Consumer Credit Slightly Higher After Major Prior Downward Revision, Commercial Banks Withdraw $6 Billion In Credit

Posted By thestatedtruth.com on June 7, 2010

By Tyler Durden on 06/07/2010 Â

Posted By thestatedtruth.com on June 7, 2010

By Tyler Durden on 06/07/2010 Â

Posted By thestatedtruth.com on June 7, 2010

Update: The pipe belongs to Enterprise Products Partners LP. Bloomberg reports: “Enterprise Products Partners LP shut a portion of its 36-inch natural gas pipeline after the line was struck by a fire. The line stretches from Waha in West Texas to the Carthage Hub in Panola, Rick Rainey, a company spokesman said in a telephone interview.”

Following up on last week’s explosion in Pennsylvania, Fox News is currently tracking a massive gas well explosion near Granbury, Texas. The fireball is so large (and currently blazing as the Fox News video below attest) that it can be seen 30 miles away. 3 have been reported dead, 6 are injured, and 10 are missing.

Posted By thestatedtruth.com on June 7, 2010

U.S.’s $13 Trillion Debt Poised to Overtake GDP

The CHART OF THE DAY tracks U.S. gross domestic product and the government’s total debt, which rose past $13 trillion for the first time this month. The amount owed will surpass GDP in 2012, based on forecasts by the International Monetary Fund. The lower panel shows U.S. annual GDP growth as tracked by the IMF, which projects the world’s largest economy to expand at a slower pace than the 3.2 percent average during the past five decades.

“Over the long term, interest rates on government debt will likely have to rise to attract investors,said Hiroki Shimazu, a market economist in Tokyo at Nikko Cordial Securities Inc., a unit of Japan’s third-largest publicly traded bank. That will be a big burden on the government and the people.

Gross, who runs the world’s largest mutual fund at Pacific Investment Management Co. in Newport Beach, California, said in his June outlook report that the debt super cycle trend suggests U.S. economic growth won’t be enough to support the borrowings if real interest rates were ever to go up instead of down.

Dan Fuss, who manages the Loomis Sayles Bond Fund, which beat 94 percent of competitors the past year, said last week that he sold all of his Treasury bonds because of prospects interest rates will rise as the U.S. borrows unprecedented amounts. Obama is borrowing record amounts to fund spending programs to help the economy recover from its longest recession since the 1930s.

Posted By thestatedtruth.com on June 7, 2010

Â

– Post-World War II Record Drop in Inflation-Adjusted M3 Signals  Intensifying Business Contraction

– Renewed Recession Will Set Stage for U.S. Solvency Crisis and Severe Inflation Threat

Posted By thestatedtruth.com on June 6, 2010

By Simon Kennedy and Mark Deen

June 7 (Bloomberg) — Global policy makers are starting to clash over their individual prescriptions for recovery as Europe demands lower budget deficits while the U.S. warns against pushing exports instead of domestic demand.

At a meeting of Group of 20 finance chiefs in Busan, South Korea, June 4-5, Treasury Secretary Timothy F. Geithner said the world cannot again bank on the cash-strapped U.S. consumer to drive growth and urged other nations to stimulate their own demand. European Central Bank President Jean-Claude Trichet said fiscal tightening in “old industrialized economies†would aid the expansion by shoring up investor confidence.

Each strategy carries threats for the global rebound that the G-20 said faces “significant challenges.†Continued stimulus risks bondholder revolt over rising debt burdens, while spending cutbacks could worsen unemployment. Relying on exports leaves the world prone to trade wars and competitive currency devaluations as countries seek to give their companies an edge.

“The world may end up in a period of sub-potential growth for two or three years,†said Venkatraman Anantha-Nageswaran, who helps manage about $140 billion in assets as global chief investment officer at Bank Julius Baer & Co. in Singapore. “We need to accept that all of us cannot simultaneously grow our way out of trouble.â€

The fragility of the recovery from last year’s worldwide recession was evident as the G-20’s finance ministers and central bankers gathered to shape the agenda for this month’s summit of their leaders in Toronto.

More at: http://www.bloomberg.com/apps/news?pid=20601087&sid=ajCu8.BfseQE&pos=2

Posted By thestatedtruth.com on June 4, 2010

Forbes.com

Focus hard on this shocking Wall Street reality: The top six bank holding companies earned an aggregate of $51 billion in pretax income in 2009. We’re talking about JPMorgan Chase, Goldman Sachs, Bank of America, Morgan Stanley, Citigroup and Wells Fargo.

All of this pretax income can be attributed to their trading revenues of $59.7 billion. The proprietary trading operations of an oligopoly of banks, saved from disaster by Uncle Sam’s largesse and subsidized with cheap money from the central bank, was the single driving force behind the restoration of their fortunes and the renewed surge in their stock prices.

For those willing to go long when the outlook was the bleakest, they’ve banked a double in JPMorgan Chase ( JPM – news – people ), scored a quadruple in Citigroup ( C – news – people ) and nearly a quintuple in BofA.

Some of the other 980 bank holding companies–like Bank of New York Mellon ( BK – news – people ), PNC Financial Services, U.S. Bancorp ( USB – news – people ) and M&T Bank ( MTB – news – people )–lost an aggregate of $19 billion for the 2009 year. Bank of New York Mellon had the seventh-largest trading revenue–it was just 1.6% of the total. By comparison, Goldman Sachs ( GS – news – people ) had 36.2%, Bank of America ( BAC – news – people ) 18.8%, JPMorgan Chase 15.4%, Morgan Stanley ( MS – news – people ) 11.3%, Citigroup 6.9% and Wells Fargo ( WFC – news – people ) 4.2%.

All data from December 2009 FR Y-9C filings. Dollar amounts in millions.

| Â | Â | Total Assets, Dec. 31, 2009 | Trading Revenue | As a Percentage of Industry Trading Revenue |

| 1 | Goldman Sachs Group | $849,278 | $23,234 | 36.2% |

| 2 | Bank of America | 2,224,539 | 12,067 | 18.8% |

| 3 | JPMorgan Chase | 2,031,989 | 9,870 | 15.4%% |

| 4 | Morgan Stanley | 771,462 | 7,279 | 11.3% |

| 5 | Citigroup | 1,856,646 | 4,448 | 6.9% |

| 6 | Wells Fargo | 1,243,646 | 2,674 | 4.2% |

| 7 | Bank of New York Mellon | 212,336 | 1,032 | 1.6% |

| 8 | State Street | 156,756 | 598 | 0.9% |

| 9 | Northern Trust | 82,142 | 508 | 0.8% |

| 10 | MetLife | 539,314 | 361 | 0.6% |

| 11 | GMAC | 172,313 | 173 | 0.3% |

| 12 | PNC Financial Services Group | 269,922 | 170 | 0.3% |

| 13 | U.S. Bancorp | 281,176 | 163 | 0.3% |

| 14 | Fifth Third Bancorp | 113,380 | 125 | 0.2% |

| 15 | SunTrust Banks | 174,166 | 100 | 0.2% |

| Â | Sum: Top 15 Banks by Trading Revenue | Â | 62,803 | 97.8% |

| Â | Remaining Bank Holding Companies | Â | 1,399 | 2.2% |

| Â | Total: All Bank Holding Companies (986 banks) | Â | 64,202 | 100.0% |

Even more fascinating for public policy reasons, Goldman Sachs’ trading revenue was 119% of its own pretax income. Bank of America’s trading was 262.8% of its pretax income and Morgan Stanley’s trading was an incredible 849.4% of its pretax income.

Goldman Sachs, Bank of America and JPMorgan Chase did not lose money during any single trading session of the 2010 first quarter. This astonishing performance underscores the casino the oligopoly has become. It bears testament to the payoff from the Wall Street bailout of 2008, which resulted in the elimination of competition and the concurrent strengthening of the few giants left standing.

More at:Â http://www.forbes.com/2010/06/03/goldman-sachs-citigroup-markets-lenzner-morgan-stanley.html

Posted By thestatedtruth.com on June 4, 2010

Robert Reich was the nation’s 22’nd Secretary Of Labor.

