow Banking System . The international bankers prefer to refer to the process as Capital Arbitrage. An arms-length agreement allowed the banks to invest in a Structured Investment Vehicle (SIV) as an affiliate investment. The large spread that an SIV captured made it an excellent investment, but more importantly it allowed the banks to use their fractional reserve (10X) money creation abilities to buy risky securitization products without them appearing on their balance sheet. The banks received huge multiplier leveraged returns from the high yielding Collateralized Debt Obligations (CDOs) until the crisis imploded the game.

HOW MUCH LEVERAGE WILL THE CENTRAL BANKER CHOOSE TO COMPOUND? => “x†times “yâ€

When the financial crisis unfolded you may recall that then US Treasury Secretary Hank Paulson’s (former Chairman and CEO of Goldman Sachs during the explosion of Shadow Banking structures) first solution was to create a $100B Super SIV. The SIV leverage thinking was so entrenched that this was the first ‘go to’ solution to fight de-leveraging. If we were to jump forward to today when we are further along in increasing and unprecedented de-leveraging, what the central bankers need to replace the shadow banking system is a vehicle that will deliver the previous scale of leverage PLUS an order of magnitude more. The answer is the Bank of International Settlements. The SIV model is used as illustrated ‘Shadow Central Banking System’ above.

With the use of the SDR ‘currency’, central bankers can compound fractional reserve lending.

IT’S ALREADY HAPPENING

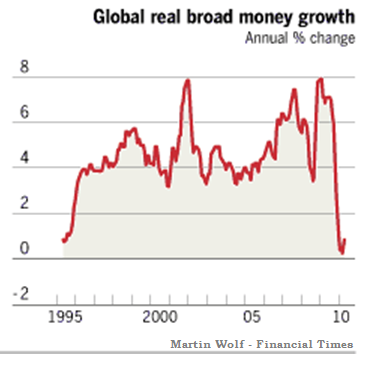

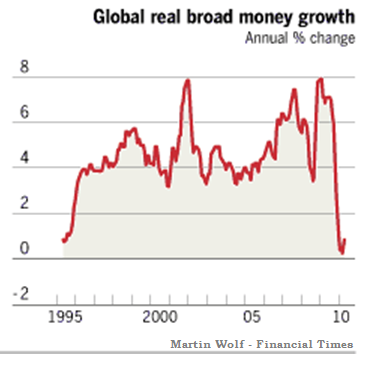

It is my view this process is already well along. The following Bloomberg global money supply growth chart graphically shows this. As the circles indicate, once again money is flowing into the pipeline or at least into global bank reserves.

CONCLUSION

The advantage of this approach is:

1.    Leverage: Compounding money creation between banks

2.    Partial gold backing: Present BIS levels of 12.4%

3.    SDR: Offers a basket of currencies approach versus a single currency dependency.

4.    Former Communist bloc regime backing: China and Russia would likely support this approach for a number of reasons, which they have already expressed as short comings to the current global reserve situation.

5.    Reserve Currency: The SDR approach offers a migration path from today’s US$ reserve currency to an alternative bank reserve currency to a future global reserve currency.

This may be the final lever required to initiate a Minsky Melt-Up (see: EXTEND & PRETEND – Manufacturing a Minsky Melt-Up) and the $5T in QE II (see: EXTEND & PRETEND: A Guide to the Road Ahead) I have been writing about for some time now.

There are many questions that are raised in the above discussion – many about the future role and safety of gold. Time and space don’t allow for this here. I hope to work through the answers in forthcoming articles.

If you would like to be notified as the articles are released, then sign-up and additionally follow the ongoing daily developments at Tipping Points.

The following gave me concern when I first read it many years ago and something for you to think about:

“…the powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences. The apex of the system was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world’s central banks which were themselves private corporations.”

Professor Carroll Quigley

Tragedy and Hope: A History of the World in Our Time (1966)

President Bill Clinton’s Georgetown Professor

Gordon T Long       Â

Tipping Points

Mr. Long is a former senior group executive with IBM & Motorola, a principal in a high tech public start-up and founder of a private venture capital fund. He is presently involved in private equity placements internationally along with proprietary trading involving the development & application of Chaos Theory and Mandelbrot Generator algorithms.

Gordon T Long is not a registered advisor and does not give investment advice. His comments are an expression of opinion only and should not be construed in any manner whatsoever as recommendations to buy or sell a stock, option, future, bond, commodity or any other financial instrument at any time. While he believes his statements to be true, they always depend on the reliability of his own credible sources. Of course, he recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction, before making any investment decisions, and barring that, you are encouraged to confirm the facts on your own before making important investment commitments.

© Copyright 2010 Gordon T Long. The information herein was obtained from sources which Mr. Long believes reliable, but he does not guarantee its accuracy. None of the information, advertisements, website links, or any opinions expressed constitutes a solicitation of the purchase or sale of any securities or commodities. Please note that Mr. Long may already have invested or may from time to time invest in securities that are recommended or otherwise covered on this website. Mr. Long does not intend to disclose the extent of any current holdings or future transactions with respect to any particular security. You should consider this possibility before investing in any security based upon statements and information contained in any report, post, comment or recommendation you receive from him.

Category: Commentary, Commodities, Economy, Finance, Gold and Silver, National News, Wall Street |

No Comments »

Tags:

Â Â Â Â Â Â