Let’s Look At Our Check List Of How The Economy Is Doing…….

Posted By thestatedtruth.com on May 27, 2010

#1) In what universe is an economy with 39.68 million Americans on food stamps considered to be a healthy, recovering economy? In fact, the U.S. Department of Agriculture forecasts that enrollment in the food stamp program will exceed 43 million Americans in 2011. Is a rapidly increasing number of Americans on food stamps a good sign or a bad sign for the economy?

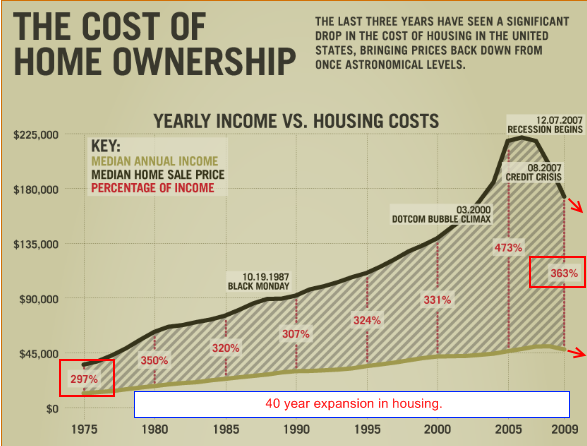

#2) According to RealtyTrac, foreclosure filings were reported on 367,056 properties in the month of March. This was an increase of almost 19 percent from February, and it was the highest monthly total since RealtyTrac began issuing its report back in January 2005. So can you please explain again how the U.S. real estate market is getting better?

#3) The Mortgage Bankers Association just announced that more than 10 percent of U.S. homeowners with a mortgage had missed at least one payment in the January-March period. That was a record high and up from 9.1 percent a year ago. Do you think that is an indication that the U.S. housing market is recovering?

#4) How can the U.S. real estate market be considered healthy when, for the first time in modern history, banks own a greater share of residential housing net worth in the United States than all individual Americans put together?

#5) With the U.S. Congress planning to quadruple oil taxes, what do you think that is going to do to the price of gasoline in the United States and how do you think that will affect the U.S. economy?

#6) Do you think that it is a good sign that Arnold Schwarzenegger, the governor of the state of California, says that “terrible cuts†are urgently needed in order to avoid a complete financial disaster in his state?

#7) But it just isn’t California that is in trouble.  Dozens of U.S. states are in such bad financial shape that they are getting ready for their biggest budget cuts in decades. What do you think all of those budget cuts will do to the economy?

#8) In March, the U.S. trade deficit widened to its highest level since December 2008. Month after month after month we buy much more from the rest of the world than they buy from us. Wealth is draining out of the United States at an unprecedented rate. So is the fact that the gigantic U.S. trade deficit is actually getting bigger a good sign or a bad sign for the U.S. economy?

#9) Considering the fact that the U.S. government is projected to have a 1.6 trillion dollar deficit in 2010, and considering the fact that if you went out and spent one dollar every single second it would take you more than 31,000 years to spend a trillion dollars, how can anyone in their right mind claim that the U.S. economy is getting healthier when we are getting into so much debt?

#10) The U.S. Treasury Department recently announced that the U.S. government suffered a wider-than-expected budget deficit of 82.69 billion dollars in April. So is the fact that the red ink of the U.S. government is actually worse than projected a good sign or a bad sign?

#11) According to one new report, the U.S. national debt will reach 100 percent of GDP by the year 2015. So is that a sign of economic recovery or of economic disaster?

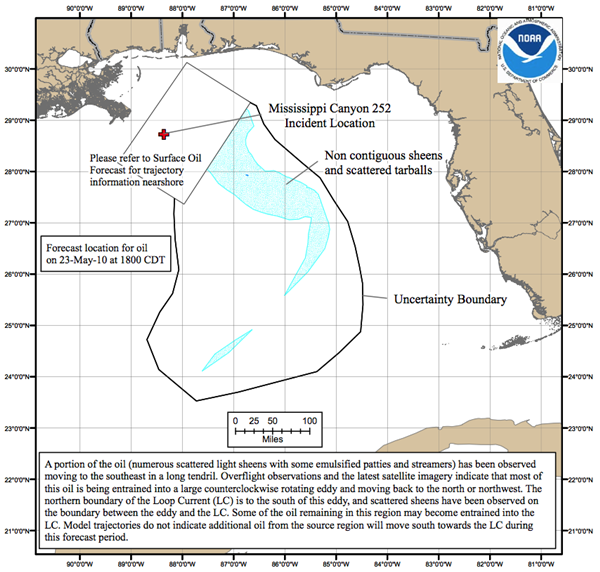

#12) Monstrous amounts of oil continue to gush freely into the Gulf of Mexico, and analysts are already projecting that the seafood and tourism industries along the Gulf coast will be devastated for decades by this unprecedented environmental disaster. In light of those facts, how in the world can anyone project that the U.S. economy will soon be stronger than ever?