By Robert Reich  Jun 4, 2010Â

The Labor Department reports this morning that the private sector added a measly 41,000 net new jobs in May. But at least 100,000 new jobs are needed every month just to keep up with population growth.

In other words, the labor market continues to deteriorate.

The average length of unemployment continues to rise – now up to 34.4 weeks (up from 33 weeks in April). That’s another record.

More Americans are too discouraged to look for a job than last year at this time (1.1 million in May, an increase of 291,000 from a year earlier.)

Of the small number of jobs created by the private sector in May, many came from temporary help services.

Which is one reason why the median wage continues to drop.

Why are we having such a hard time getting free of the Great Recession? Because consumers, who constitute 70 percent of the economy, don’t have the dough. They can’t any longer treat their homes as ATMs, as they did before the Great Recession.

Businesses won’t rehire if there’s not enough demand for their goods and services.

The only reason the economy isn’t in a double-dip recession already is because of three temporary boosts: the federal stimulus (of which 75 percent has been spent), near-zero interest rates (which can’t continue much longer without igniting speculative bubbles), and replacements (consumers have had to replace worn-out cars and appliances, and businesses had to replace worn-down inventories). Oh, and, yes, all those Census workers (who will be out on their ears in a month or so).

But all these boosts will end soon. Then we’re in the dip.

Retail sales are already down.

So what’s the answer? In the short term, more stimulus – especially extended unemployment benefits and aid to state and local governments that are whacking schools and social services because they can’t run deficits.

But the deficit crazies in the Senate, who can’t seem to differentiate between short-term stimulus (necessary) and long-term debt (bad) last week shot it down.

In the longer term, we need a new New Deal that will bolster America’s floundering middle class. Expand the Earned Income Tax Credit and extend it up through the middle class. Finance that extension through higher marginal income taxes on the wealthy, who have never had it so good.

http://wallstreetpit.com/30745-why-were-falling-into-a-double-dip-recession

Posted By thestatedtruth.com on June 4, 2010

By Jonathan Stempel

NEW YORK, June 3 (Reuters)Â Â Â Â The pace of U.S. bankruptcy filings edged up in May to the second-highest daily level since 2005, reflecting the difficulty Americans have in working off excess debt even as the economy improves.

There were 133,459 U.S. bankruptcy petitions filed in May, 10 percent more than a year earlier, according to preliminary data released Thursday by Automated Access to Court Electronic Records, or AACER.

While filings fell 9 percent from April’s 146,209, this was because there were just 20 business days in May compared with 22 in April. Average filings per day edged up to 6,673 from 6,646.

Experts say bankruptcies typically peak in an economic cycle between six and 18 months after an economy bottoms out.

This is in part because many people and businesses seek other means to work off their debts before seeking court protection.

U.S. gross domestic product rose at a 3 percent annual rate from January to March, the Commerce Department said last week, after a 5.6 percent growth pace in the fourth quarter of 2009.

Posted By thestatedtruth.com on June 4, 2010

By Jim Polson and Jessica Resnick-Ault

June 4 (Bloomberg) — BP Plc may be able to capture more than 90 percent of the oil leaking from its Gulf of Mexico well with the cap it put in place last night.

“I’d like to see us capture 90-plus percent of this flow,†Doug Suttles, BP’s chief operating officer for exploration and production, said on CBS’s “Early Show†this morning. “That’s possible with this design. We have to work through the next 24 to 48 hours to optimize that.â€

Oil is now venting from four valves in the cap that engineers expect to close today, Suttles said on CNN. The adjustable valves are intended to prevent clogging by icy gas hydrates that frustrated an initial attempt to contain the leak, he said. The cap was put atop the well to divert oil to ships on the surface.

Live video feeds on the BP website show oil still gushing into the Gulf. Suttles said that isn’t a sign the cap has failed. The leak is about 40 miles off Louisiana’s coast under about 5,000 feet (1,524 meters) of water.

BP yesterday cut off the riser pipe that used to attach the well to the Deepwater Horizon drilling rig. The company used shears after a diamond-saw blade, which would’ve made a cleaner cut and allowed for a tighter fit for the cap, got stuck.

More at: http://www.bloomberg.com/apps/news?pid=20601087&sid=a2fz_0Lrt274&pos=8

Posted By thestatedtruth.com on June 3, 2010

June 3, 2010

By John R. Taylor, Jr.

Chief Investment Officer

Troubles are everywhere, in the Gulf of Mexico, in Greece, and in Korea, to name just a few, but we already know about these problems. Other than the tragicomic opera being played out along the 38th parallel and in the waters around the western sea border, which is still lighting up our brain cells, the other news has been rehashed ad nauseam. The airwaves have been so full of Greece and the gigantic US oil slick that the rest of the world has been forgotten. In fact, the Greek problem has been ‘solved’ at least for a while. The ECB is on the bid for the dicey sovereign debt and all is getting quieter in the markets – even though we can’t quite yet believe it. And, no one will really be able to judge the effectiveness of the tax increases and spending cuts until September at the earliest. A mainstream bank just sent out a report arguing “Fiscal adjustment in the Euro area: so far so good.†Who are we –or anyone else – to argue with that opinion? Anyway it is almost summer, so most Europeans will be taking their extended vacation. All those speculators who are short the euro could start to get nervous as it climbs a bit. The BP oil leak is another issue, as the situation has gotten completely out of control. Some pundits are even clamoring for the US government to step in, throw BP out, and fix it – now. With what expertise? There is no IMF for this problem. Although this is a wild card impacting the psychological health of American investors and the electability of anyone associated with Obama in November, the imagined impact has become so negative that a solution could bring a spectacular feelgood rally. The probability of an outcome better than the bleak expectations is probably higher than 50%. Add that onto the Greek solution and this looks like the right time to bet on a risk rally. If only the North Koreans took summer vacations like the Europeans, it would be a sure thing.

Although our analysis argues that the global economy should be slowing down and starting a long decline, the tremors that went through the markets in May have halted the Central Banks’ tightening drift, which should allow financial markets to rally again. The American fiscal stimulus might be losing its steam, but it is still positive through this quarter. Although this boost will disappear in the third quarter and will turn into a retrenchment by the end of the year, the US business community, as expressed in the ISM numbers and the local Fed reports, is positive enough to keep the economic naysayers (like us) on our back foot. China, the other global locomotive, is still gently applying the brakes and could prove the Achilles heel of our positive multi-month outlook. Too dramatic a slowdown in Chinese growth could prematurely chill investors’ enthusiasm, but we consider this risk a minor one.

The non G-10 economies, having suffered very little financial distress during the banking crisis of 2008, and benefitting from the current exceptionally low dollar, euro, and yen interest rates, are doing just fine. Adding this all together, it is possible to paint a very happy picture – as long as the looming solvency issues remain in the background. However, with banks cutting their asset sizes because they are short of capital and being hemmed in by new regulations, there is no way that multiple national debt restructurings can be avoided, but that is a story for the fall, or next year.

Our analysis of the long-term cycles points to a peak in the second half of July or August which would be followed by a long and increasingly dramatic decline that would continue into the middle of 2011 at the minimum. It is very likely that the global Central Banks will lower rates further, where they can, and will resort to increased amounts of quantitative easing. As much of the economic distress will be centered in Europe, the dollar will gain against the euro, but when the Fed eventually shifts into high gear – as it always does – the Asian currencies and maybe even the euro will outperform the dollar.

ww.zerohedge.comw

Posted By thestatedtruth.com on June 3, 2010

The chatter began weeks ago as armchair engineers brainstormed for ways to stop the torrent of oil spilling into the Gulf of Mexico: What about nuking the well?

Energy Secretary Steven Chu is not considering a bomb.

Decades ago, the Soviet Union reportedly used nuclear blasts to successfully seal off runaway gas wells, inserting a bomb deep underground and letting its fiery heat melt the surrounding rock to shut off the flow. Why not try it here?

The idea has gained fans with each failed attempt to stem the leak and each new setback — on Wednesday, the latest rescue effort stalled when a wire saw being used to slice through the riser pipe got stuck.

“Probably the only thing we can do is create a weapon system and send it down 18,000 feet and detonate it, hopefully encasing the oil,†Matt Simmons, a Houston energy expert and investment banker, told Bloomberg News on Friday, attributing the nuclear idea to “all the best scientists.â€

Or as the CNN reporter John Roberts suggested last week, “Drill a hole, drop a nuke in and seal up the well.â€

This week, with the failure of the “top kill†attempt, the buzz had grown loud enough that federal officials felt compelled to respond.

Stephanie Mueller, a spokeswoman for the Energy Department, said that neither Energy Secretary Steven Chu nor anyone else was thinking about a nuclear blast under the gulf. The nuclear option was not — and never had been — on the table, federal officials said.

“It’s crazy,†one senior official said.

Government and private nuclear experts agreed that using a nuclear bomb would be not only risky technically, with unknown and possibly disastrous consequences from radiation, but also unwise geopolitically — it would violate arms treaties that the United States has signed and championed over the decades and do so at a time when President Obama is pushing for global nuclear disarmament.

The atomic option is perhaps the wildest among a flood of ideas proposed by bloggers, scientists and other creative types who have deluged government agencies and BP, the company that drilled the well, with phone calls and e-mail messages. The Unified Command overseeing the Deepwater Horizon disaster features a “suggestions†button on its official Web site and more than 7,800 people have already responded, according to the site.

Among the suggestions: lowering giant plastic pillows to the seafloor and filling them with oil, dropping a huge block of concrete to squeeze off the flow and using magnetic clamps to attach pipes that would siphon off the leaking oil.

Some have also suggested conventional explosives, claiming that oil prospectors on land have used such blasts to put out fires and seal boreholes. But oil engineers say that dynamite or other conventional explosives risk destroying the wellhead so that the flow could never be plugged from the top.

Along with the kibbitzers, the government has also brought in experts from around the world — including scores of scientists from the Los Alamos National Laboratory and other government labs — to assist in the effort to cap the well.

In theory, the nuclear option seems attractive because the extreme heat might create a tough seal. An exploding atom bomb generates temperatures hotter than the surface of the sun and, detonated underground, can turn acres of porous rock into a glassy plug, much like a huge stopper in a leaky bottle.

Michael E. Webber, a mechanical engineer at the University of Texas, Austin, wrote to Dot Earth, a New York Times blog, in early May that he had surprised himself by considering what once seemed unthinkable. “Seafloor nuclear detonation,†he wrote, “is starting to sound surprisingly feasible and appropriate.â€

Much of the enthusiasm for an atomic approach is based on reports that the Soviet Union succeeded in using nuclear blasts to seal off gas wells. Milo D. Nordyke, in a 2000 technical paper for the Lawrence Livermore National Laboratory in Livermore, Calif., described five Soviet blasts from 1966 to 1981.

All but the last blast were successful. The 1966 explosion put out a gas well fire that had raged uncontrolled for three years. But the last blast of the series, Mr. Nordyke wrote, “did not seal the well,†perhaps because the nuclear engineers had poor geological data on the exact location of the borehole.

Robert S. Norris, author of “Racing for the Bomb†and an atomic historian, noted that all the Soviet blasts were on land and never involved oil.

Whatever the technical merits of using nuclear explosions for constructive purposes, the end of the cold war brought wide agreement among nations to give up the conduct of all nuclear blasts, even for peaceful purposes. The United States, after conducting more than 1,000 nuclear test explosions, detonated the last one in 1992, shaking the ground at the Nevada test site.

A senior Los Alamos scientist, speaking on the condition of anonymity because his comments were unauthorized, ridiculed the idea of using a nuclear blast to solve the crisis in the gulf.

“It’s not going to happen,†he said. “Technically, it would be exploring new ground in the midst of a disaster — and you might make it worse.â€

Not everyone on the Internet is calling for nuking the well. Some are making jokes. “What’s worse than an oil spill?†asked a blogger on Full Comment, a blog of The National Post in Toronto. “A radioactive oil spill.â€

Henry Fountain contributed reporting.

Posted By thestatedtruth.com on June 3, 2010

There’s more going on here. For a variety of reasons, lenders are most likely to foreclose on property they own but less likely to take action on behalf of the investors whose mortgages they’re servicing, and most loans are owned by investors. Foreclosing on a loan likely means that an investor will have to write down the value and that will have a variety of negative consequences for their own finances. In addition, investors often have trouble establishing that they actually own a particular loan and have the right to foreclose. Not only have courts become increasingly unwilling to take their word for it, attorneys are increasingly aware that paperwork is missing or incomplete.

By Stan Collender Posted |Jun 3, 2010

It’s hard not to be both amused and angry after reading this story by David Streitfeld in yesterday’s New York Times about homeowners who are intentionally not paying their mortgages but are not facing foreclosure because…well…their mortgage servicer isn’t foreclosing on them.

It’s hard not to be both amused and angry after reading this story by David Streitfeld in yesterday’s New York Times about homeowners who are intentionally not paying their mortgages but are not facing foreclosure because…well…their mortgage servicer isn’t foreclosing on them.

You can’t call this a “movement†because it doesn’t appear to be organized. As the Times story notes, this is happening with increasing frequency because individual homeowners are realizing that the foreclosure process isn’t automatic and are taking advantage of the situation by deciding not to pay.

Stories like this almost certainly will encourage others to stop making payments, and, as the story also notes, a new business/industry/profession seems to be developing in mortgage payment avoidance counseling. So, the number of homeowners who simply stop making payments and dare their servicer to do something about it may well continue to grow.

The question is why are servicers letting this happen. If, as the article indicates, servicers don’t have the resources to deal with the situation, why haven’t they hired more people? It’s obviously not because, as servicers tried to say when the mortgage crisis began, workers aren’t available. And given the increasing profits of many banks, it’s not because of a lack of cash.

My contacts in the mortgage lending industry tell me that the basic reason is the prevailing thought that homeowners will start paying again on their own as the economy continues to recover in the months ahead. In other words, the industry is largely assuming that the problem will be self-correcting.

Hidden in this assumption, of course, is a calculation that the cost of foreclosing in this environment will be greater than what will be recovered and that, given the current value of the property that would be recovered, it’s not worth the time, effort, and expense to go after all of the homeowners who are voluntarily defaulting .

But there’s more going on here. For a variety of reasons, lenders are most likely to foreclose on property they own but less likely to take action on behalf of the investors whose mortgages they’re servicing, and most loans are owned by investors. Foreclosing on a loan likely means that an investor will have to write down the value and that will have a variety of negative consequences for their own finances. In addition, investors often have trouble establishing that they actually own a particular loan and have the right to foreclose. Not only have courts become increasingly unwilling to take their word for it, attorneys are increasingly aware that paperwork is missing or incomplete.

There also seems to be a growing unwillingness among some lenders to foreclose because of the likelihood that a very large number of homeowners will end up being shut out of the market for close to a decade if, as would almost certainly happen upon foreclosure, their credit ratings were negatively affected. The investors, realtors, homebuilders, etc. need more rather than less buyers so that, as conditions change, the demand and price for homes will be higher than they would otherwise be.

The mortgage lending industry also has to have made some type of political calculation. Massive foreclosures as the financial reform legislation is still being considered in Washington would trigger even more anger and would likely make it easier for Congress to be more punitive. The cost of those changes would likely be far greater than anything recovered with an aggressive foreclosure effort.

You have to wonder whether all of this will be different starting the day after Election Day. By that time action on a financial reform bill will probably be over, the elections will have been held and, if the forecasts are correct, GDP will have grown for four consecutive quarters. With most of the factors that up to now have created an incentive for investors not to foreclose changed, foreclosures may again get back in vogue.

http://wallstreetpit.com/30413-why-arent-banks-foreclosing-more-often-on-more-homeowners

Posted By thestatedtruth.com on June 3, 2010

Posted By thestatedtruth.com on June 2, 2010

Retail sales in May remained weak following a lackluster April, according to one spending barometer, providing further indication that any recovery in consumer spending is going to be choppy.

The slowdown follows a strong holiday season and start to the year, when consumers showed a willingness to spend again and even pay closer to full price. Now, they are revealing their cautious streak.

MasterCard Advisors SpendingPulse, a unit of MasterCard Inc. that tracks spending by credit card, debit card, cash and check, said that specialty-apparel sales fell 3.7% in May from a year earlier, the second consecutive month of declines after increases in January, February and March. Among other categories: Sales of furniture fell 9.6% while the combined category of electronics and appliances slipped 0.7%.

“Consumer spending across a number of industry sectors has slowed,” says Michael McNamara, vice president of research and analysis for SpendingPulse, which doesn’t release an overall monthly index on consumer spending.

Posted By thestatedtruth.com on June 2, 2010

Love him or hate him, he sure hits the nail on the head with this!

Bill Gates recently gave a speech at a High School about 11 things they did not and will not learn in school. He talks about how feel-good, politically correct teachings created a generation of kids with no concept of reality and how this concept set them up for failure in the real world.

Rule 1: Life is not fair – get used to it!

Rule 2: The world doesn’t care about your

self-esteem. The world will expect you to accomplish something BEFORE you feel good about yourself.

Rule 3: You will NOT make $60,000 a year right out of high school. You won’t be a vice-president with a car phone until you earn both.

Rule 4: If you think your teacher is tough, wait till you get a boss.

Rule 5: Flipping burgers is not beneath your dignity. Your Grandparents had a different word for burger flipping: they called it opportunity.

Rule 6: If you mess up, it’s not your parents’ fault, so don’t whine about your mistakes, learn from them.

Rule 7: Before you were born, your parents weren’t as boring as they are now. They got that way from paying your bills, cleaning your clothes and listening to you talk about how cool you thought you were. So before you save the rain forest from the parasites of your parent’s generation, try delousing the closet in your own room.

Rule 8: Your school may have done away with winners and losers, but life HAS NOT. In some schools, they have abolished failing grades and they’ll give you as MANY TIMES as you want to get the right answer. This doesn’t bear the slightest resemblance to ANYTHING in real life.

Rule 9: Life is not divided into semesters. You don’t get summers off and very few employers are interested in helping you FIND YOURSELF. Do that on your own time.

Rule 10: Television is NOT real life. In real life people actually have to leave the coffee shop and go to jobs.

Rule 11: Be nice to nerds. Chances are you’ll end up working for one.

Posted By thestatedtruth.com on June 2, 2010

By Andrew Frye and William Selway

June 2 (Bloomberg) — Warren Buffett, whose Berkshire Hathaway Inc. has been trimming its investment in municipal debt, predicted a “terrible problem†for the bonds in coming years.

“There will be a terrible problem and then the question becomes will the federal government help,†Buffett, 79, said today at a hearing of the U.S. Financial Crisis Inquiry Commission in New York. “I don’t know how I would rate them myself. It’s a bet on how the federal government will act over time.â€

Berkshire’s investment portfolio included municipal bonds valued at less than $3.9 billion as of March 31, down from more than $4.7 billion at the end of 2008. The company had a maximum of $16 billion at risk in derivatives tied to such debt, according to the company’s annual report for 2009.

Buffett, Berkshire’s chairman and chief executive, has previously warned about the risks of insuring municipal bonds. In his annual letter to shareholders in 2009, he said public officials may be tempted to default on bonds whose payments are guaranteed by insurance companies rather than push through needed tax increases. He said guaranteeing municipal bonds against default “has the look today of a dangerous business.â€

Local governments rely on the $2.8 trillion municipal bond market to raise money for construction projects and fund other budget items. The financial crisis and recession battered governments across the U.S. by cutting into tax collections and causing pension-fund losses. Some governments failed to set aside enough money to cover retirement benefits promised to employees, which may place increasing strain on public finance.

Buffett said last month that the U.S. may feel compelled to rescue a state facing default after the government committed $700 billion to bail out financial firms and automakers.

“It would be hard in the end for the federal government to turn away a state having extreme financial difficulty when they’ve gone to General Motors and other entities and saved them,†Buffett told shareholders in Omaha, Nebraska, at Berkshire’s May 1 annual meeting. “I don’t know how you would tell a state you’re going to stiff-arm them with all the bailouts of corporations.â€

A report by the Pew Center on the States in February estimated that by the end of the 2008 budget years, states had $1 trillion less than needed to pay for future pensions and medical benefits, a gap the center said was likely compounded by losses suffered in the second half of 2008.

More at: http://www.bloomberg.com/apps/news?pid=newsarchive&sid=airOwCWviFuU

Posted By thestatedtruth.com on June 2, 2010

July isn’t too shabby, but it has the misfortune of sitting between the only two months – June and September – that have produced losses, on average, since 1950. August has delivered a gain, but just barely. So when you add it all up, you can see that the stock market has not provided a very hospitable home for capital during the summer months.

|

Enter May, 2010, the worst May for the Dow Jones Industrial Average since the Andrews Sisters recorded “Boogie Woogie Bugle Boy.” The Dow stumbled 7.9% last month – dropping its year-to-date return to minus 3.9%. These numbers aren’t disastrous, but they aren’t very helpful either. Better to have sold in May and gone away.

Commodities didn’t fare any better in May, as the Reuters/Jefferies CRB Index dropped more than 8%. Only gold managed to keep its bow above the waterline by gaining 3% on the month.

Posted By thestatedtruth.com on June 2, 2010

June 2, 2010

By MATTHEW L. WALDA report just issued by the Energy Department and the North American Electric Reliability Corporation, known as Nerc, an industry group that polices the power grid, lists three categories of threats to the grid: coordinated cyber- and physical attacks, pandemic disease and electromagnetic damage.

Grid experts have long worried that the high-altitude detonation of a nuclear weapon would send a damaging pulse of energy to earth. And changes in solar activity have occasionally distorted the earth’s magnetic field and generated currents in the rock that have caused blackouts.

What the threats have in common, said Jerry Cauley, the president and chief executive of Nerc, is the “potential to simultaneously impact many assets at once.’’ The grid comprises 200,000 miles of transmission lines and millions of digital controls, he pointed out. The study is an attempt to map out preparations for events that are rare or have so far never happened, what the Energy Department calls “high-impact, low-frequency events.†Â

The electric system in Quebec was shut down by a geomagnetic storm in 1989; Mr. Cauley said that while utility systems at northern latitudes were thought to be most vulnerable, recent work has established that Mother Nature could reach further south than previously thought.

The geomagnetic problem is that the sun is constantly sending out streams of charged particles that hit the earth’s magnetic field. If the strength of the stream changes, the field will move. And if the magnetic field moves through rock that is an electric conductor, it will induce currents in the earth. These currents can overload transformers and other components of the power system.

The study recommends a variety of steps, including preparing a better inventory of spare parts and better contingency plans for starting up the grid in circumstances where there is no electric power – a trick akin to starting a fire without a match. And, in the tradition of government/industry studies, it recommends more studies.

Posted By thestatedtruth.com on June 1, 2010

State Pensions:

I’ll Buy Your Bonds if You Buy Mine

by John Rubino

June 1, 2010

Here’s a study from Northwestern University’s Kellogg School of Management that ties in nicely with the muni bond collapse qnd  federal bailout of the states.

State pension funds headed for crisis of national proportion

According to new research from the Kellogg School of Management, taxpayers, public workers and state and federal officials alike have cause for serious concern about an issue that often falls under the radar but poses serious risk to the future health of the national economy: state pension liabilities.

Data presented today in Washington, DC, at a conference called “New Retirement Realities: Pensions at a Crossroads†demonstrates that several state pension funds will not last the decade, a situation that will place tremendous pressure on the federal government to bail out financially insolvent states at a price tag likely to match or exceed the recent bailout of the U.S. financial system.

In his presentation, Joshua Rauh, associate professor of finance of the Kellogg School of Management at Northwestern University, predicts that without basic reform to the current pension system, many large state pension funds will run out, even if they achieve predicted 8 percent annual returns. As a result, Rauh warns that promised benefit payments would be so substantial that raising state taxes to make the payments would be infeasible, offering no other choice than to call on the federal government to bail out the failing states.

As an example, Rauh points to Illinois. If the state’s three main pension funds earn 8 percent returns and the state makes contributions accordingly, the funds will run out of money in 2018. In the following years, benefit payments owed to existing state workers would be an estimated $14 billion – more than half of the revenue Illinois is projected to receive in 2010 – and states are under legal obligation to make these payments.

“This is a problem of monumental proportion,†said Rauh. “Given that we see the same issue in many states, the total size of a federal rescue plan could exceed the seriousness of the recent economic crisis and potentially cost more than $1 trillion total. Plus, this scenario could happen sooner if taxpayers flee to other states with lower taxes and higher services, if contributions are deferred or not made, or if returns are lower than expected,†he said.While Illinois is currently at the highest risk, pension funds in other troubled states could dry up by the end of 2020: Louisiana, New Jersey, Connecticut, Indiana, Oklahoma, and Hawaii. And, by 2030, as many as 31 states could be affected.

To counter this problem, Rauh has outlined an innovative plan, issued today. It notes that fundamental state reform is essential, and underscores the urgent need for a federal program that offers incentives to stop the growth of unfunded liabilities. He recommends that states be allowed to issue tax-subsidized pension funding bonds for the next 15 years if they agree to a specific program of major pension reforms. To get the subsidy, states must agree to close defined benefit (DB) plans to the approximately one million new workers who take state jobs every year, and instead to offer the new hires a defined contribution plan (DC) similar to the federal Thrift Savings Program, as well as guaranteed access to Social Security.

“Right now only a quarter of all public workers contribute to Social Security,†said Rauh. “While the cost for the Pension Security Bonds over 15 years would be about $250 billion, under this plan the Social Security system would see a net gain of over $175 billion. All told, the cost to the federal government for such a program would be around $75 billion, far less than the minimum $1 trillion it could risk if the state pension fund system is left in disrepair.â€

Rauh’s plan offers a cogent solution for the tens of millions of police officers, firefighters, teachers and other public service and state employees that will enter the workforce over the next decade, while maintaining consistency for workers already in the system.

“Existing pensions would become more secure and new workers would get more than an empty promise, while the country would avoid another massive taxpayer-financed bailout,†he concluded. “It is imperative that we act today to give states the incentives they need to put themselves back on a path to fiscal sustainability.â€

Some thoughts:

www.financialsense.com

2010 John Rubino

Posted By thestatedtruth.com on June 1, 2010

France admitted that it faces a challenge in maintaining its triple-A credit rating, and announced some controversial cost-cutting measures in an effort to soothe market anxieties. France’s actions follow a Friday downgrade of Spain to AA+ from AAA.

Posted By thestatedtruth.com on June 1, 2010

Â

June 01, 2010

NEW YORK — A member of New York Gov. David Paterson’s administration said the governor is putting together a plan that would lay off thousands of government workers at the beginning of next year to help balance the state budget.

The administration official confirmed a report Tuesday in The New York Times that Paterson will direct state agencies to begin picking positions that could be eliminated starting Jan. 1.

That date marks the expiration of the no-layoffs pledge Paterson gave public employee unions last year in exchange for an agreement to reduce pension costs. It would also be the day Paterson leaves office.

The official spoke on condition of anonymity because the plan hasn’t been formally announced.  State leaders are facing a $9.2 billion deficit this year and still haven’t completed a budget for the fiscal year that began April 1.

Posted By thestatedtruth.com on May 31, 2010

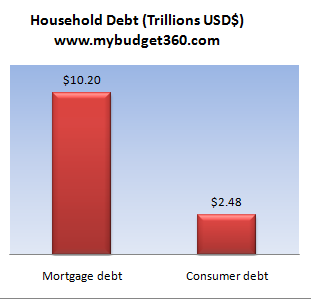

Every man, woman, and child would owe an average of $43,000 if we divided up mortgage, credit card, student, and auto debt in the United States. Of course, this is based on the current population of 309 million. But we know this isn’t exactly accurate since an infant really didn’t charge up a credit card or take out a HELOC. We should break this down to each individual household. If we average this figure out over all U.S. households the amount comes out to over $120,000 per household. When 1 out of 3 Americans have no savings, how do you think many will be able to pay off their debt? For decades, the model has revolved around servicing debt and not necessarily paying the initial balance off. But many American families are feeling the deep psychological strain of an economy largely built on debt.

The emotional strain of debt is showing up in large numbers:

Source:Â MSNBC

I think when we see surveys like this, some will tend to underestimate the amount of debt carried by each household. For example, not everyone has a mortgage and by far mortgage debt is the largest line item for consumer debt. We know that in the U.S. 51 million mortgages are outstanding. The latest Federal Reserve flow of funds shows mortgage debt at over $10.2 trillion. So run these numbers:

$10.2 trillion / 51 million mortgages = average mortgage debt of $200,000

Now the interesting thing is the median home price across the U.S. is slightly above $170,000. With that said, recent housing surveys have found that one-third of all these mortgages are attached to homes that are worth less than the actual mortgage. They are underwater. It is clear that the average American would feel incredible amounts of stress if they were living in a home that had fallen in value so much, that the attached debt was larger than the market sale price of the home. And most Americans that have a home have a generally good sense of what their home is worth. Many of course have their optimistic “dream†price but many deep down have a better sense of the real price. This is probably derived from recent home sales and other comparable properties in the area.

If we want to break down household debt, this is what we get:

The grand total of mortgage, credit card, student loans, and auto loan debt is a stunning $13.5 trillion. The tipping point came when total household debt aligned itself with the annual GDP of the United States. And this number seems to be reflected in the average income data. The typical household takes in approximately $52,000 per year and this is much lower than the $120,000 of debt each household would be responsible if we were to divide the debt share up today. What does this number tell us? We have spent far more than we earn and we earn at a level that is near the top globally.

I was fascinated that the survey was split nearly down the middle in terms of debt related stress. You have half of U.S. households worried about debt while another half seems to be comfortable with their debt. There are many households with no mortgage or that rent. You have others that pay off their credit card balance off each month. Others have paid off cars and no auto debt. What appears to happen with some American families is that they have a penchant for taking on inordinate amounts of debt. Confusing access to debt with wealth was also a large epidemic.

In California during the peak days of the housing bubble, a colleague was talking about how they refinanced out $100,000 from their home. This money was used for a lavish vacation and other “toys†that filled up their garage. When we talked, the perception was that the $100,000 home equity loan was actual free money. They failed to make the connection that the $100,000 would have to be paid off at a certain point. And many went down this road as evidenced by mortgage equity withdrawals:

Source: Calculated Risk

The great hoax was creating an atmosphere that made people believe that this money was actually free. I remember seeing many letters that had an actual check attached with the sum of $50,000 or higher as if it were a novelty gag. All you needed to do was sign and cash the check at a local bank. It really had the symptoms of a once in a generation mania. The perspective from Wall Street and banks was that there would always be someone willing to pay a higher more inflated price and willing to take on more debt to make the purchase happen. Around 2006 many insiders started getting out slowly while talking up to the public that all this wild debt was somehow sustainable.

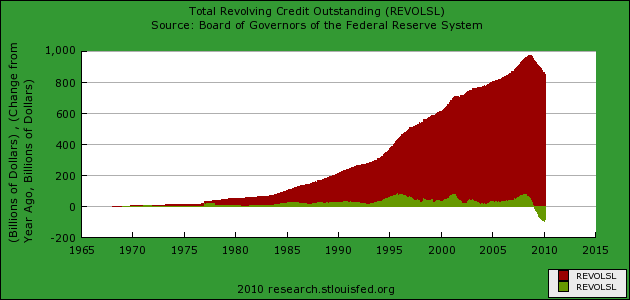

Now as a county we have always been comfortable with mortgage debt. In fact, a 30 year fixed mortgage with a decent down payment was the bread and butter of our economy for decades. Consumer debt on the other hand is really an astonishing concept. Think of credit cards. You are allowed to spend money you don’t have. Would you allow someone, completely unsecured, to spend your money on the promise they will pay you back? Maybe and this is largely how the system has been built. Banks have given Americans $850 billion in credit card debt. Some can pay it back but with the current recession, many cannot. We can see the purge going on in this sector rather clearly:

Since the peak in 2008 of $975 billion in revolving debt, $123 billion in credit card debt has been purged. Much of this has come through bankruptcies and write-offs as banks deal with poor performing loans. Ironically when Wall Street in 2007 and 2008 asked for trillions in U.S. taxpayer dollars, it was under the implicit notion that it was to keep the lending channels alive. Look at the above chart and you can clearly see that this is not the case. Credit card offers have dwindled to a trickle and credit lines have been slashed on even good standing customers.

