Posted By thestatedtruth.com on January 25, 2010

Lessons from the Panic of 1907

by Clif Droke

January 25, 2010

In their timely look at the panic of 1907, Robert Bruner and Sean Carr focus attention on what they believe to be the underlying causes of the ’07 stock market crash and recession, drawing parallels between it and the credit crisis of more recent times. Their book, “The Panic of 1907: Lessons Learned from the Market’s Perfect Storm,†is now available in soft cover published by John Wiley & Sons (2007).

The authors list seven contributing factors to the 1907 crisis:

1.)Â Â Â Complexity

2.)Â Â Â Buoyant economic growth

3.)Â Â Â Inadequate safety buffers

4.)Â Â Â Adverse leadership

5.)Â Â Â Real economic shock

6.)Â Â Â Undue fear and greed and other behavioral aberrations

7.)Â Â Â Failure of collective action

In this review we’ll focus on factor number 4, adverse leadership, under which category the policies of the U.S. Treasury and Federal Reserve fall. One of the key statements the authors make is found on page 30. Quoting the passage at length:

“In the summer of 1907, a major economic shock hit the American capital markets. In an effort to harbor gold reserves, the bank of England imposed a prohibition on U.S. finance bills, which were loans with which U.S. firms could import gold. The contemporary economist, O.M.W. Sprague, considered this action ‘the most important financial factor in the panic of 1907.’  The prohibition slashed the volume of finance bills in the London market from $400 million to $30 million by late in the summer of 1907. This meant that American debtors could not simply refinance their obligations in London. As a result, the flow of gold to America suddenly lurched into reverse as gold was remitted to London to settle the payment on finance bills. This further contracted U.S. gold reserves nearly 10 percent between May and August 1907 and contributed to a national liquidity drought.â€

In the above paragraph we discover that the underlying cause behind the Panic of 1907 was none other than a restrictive monetary policy, exactly the same posture assumed by the U.S. Federal Reserve in the year preceding the late credit crisis. Although the authors don’t see this as the primary cause of the 1907 Panic, Bruner and Carr go on to provide more insight into the relationship between tight money and stock market crashes and economic recessions by recounting other examples of how money shrinkage and credit restrictions fed the crisis of 1907.

One prominent institution in the 1907 panic was the Knickerbocker Trust of New York. Headed by the colorful Charles Barney, the financial institution was one of the largest and most successful trust company in the country and was the third largest trust in New York City, with nearly 18,000 depositors.Â

Trust companies engaged in most of the functions of both common and private banks, including making loans, industry consolidation and underwriting, and distribution of new securities. They also sometimes owned and managed real estate. Trust companies were also generally less well regulated than conventional banks. They were allowed to hold certain assets that banks weren’t permitted to hold, such as stock equity. Of significance, trusts weren’t required to hold reserves against deposits prior to 1906. As Bruner and Carr point out, the State of New York required trusts in 1906 to hold 15 percent of deposits as reserves, though only a third of the reserves had to be held in cash. “This meant that trust companies could earn a higher return on their assets compared to banks, and thus, could pay higher interest rates,†according to Bruner and Carr. “Accordingly, the higher interest rates attracted deposits, and the trust companies grew rapidly. In 1906, the assets of all trust companies in New York City approximated the assets of all national banks and exceeded the assets of all state banks.â€

Trusts were a hot commodity at the turn of the last century, attracting investment funds from countless Americans of all walks of life. They also attracted scorn from the conventional banking community. America’s leading financier at that time, J.P. Morgan, was particularly critical of the investment trusts and viewed them as upstart competitors to his banking interests. This is an important point to remember when analyzing the events of the 1907 Panic.

Morgan was also very much in support of corporate oligarchy and was a pioneer in the creation and advancement of Big Business. He took every opportunity to undermine the role of small, independent firms in the business world, and according to his biographer Frederick Lewis Allen:

“Morgan seemed to feel that the business machinery of America should be honestly and decently managed by a few of the best people, people like his friends and associates. He liked combination, order, the efficiency of big business units; and he liked them to operate in a large, bold, forward-looking way. He disapproved of the speculative gangs who plunged in and out of the market, heedless of the properties they were toying with, as did the Standard Oil crowd. When he put his resources behind a company, he expected to stay with it; this, he felt, was how a gentleman behaved….That Morgan was a might force for decent finance is unquestionable. But so also is the fact that he was a mighty force working toward the concentration into a few hands of authority over more and more of American business.â€

Morgan’s antipathy toward “speculative gangs†and to trusts in general was brought to the fore when rumors started swirling over the solvency of the Knickerbocker Trust. The rumors concerning the solvency of the Knickerbocker were less a question of the firm’s standing in the New York financial community than a question of the Trust’s president, Charles Barney, who was believe to have connections to a failed corner on the stock of United Copper by August Heinze and Charles Morse. The connection between Heinze, Morse and Barney, however tenuous, was all that the increasingly jittery public needed to hear. Before long depositors in the Knickerbocker Trust began withdrawing funds and from there the public’s fears of the Trust’s solvency spread to other financial institutions in New York. It led to a full-scale banking panic that swept the country.