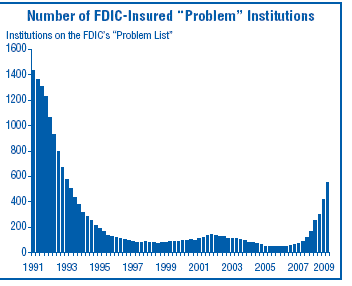

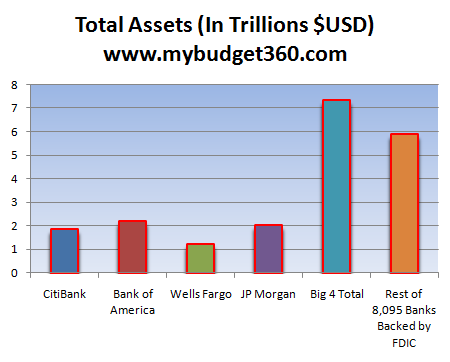

#13) The FDIC’s list of problem banks recently hit a 17-year high. Do you think that an increasing number of small banks failing is a good sign or a bad sign for the U.S. economy?

#14) The FDIC is backing 8,000 banks that have a total of $13 trillion in assets with a deposit insurance fund that is basically flat broke. So what do you think will happen if a significant number of small banks do start failing?

#15) Existing home sales in the United States jumped 7.6 percent in April.  That is the good news. The bad news is that this increase only happened because the deadline to take advantage of the temporary home buyer tax credit (government bribe) was looming. So now that there is no more tax credit for home buyers, what will that do to home sales?Â

#16) Both Fannie Mae and Freddie Mac recently told the U.S. government that they are going to need even more bailout money. So what does it say about the U.S. economy when the two “pillars†of the U.S. mortgage industry are government-backed financial black holes that the U.S. government has to relentlessly pour money into?

#17) 43 percent of Americans have less than $10,000 saved for retirement. Tens of millions of Americans find themselves just one lawsuit, one really bad traffic accident or one very serious illness away from financial ruin. With so many Americans living on the edge, how can you say that the economy is healthy?

#18) The mayor of Detroit says that the real unemployment rate in his city is somewhere around 50 percent. So can the U.S. really be experiencing an economic recovery when so many are still unemployed in one of America’s biggest cities?

#19) Gallup’s measure of underemployment hit 20.0% on March 15th. That was up from 19.7% two weeks earlier and 19.5% at the start of the year. Do you think that is a good trend or a bad trend?

#20) One new poll shows that 76 percent of Americans believe that the U.S. economy is still in a recession. So are the vast majority of Americans just stupid or could we still actually be in a recession?

#21) The bottom 40 percent of those living in the United States now collectively own less than 1 percent of the nation’s wealth. So is Barack Obama’s mantra that “what is good for Wall Street is good for Main Street†actually true?

#22) Richard Russell, the famous author of the Dow Theory Letters, says that Americans should sell anything they can sell in order to get liquid because of the economic trouble that is coming. Do you think that Richard Russell is delusional or could he possibly have a point?

#23) Defaults on apartment building mortgages held by U.S. banks climbed to a record 4.6 percent in the first quarter of 2010. In fact, that was almost twice the level of a year earlier. Does that look like a good trend to you?

#24) In March, the price of fresh and dried vegetables in the United States soared 49.3% - the most in 16 years. Is it a sign of a healthy economy when food prices are increasing so dramatically?

#25) 1.41 million Americans filed for personal bankruptcy in 2009 – a 32 percent increase over 2008. Not only that, more Americans filed for bankruptcy in March 2010 than during any month since U.S. bankruptcy law was tightened in October 2005. So shouldn’t we at least wait until the number of Americans filing for bankruptcy is not setting new all-time records before we even dare whisper the words “economic recovery