I found this interesting article dated 1986 when interest rates were relatively high:

“(LA Times) Charles Newcomer, spokesman for General Motors Acceptance Corp., General Motors’ auto-finance subsidiary, said, “All the traditional assumptions about the auto-finance market are not necessarily true today.†He noted that just as home buyers are increasingly picking 15-year mortgages over 30-year loans-despite the fact that shorter maturities require larger monthly payments-some customers are also asking for shorter-term auto loans, possibly reversing the trend of recent years toward longer terms.â€

It is amazing that today, many dealers offer 72 month financing. Just like housing, Americans have taken on too much debt to finance auto purchases. It seems that we reached a point where we simply could not expand terms and pile on more and more debt. This is a debt purge that is likely to take a decade or even longer.

The current flushing out of debt is coming through many different avenues. Foreclosures are one large way of flushing out debt. Bankruptcy is another. And these have been at elevated levels going on for a few years now. It is hard to say where the balance will occur. If the economy picks up and picks up quickly, then many Americans will be able to service their debt again. Yet all market indicators have shown that a real debt purge is occurring and is likely to continue for years to come.

Posted By thestatedtruth.com on May 31, 2010

By Tyler Durden on 05/30/2010

Even as futures are feeling buoyant as a result of the JPY drop following the collapse of the Japanese ruling coalition (which in itself will likely spell serious JGB troubles in the days ahead), Middle-east geopolitical issues have once resurfaced… or technically submerged as the case may be. The Sunday Times reports that “three German-built Israeli submarines equipped with nuclear cruise missiles are to be deployed in the Gulf near the Iranian coastline.” Presumably, this a defensive move: “The first has been sent in response to Israeli fears that ballistic missiles developed by Iran, Syria and Hezbollah, a political and military organisation in Lebanon, could hit sites in Israel, including air bases and missile launchers. The submarines of Flotilla 7 — Dolphin, Tekuma and Leviathan — have visited the Gulf before. But the decision has now been taken to ensure a permanent presence of at least one of the vessels.” We are not sure Iran will take the news with the required dose of stoic acceptance. But at least we now have confirmation that Israeli subs are not being used by the Obama administration as a means of delivering nuclear armaments to the continental shelf (unless this too, is another Criss Angelesque Emmanuel Rahm masterpiece).

More from the Times:

The flotilla’s commander, identified only as “Colonel Oâ€, told an Israeli newspaper: “We are an underwater assault force. We’re operating deep and far, very far, from our borders.â€

Each of the submarines has a crew of 35 to 50, commanded by a colonel capable of launching a nuclear cruise missile.

The vessels can remain at sea for about 50 days and stay submerged up to 1,150ft below the surface for at least a week. Some of the cruise missiles are equipped with the most advanced nuclear warheads in the Israeli arsenal.

The deployment is designed to act as a deterrent, gather intelligence and potentially to land Mossad agents. “We’re a solid base for collecting sensitive information, as we can stay for a long time in one place,†said a flotilla officer.

The submarines could be used if Iran continues its programme to produce a nuclear bomb. “The 1,500km range of the submarines’ cruise missiles can reach any target in Iran,†said a navy officer.

It now seems that the Middle East is dead set on repeating the recent submarine-centric Korean festivites pretty much verbatim. Iran’s reaction is not all that surprising:

Apparently responding to the Israeli activity, an Iranian admiral said: “Anyone who wishes to do an evil act in the Persian Gulf will receive a forceful response from us.â€

The most troubling thing is that events in the Persian Gulf are moving much faster and politicians risk to lose all control imminently: precisely the stuff market melt ups are not made of.

Israel’s urgent need to deter the Iran-Syria-Hezbollah alliance was demonstrated last month. Ehud Barak, the defence minister, was said to have shown President Barack Obama classified satellite images of a convoy of ballistic missiles leaving Syria on the way to Hezbollah in Lebanon.

Binyamin Netanyahu, the prime minister, will emphasise the danger to Obama in Washington this week.

Tel Aviv, Israel’s business and defence centre, remains the most threatened city in the world, said one expert. “There are more missiles per square foot targeting Tel Aviv than any other city,†he said.

If that is indeed the case, one wonders what the logic of an act such as this one reported by Wire Update is: “Reports say Israeli ships attack Gaza aid flotilla. At least several people were killed and scores of others were left injured after Israeli ships clashed with six ships carrying pro-Palestinian activists and aid for Gaza, according to news reports on early Monday.” A livestream of the attack on Turkish aid ships in international water via CNN Turkey can be seen here.

Is Israel now actively seeking not only to wage war, but a two-fronted one at that? (did not work out too well last time this was attempted). We don’t know, although with bizarro futures, where the ES reacts inversely to what fundamentals suggest, look for another 100 points S&P move higher even with US markets close, as the world inches one step closer to nuclear war.

Posted By thestatedtruth.com on May 31, 2010

Â

Someone sure isn’t drinking the 63 out of 63 trading days Crissy in East Hampton on this sunny morning. Spiegel reports that German president, and former IMF head, Horst Kohler has resigned effective immediately, “a shock announcement that comes as the latest in a series of blows to Chancellor Angela Merkel.” The cause for the resignation is the fierce criticism of comments he made about Germany’s military mission in Afghanistan. More importantly, this will merely add to the instability in an otherwise already politically ravaged Germany. Got Bund, Bobl and Schatz?

From Spiegel:

German President Horst Köhler announced his resignation on Monday in response to fierce criticism of comments he made about Germany’s military mission in Afghanistan.

“I declare my resignation from the office of president — with immediate effect,” Köhler, with tears in his eyes and speaking in a faltering voice, said in a statement, flanked by his wife Eva-Luise.

The president is the head of state and his duties are largely ceremonial. But the resignation is the latest in a string of setbacks for Chancellor Angela Merkel since her re-election last September. The German federal assembly — made up of parliamentary MPs and delegates appointed by the country’s 16 federal states — will have to vote for a successor to Köhler within 30 days, according to the federal constitution.

The president had become the target of intense criticism following remarks he made during a surprise visit to soldiers of the Bundeswehr German army in Afghanistan on May 22. In an interview with a German radio reporter who accompanied him on the trip, he seemed to justify his country’s military missions abroad with the need to protect economic interests.

“A country of our size, with its focus on exports and thus reliance on foreign trade, must be aware that … military deployments are necessary in an emergency to protect our interests — for example when it comes to trade routes, for example when it comes to preventing regional instabilities that could negatively influence our trade, jobs and incomes,” Köhler said.

It sounded as though Köhler was justifying wars for the sake of economic interests, in the context of the Afghan mission which is highly controversial in Germany and throughout Europe.

‘The Criticism Lacks the Necessary Respect for My Office’

In his statement on Monday, Köhler said: “My comments about foreign missions by the Bundeswehr on May 22 this year met with heavy criticism. I regret that my comments led to misunderstandings in a question so important and difficult for our nation. But the criticism has gone as far as to accuse me of supporting Bundeswehr missions that are not covered by the constitution. This criticism is devoid of any justification. It lacks the necessary respect for my office.”

Köhler became president in 2004 and was elected for a second five-year term in 2009. The former head of the International Monetary Fund was the first non-politician to become German head of state. He is a member of Merkel’s conservative Christian Democrats and was nominated for the presidency by the CDU with the backing of their coalition partners, the pro-business Free Democrats.

Köhler won praise during his first term for making a series of strong speeches urging Germany to reform its economy, and his apparent independence from the government prompted mass circulation Bild newspaper to dub him “Super Horst.” But he surprised commentators in recent months by appearing to stay on the sidelines in the euro crisis.