As the cash reserves of the Knickerbocker Trust began to dwindle, a meeting was called of the company’s board of directors by J.P. Morgan. The conference was an all-day affair and ran into the early hours of the morning. The board made the critical decision to keep the Knickerbocker’s doors open as long as it would take to secure assistance from other financial institutions in a relief effort led by Morgan himself. In the meantime, Morgan and his partners would examine the Knickerbocker’s books to determine the soundness of the trust. According to Bruner and Carr, if Morgan and his partners determined it was sound, then Morgan would find the money to keep it afloat.Â

The directors of the Knickerbocker made a fateful decision to open the doors to their depositors the next day under the assumption that help from the Morgan-led rescue operation would be forthcoming. They were disappointed in this expectation and were soon swamped by more withdrawals than they could stand. A classic bank run was soon underway and the Knickerbocker was to be among the first casualties of the developing crisis. As Bruner and Carr observe, “Despite the assurances of the financiers…the day before, the officials of Knickerbocker said that no money was forthcoming when needed.â€Â J.P. Morgan needed a high-profile victim for his plans to revolutionize the U.S. financial system and economy and he had one in the Knickerbocker Trust.

According to Bruner and Carr, the Morgan team concluded that the Knickerbocker wasn’t solvent after a review of the company’s accounts. Yet a state banking examiner who had reviewed the Knickerbocker’s accounts as recently as two weeks before the crisis had determined that the institution had sufficient funds to pay its depositors. The evidence points to the fact that the Knickerbocker was set up to fail by Morgan.

Another major factor in the 1907 panic was the tightness of money and credit alluded to earlier. Bruner and Cardded to ar observed, “The national banking system did not have an efficient mechanism for increasing the supply of currency quickly.â€Â In response to the panic conditions, depositors added to the woes of the financial system by withdrawing even more cash from circulation. According to the authors, about $350 million in deposits were withdrawn from the U.S. financial system. Most of this amount was hoarded in cash to the tune of $200 to $296 million.

One of the ways that banks sought to counteract the cash shortage was through the use of clearing house certificates, which amounted to temporary, emergency loans to member banks of the New York Clearing House. These certificates were used as a substitute currency when clearing accounts with one another each day. As Bruner and Carr observed, “Since the certificates circulated among member banks as a substitute for cash, they effectively freed up actual cash for the public, thereby artificially expanding the nation’s money supply. Without a central bank to provide this function, the certificates proved to be extremely effective at restoring the liquidity to the financial system during critical periods of stringency.â€

The use of clearing house certificates had been suggested during the crisis in New York. But as the authors point out, Morgan was opposed to this. The authors further hint that there could have been a hidden interest in the refusal to allow clearing house certificates by the larger banks: “delay might serve the interests of strong banks that want to discipline the weaker banks – as historian Elmus Wicker has argued, such behavior represented a conflict of private interest over the public interest.â€

Enter the U.S. Treasury. In an attempt at stopping the panic, then Treasury Secretary George Cortelyou transferred cash from the vaults of the U.S. Treasury to deposits in several national banks. By the middle of November 1907, however, the Treasury held only $5 million in ready cash, which significantly curtailed the rescue effort of the government. “A nation gasping for liquidity thus turned to other sources,†observe Bruner and Carr. “Bank clearing houses issued their near-money certificates in rising numbers, and imports of gold began to arrive in significant volume in November.â€

The authors quoted Oliver W. Sprague, a Harvard professor writing in 1908, as stating that “The position of the banks was far from desperate, yet they had already entered the fatal and discreditable path of suspension, paying depositors at their own discretion.â€Â In a remarkable historical parallel to the 2008 crisis, banks in New York during the 1907 crisis “actually conserved cash as a result of their membership in the clearing house and otherwise profited from the extension of cash to the trust companies.â€Â In November 1907, the New York banks obtained as much cash as they remitted elsewhere in the U.S. according to the authors. Sprague observed, “The New York bankers proved themselves wholly unequal to the duties of their position as the central reserve banks of the country.â€