Finding a successor will pose a headache for Merkel, whose popularity has slumped in recent months. She has been hit by criticism of her handling of the euro crisis and by the loss of a center-right majority in the upper house following sharp declines for her CDU in a state election in North Rhine-Westphalia, Germany’s most populous state, on May 9.

A further blow came last week with the resignation of CDU heavyweight Roland Koch, the governor of Hesse, a conservative hardliner whose departure has left a big gap in the right wing of her party.

Posted By thestatedtruth.com on May 31, 2010

Posted By thestatedtruth.com on May 30, 2010

May 30 (Bloomberg) — BP Plc said it will seek to contain a majority of oil gushing from its Gulf of Mexico well with a new tactic to plug the leak as a White House adviser said the U.S. is now telling the company “what to do.â€

The company encountered “too much flow†and the “top kill†using 30,000 barrels of mud was abandoned in favor of placing a cap over the well, Managing Director Robert Dudley said today on CNN’s “State of the Union†program. “We believe we will get a majority of the oil and gas,†Dudley said.

U.S. engineers, led by Energy Secretary Steven Chu, yesterday told BP of “grave concerns†about drilling mud, and the company halted the process, White House energy and climate adviser Carol Browner said on CBS’s “Face the Nation†broadcast. “At the end of the day, the government tells BP what to do,†Browner said on NBC’s “Meet the Press.â€

BP had put the chances of the top kill succeeding at 60 percent to 70 percent. The company made three attempts before giving up last night.

“We failed to wrestle this beast to the ground,†Dudley said on “Fox News Sunday.†Containment has “no certainty†of success, he said on Fox. “The percentages are better†than forcing mud into the well, he said.

Chu met BP engineers yesterday and told them “it was too dangerous†to continue forcing mud into the well, Browner said on CBS’s “Face the Nation†broadcast. After the scientists met and “we told them of our very, very grave concerns,†the company abandoned the process, Browner said.

http://www.bloomberg.com/apps/news?pid=20601087&sid=aBFPCwr4B9b4

Posted By thestatedtruth.com on May 30, 2010

Sunday 30 May 2010

Death toll expected to rise as India faces record temperatures of up to 122F in hottest summer on record.

Experts are forecasting temperatures approaching 50C (122F) in coming weeks. More than 100 people are reported to have died in the state of Gujarat where the mercury topped at 48.5C last week. At least 90 died in Maharashtra, 35 in Rajasthan and 34 in Bihar.

http://www.guardian.co.uk/world/2010/may/30/india-heatwave-deaths

Posted By thestatedtruth.com on May 30, 2010

Americas most famous Las Vegas club owner and desisgner speaks out about the direction of the United States and the wild uncontrolled spending and massive debt we are taking on. “We’re on our way to Greece, in the hands of a confused, foolish government,†Wynn says.

Steve Wynn says Americans are afraid. He’s just angry.

“Washington is unpredictable these days,†declares the CEO of Wynn Resorts. “No one has any idea what’s next…the uncertainty of the business climate in America is frightening, frightening to everybody, and it’s delaying the recovery.â€

Wynn speaks of “wild, uncontrolled spending,†and “unbelievable, unsustainable debtâ€. Â

He’s concerned about the prospect of inflation, of FHA repeating the mistakes of Fannie and Freddie, and the cost to business from the new healthcare law. “We’re on our way to Greece, in the hands of a confused, foolish government,†Wynn says. “It’s got to stop. It’s got to stop.â€

Posted By thestatedtruth.com on May 29, 2010

BP said its latest effort to plug a mile-deep oil and gas gusher in the Gulf of Mexico with drilling fluids has failed in stemming the flow of hydrocarbons. We now have another outlier event unfolding.

By Tyler Durden on 05/29/2010

In his May 28th interview with Bloomberg’s Mark Crumpton and Lori Rothman, Matt Simmons of energy investment bank Simmons & Company, provides some stunning revelations on what is really occurring in the Gulf of Mexico, and proposes that the only effective way to contain the leak is to relieve BP, bring in the military, and do what the Russians have done on comparable occasions, namely explode nuclear weapons within the wellbore. Simmons knows what he is talking about. As Jim Bianco points out: “Matt Simmons gained fame with his book 2005 Twilight in the Desert where he claimed that the Saudis were overstating their oil output because they hit “peak oil.” Right or wrong Simmons claimed the price of oil was going to skyrocket and three years after the bookÂ’s release the crude oil hit $147/Barrel. In January 2009 the WSJ called Simmons one of the five most important voices in the oil industry. Simmons has been wrong in the past and his views are non-conventional and often correct. Simmons is also highly connected within the oil industry so he knows who to talk to verify his claims.” In addition to his radical solution, Simmons also points out that “Top Kill” is a sideshow and the real problem is 5 to 7 miles away, where a second fissure is “releasing a plume the size of Delaware and Maryland combined.” If Simmons is indeed right, and the only recourse left to Obama is to nuke the seabed, the repercussions for his already shaky political situation will be tremendous.

Posted By thestatedtruth.com on May 28, 2010

WASHINGTON – BP’s chief executive cautioned Friday that it will be two more days before anyone knows if the latest fix attempt will stop the oil spewing into the sea, and President Barack Obama arrived on the Gulf Coast to tell residents they are not alone in dealing with it.

The New York Times reported that BP’s renewed efforts at plugging the flow of oil from stalled again on Friday, and that the company suspended pumping operations for the second time in two days. The newspaper quoted a technician involved with the response effort who spoke on condition of anonymity because he was not authorized to speak publicly about the efforts.

BP has been pumping mud into the well to stop the flow of oil, then seal it with cement. But the company suspended pumping operations at 2:30 a.m. Friday, the technician said.

Posted By thestatedtruth.com on May 28, 2010

Â

Rick’s PicksÂ

Friday, May 28, 2010

“Phenomenally accurate forecastsâ€Â Â

We may all be breathing a sigh of relief by the time you read this, but it remained uncertain at press time whether British Petroleum’s efforts to plug a massive oil leak in the Gulf of Mexico would succeed. Earlier in the day, the company began pumping a heavy fluid called “mud†into the damaged well, but the process was temporarily halted because the high-powered flow of oil and gas from the well was causing too much of the mud to escape. BP said such delays had been expected but that they hoped to resume the sealing operation by late tonight. The effort came amidst reports that oil has been gushing from the well at a rate much greater than what BP had first estimated. The company originally said that about 5,000 barrels of oil were escaping per day, but the latest estimates suggest that the true number is somewhere between 12,000 and 19,000 barrels. Converted into gallons, that implies that as much as 760,000 gallons of oil per day are flowing into the Gulf.

Last week, we linked at Rick’s Picks a very scary article from rense.com that said the “top kill†procedure being used to plug the well was the world’s last hope to get the disaster under control. The author, who sounded like he knew a thing or two about drilling platforms, explained that abrasive material contained in the gushing oil could eventually widen the well-hole so that virtually unlimited quantities of oil and explosive methane would be released into the water and atmosphere. We would strongly suggest that you read   http://rense.com/general90/analy.htm to understand what is at stake if BP’s effort fails. The only alternative at that point would be to drill an additional well to relieve the pressure. This procedure is already under way, but it will still take another two months to complete. During that time, nature could take a catastrophic course on its own, according to the author, who was identified only by the initials “SHRâ€. If BP reports that the “top kill†attempt has failed, it will be grave news indeed for Planet Earth.

Posted By thestatedtruth.com on May 28, 2010

The personal consumption to income ratio remains above 85%. A society based on excessive consumption with little investment is not sustainable. When wealth created from previous productive endeavors is consumed or transferred, society is left with obligations that it cannot pay.

Personal consumption to income ratio:

Consumer spending was stagnant in April while incomes posted a tiny advance, signs that the economic recovery could slow.

Source: finance.yahoo.com

Posted By thestatedtruth.com on May 27, 2010

By James Picerno|May 27, 2010

The pundits are buzzing about the rapid decline in the money supply of late. The latest catalyst for the chatter is a story yesterday in the Telegraph, which ran this provocative headline: U.S. money supply plunges at 1930s pace as Obama eyes fresh stimulus.

The story goes on to report:

The M3 money supply in the United States is contracting at an accelerating rate that now matches the average decline seen from 1929 to 1933, despite near zero interest rates and the biggest fiscal blitz in history.

Monetary economist Tim Congdon from International Monetary Research tells the Telegraph that the descent in the money supply is frightening. He says that the plunge in M3 has no precedent since the Great Depression. The dominant reason for this is that regulators across the world are pressing banks to raise capital asset ratios and to shrink their risk assets. This is why the US is not recovering properly.

The Federal Reserve no longer publishes M3, although the underlying components are still available and so the series can be calculated by anyone inclined to do so. Unsurprisingly, other measures of money supply are falling too. The annual percentage change in M2, for instance, has been dropping like a rock for months, as the chart below shows.

The trend is more than a little worrisome, given the recent rise in deflation risk, albeit a mild rise and therefore one that may yet turn out to be a false alarm. The markets are constantly forecasting the future, but the forecasts aren’t 100% accurate. Figuring out when they’re wrong is the trick. That said, the Treasury market’s 10-year inflation forecast has dipped under 2% over the past week or so for the first time since last October. So far, the market’s inflation outlook is holding steady at around 1.9%, as the second chart below shows.

Did the Treasury market overreact? Is the threat of deflation overstated? Maybe, although the steep fall in the money supply is one reason for wondering. Another is looking around the world and seeing that the D risk is on the rise in Britain and Japan. Deflation in the U.S. and U.K. cannot be ruled out, warned Adam Posen (external member of the Monetary Policy Committee and senior fellow at the Peterson Institute for International Economics) in a speech earlier this week.

Economist Carmen Reinhart, co-author of This Time Is Different: Eight Centuries of Financial Folly, made a similar observation yesterday. As the The Hill reported

The level of U.S. debt has reached a point at which economic growth traditionally begins to slow, a bipartisan fiscal commission making recommendations to the White House and Congress was told Wednesday.

The gross U.S. debt is approaching a level equivalent to 90 percent of the country’s gross domestic product, the level at which growth has historically declined, said Carmen Reinhart, a University of Maryland economist.

When gross debt hits 90 percent of GDP, Reinhart told the commission during a hearing in the Capitol, growth deteriorates markedly. Median growth rates fall by 1 percent, and average growth rates fall considerably more, she said.

Reinhart said the commission shouldn’t wait to put in place a plan to rein in deficits.

“I have no positive news to give,she said. Fiscal austerity is something nobody wants, but it is a fact.

Gross debt is at 89 percent and will reach 90 percent by the end of the year, said Sen. Kent Conrad (D-N.D.), a member of the commission.

The warning signs are mounting. Much depends on how the Fed conducts monetary policy from here on out. Nominal interest rates are low, virtually zero in fact. But as Scott Sumner, an economist who blogs at The Money Illusion, has repeatedly counseled, it’s still possible to have tight money and low nominal rates. As such, deflation may still be a risk at this point in the economic cycle. The solution? Growth. In particular, growth in a number of key economic metrics in May and beyond. But collecting and publishing the relevant data will take time. It’ll be a while before we definitively figure out if all the deflation talk is really just talk.

http://wallstreetpit.com/29764-the-warning-signs-are-mounting

Posted By thestatedtruth.com on May 27, 2010

Posted By thestatedtruth.com on May 27, 2010

Â

By Ambrose Evans-Pritchard

Published: 9:40PM BST 26 May 2010

Â

The stock of money in the US fell from $14.2 trillion to $13.9 trillion in the three months to April, amounting to an annual rate of contraction of 9.6pc Photo: AFP

The M3 figures – which include broad range of bank accounts and are tracked by British and European monetarists for warning signals about the direction of the US economy a year or so in advance – began shrinking last summer. The pace has since quickened.

The stock of money fell from $14.2 trillion to $13.9 trillion in the three months to April, amounting to an annual rate of contraction of 9.6pc. The assets of insitutional money market funds fell at a 37pc rate, the sharpest drop ever.Â

“It’s frightening,” said Professor Tim Congdon from International Monetary Research. “The plunge in M3 has no precedent since the Great Depression. The dominant reason for this is that regulators across the world are pressing banks to raise capital asset ratios and to shrink their risk assets. This is why the US is not recovering properly,” he said.

The US authorities have an entirely different explanation for the failure of stimulus measures to gain full traction. They are opting instead for yet further doses of Keynesian spending, despite warnings from the IMF that the gross public debt of the US will reach 97pc of GDP next year and 110pc by 2015.

Larry Summers, President Barack Obama’s top economic adviser, has asked Congress to “grit its teeth” and approve a fresh fiscal boost of $200bn to keep growth on track. “We are nearly 8m jobs short of normal employment. For millions of Americans the economic emergency grinds on,” he said.

David Rosenberg from Gluskin Sheff said the White House appears to have reversed course just weeks after Mr Obama vowed to rein in a budget deficit of $1.5 trillion (9.4pc of GDP) this year and set up a commission to target cuts. “You truly cannot make this stuff up. The US governnment is freaked out about the prospect of a double-dip,” he said.

The White House request is a tacit admission that the economy is already losing thrust and may stall later this year as stimulus from the original $800bn package starts to fade.

Recent data have been mixed. Durable goods orders jumped 2.9pc in April but house prices have been falling for several months and mortgage applications have dropped to a 13-year low. The ECRI leading index of US economic activity has been sliding continuously since its peak in October, suffering the steepest one-week drop ever recorded in mid-May.

Mr Summers acknowledged in a speech this week that the eurozone crisis had shone a spotlight on the dangers of spiralling public debt. He said deficit spending delays the day of reckoning and leaves the US at the mercy of foreign creditors. Ultimately, “failure begets failure” in fiscal policy as the logic of compound interest does its worst.

However, Mr Summers said it would be “pennywise and pound foolish” to skimp just as the kindling wood of recovery starts to catch fire. He said fiscal policy comes into its own at at time when the economy “faces a liquidity trap” and the Fed is constrained by zero interest rates.

Mr Congdon said the Obama policy risks repeating the strategic errors of Japan, which pushed debt to dangerously high levels with one fiscal boost after another during its Lost Decade, instead of resorting to full-blown “Friedmanite” monetary stimulus.

“Fiscal policy does not work. The US has just tried the biggest fiscal experiment in history and it has failed. What matters is the quantity of money and in extremis that can be increased easily by quantititave easing. If the Fed doesn’t act, a double-dip recession is a virtual certainty,” he said.

Mr Congdon said the dominant voices in US policy-making – Nobel laureates Paul Krugman and Joe Stiglitz, as well as Mr Summers and Fed chair Ben Bernanke – are all Keynesians of different stripes who “despise traditional monetary theory and have a religious aversion to any mention of the quantity of money”. The great opus by Milton Friedman and Anna Schwartz – The Monetary History of the United States – has been left to gather dust.

Mr Bernanke no longer pays attention to the M3 data. The bank stopped publishing the data five years ago, deeming it too erratic to be of much use.

This may have been a serious error since double-digit growth of M3 during the US housing bubble gave clear warnings that the boom was out of control. The sudden slowdown in M3 in early to mid-2008 – just as the Fed talked of raising rates – gave a second warning that the economy was about to go into a nosedive.

Mr Bernanke built his academic reputation on the study of the credit mechanism. This model offers a radically different theory for how the financial system works. While so-called “creditism” has become the new orthodoxy in US central banking, it has not yet been tested over time and may yet prove to be a misadventure.

Paul Ashworth at Capital Economics said the decline in M3 is worrying and points to a growing risk of deflation. “Core inflation is already the lowest since 1966, so we don’t have much margin for error here. Deflation becomes a threat if it goes on long enough to become entrenched,” he said.

However, Mr Ashworth warned against a mechanical interpretation of money supply figures. “You could argue that M3 has been going down because people have been taking their money out of accounts to buy stocks, property and other assets,” he said.

Copyright © 2025 The Stated Truth