In summarizing their post-mortem of the 1907 panic, Bruner and Carr quoted a 1983 study by the economists Diamond and Dybvig, who suggested that bank panics are simply randomly occurring events. “To be the last in line to withdraw deposited funds exposes an individual to the risk of less,†write Bruner and Carr. “Therefore, a run is caused simply by fear of random deposit withdrawals and the risk of being last in the queue.â€Â

A more pertinent explanation of financial panics is that they are at root liquidity driven phenomena, viz., the lack of liquidity causes the trouble. Bruner and Carr acknowledged the liquidity aspect of the financial panic of 1907 in stating, “In an effort to sustain the dollar, Treasury Secretary George Cortelyou and his predecessor L.M. Shaw sought to build government gold reserves for more than a year before the crash in March 1907. This took liquidity out of the financial system at a time when economic growth and the San Francisco earthquake [of 1906] and fire created an urgent demand for more cash. Correspondence within J.P. Morgan & Company noted the dearth of liquid funds with which to finance corporate needs.â€Â

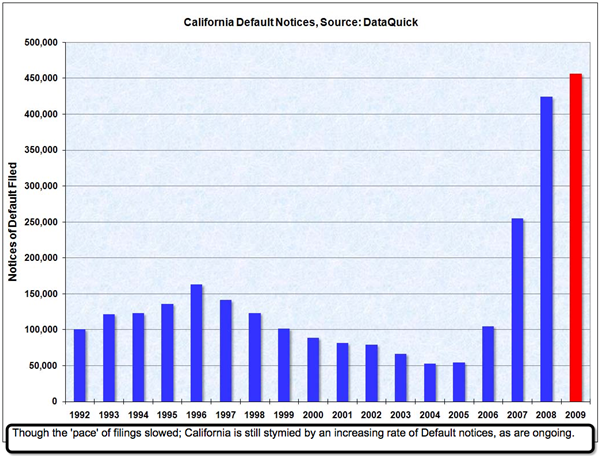

Bruner and Carr further noted that Cortelyou deposited a large volume of gold into the financial system in early 1907, which had the effect of flooding the market with liquidity. “Yet this was not sufficient and then in June and July [Cortelyou] returned to attempting to build government reserves.â€Â Gold began flowing abroad ahead of the U.S. crop harvest, adding further strain to the cash-strapped financial system. An instructive graph presented by Bruner and Carr on page 165 showed that liquid assets held by banks on behalf of the public and the U.S. Treasury began to decline in June 1907 ahead of the worst part of the panic.

The authors noted that “that summer recession was in full bloom; it was hardly a time to take liquidity from the system.  This, unfortunately, was a pattern to be repeated again, most notably by the U.S. Federal Reserve between 1930 and 1933. Economist Glenn Donaldson has noted that ‘market liquidity, or the lack thereof, is a primary element – perhaps the primary element – in determining the length and severity of a panic.’â€

The authors go on to break down what they see as the primary drivers behind the crisis and the eventual return to normalcy. There are many valuable lessons to be learned from a study of the Panic of 1907, and Bruner and Carr have done an admirable job addressing some of them. They emphasize that there is no single “magic bullet†explanation behind a crisis; rather, a confluence of factors must be analyzed in order to get the big picture. In distilling the causes of the 1907 panic down to seven, the authors present a compelling, if somewhat debatable, case for the reasons that led to the famous crash of 1907.

The authors also remind us that a nation that fails to learn from history is doomed to repeat it. On a cautionary note, the authors point out, “It is all too easy to saddle taxpayers with the costs of saving firms, jobs, and industries. Are we willing to pay for an absolutely risk-free society?â€Â

Short Selling

One of the demands among traders in recent years has been the desire to capture moves in individual stocks and ETFs in tough market environments. Most stock market literature specializes in trading techniques geared toward bull markets. Comparatively few books have been devoted to explaining techniques for profiting in down markets. Many traders are intimidated by the prospect of short selling and, quite rightly, view it as a risky proposition.Â

Short selling is risky if you lack a good technical discipline for selecting short sale candidates among individual stocks and executing the trade properly. With the right method, the risks in shorting can be minimized and the results profitable. Although the Wall Street press doesn’t like to publicize it, timely short selling can create profits for small traders much faster than conventional “buy and hold†investing. In the years leading up to the fateful 120-year Kress Cycle bottom in 2014, profitable opportunities for selling short will only increase.

© 2010 Clif Droke

Editorial Archive

Category: Commentary, Commodities, Economy, Finance, Gold and Silver, National News, Tid Bits, Wall Street |

No Comments »

Tags: